4 - OUTLINE

- Purpose of Working Groups

- IULWG - Mike Yanacheck

- LIBG -

- LIIIWG - Schwartzer

- Turning Points

- Words and Concepts

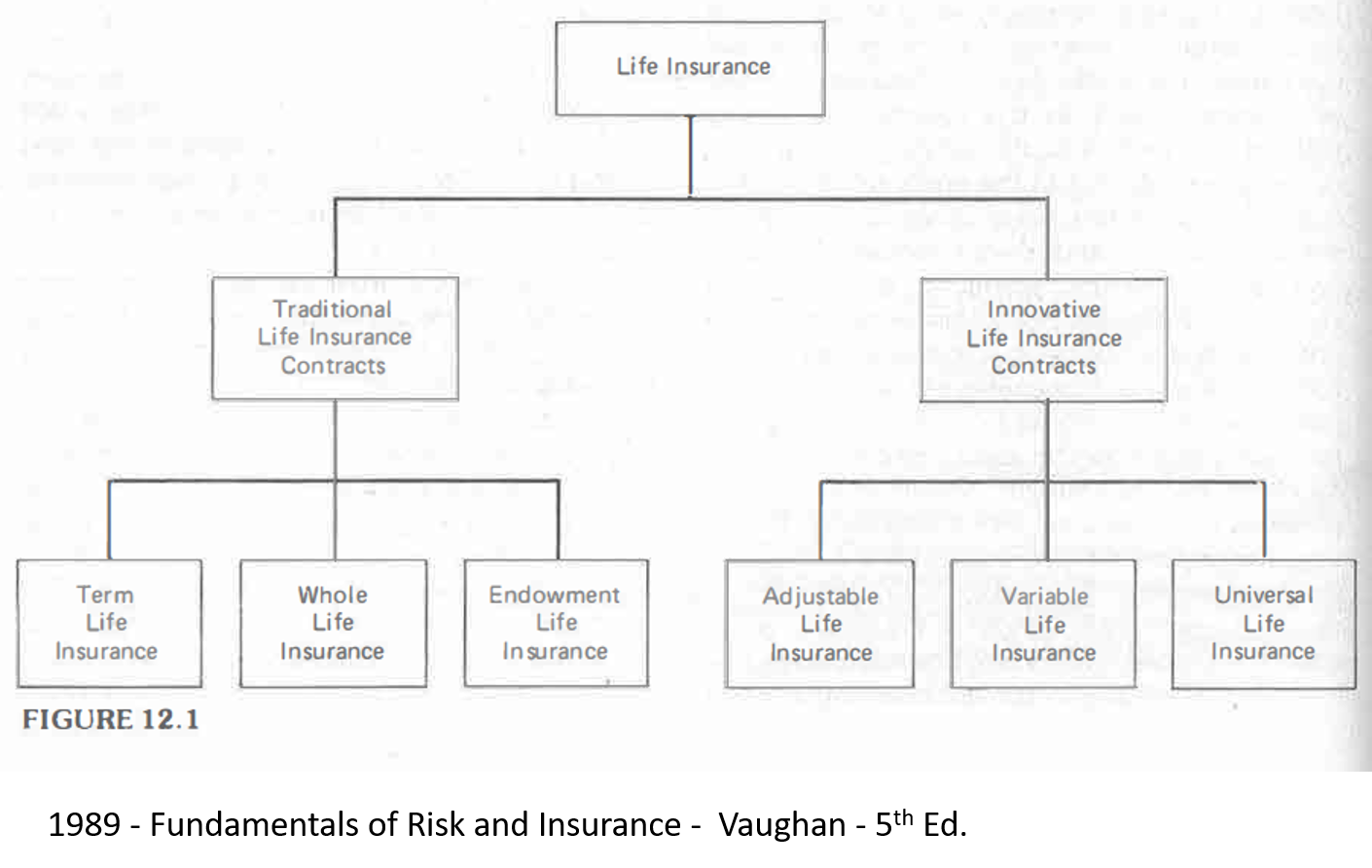

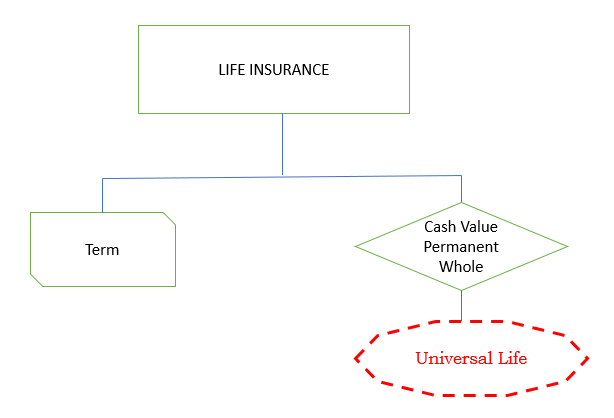

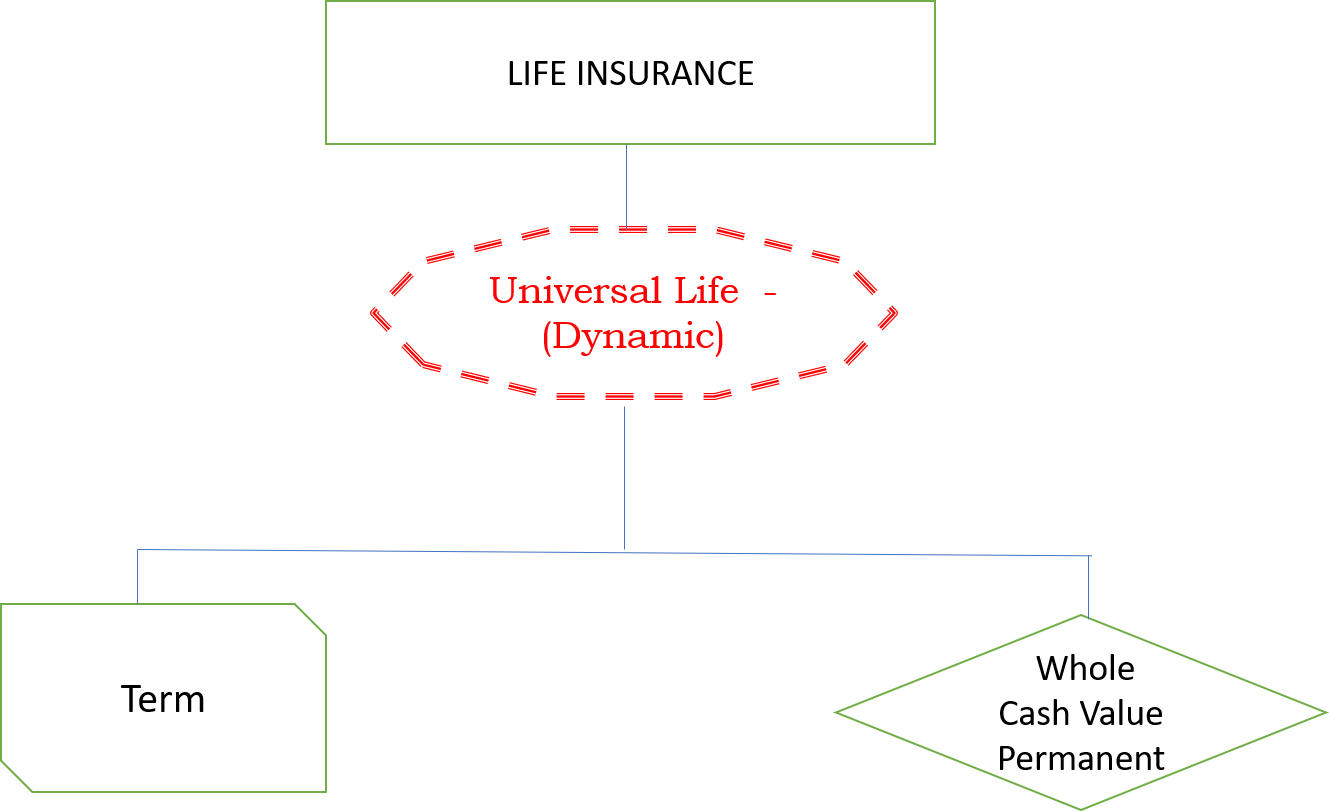

- What category is Universal Life?

