Plan of Insurance

- "Plan of Insurance" vs Specific Policy

- [Plan of Insurance]

- 2019 0903 - 2019-3, NAIC Life Insurance Illustration Issues (A) Working Group (LIIIWG) - Conference Call

- Michael Lovendusky, ACLI ... said assisting consumers to compare products is outside the scope of the Working Group’s charge, and it would limit innovation and harm consumers.

- Birny Birnbaum, CEJ ... said the Working Group’s charge specifically includes how the summaries are “designed, formatted and accessed” by consumers, and the stated purpose of Model #580 is to “require insurers to deliver to purchasers of life insurance information that will improve the buyer’s ability to select the most appropriate plan of life insurance for the buyer’s needs.”

- Section 2. Purpose

- A. The purpose of this regulation is to:

- require insurers to deliver to purchasers of life insurance information that will improve the buyer’s ability to select the most appropriate plan of life insurance for the buyer’s needs and improve the buyer’s understanding of the basic features of the policy that has been purchased or is under consideration.

NAIC - Life Insurance Disclosure Model Regulation, MDL-580 --- [BonkNote] -- 12p

- 2016-2, NAIC Proceedings - 2016 0817 - Life Insurance and Annuities (A) Committee, San Diego, California

- Birny Birnbaum (Center for Economic Justice—CEJ) said he supports a uniform format for the one- to two-page consumer document and the policy and narrative summaries because some standardization is necessary to achieve the goal of Model #580, the purpose of which is to facilitate consumer comparison shopping.

- 2016-3, NAIC Proceedings - 2016 1020 - NAIC - Life Insurance Illustration Issues (A) Working Group Conference Call (LIIIWG) CC NAIC Proceedings

- a. Purpose of Policy Overview Document

- Birny Birnbaum (Center for Economic Justice—CEJ) suggested that the policy overview document should be a tool to aid consumers in comparing plans across companies, but not to choose between types of plans.

- a. Purpose of Policy Overview Document

- 2019 0903 - NAIC - Life Insurance Illustration Issues (A) Working Group Conference Call

- Mr. Birnbaum said the Working Group’s charge specifically includes how the summaries are “designed, formatted and accessed” by consumers, and the stated purpose of Model #580 is to “require insurers to deliver to purchasers of life insurance information that will improve the buyer’s ability to select the most appropriate plan of life insurance for the buyer’s needs.”

|

- Broken down to its simplest basis, universal life has eliminated the concept of "plan of insurance", and, through the computer, coverage has been unbundled into "protection" and "savings" elements.

-- Christian J. DesRochers

1983 - SOA - Universal Life (RSA83V9N212), Society of Actuaries - 24p

- The 818(c) election is another issue that is being looked at by the Service [Bonk: IRS - Internal Revenue Service]

- One question that was discussed briefly was what was the plan of insurance? [Bonk: Universal Life Insurance]

- How do you know whether you have a permanent policy that qualifies for $21 per thousand,

- or a term policy that qualifies for $5,

- or perhaps some that qualifies for nothing.

- → That is an unanswered question.

-- William B. Harman, Jr., partner in Sutherland, Asbill & Brennan.

1981 - SOA - Universal Life (RSA81V7N412), Society of Actuaries - 16p

U.S. Department of Veterans Affairs - benefits.va.gov/insurance/plans.asp

Plans of Insurance

Government Life Insurance is issued in a variety of insurance plans. Select a plan below to view a brief description of that plan. This information is for policy numbers beginning with K, V, RS, W, J. JR. JS and RH. Information for: Servicemembers' Group Life Insurance policies (SGLI) and Veterans' Group Life Insurance policies (VGLI).

- TERM AND WHOLE- LIFE INSURANCE COST AS DEVELOPED BY THE ROYAL ARCANUM.

- A pamphlet on the above subject, by W. T. Wallace of Philadelphia, has recently made its appearance, and doubtless is being widely circulated among believers in the assessment or "pocket reserve" plan of insurance.

