Dynamic or Not?

"...completely Dynamic services and policy opportunities for their customers to purchase and to elect a variety of options."

2019/11/09- Life Insurance Illustrations Issues Working Group - Michael Lovendusky, ACLI

"They <Universal Life Policy> merely afford purchasers greater flexibility in designing their contracts so as to meet their individual needs."

STATEMENT OF THE AMERICAN COUNCIL OF LIFE INSURANCE BEFORE THE NASAA NAIC JOINT REGULATORY INSURANCE - 10p

1982-1, NAIC Proceedings

"William Koenig (Northwestern Mutual) suggested that the parties all needed a common understanding of the terms used in their discussion."

1993-4, NAIC Proceedings

The contract <Universal Life> is a lot like the Adjustable Life concepts of The Bankers and Minnesota Mutual, with the significant, additional flexibility that a plan change is not required each time there is a change in premium payments." --SPENCER KOPPEL

1979 -FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, Society of Actuaries

Broken down to its simplest basis, Universal Life has eliminated the concept of "plan of insurance".....

-- Christian J. DesRochers

1983 - Universal Life, Society of Actuaries - 24p

"Dynamic Products" are products with premiums and benefits that can fluctuate from month to month, depending on the premiums the policyholder pays, the withdrawals the policyholder makes, the investment returns credited to the policy, and the mortality and expense charges deducted from the policy."

"Some common names for dynamic products include universal life, variable universal life, unit-linked life, and adjustable life."

2000, Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

"Dynamic Products" are products with premiums and benefits <Bonk: Perrformance (VPD), Death Benefit Duration / Plan of Insurance> that can fluctuate from month to month, depending on the premiums the policyholder pays <P1>, the withdrawals the policyholder makes, the investment returns credited <i%> to the policy, and the mortality and expense charges <P2> deducted from the policy."

"Some common names for dynamic products include universal life, variable universal life, unit-linked life, and adjustable life."

2000, Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

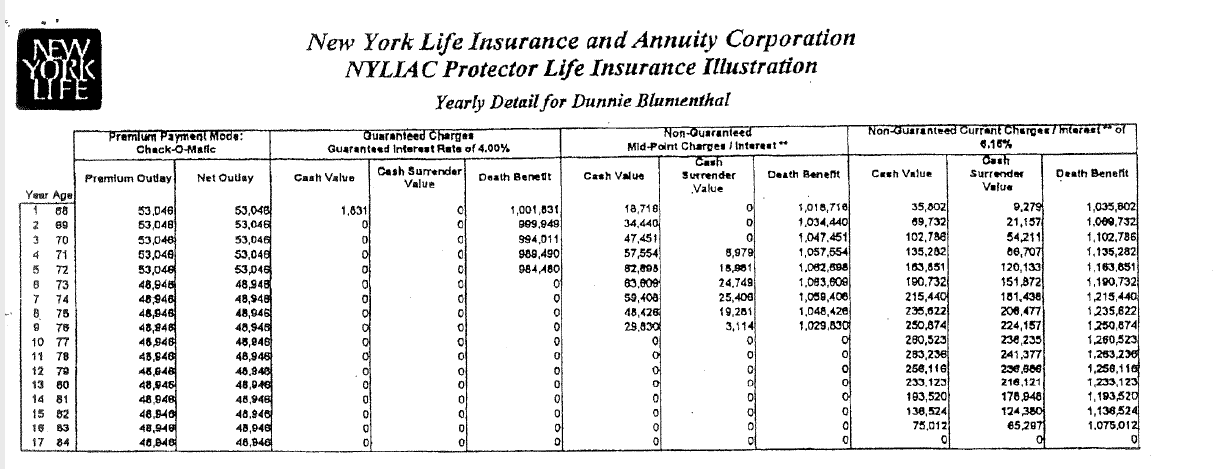

- So, I think ... if you can refer to the eventual illustration and just show the cash value. -- Teresa Winer (GA)

2019/9/17, NAIC Life Insurance Illustrations Working Group, <Bonk>

b. Accumulation of Cash Value

- Mr. Wicka said the ACLI comment letter suggested clarifying that the "accumulation of cash value" is a "yes or no" question.

- Mr. Wicka said the American Academy of Actuaries (Academy) comment letter questioned whether the accumulated values being requested are guaranteed or nonguaranteed or both.

- Mr. Wicka said he intended this to be a "yes or no" question, which takes care of the Academy's concern about which values are being shown.

- Mr. Struk agreed that this should be a "yes or no" questions.

- Birny Birnbum (Center for Economic Justice-CEJ) agreed that this is a "yes or no" question, but it should include a reference to where more detailed information can be found in the illustration.

2018-3, 6-46, NAIC Proceedings

A life insurance policy illustration is a mathematical calculation of benefits and values over time under specific, simplified, and generally static assumptions. (p141)

1991-1992 - FINAL REPORT* OF THE TASK FORCE FOR RESEARCH ON LIFE INSURANCE SALES ILLUSTRATIONS - 142p, Society of Actuaries

|

How much do the benefits build up in the policy? How will the timing of money paid and received affect interest? |

|

2018 - Life Insurance Buyer's Guide Working Group - Cude Letter / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18

2000/10/5 - Annual Report - Continued planned payments of $150.00 each month will provide coverage until:

- November 5, 2005, based on guaranteed rates

- July 5, 2013, based on current rates

2004/10/5 - Annual Report - Continued planned payments of $150.00 each month will provide coverage until:

- June 5, 2009, based on guaranteed rates

- October 5, 2014, based on current rates.

2012/10/8 - Annual Report - If continued planned payments of $150 .00 each month Bil! made, your policy will provide coverage until:

- October 5, 2013, when the Insured's age Is 67, based on guaranteed rates

- July 5, 2014, when the lnsured's age Is 68, based on current rates