- Dynamic

- ACLI

- Actuarial Book

- Whole

- Cude

- Permanent

- Birnbaum

- What category is Universal Life?

- Knowledge - Agent, Consumer, Regulator

- Performance

- References

- ACLI

- Examples of Policy Summaries - WishList

- Government

- When Will... First 35p

- just alike Illustrations -Metzenbaum Quote

- Illustrations

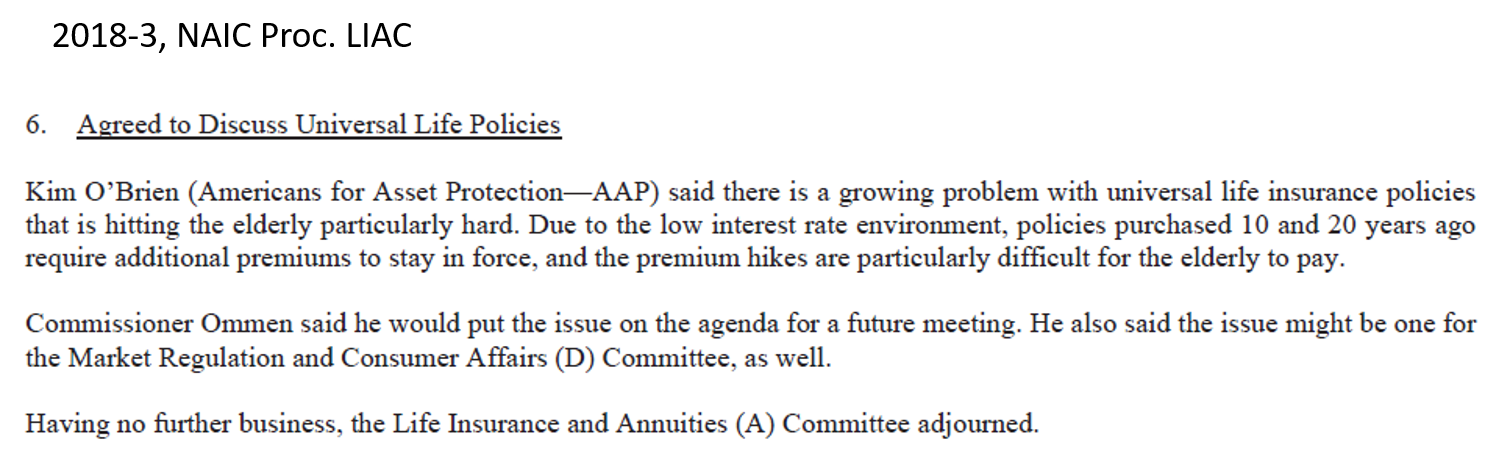

- NAIC

- Society of Actuaries

- Legal Cases

- Maloof

- The Hard Stuff

- Explore

- Projects

- Add to the Discussion

- Adjustable Life Insurance

- Law

- Actuarial

- ACLI

Actuarial:

1991-1992 - FINAL REPORT* OF THE TASK FORCE FOR RESEARCH ON LIFE INSURANCE SALES ILLUSTRATIONS - Society of Actuaries, 142p

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM! - Society of Actuaries, 20p

Government

1993 - When will.... First 30 pages

Industry

Universal life insurance: A type of permanent life insurance that allows the insured, after the initial payment, to pay premiums at various times and in varying amounts, subject to certain minimums and maximums. To increase the death benefit, the insurance company usually requires the policyholder to furnish satisfactory evidence of continued good health. Also known as adjustable life insurance.

