NOW THEN

Saylers-v-MetLife So, how does this whole system work?

Industry Reputation

Market Conduct/

Complaints/

Lawsuits

Product Performance-

Universal Life

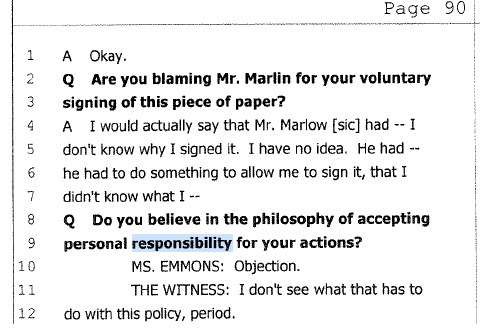

Consumer Accountability

Disclosure

Sales Process

Plan of Insurance

Interest Variability

Premium

Coverage Period-

Universal Life

Premium -

Universal Life

Benefits -

Universal Life

Compare Contrast:

Pricing - Life Insurance vs Car Insurance

Non-guaranteed Elements (NGE's)

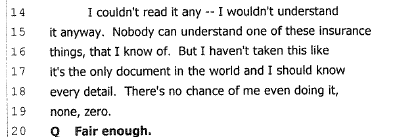

Misleading Illustrations

What's the Goal?

What's the Problem?

2015/3/29 -Life Insurance and Annuities (A) Committee

Appointed a New Working Group to Revise the Life Insurance Buyer’s Guide.

Ms. Matthews said the Committee has a 2015 charge to review and consider revisions to the Life Insurance Buyer’s Guide (Buyer’s Guide) in conjunction with the Life Insurance Disclosure Model Regulation (#580). She noted that the Buyer’s Guide is woefully outdated.

2016 0403, NAIC Proceedings - LIIIWG - Life Insurance Illustration Issues (A) Working Group Conference Call, (6-8)

- Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products. (IULISG – Indexed Universal Life Illustrations Subgroup)

- During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers.

2016/10/20 - LIIIWG CC, 2016-3 NAIC Proceedings

a. Purpose of Policy Overview Document

Birny Birnbaum (Center for Economic Justice—CEJ) suggested that the policy overview document should be a tool to aid consumers in comparing plans across companies, but not to choose between types of plans.

Mr. Wicka explained that he envisions the policy overview as being a high-level document including the basic elements of the plan. He said the policy overview should enhance consumer understanding, but not replace the buyer’s guide or the details in the illustrations

Ms. Mealer said she agrees with Mr. Wicka’s description of the intended purpose of the policy overview document.

- It was important to observe that these nonactuary regulators, experienced, competent people, were seeing a different set of problems than we, as actuaries, were used to focusing on.

-- Robert E. Wilcox - Chairman of the Life Disclosure Working Group (NAIC)

1994 - PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS, Society of Actuaries

- Neither model was intended to generate Buying Guides or to relieve consumers of their own individual responsibilities to understand the product that they are spending their hard-earned money to buy after all.

- And what has happened most recently is that.. And indeed in the most recent development …there are examples of companies attempting to develop completely Dynamic services and policies opportunities for their customers to purchase and to elect a variety of options.

- And that the options themselves might be changed over time, dynamically, at the will of the purchaser with perhaps his or her financial advisor.

- And so, one must I think wonder we're actually whistling into the winds of change here by attempting to make these summaries and overviews more static and less dynamic.

-- Michael Lovendusky, ACLI

2018 1109, NAIC - LIIIWG - Life Insurance Illustrations Working Group, Conference Call, [Bonk]

Market Conduct/

Complaints/

Lawsuits

- <Mr. Lovendusky - ACLI> said the ACLI work group thinks that most confusion for consumers involves complex products like Universal Life, and not Simple products like term life.

- He said consumers are mostly confused about options, guarantees and riders.

- Ms. Winer (GA)asked if it would be useful to ask states whether they have received consumer complaints about the summaries.

- Mr. Wicka (WI) said that it would be helpful to have that kind of information but that he is not sure it would be possible to track down complaints to that level of detail.

2016/4/3 - Life Insurance Illustrations Issues Working Group, NAIC Proceedings

Complaints and inquiries related to life insurance and annuity products were less frequent, and generally concerned consumer dissatisfaction with, or confusion regarding Universal Life insurance policies.