1909 0617 - The Spectator - [link-GooglePlay]

- When it offers a plan of insurance for a specified premium it does so on the basis of an expected level of mortality, interest, withdrawal, expense and taxation in the future.

- It also recognizes that the future experience levels will vary from those expected at issue through statistical variability or through long term or cyclical trends and sets its premiums to make allowances for this variability.

- As the experience under the plan unfolds the company can release into earnings the differences between the provisions in the premiums for variability and actual variations experienced to date.

- The instrument for accomplishing this is the reserve and, specifically, the release from risk reserve system is based on this concept

1974 - SOA - Report of the Historian - Special Report, Society of Actuaries - 116p

- The guaranteed plan is important because it also affects policyholder taxes (such as Internal Revenue Code, secs. 72, 101, and 1035).

- The guaranteed plan for many universal life contracts is unspecified.

1983 - SOA - Universal Life and Policyholder Dividends by Thomas Kabele, Society of Actuaries - 96p

- EXHIBIT A - NAIC MODEL REGULATION AS AMENDED AND ADOPTED 6/6/73 - LIFE INSURANCE INTEREST-ADJUSTED COST COMPARISON INDEX

- Section l Authority - This rule is adopted and promulgated by (title of supervisory authority) pursuant to Sections of the insurance code.

- Section 2 Purpose - It is in the interests of prospective purchasers of life insurance that there should be available to such persons a cost comparison index prepared on a uniform basis for comparison of the relative cost of similar plans of insurance.

- It is in the public interest to make such an index available so that price competition in the life insurance market is encouraged and stimulated.

1973-2, NAIC Proceedings

- NEITHER IS BETTER

- Reams of copy have been written about the relative values of term and straightlife.

- Pennsylvania Insurance Commissioner Herbert Denenberg, a severe critic of the insurance industry, concludes:

- "Neither plan of insurance is necessarily superior to the other.

- ... they are fundamentally different but both are useful contracts and there are 'good buys' and 'bad buys' on both." (p802)

1973 - GOV - The Life Insurance Industry - Hart - Part 1

- (p243) - Any of the foregoing provisions or portions thereof not applicable by reason of the plan of insurance may to that extent be omitted from the policy.

- Gross Premiums Calculated on Basis of Assumptions Plan Ages: 26 ~~ 40

- Ordinary Life - $15.03 $15.42 $48.20

- 20 Payment Life - 22.23 33.53 53.93

- 20 Year Endowment 42.46 46.60 57.70

1942-Supplement, NAIC Proceedings

- Adjustable life is characterized as either "term" or "whole" life depending on how long the plan of insurance will last on a guaranteed basis with the face amount and premium chosen.

2001 - LC - MCCORD V. MINNESOTA MUTUAL LIFE INSURANCE COMPANY, (D.MINN. 2001) - casemine.com/judgement/us/5914b9b9add7b0493478cbb9

- I guess my problem can be stated thus: how can you emphasize that the guaranteed plan of insurance may be term to age 65 but then say it is all right to ignore that and take a whole life expense allowance calculated at a low interest rate because the plan is sold as whole life?

-- Jeff T. Dukes

1983 - SOA - Universal Life Valuation and NonForfeiture: A Generalized Model, Shane A. Chalke and Michael Davlin, Society of Actuaries - 72p

- Drafting Note: The drafters chose a whole life initial expense allowance for several reasons. Although highly flexible, universal life insurance is generally considered a permanent life insurance plan.

- Most companies encourage a premium level which will provide lifetime insurance protection.

- Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection.

- As a result, it is expected that most universal life insurance policies will be sold as permanent plans.

- The guaranteed maturity fund at any duration is that amount which, together with future guaranteed maturity premiums, will mature the policy based on all policy guarantees at issue.

- (C) is the quantity ((a)-(b))ax+t r where (a)-(b) is as described asin [insert reference to Section 4 of the Standard Valuation Law] for the plan of insurance defined at issue by the guaranteed maturity premiums and all guarantees contained in the policy or declared by the insurer.