Adjustable life insurance: A type of life insurance that allows the policyholder to change the plan of insurance, raise or lower the policy’s face amount, increase or decrease the premium, and lengthen or shorten the protection period."

2017 - GLOSSARY OF INSURANCE-RELATED TERMS, ACLI FACT BOOK

Legal Cases

2010 - Maloof v John Hancock - Alabama Supreme Court Opinion - 39p

2010 - Blumenthal v New York Life

What they did not understand, they did not find useful.

1990-1A - NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p

No difference how well-intentioned and honest an insurance man's advice may be it may prove very expensive and harmful if not based on accurate knowledge.

-- ISAAC MILLER HAMILTON, President of the· Federal Life Insurance Company

1914 - Conference on Life Insurance and Its Educational Relations

Why is insurance law and regulation so fixated on promoting coverage information despite the fact that so little of this information seems to filter down to ordinary consumers?

2017 - Coverage Information in Insurance Law - Daniel Schwarcz - 72p

MR. WILCOX: If we are going to have a group of consumers of our products who are satisfied with what they get, we have to meet their expectations.

Obviously, there are two adjustment points whereby that can be accomplished.

One is that you can change the outcome to match the expectations.

The other is to change the expectation to match the outcome.

1994 - PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS - 28p, Society of Actuaries

I have been present at such meetings more than once when the whole course of a debate on some important question was changed by the halting remarks of some man who was reluctantly moved by a compelling sense of responsibility to combat theories and statements which had been glibly presented and generally accepted and which he knew to be erroneous, wholly or in part.

Alexander C. Humphreys, President of Stevens Institute of Technology

1920, Proceedings of the Association of Life Insurance Presidents - Annual Meeting, Life Insurance Association of America: Volume 14

CORE ISSUE - <Bonk

Life Insurance Illustration Issues (A) Working Group (LIIIWG)

2016/4/3, LIIIWG CC, NAIC Proceedings

During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers. <Bonk: Specifically Universal Life>

Examples

-Dynamic

-Adjustable Life - 1977 Changing Times

-Any Plan of Insurance

-A Whole Ratebook

-Whole

-Permanent

-Cash Vaue

-Term

Whole - Brenda Cude - Consumer Rep. / Professor -

|

No Date

|

Comment [BJC2]: Permanent insurance is a We would prefer – Life insurance comes |

Permanent- Birney Birnbaum, Michael Wicka,

Actuarial

-JESSE M. SCHWARTZ: Why are people so reluctant to call Total Life <Universal Life> permanent insurance?

-Mr. MARGOLIN: Universal Life type products are, I suppose, permanent. It is a semantic question whether they are permanent life or not, but clearly they are not the traditional cash value products as we have known them and that was what I was addressing.

1981, THE FUTURE OF PERMANENT LIFE INSURANCE, Society of Actuaries

Law

Universal Life Is Permanent lnsurance

Mr. Affleck <Plaintiff Expert Witness> states that using the term "permanent" is "deceptive" with regard to universal life insurance.'

Universal life is considered "permanent insurance" in the industry. For example, a governmental website for seniors, maintained by the Social Security Administration, has the following definition "Permanent Insurance -- including whole, ordinary, universal, adjustable and variable life -- is protection that can be kept in force for as long as you live."8

2003 - REBUTTAL OF MR. AFFLECK'S REPORT, BY DONNA R CLAIRE

RE: William L. Fay, Sr. et al. v. Aetna Life Insurance and Annuity Company

Dynamic -

-ACLI - Michael Lovendusky - 10/18/2018 - Conference Call

-2000, Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

Academic

The interest rate sensitivity of UL policy cash values, amplified by the corresponding cost of insurance sensitivity with declining interest income, suggests UL has always been a simple question of Duration.