2018 - Wisconsin Insurance Report, page 90

-

They are complaints about things that we can’t do anything about because the contract might be a universal life type product with nonguaranteed elements, and there is no regulatory framework to deal with those issues.

-

Those complaints just fall by the wayside because there is nothing that can be done.

-- Mr. Gorski <Regulator>

1996 - Nonforfeiture Law Developments, Society of Actuaries - 23p

The Department's administrative authority to obtain remedies for individual consumers is more limited than that of a plaintiff in a UCL lawsuit with respect to monetary and injunctive relief.

- Further, the existence of private plaintiffs' lawsuits helps forward the course of the law more effectively than would be the case if the only adjudications were those proceedings, largely administrative, initiated by the Commissioner.

2015 - Brief of the State of California and the California Insurance Commissioner as Amicus Curiae in Support of Plaintiffs, Walker vs Life Insurance Company of the Southwest. Case: 15-55809, 12/16/2015, ID: 9795445, DktEntry: 24, pg 27-28

I think it is. If we are going to have a group of consumers of our products who are satisfied with what they get, we have to meet their expectations.

Obviously, there are two adjustment points whereby that can be accomplished.|

- One is that you can change the outcome to match the expectations.

- The other is to change the expectation to match the outcome1994, PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS, Society of Actuaries

Industry Reputation

2019 1115, NAIC Proceedings - IULISG – Indexed Universal Life Illustrations Subgroup, Conference Call - [Bonk]

- Rachel (Texas) : We can see why it would be confusing and difficult to explain… without eroding some confidence on the consumer's part.

- There is a disintermediation risk for carriers when policyholders are educated through updated illustrations when their policies go off track.

2016, NAIC LIBGWG, Assurity White Paper - 11p

- Greg Gurlick (Northwestern Mutual Life) said that if consumers are not satisfied with results of their IUL policies, it will not only impact the reputations of the companies selling the products but also the entire industry will be painted with a broad brush.

2014 11/14-15, NAIC Proceedings - LATF 6-63

"The working group's concern was how to bring about a change without damage to the marketplace.

1993-4, NAIC Proceedings

- So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer.

- Our biggest mistake would be to delay. I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing.

-- Robert M. Nelson (Chairman- National Association of Life Underwriters (NALU) Task Force on Illustrations)

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

A third problem is of great concern to me...

A few years ago, an awful lot of universal life policies were sold using, in effect, level premium illustrations - your policy will go for all of life or whatever - with companies using 10% or 11% interest rates, which is what the interest rate environment was then.

The concern that I have, which may soon give much of the industry a very black eye, is that while people have received, as required by law, the annual updated policy values, they have not been shown that in all too many cases, their policy is going to end up having no cash value, perhaps when they reach 74 or 75.

-- BRUCE E. NICKERSON

1991, Illustrations, Society of Actuaries

Timing of Disclosures

c. Life Insurance Illustration Issues (A) Working Group

<Ms. Stegall> explained that the Working Group originally was working on revisions to both the Life Insurance Disclosure Model Regulation (#580) the Life Insurance Illustrations Model Regulation (#582). However, under the new approach, revisions only under Model #580 equired. She said the policy overview document would be distributed along with the Buyer's Guide with all life insurance policies.

2018-3, NAIC Proceedings

C. Timing of disclosure

Finally, the Commission <FTC> was concerned about the timing of the disclosure. Under the NAIC model regulation, consumers generally received the buyer's guide and policy summary only when the policy is actually delivered, often a week to 10 days after purchase.

Our experience indicates that if cost disclosure is to be effective, it must take place before the purchase decision. Consumers are very

unlikely to read and use a disclosure package provided after the transaction has been completed.

-- MICHAEL PERTSCHUK, CHAIRMAN, FEDERAL

TRADE COMMISSION

1979 - GOV - FTC STUDY OF LIFE INSURANCE COST DISCLOSURE- Cannon - 592p

Inappropriate Timing of Message

Dissemination of the message at an inappropriate time also reduces effective exposure.

For example, the life insurance cost disclosure package adopted by the National Association of Insurance Commissioners (NAIC) suffers from a serious timing problem.

Purchasers receive a disclosure package containing several cost indices for comparing policies, but the information comes only after the policy is delivered, usually a week to 10 days after purchase.

