Adjustable Life Insurance

- Adjustable Life Descriptions

- Universal Life as Adjustable Life

- Universal Life and Adjustable Life are Different

- Q: What Came First Universal Life or Adjustable Life?

- 1977 – October – Changing Times – Adjustable Life

- 1977 10 – Changing Times – Adjustable Life

- 1982 – Principles of Insurance – Adjustable Life – Rejda – p342

- 1984 – May – Changing Times – Adjustable Life

- 1989 – October – Changing Times – Adjustable

- Minnesota Mutual pioneered, and Bankers Life of Des Moines quickly adopted, an adjustable life policy enabling policyholders to switch from term to whole‐life and back again.

1979 0930 - NYT - The Appeal of Life Insurance Fades, But Most Families Still Buy It, By Edwin McDowell --- [BonkNote] --- [link-Paywall Free]

- 5. Other Special Life Insurance Plans

- The adjustable life insurance plans are life insurance policies which offer a variety of options to the policyholder, but which are contractually modified every time the policyholder elects an option.

- A definite amount can always be calculated as the present value of future insurance benefits, and there is a definite pattern of future premiums at any specific time.

- Reserves and cash values can be calculated prospectively, as they are calculated for traditional life insurance policies.

- The (C-4) Technical Subcommittee has concluded that these adjustable life insurance plans do not require any further attention.

1981-2, NAIC Proceedings

- People / Company

- Walter L. Chapin --- Minnesota Mutual Life, Currently Securian Life

- Charles Trowbridge --- Bankers Life, currently Principal Life

- Nationwide

- Ratebooks

- 1983 - Best's Flitcraft Compendium, Minnesota Mutual - Adjustable Life II - p335

- 1987 - Best's Flitcraft Compendium, Minnesota Mutual - Adjustable Life III - p272

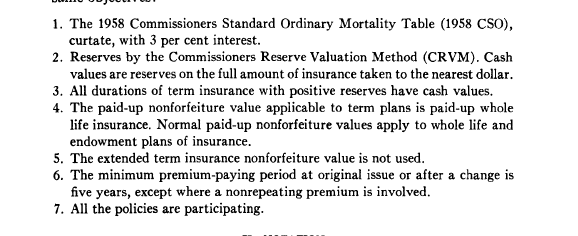

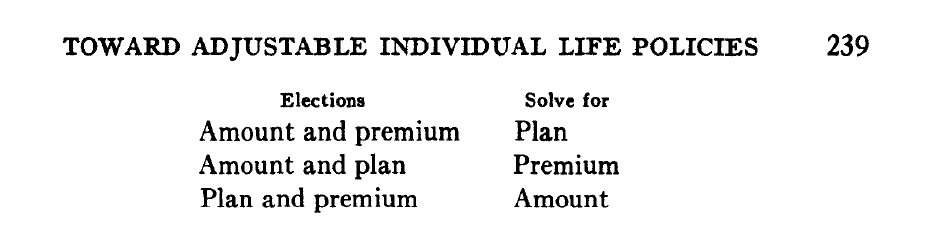

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, by Walter L. Chapin - 50p

- Based on the owner's selection of any two of three components of a Contract face amount, premium and plan of insurance-Minnesota Mutual will then calculate the third.

- In addition, the Contracts may be adapted to the owner's changing needs and objectives subsequent to issue.

- The owner may change or "adjust" the face amount and premium level, and thus the plan of insurance, subject to certain limitations, so long as the Contract remains in force." (p14406)

