Reserves

- Principles-Based Reserves – PBR

- Premiums and Benefits – Reserves

- Benefit Reserves

- CRVM

- modified reserve systems

- Natural Reserves

- PBR

- Policy Reserves

- Terminal Reserves

- 2013 0917- ThinkAdvisor - ACLI calls Lawsky's letter on reserves 'irresponsible', By Elizabeth D. Festa - [link]

- In a letter to state insurance commissioners, the American Council of Life Insurers (ACLI) called the top New York insurance regulator’s remarks on life insurance reserving “irresponsible” and inaccurate, the former because they erode trust in the state regulatory system and the industry and the latter for actuarial reasons.

- Actuarial Guideline 38 (AG 38)

- Lawsky Letter - Bad Link - https://www.dfs.ny.gov/about/press2013/pr1309111-link.pdf - <WishList>

- ACLI Letter - <WishList>

- asset adequacy approach

- Stochastic

- Linear

- Principles-based

- Commutation Functions

- Asset Shares

- Reserve Factors

- Pricing

- Valuation

- The 1980s ushered in the era of universal life policies.

- While such universal life policy features as flexible premiums, current and guaranteed cost of insurance scales, guaranteed maturity funds and guaranteed maturity premiums added a few wrinkles to the calculation process, the fundamentals of generating policy reserves remained fairly intact.

- In contrast, today’s products have become much more complex. (p11)

- While such universal life policy features as flexible premiums, current and guaranteed cost of insurance scales, guaranteed maturity funds and guaranteed maturity premiums added a few wrinkles to the calculation process, the fundamentals of generating policy reserves remained fairly intact.

2013 01 - NAIC / CIPR Newsletter, By Reggie Mazyck, NAIC Life Actuary - 33p

- 1984-1, NAIC Proceedings, Reserves Examples, CRVM

- 1997 - SOA - A Comparison of Canadian and U.S. Reserving Methods and Their Financial Implications, Society of Actuaries - 30p

- 1997 - SOA - Equity-Indexed Insurance Products - Pricing, Investment, Accounting, and Reserving, Society of Actuaries - 21p

- 1997 - SOA - Term Insurance Reserving, Society of Actuaries - 24p

- 2015-3, NAIC Proceedings - 6-203

- Appendix I – Whole Life Net Single Premium Comparison - CRVM Net Single Premiums

- 2016-1, NAIC Proceedings - 6-335

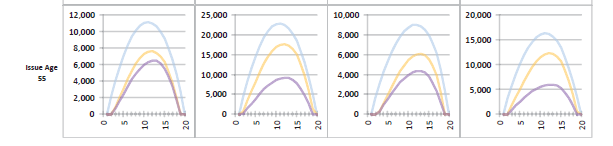

- 20 Year Level Premium Term Life Insurance (Cont. Terminal Reserves for Single Cells — Face Amount

- C. Life Insurance is only Balance sheet where 99% of the reserves (the major liability risk item) include no indication of what the company actually believes about the listed future obligations other than that they are adequate. (p49)

2001 12 - AAA to NAIC - Risk Management in the Insurance Industry - Session 7a, American Academy of Acturies - 51p

- 2008 1120 – NCOIL - Life Insurance & Financial Planning Committee Minutes - National Conference of Insurance Legislators - 6p

- Dave Sandberg with the American Academy of Actuaries (AAA) ... said companies in Australia, the United Kingdom, and Canada were subject to principles-based reserving requirements, and had remained solvent despite the far-reaching impacts of a global credit crisis.

- He said the current reserving requirements in the United States hid the real risks.

- Dave Sandberg with the American Academy of Actuaries (AAA) ... said companies in Australia, the United Kingdom, and Canada were subject to principles-based reserving requirements, and had remained solvent despite the far-reaching impacts of a global credit crisis.

- 1961 - SOA - Discussion of Subjects of Special Interest: Cash Values, Society of Actuaries - 3p

- In considering the 1958 CSO revisions, to what extent is it necessary to take into account statutory requirements that cash values be not less than the reserve minus $25 per thousand?

- Our concern relates to the lack of clarity as to the meaning of this paragraph.

- The words "traditional plan" are particularly troubling.

- Does this mean a universal life policy, a whole life policy, or a term policy?

- We are concerned that the vagueness of this wording will once again lead to different interpretations by the reader.

- Also, we are concerned that this wording may be an attempt to hold the same reserves for universal life insurance and whole life insurance, which we strongly believe is incorrect.

- Universal life and whole life are entirely different product structures, with different products features, and consumers buy these products for different reasons and purposes.

- Therefore, reserves for these products should be different.

2004-4, NAIC Proc

- We’re going to actually go through and calculate reserves in detail for this product. The product is a fairly standard product.

- It has a $12.50 per month load.

- It has a guaranteed interest rate of 4 percent.

- It’s a 2001 CSO product, and the current costs of insurance (COIs) are reverse select and ultimate COIs.

- With the COIs, the first 20 years are 90 percent of the guarantees, and then for years 21 and after they are 50 percent.

2005 - SOA - Statutory Financial Reporting for Universal Life, by Jeffrey A. Beckley, Society of Actuaries - 15p

- Vanishing premium whole life is often called ... the benefit reserve being something like a statutory reserve and the deferred acquisition expense item ...

-- Ralph H. Goebel

1985 - SOA - New Product Accounting Alternatives, Society of Actuaries - 26p

- Finally, effective the first of this year, the California Department imposed new requirements for universal life (UL) reserves.

- For a company to which these requirements are applicable, and assuming it opt's for the Califomia method, things are even more complicated, because statutory reserves are farther away from tax reserves.

- Of course, the results could be even worse if, instead of the California method, the company used reserve interest rates equal to the fund accumulation rate, which is the other option.

-- Mark A. Tullis

1992 - SOA - Strategic Product Development, Society of Actuaries - 36p