Once the purchase decision has been made, however, "the buyer becomes psychologically committed to it and is very unlikely to read and use a disclosure package" [Kramer 1978, pp. 12-13].

1982 - Using Information-Processing Principles in Public Policymaking, Michael B. Mazis and Richard Staelin

Universal Life - Descriptions

NAIC

- Cash Value - Life Insurance Buyer's Guide - Since 1996

- <Bonk: Compare and Contrast versions of the NAIC Life Insurance Buyer's Guide>

- 1984 - NAIC Life Insurance Buyer's Guide <Bonk: written primarily by the ACLI>

- Universal Life under "Combinations and Variations"/ "Special Plans"

- Other policies <Universal Life> may have special features which allow flexibility as to premiums and coverage. Some let you choose the death benefit you want and the premium amount you can pay. The kind of insurance and coverage period are determined by these choices.

- Universal Life under "Combinations and Variations"/ "Special Plans"

- Permanent -

- Life Insurance Illustrations Issues Working Group is currently categorizing Universal Life as Permanent.

- ...permanent life insurance combining term insurance with a cash account earning tax-deferred interest. https://content.naic.org/cipr_topics/topic_life_insurance.htm

- Drafting Note: Although highly flexible, universal life insurance is generally considered a permanent life insurance plan.

Universal Life Model Regulation (MDL-585-5)

Professor Brenda Cude

<Bonk: Is she categorizing Universal Life as Whole or Term?>

Comment [BJC2]: Permanent insurance is a term used only by the industry – not by consumer educators.

We would prefer – Life insurance comes in two basic types: Term and whole life (also referred to as permanent insurance)

No Date. Assuming approximately 11/15/2017

- "Whole Life"

- There are two main types of life insurance policies: Whole (or universal) life insurance policies are considered permanent. As long as you pay the premium, the policy is in effect.

- usa.gov - CONSUMER ACTION HANDBOOK, (page 33)

- "Term Life"

- "A few companies have introduced a product known as Universal or Total Life."

- "The concept involves...the company withdraws an amount sufficient to pay the premiums for an annual renewable term coverage for the amount selected for the for the current policy year."

- 1982 - Life Insurance - Academic Textbook, Huebner and Black <Bonk: This passage was in Chapter 5 titled "Term Insurance,"> page 70

ACLI - Dynamic / Adjustable

- Dynamic "...completely Dynamic services and policy opportunities for their customers to purchase and to elect a variety of options."

- 2019/11/09- LIIIWG CC - Michael Lovendusky, ACLI

- "Dynamic Products" are products with premiums and benefits that can fluctuate from month to month, depending on the premiums the policyholder pays, the withdrawals the policyholder makes, the investment returns credited to the policy, and the mortality and expense charges deducted from the policy.

Some common names for dynamic products include universal life... adjustable life...

2000, - Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

-

Definitions - 2017- GLOSSARY OF INSURANCE-RELATED TERMS, ACLI FACT BOOK

"Universal life insurance...... Also known as adjustable life insurance."

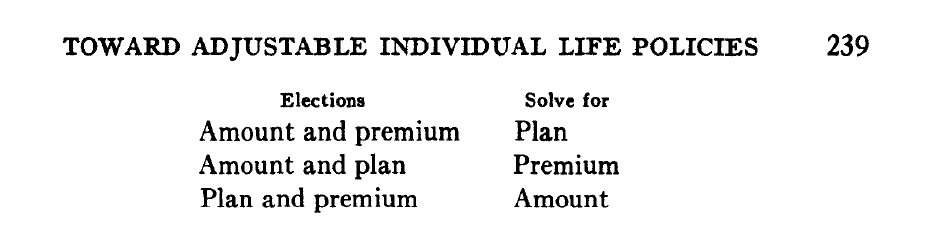

Defining the principal elements of a policy as amount of insurance,

gross premium, and plan of insurance, an original issue involves election of any two of the elements and calculation of the third.

Each change after issue involves a change elected for one element, either a change or continuation for a second element, and calculation of the third element.

1976 - Toward Adjustable Individual Life Products, Walter L. Chapin, Society of Actuaries - 50p

- Jesse M. Schwartz: Why are people so reluctant to call Total Life <Universal Life> permanent insurance?

- Myron H. Margolin: Universal Life type products are, I suppose, permanent.

- It is a semantic question whether they are permanent life or not, but clearly they are not the traditional cash value products as we have known them...

