Expectations

- Life insurance, because it is a nontangible product, is extremely susceptible to being perceived as whatever people think it to be.

-- Larry Silkes

1983 - SOA - Universal Life Valuation and NonForfeiture: A Generalized Model, Shane A. Chalke and Michael Davlin, Society of Actuaries - 72p

- The most obvious is if we fail policyholder expectations, we may have policyholder suits.

-- Larry R. Robinson (Chairman of the ACLI Subcommittee on Cost Comparisons)

1988 - SOA - Actuarial Opinion on Non-Guaranteed Elements, Society of Actuaries - 12p

If we are going to have a group of consumers of our products who are satisfied with what they get, we have to meet their expectations.

Obviously, there are two adjustment points whereby that can be accomplished.

- One is that you can change the outcome to match the expectations.

- The other is to change the expectation to match the outcome

-- Robert E. Wilcox - Chairman of the Life Disclosure Working Group (NAIC)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- (p70) - Mrs. COLLINS. Just a couple of quick questions. Mr. Weiss, what do you think the significance of liquidity is with respect to the solvency of life insurance companies?

- Mr. Weiss. Liquidity has always been an important factor behind the scenes and now it's becoming a very important factor right here and now.

- Mrs. COLLINS. Well, I am concerned because of the runs that we seem to be having both in other places and particularly in Chicago.

- Mr. WEISS. The companies should have on hand sufficient liquidity to cover the potential demands that policyholders may make.

- Either that or you need to disclose ahead of time to the consumer that his investment may not be liquid.

- If you have no surprise, you will not have any panics.

1991 0717 and 0724 - GOV (House) - Life Insurance Solvency Issues, (CSPAN) - Insurance Insolvencies, (NAIC) - The Impact of Junk Bonds, Real Estate and Mortgages on the Life Insurance Industry - [PDF-217p-GooglePlay, <VIDEO-?-0717> 0724-VIDEO-CSPAN]

- IMPORTANT POLICY OWNER NOTICE: During the past year, previously illustrated values for your policy in the area of [describe which values have diminished] have diminished and may have an impact on your expectations.

- You should consider more detailed information about your policy to understand how it has performed and may perform in the future.

1995-1, NAIC Proc.

- What I do not like is "high likelihood of meeting policyholders' expectations."

- I think when we are talking about that, we are really talking about moving to guarantees and with all the problems attendant thereon.

- The 44% of the values and benefits paid by Prudential in 1993 were nonguaranteed elements.

- That is an important aspect of our sales, if we are trying to meet expectations, then I think we have a major problem.

- If we are selling on the basis that this is going to fulfill your expectations without the disclaimers that are necessary, then we have some major problems.

--- George Coleman (Prudential / NAIC Technical Resources Group - TRG)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- 1995-1, NAIC Proceedings - Guaranty Fund Issues Working Group B of the Insolvency (EX5) Subcommittee - September 11, 1995

- (p588) - Len Stillman (Utah) asked why consumers who purchase investment type insurance products should be afforded protection that other investors are not offered.

- Commissioner Bartlett (Marryland) responded that there is a perception that products offered by life insurers are more secure than other investments.

- The agent said that Universal Life policy premiums would stay the same, but I came to realize that this is not true of our policies.

- ...what bothers me is that I am afraid that this same misleading information may be the basis of my children's and grandchildren's ... planning...

-- Statement of Gloria Darleen Newberry

1993 0525 - GOV (Senate) - When Will Policyholders Be Given The Truth About Life Insurance? - [PDF-354p-GooglePlay,

- Mrs. Vogt’s testimony reveals that the Vogts’ actual grievance with the policy performance arose from their agent’s alleged oral representation in 1999 that if they paid a $150 premium each month, their $100,000 policy would remain in force and would never lapse. (Ex. A at 17:17-20:12.)

Legal Case - Vogt v State Farm

- One problem area in a lot of policies has been interest rates.

- A slow cumulative, very large decline in interest rates has affected everything.

- Why are we getting so many complaints?

- Did the policyholder expect rates to stay the same forever?

- Did the agent or the company mislead?

- Did the policyholder think we were promising?

- He shouldn't have, I hope he didn't.

-- Bruce E. Booker (ACLI)

- Vice President and actuary with Life of Virginia in charge of product development.

- Member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure

- Member of the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustrations

1993 - SOA - Sales Illustrations: We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries - 28p

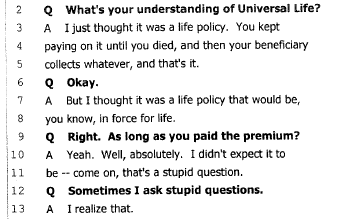

Blumenthal v New York Life - Blumenthal Deposition - As Long as You Pay Premium

- LSW also disputes that any alleged misstatements or omissions caused any injury to Plaintiffs or members of the class.

- Among other evidence, LSW will introduce evidence of surveys conducted on consumers demonstrating that the aspects of illustrations Plaintiffs challenge have no impact on consumer purchasing behavior.

- Further, the evidence will show that Plaintiffs’ expert, Dr. Jason Abrevaya, lacks any credible basis to opine on the purported values of Plaintiffs’ and class members’ policies, or restitution, including but not limited to because his calculations are (contrary to his representations) based on a Simulation that is deeply flawed and inaccurate.

Case 2:10-cv-09198-JVS-JDE Document 1062 Filed 12/21/18 Page 9 of 16 Page ID #:46738

CASE NO.: CV 10-9198 JVS (RNBx) - Formerly Case No.: 3:10-cv-04852 JSW - From Northern District of California - FINAL PRETRIAL CONFERENCE ORDER

3. Plaintiffs failed to prove consumer expectations

- That failure properly doomed Plaintiffs’ claim. See, e.g., Clemens, 534 F.3d at 1026 (proof of UCL fraud claim requires proof of consumer expectations by class-wide evidence: “a few isolated examples of actual deception,” “personal experience,” “personal assumptions,” and personal “expectations” of named plaintiffs are insufficient).

- Plaintiffs can hardly complain about the court commenting on the absence of survey evidence— Plaintiffs’ own expert testified that, without a survey, he could not opine about consumer expectations. ER791 59:18-21.

2016 0208 - Walker et al v. Life Insurance Company of the Southwest - Case: 15-55809, 02/08/2016, Appellees Answering Brief, ID: 9858577, DktEntry: 42, Page 42 of 126 - 126p