Questions - 2021 11

- Product Descriptions

- Coverage Period

- Premium

- Benefits

- Policy Mechanics

- Complaints

Language

- The Working Group discussed some language that was hard to understand referring to premiums and benefits.

- The Working Group discussed language suggested by the ACLI defining the different kinds of life insurance policies for inclusion in the section titled, “Compare Different Kinds of Life Insurance.”

- Laura Hanson (Academy) expressed concern that, in the effort to provide a brief overview, the definitions are not wholly accurate.

2018 0312 - Life Insurance Buyer's Working Group (LIBGWG)

- The "unbundling' of services and other product differences between Universal Life and Ordinary Life cause current literature to be inapplicable, as well as insufficient, for Universal Life.

1984, American Academy of Actuaries - Journal

- C. Universal Life

- The agent and prospect have the ability to choose almost any pattern of benefits and premiums.

- No longer is the sale limited to one of several fixed plans of insurance from a ratebook.

1991-1992 - SOA - Final Report* of the Task Force for Research on Life Insurance Sales Illustrations, Society of Actuaries - 142p

- Appendix II - Illustration Examples

Consumer Testing / Focus Groups / Surveys

Target Market - Life Insurance Buyer's Guide

- Thank you for the clarification you provided in our recent conference call about the target market for the draft life insurance buyer’s guide.

- With that in mind, we started by making a list of basic information about life insurance that first-time buyers probably don’t know.

- We didn’t find any scholarly research on the topic but did find references to a number of industry-sponsored surveys.

2017 0719 - NAIC LIBG - Consumer Reps to Mary Mealer, Chair Life Insurance Buyer's Guide Working Group, From: Brenda Cude, Karroll Kitt, Birny Birnbaum - 6p

Product Descriptions - Universal Life

- During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers.

2016 0403, Life Insurance Illustrations Working Group (LIIWG) Conference Call, NAIC Proceedings (6-8)

- Broken down to its simplest basis, Universal Life has eliminated the concept of "plan of insurance".....

-- Christian J. DesRochers

1983 - Universal Life, Society of Actuaries - 24p

- In fact, it is accurate to describe Universal Life as a generalized version of the actuarial formulas underlying traditional life insurance products.

- In other words, it is possible to produce any traditional plan of insurance from the generalized formulas underlying universal life.

-- Alan Richards, president and chief executive officer of E. F. Hutton Life Insurance Co.,

1983 - GOV - Tax treatment of life insurance: Hearings before the Subcommittee on Select Revenue Measures of the Committee on Ways and Means, p448

RE: Universal Life

- If that is the case, how does an agent program somebody?

- How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65?

-- Allan W. Sibitroth

1979 - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

Complaints

- Ms.Winer asked if it would be useful to ask states whether they have received consumer complaints about the summaries.

- Mr. Wicka said that it would be helpful to have that kind of information but that he is not sure it would be possible to track down complaints to that level of detail.

20xx, NAIC Proceedings - LIIIWG Conference Call

Senator Metzenbaum:

- Mr. Rips, you testified that last year the largest group of complaints that you received about life insurance came from people whose policies didn't have the amount of cash value that they had been told and were shown.

- l am talking about illustrations like those on the charts in this room.

(Geoff Rips, public information director, Texas Office of Public Insurance Counsel)

1992 - GOV - Consumer Disclosure of Insurance - [PDF-323p]

- Monitoring of litigation may alert regulators to issues that the regulatory system has not yet addressed.

2008-3, NAIC Proc.

- He <Ario - Pennsylvania> said the consumer complaint analysts in a state are a “focus group” that each state should rely on.

2009-3, NAIC Proceedings

- Complaints and inquiries related to life insurance and annuity products ... generally concerned consumer dissatisfaction with, or confusion regarding, universal life insurance policies. (p90)

2018 - Wisconsin OCI - Wisconsin Insurance Report - 219p

Timing of Disclosure

Coverage Period

g. Clarifying “Coverage Period Description”

- The Working Group discussed what information is intended to be included.

- Mr. Yanacheak said this is intended to capture how long a policy’s term is—a term of years or for life.

- Mr. Birnbaum said it is intended to answer the question: If I pay my premium, this policy will cover x amount of time.

- Mr. Wicka suggested, and the Working Group agreed, to the following revised language to Section 5A(2)(e)(iii): (iii) Indicate whether it is a term or permanent policy.