1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

"In fact, it is accurate to describe Universal Life as a generalized version of the actuarial formulas underlying traditional life insurance products.

In other words, it is possible to produce any traditional plan of insurance from the generalized formulas underlying universal life."

Alan Richards, president and chief executive officer of E. F. Hutton Life Insurance Co.,

1983 - GOV - Tax treatment of life insurance: Hearings before the Subcommittee on Select Revenue Measures of the Committee on Ways and Means, (page 448)

After receiving these notices, John contacted Glasgow <Agent>, who had retired in 2000, to inquire why his policies would be terminating, even though he had timely paid the premiums on the policies for approximately 18 years.

(p21) The Maloofs allege that Glasgow <Agent> agreed to procure life-insurance policies for them that would provide benefits available to pay estate taxes due upon John's death; however, they argue, they now have no such life-insurance policies.

(p22) Thus, the undisputed facts indicate that Glasgow in fact fulfilled the Maloofs' request to procure life-insurance policies that would provide funds that could be used to pay estate taxes upon John's death, and those policies were canceled only after the Maloofs failed to pay the required premiums.

Glasgow <Agent> subsequently joined in that motion.

2010 - Maloof v John Hancock - Alabama Supreme Court Opinion - 39p

Product Performance

2016/4/3, LIIIWG, NAIC Proceedings

Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products.

2017-3V1, NAIC Proc. - Life Insurance Buyer’s Guide (A) Working Group (LIBGWG)

"Because NGEs <Non-Guaranteed Elements> are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

-- American Academy of Actuaries Letter

Recommendation 5:

- If appropriate, the paragraph might add something like:

- "The amount of premium you have elected to pay, $300 per year, is however insufficient to keep the policy in force to age 95 at the guaranteed minimum interest rate of 4%; the policy would terminate at age 66.

- <Plan of Insurance>

- x-Year Term on a Guaranteed Basis

- x-Year Term on a Current Basis>

- To be sure that the policy continues to age 95, even at the minimum interest rate of 4%, you would have to pay $644.30 per year <Guaranteed Maturity Premium> for the entire life of the policy." <Plan of Insurance - ???? - See Legal Case Faye v Aetna>

- (page 466)

1990-1A - NAIC Proceedings - NAIC / LIMRA Focus Group - Universal Life Disclosure Form Test Market Results - 10p

- C. Universal Life

From the beginning, a necessity for successful marketing of Universal Life has been the ability of the seller to illustrate the performance of a policy tailored (within policy limits) to the needs and resources of the prospective purchaser. - The purpose of these illustration requirements is to ensure that both the guaranteed and nonguaranteed performance of the policy are disclosed to the buyer.

1991-1992 - Final Report of the Task Force for Research on Life Insurance Sales Illustrations, Society of Actuaries - 142p

The actual-versus-expected performance for some UL policies led to class-action lawsuits that have caused a substantial amount of negative attention to be focused on cash-value life insurance in the illustration of projected values.

-- Deanne Osgood

1997 - The Next Generation Universal Life, Society of Actuaries

I’ll talk about the complications.

- The typical policy that runs into this issue is a policy with a 3% interest guarantee where the guideline level premium requires a 4% interest guarantee.

- Therefore, under the policy guarantees, and by paying the guideline level premium year by year, the policy will expire at age 68 without value. It’ll be term to 68.

- Your guideline level premium is less than the premium that would be theoretically required to mature the policy at age 100 or 95.

- Therein lies the problem.

1999, Valuation Actuary Symposium - Session 44, Edward L. Robbins, Society of Actuaries

Consumer Accountability

Neither model was intended to generate Buying Guides or to relieve consumers of their own individual responsibilities to understand the product that they are spending their hard-earned money to buy after all.

ACLI - Michael Lovendusky

2018/11/09 - LIIIWG <Bonk>

"Second, it was observed that there was a real lack of accountability in the current marketplace involving life insurance sales, there is virtually no accountability for any of the participants in the sale, not for the company, not for the agent, and interestingly, the white paper discussed accountability on the part of the purchaser as well. Accountability is a major issue."

-- ROBERT E. WILCOX - Chairman of the Life Insurance Disclosure Working Group (NAIC)

1994 - PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS, Society of Actuaries

Sales Process

Wicka: How do Agents use these? It would be good to hear from agents.