1989 0411 - Federal Register - 284p

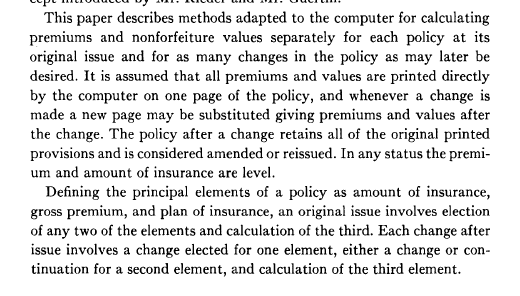

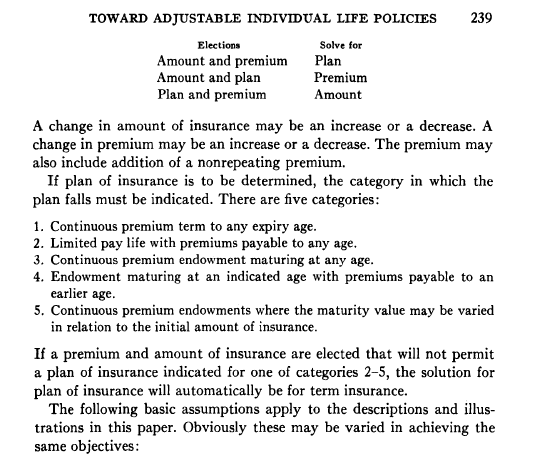

- The computer-produced policy specifications page shows the face amount, gross premium, protection period, and premium paying period.

-- Alice M. Neenan

1978 - SOA - Adjustable Life Products (rsa78v4n33), Society of Actuaries, Moderator: Samuel H. Turner - 14p

- J. ROSS HANSON: Many people think adjustable life is very complicated and costly to administer. In fact it is just the opposite.

- If a company has an adjustable policy, it could conceivably be the only policy of the company.

- The cost of administering this policy is much less than maintaining a portfolio of 40 or 50 different plans of insurance with different cash values and dividend scales and all the related expense of management.

1977 - SOA - Effective Product Management, Society of Actuaries - 12p

- Because of the high level of flexibility provided in a "Universal Life" style Adjustable Life product.....

-- David R. Carpenter

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- ACLI Fact Book - Glossary of Insurance-Related Terms - [link]

- "Universal life insurance...... Also known as adjustable life insurance."

- "Adjustable life insurance: A type of life insurance that allows the policyholder to change the plan of insurance, raise or lower the policy’s face amount, increase or decrease the premium, and lengthen or shorten the protection period."

- 2001 - LC - McCord v. Minnesota Mutual Life Insurance Company - (D.MINN. 2001)

- casemine.com/judgement/us/5914b9b9add7b0493478cbb9

- Adjustable life is characterized as either "term" or "whole" life depending on how long the plan of insurance will last on a guaranteed basis with the face amount and premium chosen.

- This leads to the second attitude adjustment that is needed.

- The old distinction between term and permanent is usually not appropriate for an adjustable life policy.

- ⇒ In every sense an adjustable life policy should be a permanent policy regardless of what the current static plan may be.

- Its flexibility means that it can be the only policy a person ever owns even if the initial version corresponds to a ten-year term plan.

- It seems better to look at it in terms of what it can adjust to in the future rather than to concentrate on whatever plan today's premium/face amount relationship requires for defining values and dividends.

- The emphasis should be on the basic permanent result that flows from the adjustability.

- It is necessary that those with experience in individual life insurance adjust their thinking to adjustable life.

- Traditional attitudes and approaches are not always appropriate. (p282)

-- Charles E. Rohm

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, Walter L. Chapin - 50p

- I predict that adjustable life will be the product of the future.

- It can duplicate the coverage provided by all the traditional life, term, and endowment forms, but the policyholder has the flexibility to increase or decrease his premium or face amount at any time, subject to stated requirements for evidence of insurability.

- A change in the form of coverage can be accomplished by requesting the appropriate premium and face amount changes, allowing the policyholder to adjust the relative savings and protection elements.

-- Alice Neenan

1977 - SOA - Effective Product Management, Society of Actuaries - 12p

- Unfortunately the terminology that has developed to describe adjustable life and universal life has been confusing.

- Many insurers have used the word adjustable in the title or name for their universal life policies.

- Consequently many agents have come to regard adjustable life as simply an alternate name for universal life.

- Many of them are unaware that generic adjustable life policies predate universal life.