- If it is a term policy, indicate the length of the initial term.

2019 0917 - Life Insurance Illustration Issues (A) Working Group Conference Call

Other policies may have special features which allow flexibility as to premiums and coverage.

- Some let you choose the death benefit you want and the premium amount you can pay.

- The kind of Insurance and coverage period are determined by these choices.

1983-1996 - NAIC Buyer's Guide (Scribe-ACLI) - [LINK]

- A regulator had told them that in that case they should not treat their universal life as though it was a whole life policy matured by paying the GMP <Guaranteed Maturity Premium>.

- Rather, you should assume that people will pay the guideline level premium, and that will give you a policy that provides guaranteed coverage for something less than the whole of life.

-- Daniel J. McCarthy

1999 - Valuation Actuary Symposium, Society of Actuaries - 28p

Universal life insurance is more flexible than whole life. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower than the cost of insurance, the difference is taken from the cash value. If the cash value reaches zero, your policy could lapse.

The company will send you a report each year showing your cash value and how long the policy might last. The estimate is based on the cash value amount, the cost of insurance, and other factors. Review it carefully. You might need to pay more in premiums to keep the policy in effect until the maturity date.

Premium

- If an insurer can produce an illustration for a complex, investment type life insurance product prior to the consumer purchase, it is clearly possible for an insurer to provide the premium for a policy prior to purchase.

2019 0830 - LIIIWG - Birney Birnbaum - CEJ Letter-12p

- Traditional plans are fairly simple in their structure.

- Universal life presents something of a paradox.

The complications begin with a very simple question:

- What's the premium for Universal Life?

- It could be almost anything.

- Then what's the cash value?

- That depends on the premium.

- It is the relationship between the premium and cash value that determines the product characteristics of Universal Life.

-- Ben H. Mitchell

1981 - Universal Life, Society of Actuaries - 16p

As Long as the Premium is Paid...

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form Focus Group Summary, Consumer Issues Disclosure Working Group - NAIC - --- [BonkNote] --- 10p

- After receiving these notices, John <Policyowner> contacted Glasgow <Agent> who had retired in 2000, to inquire why his policies would be terminating, even though he had timely paid the premiums on the policies for approximately 18 years. (p5)

2010 - Maloof v John Hancock - 60 So. 3d 263 - Ala: Supreme Court - Alabama Supreme Court Opinion - 39p

- Permanent (cash value) life insurance pays the beneficiary whenever the insured dies, as long as premiums have been paid. (p38)

2016 11 - FIO (Federal Insurance Office) - Report on Protection of Insurance Consumers and Access to Insurance - 58p

Benefits

Universal Life:

- While it is true these policies offer some flexibility, there are circumstances out of the policyholder’s control, such as decreasing interest credits or increasing policy charges, where additional premium payments may be required to keep the policy in force.

- Universal life also allows for flexibility in policy benefits, not just premium payments.

2017 1115 Letter, LIBGWG, American Academy of Actuaries, Letter

|

How much do the benefits build up in the policy? How will the timing of money paid and received affect interest? |

|

2018 - LIBGWG - Cude Letter / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18

-

(page 21) The Maloofs allege that Glasgow agreed to procure life-insurance policies for them that would provide benefits available to pay estate taxes due upon John's death; however, they argue, they now have no such life-insurance policies.

-

The undisputed facts indicate that Glasgow <Agent> did in fact procure two universal life-insurance policies for the Maloofs and that, had the Maloofs continued to pay sufficient premiums on those policies, they would have remained in effect and the benefits of those policies would have been available for any purpose after John died.

2010 - Maloof v John Hancock - 60 So. 3d 263 - Ala: Supreme Court - Alabama Supreme Court Opinion - 39p

I'm really surprised that the "r" factor didn't get more publicity, because it really seems as if it came right out of left field.

- The purpose of the "r" factor, however, is really quite simple.

- If the actual account value is less than the GMF, then future guaranteed policy benefits will run out before the maturity date.

- This is true because the GMF is that amount which is exactly on target to mature the policy.

Therefore, anything less than the GMF will be insufficient to mature the policy on a guaranteed basis.

It was felt that in order to reserve adequately for all policy guarantees, it would be desirable to make sure that any projection of benefits extends until the maturity date of the policy.

