Focus Groups / Consumer Testing

- Consumer Disclosure Issues Working Group of the Product Development (A) Task Force - NAIC

- Focus Groups - NAIC - 2000s

- A great deal of the confusion seems to stem from a lack of understanding of how cash value insurance products work and a lack of understanding of insurance terminology.

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

- One person was so confused that he said that the maturity age and endowment benefit were moot points, since the policy was going to end at year 31 anyway.

1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form Test Market Results, NAIC Product Development Task Force- 10p

- 1979-2, NAIC Proceedings

- Consumer Reaction to Cost Disclosure: An Annotated Bibliography of Studies

- Life Insurance Committee Advisory Committee on Monitoring the Impact of the NAIC Model Life Insurance Solicitation Regulation

- 1981 - AP - The NAIC Model Life Insurance Solicitation Regulation: Measuring the Consumer Impact in New Jersey, Roger A. Formisano - 22p

- 2001-4V1, NAIC Proceedings - Do Product Disclosures Inform and Safeguard Insurance Policyholders? - 11p

- Joel Ario (Pennsylvania Insurance Commissionere... said the consumer complaint analysts in a state are a “focus group” that each state should rely on.

2009-3, NAIC Proceedings

Words: Focus Groups, Consumer Testing, Test Market, Survey

- A survey was used in Fairbanks v. Farmers New World Life Insurance Co.85 to defeat a showing of materiality.

- In that case, defendants relied on a survey commissioned by plaintiff’s counsel, in which 500 policyholders were asked if they would have purchased their policies had it been disclosed that the policies were not permanent.

- A total of 47.4% of the respondents said they would still have purchased the policies.86

- Citing the survey results, the court found that the materiality issue was subject to individual proof, and affirmed the lower court’s denial of class certification.87

2016 - LR - Recent Trends in the Use of Surveys in Advertising Law Disputes; an Update on the Case Law, by Kenneth Plevan - 45p

- We hear a lot about, "we did some market research and we found that this percent of our policyholders didn't know what it was buying."

-- Justin N. Hornburg

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- NAIC

- Life Insurance Buyer's Guide Working Group

- Life Insurance Illustrations Working Group

- Product Development Task Force

- Consumer Issues Disclosure Working Group

- Consumer Disclosure Issues Working Group

- David Lyons (Iowa), William Hager (Iowa)

- 1990-1A - NAIC Proceedings - NAIC / LIMRA Focus Group - Universal Life Disclosure Form Test Market Results - 10p

- 1993 - Policy Information for Applicant- Universal Life - 3p, Life Insurance Disclosure Model Regulation - Appendix D

- Found in 1993 0525 - GOV (Senate) - When Will Policyholders Be Given The Truth About Life Insurance? - [PDF-354p-GooglePlay, No Video]->Not on govinfo.gov

- NAIC

- 1979-2, NAIC Proceedings

- Consumer Reaction to Cost Disclosure: An Annotated Bibliography of Studies

- Life Insurance Committee Advisory Committee on Monitoring the Impact of the NAIC Model Life Insurance Solicitation Regulation

- 1990-1A - NAIC Proceedings - NAIC / LIMRA Focus Group - Universal Life Disclosure Form Test Market Results - 10p

- 2001-1V2 - NAIC Proceedings - Do Product Disclosures Inform and Safeguard Insurance Policyholders? - 11p

- 1979-2, NAIC Proceedings

- ACADEMIC

- 1972 - AP - An Empirical Investigation of Attitudes Toward the Life Insurance - Marketing - 181p

- 1978 - AP - Consumer Accessing and Use of Information in Making Life Insurance Purchase Decisions, Jacob Jacoby - 124p

- 1981 - AP - The NAIC Model Life Insurance Solicitation Regulation: Measuring the Consumer Impact in New Jersey, Roger A. Formisano - 22p

- ACTUARIAL

- 1982 - SOA - Universal Life Update, Society of Actuaries (rsa82v8n34) - 26p

- 1991 - SOA - Illustrations, Society of Actuaries - 20p

- 1991-1992 - SOA - Final Report* of the Task Force for Research on Life Insurance Sales Illustrations, Society of Actuaries - 142p

- 1996 - SOA - Nonforfeiture Law Developments (rsa96v22n38pd), Society of Actuaries - 23p

- INDUSTRY

- 2005 - SOA - Regarding Your Direct Response Offer, As published in the Winter 2004 edition of LIMRA’s MarketFacts Quarterly Barometer - 8p

- MAP - "Monitoring the Attitudes of the Public"

- LAW

- 2014 - LR - The No Reading Problem in Contract Law, by Ian Ayres* & Alan Schwartz, Stanford Law Review - 66p

- 3. Plaintiffs failed to prove consumer expectations

- That failure properly doomed Plaintiffs’ claim. See, e.g., Clemens, 534 F.3d at 1026 (proof of UCL fraud claim requires proof of consumer expectations by class-wide evidence: “a few isolated examples of actual deception,” “personal experience,” “personal assumptions,” and personal “expectations” of named plaintiffs are insufficient).