201x - Universal Life Insurance Duration Measures - Lange, Alonzi, Simpkins - 14p

Actuarial

"The contract is a lot like the Adjustable Life concepts of The Bankers and Minnesota Mutual, with the significant, additional flexibility that a plan change is not required each time there is a change in premium payments." SPENCER KOPPEL

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, Society of Actuaries

But we did not communicate the impact of change as well as we should have, especially the impact of change on the numbers we used in our sales illustrations. So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer.

Our biggest mistake would be to delay. I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing."

-- Robert Nelson, NALU (now NAIFA)

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

Purpose of Working Groups

Life Insurance Illustration Issues (A) Working Group (LIIIWG)

2016/4/3, LIIIWG CC, NAIC Proceedings

Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products.

2016/4/3, LIIIWG CC, NAIC Proceedings

During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers.

2019/9/3, LIIIWG , NAIC, <Bonk>

... this came out of the fact that Illustrations were not as clear. And the purpose of this entire committee was to provide some kind of summary to make it a little bit more clear.

So, I think ... if you can refer to the eventual illustration and just show the cash value.

-- Teresa Winer

Life Insurance Buyer’s Guide (A) Working Group (LIBGWG)

2015/3/29 -Life Insurance and Annuities (A) Committee

Appointed a New Working Group to Revise the Life Insurance Buyer’s Guide.

Ms. Matthews said the Committee has a 2015 charge to review and consider revisions to the Life Insurance Buyer’s Guide (Buyer’s Guide) in conjunction with the Life Insurance Disclosure Model Regulation (#580). She noted that the Buyer’s Guide is woefully outdated.

IUL ILLUSTRATION (A) SUBGROUP (IULWG)

2014/1/14 - LATF CC - RE: IULWG

John Bruins (American Council of Life Insurers – ACLI) said there are a wide range of practices in the area of policy illustrations, particularly for indexed universal life (UL) policies.

2014/11/13 - IULWG

It is my recollection and understanding that AG 49 was created in part due to a problem with ‘gamesmanship’ in IUL illustrations. -- Mike Yanacheck

Turning Points

2016/4/3, NAIC Proceedings, LIIIWG CC,

"He <Michael Lovendusky - ACLI> said consumers are mostly confused about options, guarantees and riders. The ACLI work

group was considering asking the Life Insurance and Annuities (A) Committee to narrow the charge to look at only products

with options, guarantees and riders, but Ms. Cude said she thinks that it is important to consider how the disclosures for all

products could be improved.

2016/10/20 - LIII WG CC, 2016-3 NAIC Proceedings

a. Purpose of Policy Overview Document

Birny Birnbaum (Center for Economic

Justice—CEJ) suggested that the policy overview document should be a tool to aid consumers in comparing plans across

companies, but not to choose between types of plans.

Mr. Wicka explained

that he envisions the policy overview as being a high-level document including the basic elements of the plan. He said the

policy overview should enhance consumer understanding, but not replace the buyer’s guide or the details in the illustrations

Ms. Mealer said she agrees with Mr. Wicka’s description of the intended purpose of the policy overview document.

American Academy of Actuaries - "Because NGEs <Non-Guaranteed Elements> are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

The Hard Stuff

Life Insurance Illustration Issues (A) Working Group (LIIIWG)

2016/4/3, LIIIWG CC, NAIC Proceedings

...consumers being better able to understand the product performance and interest variability of <Universal Life> products.

The Life Insurance Illustration Issues (A) Working Group will:

Explore how the narrative summary required by Section 7B of the Life Insurance Illustrations Model Regulation (#582) and the policy summary required by Section 5A(2) of Model #580 can be enhanced to promote consumer readability and understandability of these life insurance policy summaries, including how they are designed, formatted and accessed by consumers.

Regulation

The lack of understanding of cash value products was evidenced by the fact that the majority of people could not understand why, in Chart A, if you continue to pay your premium, the benefit would run out before age 95.

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p

Section 8. Disclosure Requirements

-American Council of Life Insurance (ACLI) presented a paper on cost disclosure for universal life products.

-Further, the policy summary should include a statement on the point at which the policy will expire based on the policy guarantees and the anticipated premiums shown in summary.

