Q: Is it Accurate to Call Universal Life a Whole Life Policy? Maybe...Maybe Not....

Who refers to Universal Life as Whole?

- Permanent insurance is a term used only by the industry – not by consumer educators.

- We would prefer – Life insurance comes in two basic types: Term and whole life (also referred to as permanent insurance). <Bonk: I'm assuming she is categorizing Universal Life as Whole Life>

-- Brenda Cude, Professor, NAIC Consumer Representative - Comment [BJC2]

No Date. Assuming approximately 11/15/2017

- Whole (or universal) life insurance policies are considered permanent.

- As long as you pay the premium, the policy is in effect. (p32)

2015 Version - Consumer Action Handbook, published by USAGov, part of the U.S. General Services Administration’s (GSA) Office of Citizen Services and Innovative Technologies - 146p

Universal life insurance, like whole life insurance, is a type of permanent life insurance policy that accumulates tax- deferred cash value.

The policy stays in effect for as long as you remain alive and pay the premiums.

usnews.com/360-reviews/life-insurance/universal-life-insurance

- Universal Life Insurance – A form of whole life insurance that is characterized by flexible

premiums, flexible face amounts and flexible death benefit amounts and its unbundling of the

pricing factor. (p88/13)

2022 0813 - NAIC - Market Conduct Annual Statement - Life & Annuities Data Call & Definitions - (Adopted by the MCAS Blanks (D) Working Group 5/26/2022) - Attachment Seven - Executive (EX) C mmittee and Plenary - 8/13/22 - 105p

- Universal life insurance is more flexible than whole life.

- Guaranteed Maturity Premium

- Target Premium

- Guaranteed Maturity Fund

- Policy Value

- r-ratio (“r” is the ratio of the policy value to the guaranteed maturity fund.")

- Mr. Montgomery <Regulator-CA> commented on the flexible premium universal life policy and the fact that it is not really a whole life policy, but a term policy until the premium is actually paid.

1988-2, NAIC

- Unlike the unitary nature of traditional whole life insurance, a distinguishing feature of universal life insurance is the existence of an indeterminate policy value from which specific periodic charges are deducted and to which specified periodic interest is credited at a rate not determined at issue. (p202)

1984 Journal - American Academy of Actuaries

UNIVERSAL LIFE INSURANCE MODEL REGULATION

- D. “Flexible premium universal life insurance policy” means a universal life insurance policy which permits the policyowner to vary, independently of each other, the amount or timing of one or more premium payments or the amount of insurance. (585-1)

- The guaranteed maturity premium for flexible premium universal life insurance policies shall be that level gross premium, paid at issue and periodically thereafter over the period during which premiums are allowed to be paid, which will mature the policy on the latest maturity date..... (585-3)

- The guaranteed maturity fund at any duration is that amount which, together with future guaranteed maturity premiums, will mature the policy based on all policy guarantees at issue.

- The letter “r” is equal to one, unless the policy is a flexible premium policy and the policy value is less than the guaranteed maturity fund, in which case “r” is the ratio of the policy value to the guaranteed maturity fund.

- Drafting Note: Most companies encourage a premium level which will provide lifetime insurance protection. (585-5)

Proceeding Citations

Section 8. Disclosure Requirements

The main concern was that an unsophisticated buyer purchased a policy and did not know what the coverages, benefits and limitations were. 1988 Proc. II 566.

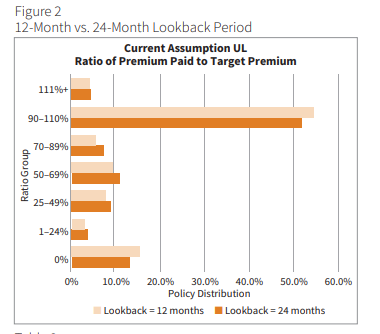

Some of the items identified which should be disclosed: (1) what is guaranteed versus what is not; (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988-2 . II 566.