- Plaintiffs can hardly complain about the court commenting on the absence of survey evidence— Plaintiffs’ own expert testified that, without a survey, he could not opine about consumer expectations. ER791 59:18-21.

lswclassaction.com/docs/download/SANFRAN-%238165194-v1-2016_02_08_042_Appellees_Answering_Brief.pdf

- To date, no state has adopted these forms.

- Why this complete lack of action after all the effort in developing the forms?

-- Tony Spano, ACLI

1990 - SOA - Quality of Life Insurance Sales Illustrations, Society of Actuaries - 16p

⇒ [Bonk: "these forms" - 1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form Focus Group Summary --- [BonkNote] --- 10p

- 4) Illustrations Focus Groups

- One of the key motivations of the working group is the conviction that an illustration should be more of an education tool than a sales tool.

- He said to be sure that the illustration format the working group devises will educate rather than confuse the consumer, the group has expressed an interest in having testing done with focus groups.

1994-4, NAIC Proceedings

- John KELLER, Northwestern Mutual: I'll respond briefly to the suggestion that we use focus groups to get the consumer point of view.

- We did consider that early on in our work and rejected it for a couple of reasons.

- One was the time constraints we were under and the cost of doing focus groups.

- But probably the most important reason is that if you get 15 people in a room who are recent purchasers of life insurance and then spend an hour or two dissecting the sales process and the use of their illustrations in that sales process, you're likely to have 13 people coming out slightly or greatly disillusioned over what they just did.

- We found that our field force and our marketing department didn't like that idea at all.

- So if somebody could think of a way to get to the consumer without causing real problems among recent buyers, who are our most fragile customers, we would like to hear it.

- We did consider that early on in our work and rejected it for a couple of reasons.

- Judy FAUCETT: In line with John's comments, we were told by one group that actually runs focus groups that if you got a group of recent purchasers of insurance in a room, you might get responses of what they think they did or what they think they should have done, as opposed to what they actually did.

1991 - SOA - Illustrations, Society of Actuaries - 20p

- It seems more like we are focused within, and we are afraid to go out and ask the consumer, “What do you really want?”

- Maybe we need to have some focus groups.

- But, as I say, maybe that too would be a problem because we do not even know the right questions to ask because we have not educated our customer about our products and services.

-- Larry J. Bruning

1996 - SOA - Nonforfeiture Law Developments (rsa96v22n38pd), Society of Actuaries - 23p

Baseline Consumer Surveys

Formisano's survey of life insurance policyholders is now some 20 years old and is in dire need of updating and elaboration.

- An important first step would be to survey groups of recently enrolled policyholders (e.g., universal life, long-term care, credit life) who have been exposed to the current generation of NAIC model disclosures.

- The purpose would be to obtain baseline data about their exposure to and awareness of disclosure messages, comprehension of key disclosures, the beliefs and meanings they extract from product messages, and their ability to use disclosures correctly.

3. Effectiveness of Disclosures

- Commissioner Morrison asked the NAIC staff to report on the literature search on the effectiveness of disclosures.

- Ms. Lindley-Myers indicated that the research centered on the effectiveness of disclosures and their usefulness as related to insurance products.

- Unfortunately, there is very little information available on this topic.

- With the exception of product liability and warranties, there is very little information involving disclosure in an insurance setting.

- However, she indicated that Larry Kirsch of IMR Health Economics, LLC in Brookline, MA, had produced an issues generating paper entitled, Do Product Disclosures Inform and Safeguard Insurance Policyholders? (Attachment Three-C).

2001-4V1 NAIC Proceedings

1994 1210 - NAIC - ATTACHMENT TWO-A - NAIC CONSUMER INFORMATION RESEARCH PROJECT

- 1. PROJECT SCOPE

- The project will be conducted under the oversight of the NAIC and the Consumer Information Working Group.

- The design of the research and the release of the final report will be subject to the approval of the NAIC.

- Tim Ghan (Nev.) presented a draft research proposal for a study of consumer information in personal lines insurance (Attachment Two-A).

- The proposed study would involve three steps:

- 1) a review of the relevant literature;

- 2) an analysis of the extent of consumer information and its impact on competition and market performance; and

- 3) an analysis of how consumer information could be most effectively enhanced.