-- Shane Chalke

1984 - NAIC Update, Society of Actuaries - 24p

Assumptions

- The group first considered a suggestion from Chris Kite (FIPSCO) for a new type of index that would allow consumers to compare the assumptions in the illustration.

- Brenda Cude (Cooperative Extension Service) opined that the target audience does not care about assumptions.

-- Report of the Cost Indices Subgroup of the Life Disclosure (A) Working Group

1996-3V2, NAIC Proceedings - (p931)

Assumptions lie at the heart of actuarial work.

2017 - The Great Assumptions Debate, American Academy of Actuaries

Wishlist: archived slides and audio

Non-Guaranteed Elements (NGE's)

2017 10/15 or 19 - LIBWG - Letter from the Non-Guaranteed Elements Work Group of the American Academy of Actuaries

We believe consumers would benefit from the inclusion of a discussion of NGEs in the buyer’s guide, and think the following points would be helpful:

- Products with NGEs have the risk that costs could increase or benefits could decrease, subject to guaranteed limits stated in the policy.

- Illustrations, if available during the purchasing process, can be useful tools to help consumers understand a range of possible product performance outcomes.

Brenda Cude (University of Georgia) said the issue of NGEs is interesting, but not something the average consumer would understand.

- She did not think it was information that was appropriate for a short guide for first-time purchasers.

- Karrol Kitt (University of Texas—Austin) agreed with Ms. Cude.

- Ms. Mealer also agreed that this was an important topic probably best addressed in the online tool.

2017 1106 - Life Insurance Buyer’s Guide Working Group (LIBG) Conference Call - Attachment Four

A new exposure draft of a revised model regulation has been prepared by the staff of the American Council of Life Insurance <ACLI>

The following are among the principal features incorporated in the revised draft:

- The introduction of the concept of a nonguaranteed element to measure the extent to which policy costs can be affected by premiums, benefits, or other items that are subject to change by the company without the consent of the policyholder.

- A special plans section to accommodate the unique features of nontraditional plans such as universal life insurance.

1982-2, NAIC Proc.

Cost of Insurance

- Ms. Micale asked what information was envisioned in data element "a description of cost of insurance fees needed to keep the policy in force and how it changes over time"

- Mr. Wicka said he wanted to flag the Issue of cost of insurance for consumers since it can be a more complicated element of a universal life policy.

- He said he was envisioning more of an explanation rather than the actual fees.

- Ms. Micale said she is concerned that companies would be concerned with revealing trade secrets if they were required to disclose the cost of insurance schedule.

2018 0314 - Life Insurance Illustrations Working Group (LIIWG) Conference Call, NAIC Proceedings

- While many of the original intentions of issuers of universal life was to make clear the exact costs of life insurance by showing and charging exactly the interest, mortality and expenses incurred, most insurers do not observe this at the present time. (p15)

2007, Actuarial Aspects of Individual Life Insurance And Annuity Contracts, Easton and Harris

Cash Value

- Mr. Reyna said the policy overview should help consumers understand how cash value accumulates and can work to their advantage over time.

- Mr. Wicka acknowledged that the issue is complicated because a lot depends on how the policy is funded; however, just the knowledge that the policy has cash value could be helpful information for a consumer comparing a term policy to a whole life policy.

2017 1116, Life Insurance Illustrations Working Group (LIIIWG) Conference Call, 2017-3 NAIC Proceedings

- Despite the fact that there are cash values in the thirty‐year term contract, from a consumer's viewpoint it has no savings element.

-- Paul Overberg

1973 - Price Disclosure and Cost Comparison, Society of Actuaries - 186p

Performance

Policy Mechanics

- Its <Universal Life> fundamental "mechanics" are indistinguishable from those underlying traditional life insurance products.

-- Samuel H. Turner, President - The Life Insurance Company of Virginia

1982 - Journal of Insurance Medicine - 1p

Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.

- A premium may be paid at any time and in any amount desired.

- Whenever a premium is paid, loads are deducted from that premium.

- The balance is added to a fund.

- On a monthly basis, cost of insurance charges are deducted from the fund.

- Expense charges may be deducted from the fund, especially in the early policy years, and interest is added to the fund on a monthly basis.

- The cash value changes each month based on the net impact of the income and deduction transactions.

- The policy does not lapse if a premium is not paid; rather, it lapses if the fund balance becomes too small to pay the next month's cost of insurance.