McGill's Life Insurance - [link-Adjustable Life]

- Traditional ratebooks simply do not work with Adjustable Life.

- In the first place, it is not feasible to print rate pages for every conceivable plan.

- Secondly, it is impossible to print rate tables for plans which have been adjusted, because the amount of reserve in force at the time of change effects the calculation of the new values.

- Adjustable Life is truly a product of the computer age, and both the home office and the field must rely heavily on modern technology.

-- Alice M. Neenan

1978 - SOA - Adjustable Life Products, Moderator: Samuel H. Turner, Society of Actuaries - 20p

- The Adjustable Life policy offered by Minnesota Mutual was first test marketed in 1971.

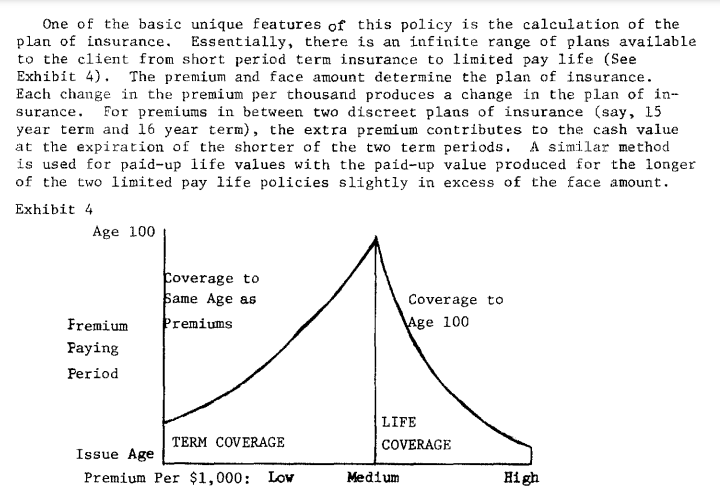

- One of the basic unique features of this policy is the calculation of the plan of insurance.

- Essentially, there is an infinite range of plans available to the client from short period term insurance to limited pay life (SeeExhibit 4).

- The premium and face amount determine the plan of insurance.

- One of the basic unique features of this policy is the calculation of the plan of insurance.

-- Robert E. Hunstad

1975 - SOA - Ordinary--New Products, Society of Actuaries - 18p

- Actuarial

- 1975 - SOA - Ordinary--New Products, Society of Actuaries - 18p

- 1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, Walter L. Chapin - 50p

- 1976 - SOA - Adjustable Life Products (rsa76v2n44), Moderator: Robert E. Hunstad, Society of Actuaries - 14p

- 1978 - SOA - Adjustable Life Products (rsa78v4n33), Society of Actuaries, Moderator: Samuel H. Turner - 14p

- 1978 - SOA - Adjustable Life Products (rsa78v4n23), Society of Actuaries, Moderator: Robert D. Houge - 22p

- 1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- 1979 - SOA - Nonparticipating Adjustable Individual Life Policies, Society of Actuaries - 32p

- 1979 - SOA - The Adjustable Life Decisions, Society of Actuaries - 18p

- 1979 - SOA - Adjustable Life Expense Allowances Under The Commissioners Reserve Valuation Method, Society of Actuaries - 36p

-

- 2018 - SOA - In the Beginning... A Column Devoted to Tax Basics, Why Section 7702 (and 7702A, Too>? Some Historical Perspectives, Society of Actuaries, John T. Adney - 5p

- Law

- Law Reviews

- 1985 - LR - Federal Income Taxation of Life Insurance Products after the Tax Reform Act of 1984 - 21p

- Legal Cases

- 1997 - LC - Grove v. Principal Mut. Life Ins. Co. (Formerly Bankers Life)

- Case NO. 4-97-CV-70224

- District Court - Southern District of Iowa

- 1992 - LC - Grove v Principal - Adjustable Life - Policy Data Page, Jerry Grove - 4p

- Not on Pacer.gov

- 2000 - LC - Seckel v. Minnesota Mutual Life Ins. Co.