12/2018 - NAIC Life Insurance Illustrations Issues Working Group

Our purpose in commenting today is to emphasize to Working Group members and interested parties the important role that the professional agent plays in the disclosure and consumer education regime that is at the heart of the Working Group’s efforts.

2019/8/26 - NAIFA Letter, Gary Sanders - NAIC Life Insurance Illustrations Working Group

In many cases the selling agent does not understand what he is presenting, and this needs to be addressed."

-- MR. ROBERT E. WILCOX, NAIC Chairman - Illustrations Working Group

I'm not saying that we are trying to circumvent the system, but consider for a minute that I don't sell a considerable amount of insurance by saying, "Let me tell you all that's wrong with this product.

In addition, let me clearly explain the risk that you are about to assume."

So where in the ideal sales process does this get communicated?

-- Robert Nelson (NALU / NAIFA)

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

<Bonk: re: Universal Life>

"If that is the case, how does an agent program somebody? How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65?"

-- ALLAN W. SIBIGTROTH

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, Society of Actuaries - 24p

**** Warning: Volume is Loud... Haven't figured out how to automatically Lower it.

2017 - State Farm Agent Training / Van Mueller

<BonkNote - Clip - Starts about 2:06:00,

See the rest at Youtube - Van Mueller | State Farm Agent Training Feb 2017 (Complete)

Agent Involvement in Groups

1970s -------- Agents Task force………….

Without agents on the committee I don’t know.

- (page 7) - Glasgow <Agent> subsequently joined in that motion.

2010 - Maloof v John Hancock Life Insurance Company and Parker A. Glasgow - SUPREME COURT OF ALABAMA

Disclosure

2019/9/17, NAIC Life Insurance Illustrations Issues Working Group (LIIIWG) - Proceedings (Fall, 6-77)

Ms. Winer said that disclosure is helpful, but only if it is meaningful.

2020/7/24 - NAIC Life Insurance Illustrations Working Group Conference Call - ACLI - Pat Reeder

-Idea of the Informed Consumer

3 Broad Recommendations:

#3) Have a larger discussion about the disclosure and buying process... backed with data driven studies to understand when consumers need what information in the buying process. Consider the information available at each point in time.

Joyce Walker v. Life Ins. Co. of the Southwest

Barbara Lautzenheiser…pointed out that mutual funds do not have to say in big print that it is possible that the investor will not get any money back, and compared that to the requirements on illustrations.

1994-1, NAIC Proc.

199x GOV Video - ACLI - ~~Disclosure doesn't happen if the information is there, but it doesn't mean anything to consumers or agents.

"Commissioner Hager of the Universal & Other Plans (A) Task Force stated that there appeared to be disclosure problems with universal life plans....

- "The main concern was that an unsophisticated buyer purchased a policy and did not know what the coverages, benefits and limitations were."

- ....items identified which should be disclosed: (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

John Montgomery (Calif.) said that complicated products are not understood by the typical applicant.

Commissioner Wilcox said that a "typical applicant" for a sophisticated policy should be a sophisticated applicant, and he acknowledged that the wording might need to be clarified in that instance.

1994-3 - NAIC Proceedings

Interest Variability

Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products.

2016/4/3, LIIIWG CC, NAIC Proceedings (6-8)

But we did not communicate the impact of change as well as we should have, especially the impact of change on the numbers we used in our sales illustrations.

So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer.

Our biggest mistake would be to delay. I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing.

-- Robert Nelson, chairperson of the National Association

of Life Underwriters (NALU) Task Force on Illustrations

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

In the ACLl's view, there is no investment risk to the consumer since the product typically carries a guarantee which includes principal plus four percent and since the interest to be earned beyond the guaranteed amount does not involve the kind of risk that is associated with securities.

-- Gary Hughes (ACLI)

1982-1, NAIC Proceedings

Coverage Period-

Universal Life

Life Insurance Illustration Issues (A) Working Group

Conference Call

September 17, 2019

-Mr. Birnbaum said it is intended to answer the question: If I pay my

premium, this policy will cover x amount of time.

- Mr. Wicka suggested, and the Working Group agreed, to the following revised language to Section 5A(2)(e)(iii): (iii) Indicate whether it is a term or permanent policy. If it is a term policy, indicate the length of the initial term.