Works

- He <Richard Wicka> explained that state insurance departments do not give advice and should not be a place where consumers call with questions about how a specific policy works.

2017 0914, Life Insurance Illustrations Working Grroup, LIIIWG Conference Call, NAIC Proceedings

Actuaries can do lots of things.

- We can provide the field with a clear description of the policy and how it works.

-- Bruce E. Booker, (a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustrations

1993 - Sales Illustrations - We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries - 28p

It has been aptly stated that it is more important for the policyholder to know what he gets than how it works.

- In that respect, the life insurance buyer can be compared with the purchaser of a television set; he is more interested in what shows up on the tube than what takes place behind it.

1976-4, NAIC Proc.

Policy Overview

- Birny Birnbaum - Policy Overview only applies when the consumer is shopping for the policy.

- Lovendusky (ACLI) - Whistling into the winds of change.

- These are Dynamic Contracts.

2018 1009- Life Insurance Illustrations Working Group LIIIWG - <Bonk>

Mr. Reyna said the policy overview should help consumers understand how cash value accumulates and can work to their advantage over time.

Mr. Wicka acknowledged that the issue is complicated because a lot depends on how the policy is funded; however, just the knowledge that the policy has cash value could be helpful information for a consumer comparing a term policy to a whole life policy.

2017/11/16, LIIIWG CC. , 2017-3

Agents - Summaries / Illustrations

- She (Ms. Stegall - WI) also said that, except from some whole life insurance and term life insurance products, the summaries are explained to the consumer by an agent or broker and really serve as a tool for financial advisors in highlighting the features of a product.

2016 0817, NAIC Proceedings - LIIIWG - Life Insurance Illustrations Working Group - Conference Call

- How do Agents use these?

- It would be good to hear from agents.

-- Richard Wicka

2018 12 - NAIC Life Insurance Illustrations Issues Working Group

Idea of the Informed Consumer

Pat Reeder, ACLI: 3) Have a larger discussion about the disclosure and buying process... backed with data driven studies to understand when consumers need what information in the buying process.

Richard Wicka: As far as comments 2 and 3, I'm not sure that those are things that our Working Group can address, but I appreciate how this workstream goes into those larger issues.

2020 0724 - Life Insurancer Illustrations Working Group (LIIIWG) Conference Call, NAIC Proceedings - <Bonk>

- Let's go back to the question of understandability.

- With no standardized format being utilized, many of the illustrations currently in use are far too complex for the average consumer or applicant to understand.

- In many cases the selling agent does not understand what he is presenting, and this needs to be addressed."

-- Robert E. Wilcox, NAIC Chairman - Illustrations Working Group

1994 - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

2017 - State Farm Agent Training / Van Mueller

See the rest at Youtube - Van Mueller | State Farm Agent Training Feb 2017 (Complete)

Education - Agents

- Brenda J. Cude (University of Georgia) commented that there are agents and brokers not doing a good service to consumers and that educating the agents and brokers is important.

2016-2, 8/26/16 -ltc - Senior Issues (B) Task Force, Attachment Four-F

- No difference how well-intentioned and honest an insurance man's advice may be it may prove very expensive and harmful if not based on accurate knowledge.

1914 - Conference on Life Insurance and Its Educational Relations

Reputational Risk

- We believe current illustrated rates are much higher than what is reasonably expected over the course of the policy and may lead to consumer disappointment, which could negatively impact the entire industry.

-- Metropolitan Life Insurance Company, New York Life Insurance Company and Northwestern Mutual Life Insurance Company

2014 0812 - Letter to NAIC LATF - IULISG – Indexed Universal Life Illustrations Subgroup – NAIC

Conflicts between Foundations and the Views of the Public

- The foundations of actuarial science are not so esoteric or so abstruse that the average well-informed business person has great difficulty in understanding them.

- There are, however, points at which the actuarial view and that of the general public can come into conflict.

- Actuaries will do well to recognize where these potential trouble spots are, and to do what they can to resolve misunderstandings.

