Interest Rate Risk - (C-3)

- In many jurisdictions, insurance companies have expended significant efforts to understand the sensitivity of their investment portfolios to underlying market risks, especially interest rate risk.

2001 11 - BIS / The Joint Forum - Risk Management Practices and Regulatory Capital Cross-Sectoral Comparison - 126p

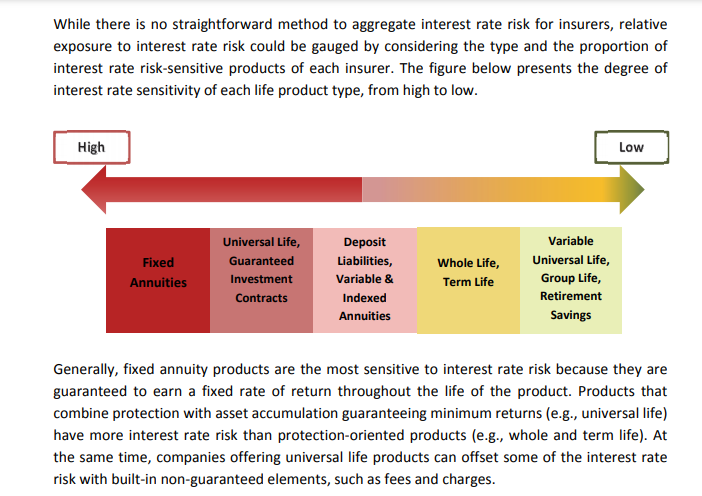

- The mismatch between the cash flows from assets and liabilities for traditional products like universal life or fixed annuities is due mostly to interest rate risk. (p18)

2018 - IAIS - GIMAR - Global Insurance Market Report - 72p

- 1981 - SOA - The Impact of Inflation on Insurance and Annuity Reserve Valuation: The C-3 Risk, Society of Actuaries - 44p

- 1982 - SOA - The Financial Risk to Life Insurance Companies from Changes in Interest Rates, Society of Actuaries - 56p

- 1985 - SOA - Measuring the Interest Rate Risk, Paul R. Milgrom, Society of Actuaries - 62p

- 2002 - SOA - Phase 2 Of The C-3 Project Update, Society of Actuaries - 26p

C. L. Trowbridge coined the term C-3 risk to denote the risk of losses due to changes in interest rates.

1988 - SOA - Algorithms for Cash-Flow Matching, Society of Actuaries - 8p

- SOA

- C-3 Risk

- Committee on Valuation and Related Problems - Trowbridge Committee

- Life insurance companies are also largely exposed to interest rate risks through long-term life insurance products with guaranteed interest rates. (p20)

2001 11 - BIS / The Joint Forum - Risk Management Practices and Regulatory Capital Cross-Sectoral Comparison - 126p

2013 NAIC State of the Life Insurance Industry p137

- The December 12, 1981 report on this subject discussed the risk of loss to a life insurance company from changes in the interest rate environment (now commonly referred to as "(C3) risk"), and its implications for actuarial opinions of reserve adequacy and minimum surplus tests.

- We noted a number of important projects underway and indicated chat we would monitor the projects and report to the TSAG on progress in the spring of 1982.

- We do that with this report.

1982-2, NAIC Proceedings

- A major problem facing the insurance industry today is interest rate fluctuations.

- If the terms of the assets are shorter than those of the corresponding liabilities, reinvestment risk arises because interest rates can fall.

- On the other hand, if assets are invested longer than liabilities, then disinvestment risk exists because interest rates can rise.

1988 - SOA - Algorithms for Cash-Flow Matching, Society of Actuaries - 8p