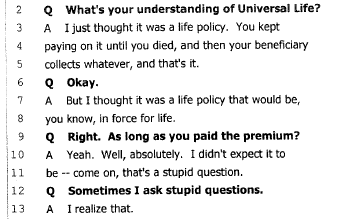

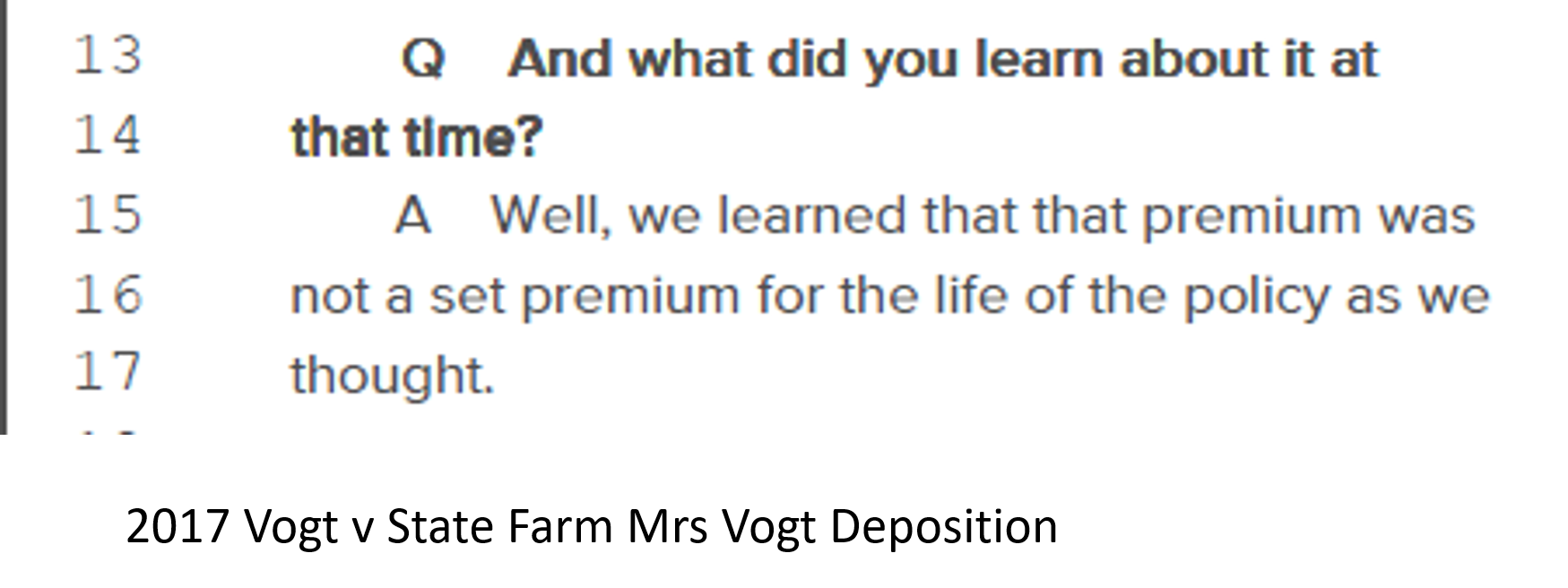

Blumenthal v New York Life - Deposition - Pay Premium - "Stupid Question"

Evaluate the Future of Your Policy

Ask your insurance agent, financial advisor, or an insurance company representative for an illustration showing future values and benefits.

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p - Consumer Testing

"Some of the items identified which should be disclosed: (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988-2 349, Universal Life Insurance Model Regulation, Proceeding Citations

Other policies may have special features which allow flexibility as to premiums and coverage. Some let you choose the death benefit you want and the premium amount you can pay. The kind of insurance and coverage period are determined by these choices.

One kind of flexible premium policy, often called Universal Life, lets you vary your premium payments every year, and even skip a payment if you wish. The premiums you pay less expense charges) go into a policy account that earns interest, and charges for the insurance are deducted from the account. Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

1983-I. NAIC Proc - STATEMENT ON BEHALF OF THE AMERICAN COUNCIL OF LIFE INSURANCE TO THE NAIC (A) COMMITTEE'S LIFE COST DISCLOSURE TASK FORCE. November 29, 1982

- <Bonk: Also Found in NAIC Life Insurance Buyer's Guide editions until the 1996 Proc. 3rd Quarter 9, 40, 907, 918, 931-936 (amended Buyer’s Guide).