1989 - FUNDAMENTAL CONCEPTS OF ACTUARIAL SCIENCE - CHARLES L. TROWBRIDGE, p78

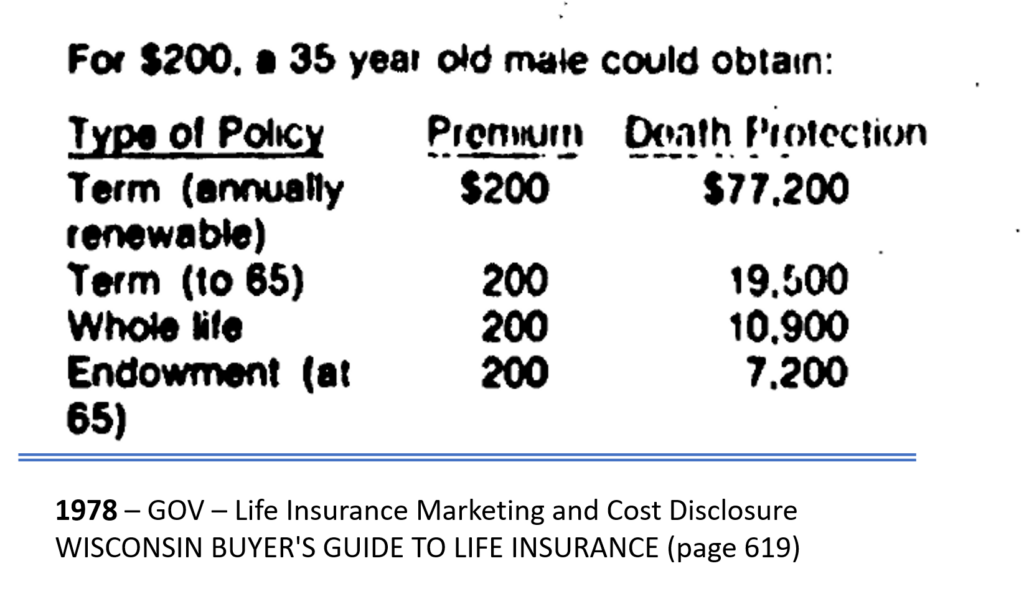

Shopping for Life Insurance / Comparisons

Mr. Birnbaum:

- said the purpose section of Model #580 states: "The purpose of this regulation is to require insurers to deliver to purchasers of life insurance information that will improve the buyer's ability to select the most appropriate plan of life insurance for the buyer's needs and improve the buyer's understanding of the basic features of the policy that has been purchased or is under consideration."

- He said this clearly contemplates comparison shopping.

2018 0501 - Life Insurance Illustrations Working Group (LIIIWG) Conference Call

- Ms. Faucett <NAIC Actuarial Consultant to the NAIC> responded that people spend more time buying a microwave than they do an insurance policy.

1994-1, NAIC Proceedings

Cost comparison and disclosure for individual life insurance has been discussed and debated for well over a decade.

Why is it that there are still divergent views on a subject that has received so much extended attention?

Certainly, it is not for lack of techniques or methods for comparing costs to the consumer.

- Over the years, actuaries, academicians and others have proposed, analyzed, compared, studied, discarded, and reintroduced a variety of approaches to cost comparison.

Nor is it for lack of public debate on the subject inasmuch as it has been discussed in many hearings before the National Association of Insurance Commissioners (NAIC), state insurance departments, committees of state legislatures and committees of the U.S. Congress.

If the solution to the cost comparison and disclosure issue was merely one of finding the right method or technique for providing consumers with information to help compare policy costs, it would have been resolved long ago.

- What makes the issue so difficult is that it directly impacts the ability of rival life insurance marketing forces to compete for the consumers' dollar.

-- John K. Booth

1981 - SOA - Individual Life Insurance Cost Disclosure Issues, Society of Actuaries - 22p

Confusing

And that leads to my second concern which is that consumer confusion I think, and we fear, in large part is going to be translated into a lack of confidence or a lack of trust in their advisor.

- And in some way or another, the consumer is going to end up with the feeling that the advisor did some form of misrepresentation initially to the consumer and now the truth is coming out.

- And I think that is a very big concern and not only would it harm the consumer's confidence in the producer, but it could have a lot of reputational damage to producer's as well.

-- Gary Sanders (NAIFA)

2019 1115 - NAIC - IULISG – Indexed Universal Life Illustrations Subgroup - Conference Call [Bonk]

The mystery of life insurance!

- Why, there is not the least mystery in it.

- The only mystery is, how it has managed to live so long on the reputation of having a mystery, which it has not. [Laughter]

-- Mr. Bryant

1871 - NAIC Proceedings - Vol 1