NAIC - ULMR - Universal Life Insurance Model Regulation - (MDL-585) - Citations --- [BonkNote] --- 22p

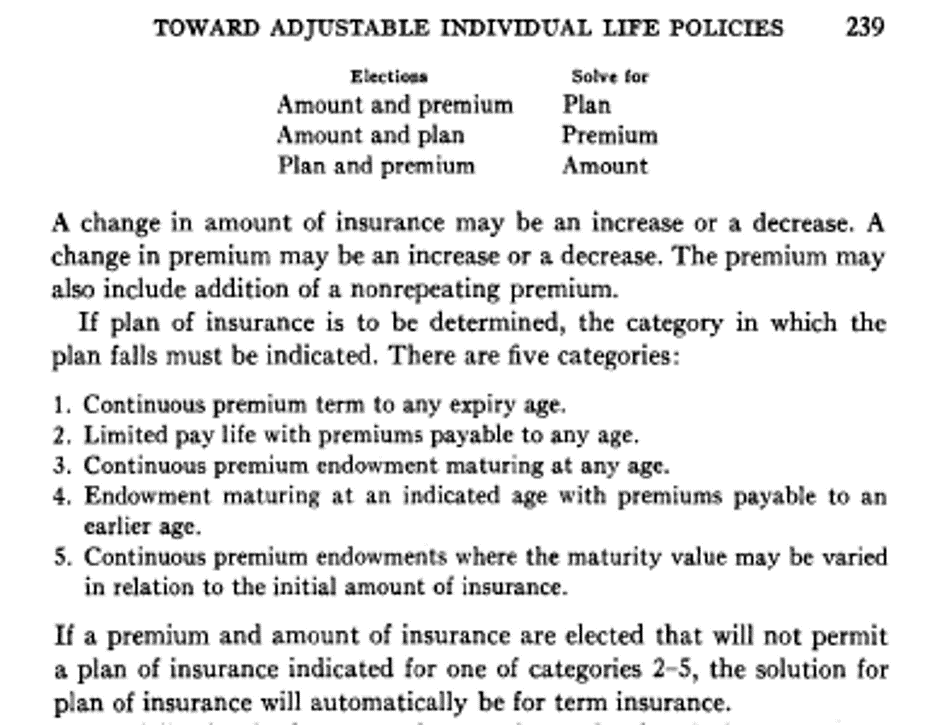

- Plans of insurance fall into five categories: term, limited pay whole life, continuous premium endowment, limited pay endowment, and income endowment where the ratio of amount of insurance to maturity value may be varied.

