1989-2

5. Report of the Financial Services and Insurance Regulation (EX) Task Force

- Commissioner William Hager (Iowa) presented the report noting that the task force had adopted amendments to the Model Act Relating to Unfair Methods of Competition and Deceptive Acts and Practices in the Business of Insurance to address the issue of insurance agents holding themselves out as financial planners and to require disclosure of fees charged.

1989-2, NAIC Proceedings

Commissioner Harold Yancey (Utah) presented the report of the Life Insurance (A) Committee.

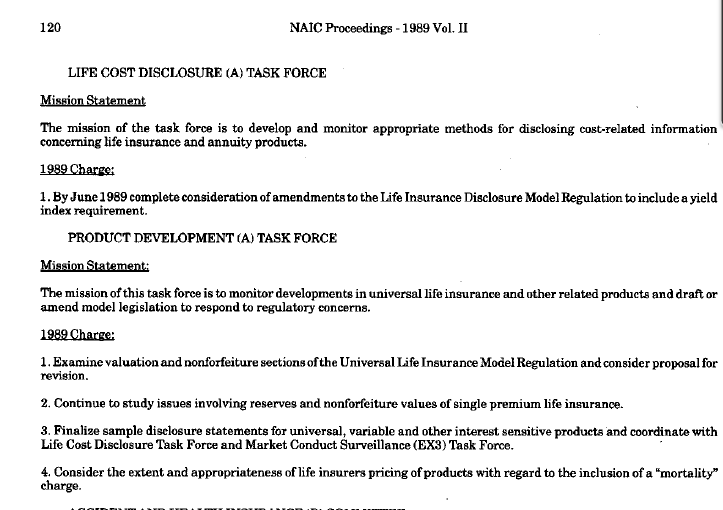

- He noted that the Life Cost Disclosure (A) Task Force had adopted the Optional Form of the Life Insurance Disclosure Model Regulation with Yield Index and had recommended that the task force be disbanded.

- He noted that the Product Development (A) Task Force had amended the disclosure requirements in the Life Insurance Disclosure Model Regulation and the Universal Life Insurance Model Regulation concerning interest-sensitive products.

1989-2, NAIC Proceedings

- She further noted that the amendments would require disclosure to consumers if fees were to be charged in addition to commissions for the sale of insurance.

- The chair then called for comments. Jack Burbidge (IDS Life Insurance Co.), chair of the advisory committee, noted that the advisory committee had not met since May 19 and that, therefore, it would be impossible to speak for the group.

- It was his understanding, however, that the advisory committee was generally in favor of the amendments, but did worry that the amendments as proposed could conflict with some states' insurance consultants laws.

- He noted that 27 states have consultant laws which are not uniform and which could be in conflict with the amendments as proposed to the Model Unfair Trade Practices Act. He noted that he had suggested an amendment to the exposure draft proposal (Proceedings, 1989, vol. I, pp. 85-86) in a June 2.

1989-2, NAIC Proceedings