- The proposed study would involve three steps:

- Brenda Cude (Cooperative Extension Service at University of Illinois - Champaign/Urbana)

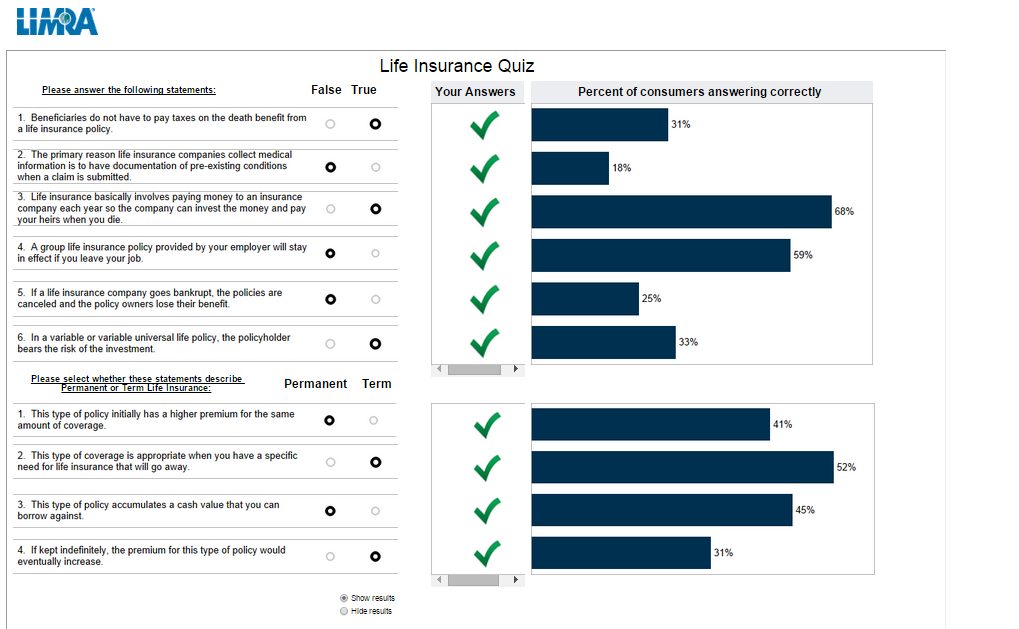

- ...noted the widespread lack of consumer knowledge about insurance, citing a Consumer Federation of America (CFA) study that found that the adults tested were able to answer only 54% of the insurance questions they were given.

- She stressed the difference between consumer information and education and why both are important.

- She added that there is a need for information that time-pressed and limited reading ability individuals can use easily at the point of need.

- Sam Sarab (W.Va.) suggested that consumers could be surveyed as to the different information sources they have been exposed to.

- Robert Klein (NAIC/SSO) responded that the personal lines market study would not analyze the quality of consumer information, as contemplated in the proposal.

1994-4, NAIC Proceedings

- Commissioner Lyons reported that AARP will be doing a review with senior citizens on the readability and understandability of the disclosure form.

- He reminded committee members that the working group will be doing additional work to determine whether these policies provide minimum values to consumers.

- He said that decision would be made after an NAIC staff actuary completes a study of the value of these policies.

- The working group plans to provide that information and its recommendations to the Life Insurance (A) Committee in 1991.

1991-1A, NAIC PRoceedings

Because of the concerns expressed by several states over the potential impact of the survey and at the suggestion of NAIC staff, a draft of the survey was forwarded to the Special (EX) Committee on the McCarran-Ferguson Act.

The Executive Committee designated Commissioner Earl Pomeroy, as chair of that committee and as the President of NAIC, to provide further input and direction.

Accordingly, on Sept. 10, I met with Commissioner Pomeroy, along with Mike Hessler (Ill.), Tom Reents (Neb.) and Art Chartrand (NAIC) to review these issues.

- First, I wish to greatly express my appreciation to Commissioner Pomeroy for articulating his concerns and providing a productive framework for this subgroup to continue to carryout its charge.

- As a result of that meeting, it was mutually agreed to suspend the activity on the current survey and to proceed as follows:

2. Commissioner Pomeroy was very supportive of the subgroup recommending to EX3 Subcommittee that it pursue its investigation and make any appropriate recommendations in regard to the use of purported "consumer'' groups fronting as leads or advertising agencies for insurance companies.

1991-1A, NAIC Proceedings

TO: Members of the Market Conduct & Consumer Affairs (EX3) Subcommittee

FROM: Brad Connor (Mo.), Chair of EX3 Subgroup on Unfair Trade Practices

DATE: October 11, 1990 .

RE: Meeting with NAIC Leadership on Subgroup's Projects