"Universal Life type products are, I suppose, permanent. It is a semantic question whether they are permanent life or not, but clearly they are not the traditional cash value products as we have known them..."

-- Stanley B. Tulin

1981 - THE FUTURE OF PERMANENT LIFE INSURANCE, Society of Actuaries

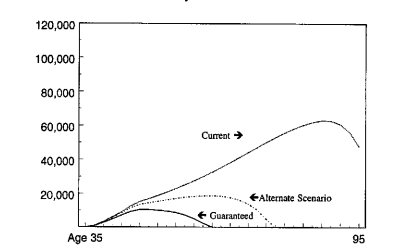

Premium -

Universal Life

The personalized information in the Policy Overview is the premium for the policy – based on information known to the producer or insurer at the time and subject to change based on additional or revised information – and that information can be provided prior to purchase.

If an insurer can produce an illustration for a complex, investment type life insurance product prior to the consumer purchase, it is clearly possible for an insurer to provide the premium for a policy prior to purchase.

2019/8/30 - Life Insurance Illustrations Issues Working Group - CEJ Letter

2017/11/15- ACLI Redlined Draft, Life Insurance Buyer's Guide Working Group (LIBGWG),

Unlike a term policy, which can end after a specified number of years, permanent life insurance will continue to the policy’s maturity age so long as premiums are paid.

(Note that this isn’t exactly accurate for UL, where policies can continue as long as the cash value is sufficient to pay the policy charges. We may want to make that distinction.) <<< ----ACLI Wording>>>

"The complications begin with a very simple question: What's the premium for Universal Life? It could be almost anything. Then what's the cash value? That depends on the premium. It is the relationship between the premium and cash value that determines the product characteristics <Coverage Period> of Universal Life."

-- BEN H. MITCHELL

1981, UNIVERSAL LIFE, Society of Actuaries

- The <Universal Life> Model Regulation assumes that future premiums will be paid at the whole life level, and calls this premium the GMP (the guaranteed maturity premium).

- The GMP is analogous to the guideline level premium (GLP) from TEFRA, the only differences being in the area of assumptions.

- The GMP is calculated using plan guarantees, regardless of their level, and with no restrictions on plan form (20 year endowment, I0 pay life, etc.).

- For most plans, however, the GMP should be equal to the GLP from TEFRA.

-- Shane Chalke

1984 - NAIC UPDATE, Society of Actuaries - 24p

- In our Universal Life products, we need to find that critical point, or what is as important, what is the best level of premium relative to the target premium.

- You don't want all target premiums.

- In fact, the lower the premium is, the closer to the minimum premium, the happier we are.

- How do we communicate that to our agency people?

-- RICHARD SCHWARTZ, (responsible for the product marketing function for the agency distribution systems for the Sun Life Group of America)

1986 - ORGANIZING THE PRODUCT DEVELOPMENT FUNCTION, Society of Actuaries - 46p

2016 - A Practical Approach to an Enhanced Premium Persistency Assumption, Society of Actuaries -3p

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

1990-1A, NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p - Consumer Testing

The agent said that Universal Life policy premiums would stay the same, but I came to realize that this is not true of our policies.

...what bothers me is that I am afraid that this same misleading information may be the basis of my children's and grandchildren's ... planning...

STATEMENT OF GLORIA DARLEEN NEWBERRY

1993 - GOV - When Will Policyholders Be Given The Truth About Life Insurance - 354p

Benefits -

Universal Life

|

How much do the benefits build up in the policy? How will the timing of money paid and received affect interest? |

|

2018 - LIBGWG - Brenda Cude Letter / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18

C. Universal Life

From the beginning, a necessity for successful marketing of Universal Life has been the ability of the seller to illustrate the performance of a policy tailored (within policy limits) to the needs and resources of the prospective purchaser.

The agent and prospect have the ability to choose almost any pattern of benefits and premiums. No longer is the sale limited to one of

several fixed plans of insurance from a ratebook. Each one is different.

1991-1992 - Final Report of the Task Force for Research on Life Insurance Sales Illustrations, Society of Actuaries - 142p

[[Legal Case]] - Fairbanks vs Farmers

Cash Value

Mr. Reyna said the policy overview should help consumers understand how cash value accumulates and can work to their advantage over time.

