Q: Does Anyone Know Anything?

- (p87) - Gustavus Smith (Kentucky - Insurance Commissioner):

- We have got a vast deal to learn.

- While on this subject, I may allude to what I consider the great trouble in life insurance.

- It is, in my opinion, an undoubted fact that educated, intelligent, influential business men of this country, as a class, are utterly ignorant of what this thing is.

1871-1, NAIC Proceedings - 233p

- FSOC / MetLife - GOV - Carolyn Maloney

- 2009 0317 - Christopher Dodd -

- treas.yorkcast.com/webcast/Play/273037e959924edeba02d81c529b62b51d

- IPAC, Milliman.

- {IAIS doesn't understand our products}

- IPAC, Milliman.

- During the course of....we ascertained that there were very few people within the Federal Government with an understanding of the insurance industry.

- A staff memo...stated: "It appears that for many years the workings of the life insurance business have been misunderstood by those at the [Internal Revenue Service and Justice Department] associated with the question.

-- Chairman John LaFalce (D-NY)

1979 1011/1022 (Part 1) - GOV (House) - Small Business Problems with Insurance - Part 1 - [PDF-337-GooglePlay]

- 2009 1026 - InsuranceNewsNet / Best's Review - Relieved to Have Survived a Dangerous Year, ACLI Members Look Ahead, By Ron Panko, senior associate editor, Best's Review - [link]

- The year certainly tested the ACLI leadership.

- Frank Keating, its president and CEO, related the many actions he and his team took to work with federal officials to provide some level of support for affected life companies.

- Because we were state-regulated, we were very concerned, if not alarmed, that the Fed, the FDIC, perhaps the SEC, obviously the Treasury Department, might have a high level of ignorance and not appreciate that individual companies within our industry may not be systemic, but we as an industry are."

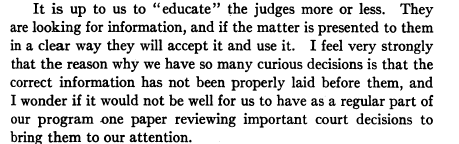

-- Mr. Anderson - (p261)

1919 - The Record, American Institute of Actuaries - Individual Reserves in Life Insurance - [Educate Judges] - [PDF- 451p-GooglePlay]

- I-Team: Suspended Insurance Commissioner Jim Beck guilty on all counts, 2019-2021 - Georgia Insurance Commissioner - [VIDEO-YouTube]

- INTERDEPENDENCE OF SUBJECT MATTER

- The Subject of Life Insurance is one that everyone will discuss sooner or later.

- Fortunately, nearly everybody knows something about it, but unfortunately many who buy it and some who sell it have only a superficial knowledge.

- Even those who legislate controls or propose reforms for the business are not always sufficiently informed.

- What does one need to know to become adequately informed about life insurance?

- It is essential that he know a few basic principles of law, mathematics, accounting, economics, marketing, finance, business management, statistics, history, and government—all as they apply to life insurance.

- This seems a rather large order, but actually it is not, because everything is logical, and the pattern as a whole fits quite neatly.

- However, in gaining a life insurance education, one problem does present itself.

- Although the pieces fit together snugly, it is not easy to determine the order in which the pieces should be developed.

- For example, to understand types of policies thoroughly one should know something about methods of premium computation.

- But to comprehend premium computations adequately, one must know something about types of policies.

- This interdependence applies with equal force to other aspects of knowledge about the field.

- Fortunately, nearly everybody knows something about it, but unfortunately many who buy it and some who sell it have only a superficial knowledge.

- Thus, since it is necessary to know something of the whole to understand and appreciate the parts, the basic question is where to begin. (p1)

1961 - Book - Modern Life Insurance - Professor Robert I. Mehr

- And third, as Congress and the administration address the deepening crisis in the financial sector, decisions are being made that have a profound effect on the life insurance business.

- Unfortunately, Mr. Chairman, those decisions are being made without any real understanding of how our business operates and without any significant input from our regulators. (p12)

-- Frank Keating, President and CEO, The American Council of Life Insurers (ACLI)

2009 0317 - GOV (Senate) - Perspectives on Modernizing Insurance Regulation - [PDF-160p,

- Gary Hughes (ACLI)

- It should be clear that anyone presuming to regulate life insurance products must be intimately familiar with the technical underpinnings of these products as well as with how product design relates to overall solvency.

- Put differently, life insurance company product regulation requires in-depth insurance regulatory expertise.

- As this committee well knows, that sort of expertise is absent at the Federal level, although that is a gap in the overall regulatory framework that we would like to see remedied through the creation of a Federal functional insurance regulator.

- But it is unrealistic to expect that the CFPA would ever have the degree of expertise necessary to handle insurance product regulation effectively.

2009 0624 - (GOV - House) - Regulatory Restructuring: Enhancing Consumer Financial Products Regulation [PDF-286p, VIDEO-?)