ACLI - Premiums and Benefits

- 11. Review Your Life Insurance Program Every Few Have your premiums or benefits changed since your policy was issued?

2018 0218 - ACLI Comments on Draft 2/9/2018 - conference call 2-26-18

- 1981 0831 - ACLI - Statement of the American Council of Life Insurance Before the NASAA NAIC Joint Regulatory Insurance - 10p

- 1981 1215 - ACLI - Paper on Cost Disclosure for Universal Life, by the Special Task Force of the ACLI Cost Disclosure Subcommittee - 4p

- 1982 1129 - ACLI - Statement on Behalf of the American Council of Life Insurance To The NAIC (A) Committee's Life Cost Disclosure Task Force - p523-? - 27p

- 1988 0613 - ACLI - A Statement on Behalf of the American Council of Life Insurance to the NAIC Market Conduct Surveillance (EX3) Task Force, Subgroup on Life Advertising Issues - 3p

- ...completely Dynamic services and policy opportunities for their customers to purchase and to elect a variety of options.

2019 1109 - ACLI - Michael Lovendusky - Life Insurance Illustrations Working Group (NAIC)

- "Dynamic Products" are products with premiums and benefits that can fluctuate from month to month

- ...Some common names for dynamic products include universal life...

2000 - Book - Life Insurance Products and Finance, by D.B. Atkinson and J.W. Dallas, p288

1980s - ACLI - Premiums and Benefits

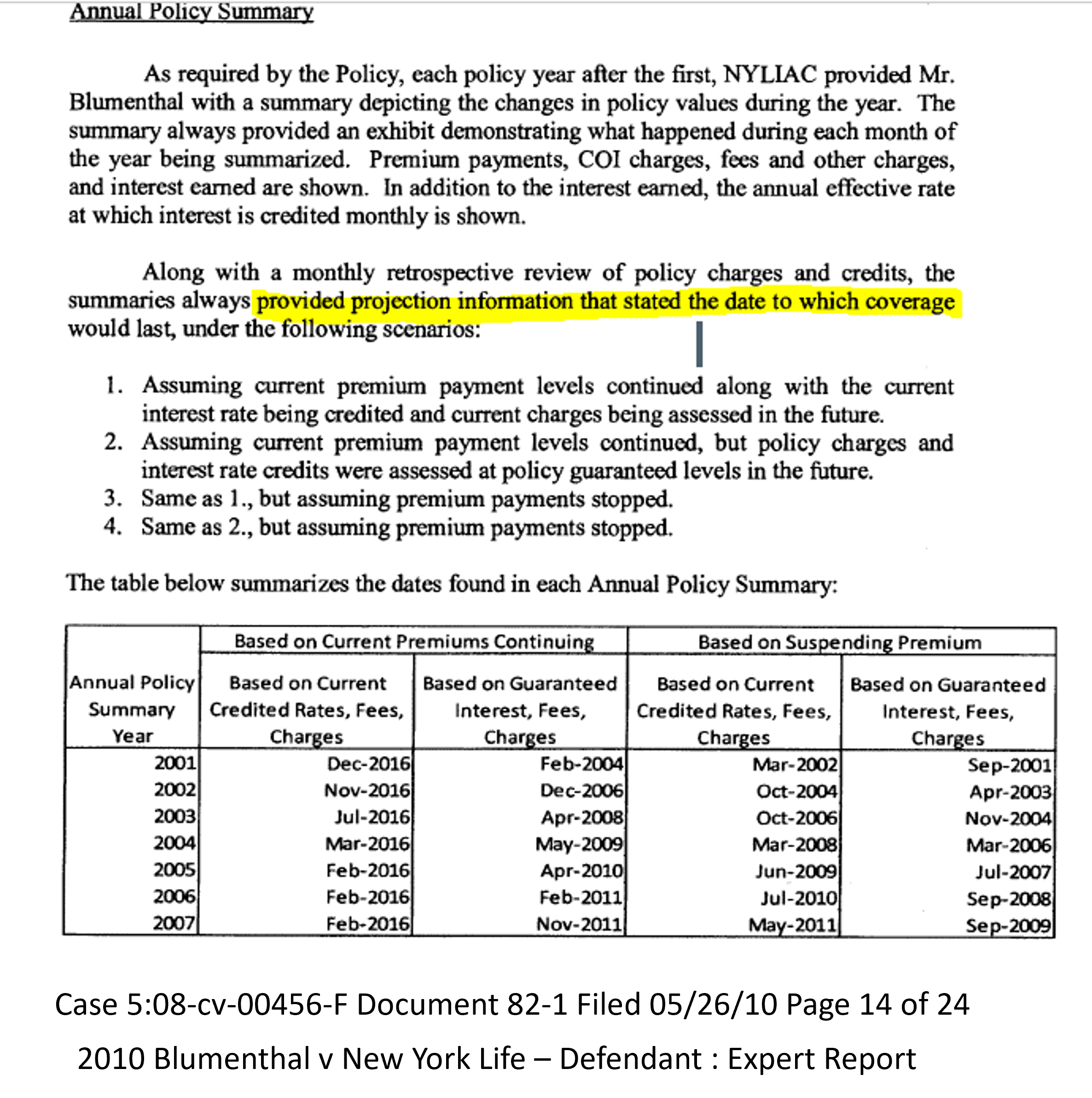

- ... the policy summary should include a statement on the point at which the policy will expire based on the policy guarantees and the anticipated premiums shown in summary.

- ...Universal Life should be treated as a life insurance plan with a nonguaranteed cost element for cost disclosure purposes.

-- 1981 1215 - ACLI - Paper on Cost Disclosure for Universal Life, by the Special Task Force of the ACLI Cost Disclosure Subcommittee - p399-402 - 4p

1982-1, NAIC Proceedings

- ….provide illustrations based on different assumptions.

- This would serve to demonstrate to the consumer the effect on future benefits of changes in assumptions. (p183)

-- 1988 0613 - ACLI - A Statement on Behalf of the American Council of Life Insurance to the NAIC Market Conduct Surveillance (EX3) Task Force, Subgroup on Life Advertising Issues - 3p

1988-2, NAIC Proceedings

- The essence of the proposal is that universal life insurance be treated for cost disclosure purposes as a life insurance plan with a nonguaranteed cost element.

- Thus, the policy summary would show for the prescribed policy years the anticipated premiums and, both on the guaranteed and currently illustrated bases, the death benefits, cash surrender values, and endowment amounts, if any.

- An additional item of information that is recommended to be required in the policy summary is the point at which the policy will expire based on the policy guarantees and the anticipated premiums shown in the summary.

-- 1981 1215 - ACLI - Paper on Cost Disclosure for Universal Life, by the Special Task Force of the ACLI Cost Disclosure Subcommittee - p399-402 - 4p

1982-1, NAIC Proceedings

- Other policies may have special features which allow flexibility as to premiums and coverage.

- Some let you choose the death benefit you want and the premium amount you can pay.

- The kind of insurance and coverage period are determined by these choices.

- One kind of flexible premium policy, often called Universal Life, lets you vary your premium payments every year, and even skip a payment if you wish.

- The premiums you pay less expense charges) go into a policy account that earns interest, and charges for the insurance are deducted from the account.

- Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

-- 1982 1129 - ACLI - Statement on Behalf of the American Council of Life Insurance To The NAIC (A) Committee's Life Cost Disclosure Task Force - p523- - 27p

- [Bonk: Also Found in NAIC Life Insurance Buyer's Guide editions until the1996 Proc. 3rd Quarter 9, 40, 907, 918, 931-936 (amended Buyer’s Guide)]

1983-1, NAIC Proc.