Robert I. Mehr

- 1961 - Book - Modern Life Insurance, by Robert I. Mehr

- 1975 - AP - The Concept of the Level-Premium Whole Life Policy Reexamined, by Robert I. Mehr - 14p

- 1984 - Book - Life Insurance: Theory and Practice, by Robert I. Mehr

- 1994 - Book - Insurance, Risk Management, and Public Policy: Essays in Memory of Robert I. Mehr (Huebner International Series on Risk, Insurance and Economic Security, 18), by Sandra G. Gustavson (Editor), Scott E. Harrington (Editor) - <WishList>

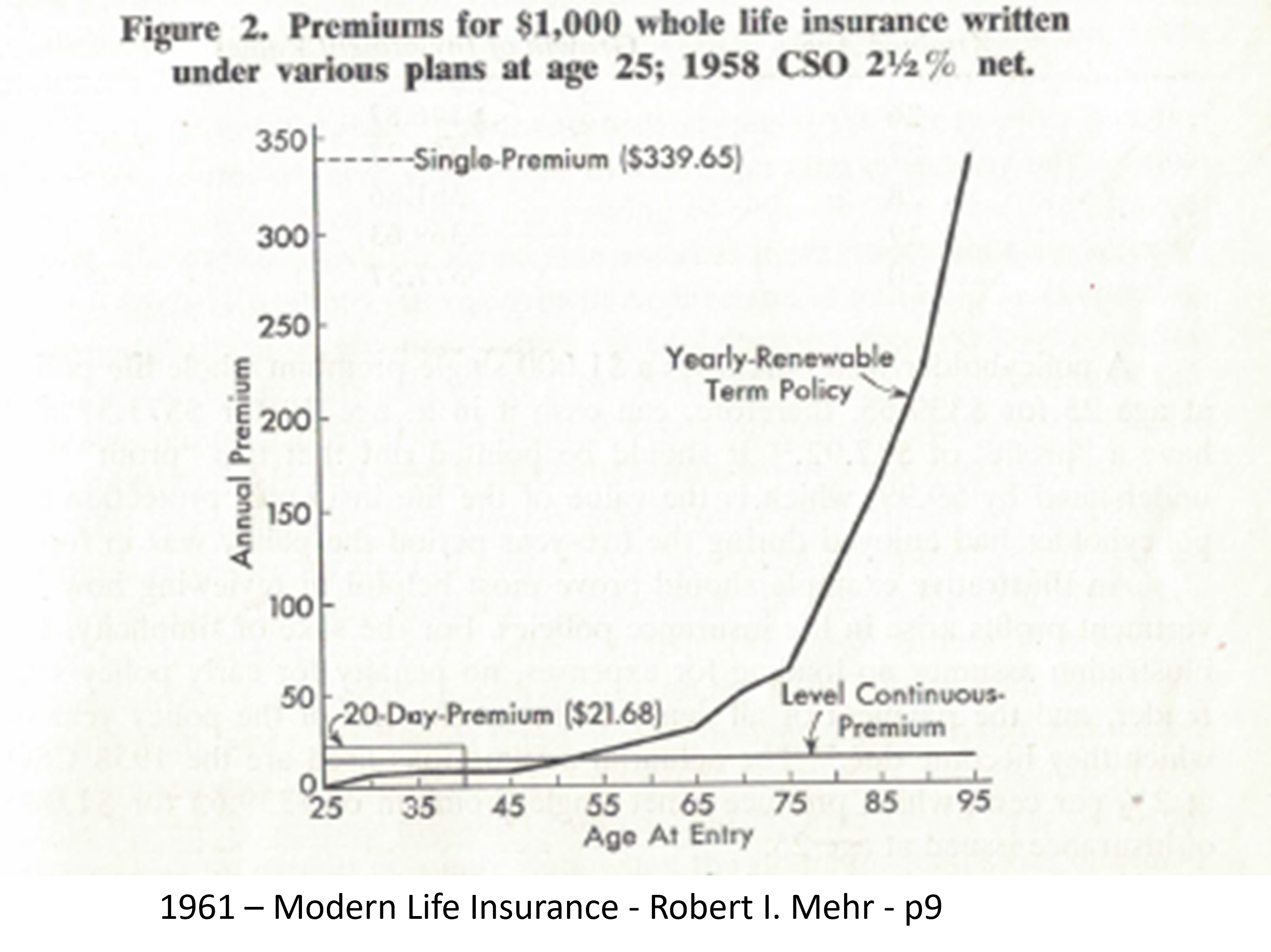

- Persons seeking life insurance for the Whole of Life have several choices: they may:

- buy a one-year renewable term contract and renew it annually, paying the full cost of insurance for each year

- buy coverage for the insured's life with a single premium payment, or

- buy coverage for the whole of life under some type of installment arrangement. (p47)

1984 - Book - Life Insurance: Theory and Practice, by Robert I. Mehr

... in gaining a life insurance education, one problem does present itself... the basic question is where to begin. (p1)

1961 - Book - Modern Life Insurance, by Robert I. Mehr

(p1) - INTERDEPENDENCE OF SUBJECT MATTER

The Subject of Life Insurance is one that everyone will discuss sooner or later.

- Fortunately, nearly everybody knows something about it, but unfortunately many who buy it and some who sell it have only a superficial knowledge.

- Even those who legislate controls or propose reforms for the business are not always sufficiently informed.

- What does one need to know to become adequately informed about life insurance?

- It is essential that he know a few basic principles of law, mathematics, accounting, economics, marketing, finance, business management, statistics, history, and government—all as they apply to life insurance.

- This seems a rather large order, but actually it is not, because everything is logical, and the pattern as a whole fits quite neatly.

- However, in gaining a life insurance education, one problem does present itself.

- Although the pieces fit together snugly, it is not easy to determine the order in which the pieces should be developed.

- For example, to understand types of policies thoroughly one should know something about methods of premium computation.

- But to comprehend premium computations adequately, one must know something about types of policies.

- This interdependence applies with equal force to other aspects of knowledge about the field.

Thus, since it is necessary to know something of the whole to understand and appreciate the parts, the basic question is where to begin.