Mr. Wicka acknowledged that the issue is complicated because a lot depends on how the policy is funded; however, just the knowledge that the policy has cash value could be helpful information for a consumer comparing a term policy to a whole life policy.

2017/11/16, LIIIWG CC. , 2017-3

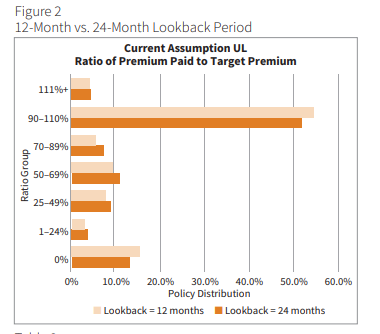

Non-guaranteed Elements (NGE's)

2017-3V1, NAIC Proc. - Life Insurance Buyer’s Guide (A) Working Group (LIBGWG)

"Because NGEs <Non-Guaranteed Elements> are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

-- American Academy of Actuaries Letter

2017-3V1, NAIC Proc. - Life Insurance Buyer’s Guide (A) Working Group (LIBGWG)

"Brenda Cude (University of Georgia) said the issue of NGEs is interesting, but not something the average consumer would understand. She did not think it was information that was appropriate for a short guide for first-time purchasers."

1996-3V2, p931, NAIC Proceedings

Report of the Cost Indices Subgroup of the Life Disclosure (A) Working Group

- "Brenda Cude (Cooperative Extension Service) opined that the target audience does not care about assumptions."

He said the most striking change in life insurance in past years was in the non-guaranteed elements.

-- Richard Minck (American Council of Life Insurance -- ACLI)

1994-1, NAIC Proc.

1996 - Nonforfeiture Law Developments, Society of Actuaries - 23p

Mr. Foley <Regulator>: That is the fundamental question. If you stop and think about all your comments, you probably answered your own question. Up until 15 years ago, the deal was generally in the contract, but now, a large part of the deal is not in the contract. It is outside the contract because now we have a nonguaranteed element.

Mr. Frank P. Dino: I would like to respond to Tom Foley’s comment. If nonguaranteed elements are really the issue... we need to ....create a better explanation of what is going on. If that is the issue then let us just do that because ultimately, when this ends up in court, the words written on that piece of paper <contract> are the deal.

Policy Mechanics

- First thing that I want to say is that there have been some references to Misleading Illustrations.

- I'm certainly not aware of the Regulators have not found that Illustrations are misleading.

- That seems to be just an allegation that is left hanging in the air, which is inaccurate. The Illustration is not misleading.

- The policy is performing according to policy mechanics.

-- Scott Harrison

2019 1115, NAIC Proceedings - IULISG – Indexed Universal Life Illustrations Subgroup Conference Call - [Bonk]

With this product <Universal Life>, the mechanic is "unbundled" and open.

But events that are now observable may be misinterpreted.

--Douglas Doll <Actuary>

1988-2, NAIC Proceedings

- The Mechanics of Universal Life Policies

- Once the policy is activated, the term policy and the accumulation account each operate independently.

- He or she may switch back and forth between whole life and term coverage, and may increase or decrease the amount of coverage as needed.

1985 - Law Review - TEFRA'S RESPONSE TO SHORT-TERM ABUSES OF INSURANCE ANNUITY POLICIES

Misleading Illustrations

The NAIC was only too well aware of the fact that sales illustrations were the subject of innumerable abuses and they wanted to correct those abuses.

-- Mr. Frank S. Irish <ASB>

1998 - Professional Standards Affecting Life Actuaries, Society of Actuaries

Compare Contrast:

Pricing - Life Insurance vs Car Insurance

Michael Lovendusky (ACLI): Pricing - different from property / Casualty pricing

Birney Birnbaum: <Michael Lovendusky (ACLI)> ...off the mark. Ludicrous …. Pricing for Life Insurance and Property Casualty pricing is not different…Collect information, run through algorithm….

2019 9 3- LIIIWG Conference Call, <Bonk>

There is no analogy, whatever, between the insurance of life and that of property ; for, while the risks of fire and marine companies are taken for a short, fixed time, upon the expiration of which the contract terminates , and it is optional with both parties to renew it or not, those of liſe companies end only with the life of the assured, and the whole sum promised him must then be immediately paid. (pXV)

1871-1, NAIC Proceedings

Variable Life Exemption

Definition of Illustration