-Basically, it summarized that universal life should be treated as a life insurance plan with a nonguaranteed cost element for cost disclosure purposes.

1982 Proc. I 395.

-Commissioner Hager of the Universal & Other Plans (A) Task Force stated that there appeared to be disclosure problems with universal life plans and that the identification of these items should be placed on the Actuarial Task Force agenda .

-Some of the items identified which should be disclosed:

(2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988 Proc. II 566.

UNIVERSAL LIFE INSURANCE MODEL REGULATION

Proceeding Citations

The letter “r” is equal to one, unless the policy is a flexible premium policy and the policy value is less than the guaranteed maturity fund, in which case “r” is the ratio of the policy value to the guaranteed maturity fund.

UNIVERSAL LIFE INSURANCE MODEL REGULATION

Actuarial

A life insurance policy illustration is a mathematical calculation of benefits

and values over time under specific, simplified, and generally static assumptions. (p141)

1991-1992 - FINAL REPORT* OF THE TASK FORCE FOR RESEARCH ON LIFE INSURANCE SALES ILLUSTRATIONS - 142p, Society of Actuaries

"Actuaries can do lots of things. We can provide the field with a clear description of the policy and how it works."

BRUCE E. BOOKER (a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustrations

1993, SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

MS. SUSAN OBERMAN SMITH: I think that one problem, even with the illustration disclosure, is that you are still not controlling what the agent actually says to the client, even when he or she sees that illustration.

1995 - PRACTICAL ILLUSTRATIONS AND NONFORFEITURE VALUES, Society of Actuaries - 14p

-Product performance risk is really a sales and marketing risk that one carries.

-If your training process for your agents is to sell at target premium, for example, and target premium carries the policy to maturity at a 7 percent rate, if you’re only crediting 6, it’s not making it there.

-So keep an eye on how you’re training your agents to sell your products and try to avoid problems up front in the product performance before they become a premium risk problem. --JOSEPH E. PAUL

2001 - Investment Strategies To Maximize Yield, Society of Actuaries

Industry

George Coleman (Prudential) spoke next. He said that the NAIC had formed a resource group <Industry Members> last November to assist and recommend changes. The resource group recommended a cover page to the illustration to include essential information about the illustrated policy. -- George Coleman

1993-3 NAIC Proc.