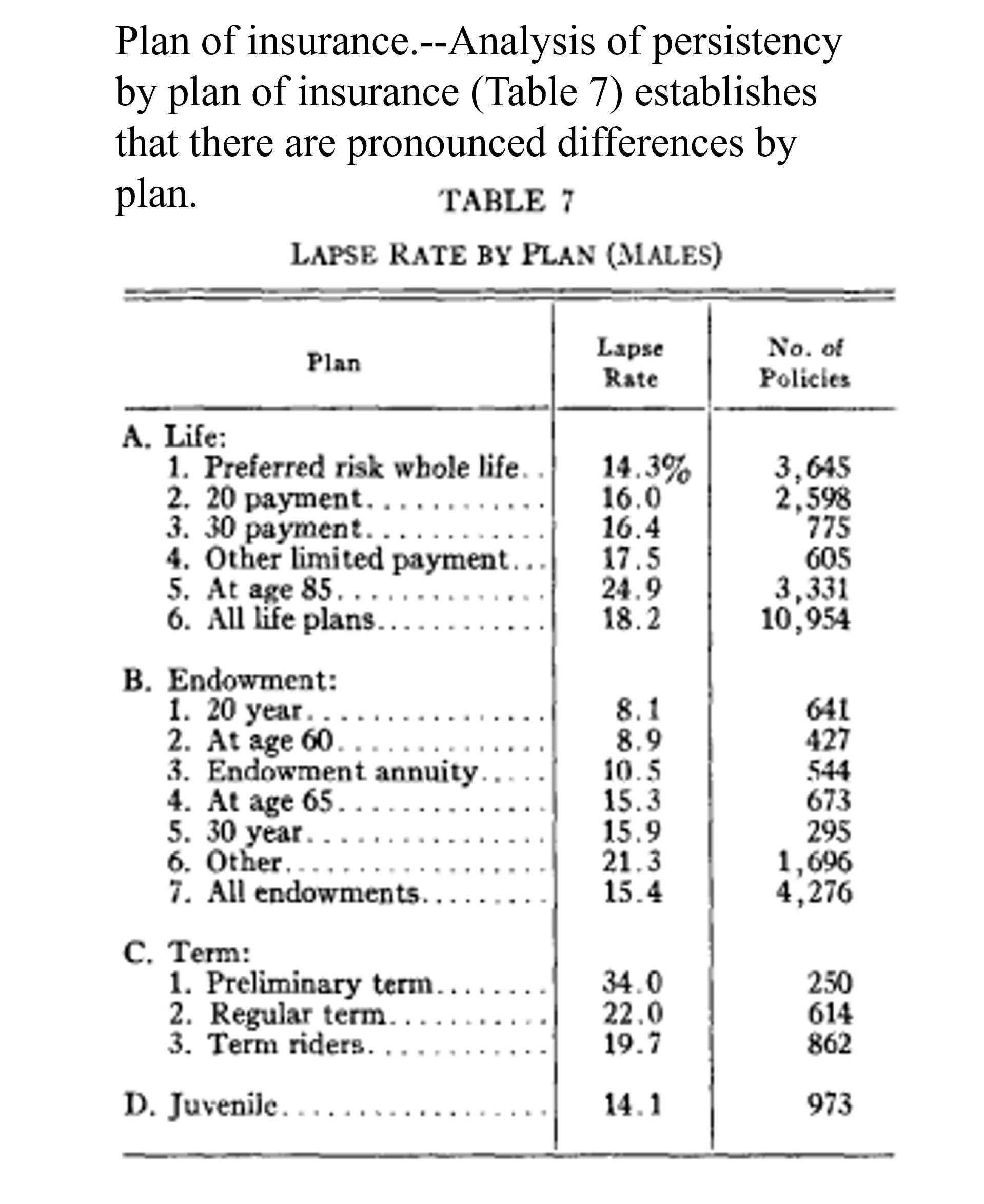

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, Walter L. Chapin - 50p

- Defining the principal elements of a policy as amount of insurance, gross premium, and plan of insurance, an original issue involves election of any two of the elements and calculation of the third.

- Each change after issue involves a change elected for one element, either a change or continuation for a second element, and calculation of the third element.

- Proposed Article IV, Section 3f

- f. a provision that at any time during the first eighteen months of the variable life insurance policy, so long as premiums are duly paid the owner may exchange the policy for a policy of permanent fixed benefit life insurance on the life of the insured for the same initial amount of insurance as the variable life insurance policy and on a plan of insurance specified in the policy, provided that the new policy: (p563)

1976-1, NAIC Proceedings

- 5. Effect of an Election Under Section 5-c of the Standard Nonforfeiture Law for Life Insurance

- Mr. Montgomery's letter of October 15, 1982 contained a copy of a California Bulletin which set forth the conditions under which companies could elect separate operative dates by plan of insurance.

- Under the Bulletin, a company could issue a new plan on the new standards provided like plans on the old standards were discontinued in California and in other states permitting plan-by-plan elections.

- In addition, once a company had issued a plan on the new standards, those standards would apply to other new plans unless the company could demonstrate a need to apply the old standards.

- Mr. Montgomery suggested that the California Rule could serve as a basis for developing an NAIC guideline. (p478)

1983-1, NAIC Proceedings

- No results for "plan of insurance" - ACLI.com

- There were no results for your search. - https://actuarialtoolkit.soa.org/

- Those who are interested in the stock plan of life insurance, maintain that this rule holds even to the extent of a six per cent reserve.

1871-2, NAIC Proceedings