- CIVIL ACTION NO. 99-2834

- (E.D. Pa. Mar. 1, 2000)

- 2001 - LC - McCord v. Minnesota Mutual Life Insurance Company - (D.MINN. 2001)

- casemine.com/judgement/us/5914b9b9add7b0493478cbb9

- Adjustable life is characterized as either "term" or "whole" life depending on how long the plan of insurance will last on a guaranteed basis with the face amount and premium chosen.

- Not on Pacer.gov

- 1997 - LC - Parkhill v. Minnesota Mut. Life Ins. Co

- No. 97-CV-515.

- Book - Principles of Insurance Law, Jeffrey W. Stempel - p1057

- Not on Pacer.gov

- 1999 - LC - Zarrella v. Minnesota Mutual Life Ins., 96-2782 - Snippets

- Opinion - 26p

- (p1) - The plaintiff-insured Ann Zarrella (plaintiff)1 and the defendant-insurer Minnesota Mutual Life Insurance Company (Minnesota Mutual or defendant) have been engaged in a lengthy dispute over the proper surrender value of the plaintiff’s life insurance policy.2

- 2 Similar to the case of Jarndyce v. Jarndyce, in Charles Dickens’s novel, Bleak House (Nicola Bradbury ed., Penguin Books 1996) (1853) this seemingly endless litigation has cost both parties far more than the case is worth; the parties would have been better served by mediation.

- Not on Pacer.gov

- Opinion - 26p

- 1997 - LC - Grove v. Principal Mut. Life Ins. Co. (Formerly Bankers Life)

- MEDIA - Adjustable Life Insurance

- 1977 10 - Changing Times - Adjustable Life Insurance --- [BonkNote]

- "Adjustable" Life Insurance. The idea is to have one policy you can change as your needs change.

- 1977 10 - Changing Times - Adjustable Life Insurance - (p17-19) - GooglePlay --- [BonkNote]

- 1984 05 - Changing Times - Term, Whole Life, Universal Life. Only Adjustable Life II gives you the best of all three! - Bankers Life - (p19) --- [BonkNote]

- 1989 10 - Changing Times - Adjustable Life Insurance - (p70) - Principal Life --- [BonkNote]

- Each Time Your Life Changes, Our Life Gives You An Edge

- 1977 10 - Changing Times - Adjustable Life Insurance --- [BonkNote]

- NAIC

- 1981-2, NAIC Proceedings

- 1982-2, NAIC Proceedings

- In 1965, when Combined Insurance Company determined that the time was right for it to enter the life insurance market, Walter Chapin was hired as a consultant.

- Walter suggested a product concept from which was designed that first "prototype" adjustable policy.

- It was adjustable in that it permitted the policyholder to, at his option, adjust his face amount.

-- Spencer Koppel

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- Another recent product is "adjustable life insurance."

- The policyholder must pay premiums on the specified due dates but can request changes in the amount of the premium, the amount of insurance, or the plan of insurance.

- The policy thus can be changed from a permanent insurance plan to a term plan, and vice versa.

1982-2, NAIC Proceedings

- How does an Adjustable Life plan change differ from a traditional plan change?

- There is no charge or refund based on the difference in reserves or gross premiums.

- The cash value stays in the contract, and the size of the reserve at the time of the adjustment is factored into the calculation of the new premium.

- In effect, the impact of the plan change is spread over the entire remaining premium paying period, rather than being accounted for by a one shot charge or refund.

- However, the policyowner who wishes to improve the plan (that is, lengthen the protection period of a term form, or shorten the premium paying period of a life form, or increase the maturity cash value of an endowment form) can do so by the payment of an unscheduled single premium.

-- Alice M. Neenan

1978 - SOA - Adjustable Life Products (rsa78v4n33), Society of Actuaries, Moderator: Samuel H. Turner - 14p

- 1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, Walter L. Chapin - 50p

Chapin - Ultimate Interest