Law

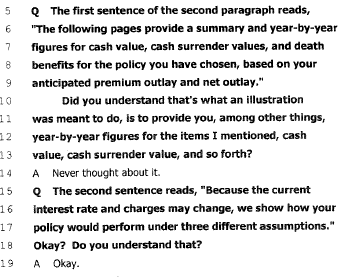

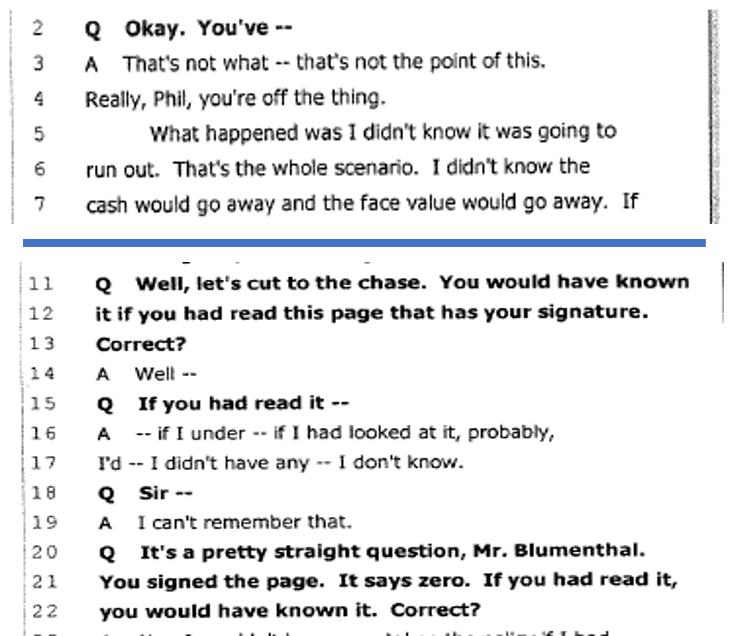

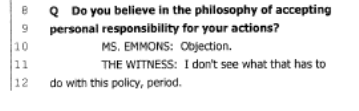

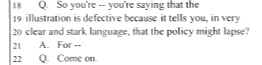

2010 - Blumenthal v New York Life

Illustration Disclosures Lead to Dismissal of Universal Life Insurance Class Action - Sutherland Legal Alert

Deposition of Plaintiff - Blumenthal

Deposition of Plaintiffs Expert Witness

Government Hearing

Overwhelming numbers of Life Insurance buyers do not even understand which, if any, elements of their sales illustrations are guaranteed. For instance, as we demonstrated in our hearing, an Alexander Hamilton illustration did not make it clear that there was no guaranteed death benefit after 12 years. -- Senator Howard Metzenbaum, letter to the NAIC

1993 - GOV - When Will Policyholders Be Given The Truth About Life Insurance? - p196

Life Insurance Buyer’s Guide (A) Working Group (LIBGWG)

2018/3/19 -LIBGWG Conference Call NAIC Proceedings

The Working Group discussed some language that was hard to understand referring to premiums and benefits.

Actuarial

...how does an agent program somebody? How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65? ALLAN W. SIBIGTROTH

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, 24p, Society of Actuaries

"The complications begin with a very simple question: What's the premium for Universal Life? It could be almost anything. Then what's the cash value? That depends on the premium. It is the relationship between the premium and cash value that determines the product characteristics <Performance/Plan of Insurance/Duration> of Universal Life." BEN H. MITCHELL

1981, UNIVERSAL LIFE, Society of Actuaries

"If your training process for your agents is to sell at target premium, for example, and target premium carries the policy to maturity at a 7 percent rate, if you’re only crediting 6, it’s not making it there. So keep an eye on how you’re training your agents to sell your products and try to avoid problems up front in the product performance before they become a premium risk problem." MR. JOSEPH E. PAUL

2001 - Investment Strategies to Maximize Yield, Society of Actuaries

Industry

The American Council of Life Insurance (ACLI) presented a paper on cost disclosure for universal life products..,..Further, the policy summary should include a statement on the point at which the policy will expire based on the policy guarantees and the anticipated premiums shown in summary. Basically, it summarized that universal life should be treated as a life insurance plan with a nonguaranteed cost element for cost disclosure purposes.

1982-1, NAIC Proceedings

Law

"The gravamen of their complaint was that Glasgow <The Agent-Retired> had misrepresented to them ....that the policies would provide benefits that would be available to pay any estate taxes due upon John's death when, in fact, based upon the projected insurance and interest rates at the time of sale, those policies would likely lapse when John was approximately 78 years old unless the Maloofs at some point substantially

increased the amount of the premiums they paid."

Thus, the undisputed facts indicate that Glasgow <The Agent> in fact fulfilled the Maloofs' request to procure life-insurance policies that would provide funds that could be used to pay estate taxes upon John's death, and those policies were canceled only after the Maloofs failed to pay the required premiums.

Glasgow <The Agent> subsequently joined in that motion <lawsuit>.

http://www.bonknote.com/maloof-v-john-hancock/

2018 - Mrs. Vogt Deposition - Vogt v State Farm, Missouri

This rash of life insurance litigation has several root causes.

First, although the existence of unscrupulous insurance sales professionals and predatory insurers cannot be denied, a more serious problem is the failure of agents and brokers to appreciate that cash value life insurance can be confusing, even for those who are financially sophisticated.5

Although much of this confusion could be eliminated if insureds would read their policies or accompanying prospectuses, carefully review policy illustrations, or question their agents or brokers about key aspects of policies, many do not.

Their ultimate disappointment with their policies leads to anger and blame and thus to litigation against the insurers and intermediaries whom they consider responsible for their alleged predicaments.

