Features

- Key Attributes of Generic Life Insurance Policies --- Table 4-2

- Duration of coverage - Universal Life - Depends on premiums paid (p111)

2015 - Book - Life Insurance 15th Ed. - Black, Skipper, Black (Huebner Series)

- The foregoing is only one approach to the design of a contract with the desired characteristics.

- There is ample scope for variations in the form of the term life insurance, the loading pattern, the accumulation process, the availability of optional benefits and other features.

- It should be noted that the suggested design can provide any conceivable pattern of premium payment and coverage and thus can replace all other products.

- Hence, the Universal Life Insurance Policy.

1975 (originally) - SOA - The Universal Life Insurance Policy, James C.H. Anderson, Society of Actuaries - 10p

- Other policies may have special features which allow flexibility as to premiums and coverage.

- Some let you choose the death benefit you want and the premium amount you can pay.

- The kind of insurance and coverage period are determined by these choices.

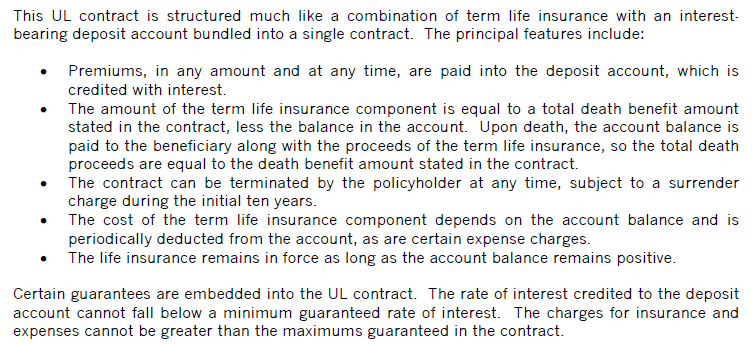

- One kind of flexible premium policy, often called Universal Life, lets you vary your premium payments every year, and even skip a payment if you wish.

- The premiums you pay less expense charges) go into a policy account that earns interest, and charges for the insurance are deducted from the account.

- Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

-- 1982 1129 - Letter - ACLI to NAIC - Statement on Behalf of the American Council of Life Insurance To The NAIC (A) Committee's Life Cost Disclosure Task Force - p523-? - 27p

1983-1, NAIC Proceedings

⇒ [Bonk: Also Found in NAIC Life Insurance Buyer's Guide editions until the 1996 Proc. 3rd Quarter 9, 40, 907, 918, 931-936 (amended Buyer’s Guide)]

- The features that distinguish Universal Life from traditional whole life include premium payment flexibility, adjustable death benefits, and improved transparency.

2008 - SOA - A Layman’s Guide to Corporate-Owned Life Insurance, Rick Schnurr, Society of Actuaries - 76p

- This proposal would incorporate the following new features into the model regulation:

- The concept of a nonguaranteed element to measure the extent to which policy costs can be affected by premiums, benefits, or other items that are subject to change by the company without the consent of the policyholder.

- A special plans section to accommodate the, unique features of nontraditional plans such as universal life insurance.

-- ACLI - Statement on Behalf of the American Council Of Life Insurance To The NAIC (A) Committee's Life Cost Disclosure Task Force - p523- - 27p

1983-1, NAIC Proceedings - November 29, 1982

- Market regulators should also be aware that sales of products, such as fixed-index annuities (formerly referred to as equity-indexed annuities) and index life insurance products (such as universal index life insurance) continue to increase.

- These products typically include features that require an understanding of bonuses, guaranteed elements and an array of interest-crediting methods.

- In some cases, existing NAIC model laws and regulations may not give specific guidance on all aspects of all products.

- In such instances, examiners may rely on general principles found in the NAIC Unfair Trade Practices Act and the NAIC Annuity Disclosure Model Regulation.

2009-3, NAIC Proceedings

- Overview of Universal Life Product Features

- Fixed, indexed, and variable products

- Flexible and fixed premium products

- Persistency bonuses

- Secondary guarantees (with and without shadow accounts)

- Various types of reinsurance and the reinsurance reserve offset

2018 - SOA - A Comprehensive Look at U.S. Reserving Principles for Universal Life Insurance: Fixed, Indexed and Variable Seminar, Society of Actuaries