Second, in their zeal to make sales, some agents and brokers provide customers with optimistic illustrations of policy performance that, while perhaps permissible under insurers' compliance standards, unreasonably raise customers' expectations and lead to litigation when those expectations are not met.6

Third, many plaintiffs' lawyers do not understand the cash value life insurance products that they are suing over, or they ascribe sinister explanations to events beyond insurers' and intermediaries' control, such as declines in interest rates that lower policy values.7

2005 - Liability Issues in the Sale of Life Insurance - 34p

IUL ILLUSTRATION (A) SUBGROUP (IULWG)

2019/11/15 - IULWG Conference Call - <Bonk>

Rachel (Texas) : We can see why it would be confusing and difficult to explain… without eroding some confidence on the consumer's part.

Gary Sanders (NAIFA): And that leads to my second concern which is that consumer confusion I think, and we fear, in large part is going to be translated into a lack of confidence or a lack of trust in their advisor.

And in some way or another, the consumer is going to end up with the feeling that the advisor did some form of misrepresentation initially to the consumer and now the truth is coming out.

And I think that is a very big concern and not only would it harm the consumer's confidence in the producer, but it could have a lot of reputational damage to producer's as well.

Regulation

The working group's concern was how to bring about a change without damage to the market place.

1993-4, NAIC. Proceedings

Actuarial

"So if somebody could think of a way to get to the consumer without causing real problems among recent buyers, who are our most fragile customers, we would like to hear it. " --Mr. Keller

1991 - Illustrations, Society of Actuaries

What I noticed was ... people may have thought they bought one thing and whenever you have to give them an in-force illustration with a current disciplined scale, they're going to realize they bought something else. I think many companies will have serious problems with policyholder retention." --MR. MARK J. GREENE |

1995, PRACTICAL ILLUSTRATIONS AND NONFORFEITURE VALUES, Society of Actuaries

collectively we forgot to talk about the fact that dividends weren't guaranteed. We very seldom made that point up front during the sale near the end of that period when things were about to turn around. We never showed alternate illustrations at less favorable interest rates to show the potential volatility of policy performance if conditions change.|

-- WALTER N. MILLER

1995 - CURRENT DEVELOPMENTS SURROUNDING REGULATIONS

AND STANDARDS OF LIFE AND ANNUITY PRODUCTS, Society of Actuaries

Government Hearings

... I am a mother and a grandmother, and what bothers me is that I am afraid that this same misleading information may be the basis of my children's and grandchildren's retirement planning by the same ... type agents, and they may never ask questions, as I have. --GLORIA DARLEEN NEWBERRY, p12

1993 - GOV - When Will Policyholders Be Given The Truth About Life Insurance?

Projects

Life Insurance Buyer’s Guide (A) Working Group Conference Call

2018/2/5

- <Laura> Hanson <Academy>suggested leaving out details if the information is something the consumer will undoubtedly find out and focus on information that could be missed. Ms. Kitt and Ms. Cude said they are concerned with eliminating information on the basis that the consumer will find out eventually.

2014 - The No Reading Problem in Contract Law - 66p - Ian Ayres* & Alan Schwartz, Stanford Law Review

- "We propose a system under which mass-market sellers are required periodically to engage in a process of “term substantiation” through which sellers would learn whether their consumers held accurate beliefs about the terms of their agreement."

2019/11/15 - ACLI Letter to Richard Wicka, LIIIWG

Should the Working Group believe that further consideration be given to promoting consumer readability and understandability of the policy summaries and policy narratives, the ACLI recommends we go “back to the future” and undertake a fact-finding as to whether, and with regard to which type of insurance policies, an actual problem exists...

Such a fact-finding might profitably begin with a professionally (or perhaps academically) constructed, objectively managed consumer test of representative sample policy summaries and narrative summaries.

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p

2001-1V2 NAIC Proceedings - Do Product Disclosures Inform and Safeguard Insurance Policyholders? -11p