Sales Process

- The agent, as a result of not understanding the illustration, may misrepresent the product to the consumer.

-- Judy Faucett

1992 - SOA - Life Insurance Sales Illustrations, Society of Actuaries - 16p

- Mr. Wright said the Society of Actuaries report referred to the fact that companies said they had no control over what agents did.

- Mr. Morgan responded that the regulation could deal with that explicitly by saying the company is responsible.

1994-4, NAIC Proceedings

- [Bonk: re: Universal Life]

- If that is the case, how does an agent program somebody?

- How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65?

-- Allan W. Sibigtroth

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- .....the agents may not understand the product or its illustration.

- I was in a meeting where I asked an agent about the interest rate that was shown on the illustration, and he didn't know whether that was the interest rate before or after the bonus was paid.

- He then turned to the person sitting next to him, who was representing the company, and that person wasn't sure what the interest rate was either.

- The agent, as a result of not understanding the illustration, may misrepresent the product to the consumer.

- Finally, agents may not have the expertise for that particular market, but they believe that having the illustration in front of them makes them capable of selling to the market.

-- Judy Faucett

1992 - SOA - Life Insurance Sales Illustrations, Society of Actuaries - 16p

- The way the contracts were sold and marketed (e.g., a universal life contract sold as low premium term insurance or primarily for investment purposes). (p156)

2007 - IAA (International Actuarial Association) - Measurement of Liabilities for Insurance Contracts: Current Estimates and Risk Margins, IAA ad hoc Risk Margin Working Group - 170p

| 2/22/2018 LIBG WG |

Academy Letter |

Section #1: Since there are many sources knowledgeable about insurance, such as insurance agents, company representatives, financial planners, registered investment advisors (RIAs), Certified Public Accountants (CPAs), and attorneys, we recommend referring to individuals knowledgeable about life insurance and providing some examples. |

- About the same time that we were entering the Universal Life business, Universal Life brought about a change in the way we think about sales.

- Replacement used to be a dirty word.

- We have all heard some talk about twisting, and it has strong negative connotations.

- Universal Life, mainly because of its premium flexibility, has changed that.

- I recently heard one of our marketing people refer to replacement of old traditional permanent policies with Universal Life.

- ⇒ He called it "The Enlightened Liberation of Assets".

-- Stuart Grodanz

1984 - SOA - Variable Universal Life, Society of Actuaries - 22p

- Let's go back to the question of understandability.

- With no standardized format being utilized, many of the illustrations currently in use are far too complex for the average consumer or applicant to understand.

- In many cases the selling agent does not understand what he is presenting, and this needs to be addressed."

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- Issue: Universal Life sold as Permanent / Whole

- 2xxx- LC - Fairbanks v. Farmers New World Life --- [BonkNote]

- The complaint set forth a litany of alleged facts misrepresented or concealed from policyholders, including, but not limited to, the following: (a) Farmers marketed the policies as permanent insurance, but the policies would actually lapse before maturity;

- 2xxx- LC - Fairbanks v. Farmers New World Life --- [BonkNote]

- 2010 - LC - Maloof v John Hancock - Alabama Supreme Court Opinion - 39p

- "The gravamen of their complaint was that Glasgow had misrepresented to them ....that the policies would provide benefits that would be available to pay any estate taxes due upon John's death....

- .....in fact, based upon the projected insurance and interest rates at the time of sale, those policies would likely lapse when John was approximately 78 years old unless the Maloofs at some point substantially increased the amount of the premiums they paid."

- (20) - However, the Maloofs could not have reasonably relied on the alleged misrepresentations concerning the availability of benefits from those policies to pay estate taxes due upon John's death in light of the clear language of the insurance policies.

- (22) - Thus, the undisputed facts indicate that Glasgow in fact fulfilled the Maloofs' request to procure life-insurance policies that would provide funds that could be used to pay estate taxes upon John's death, and those policies were canceled only after the Maloofs failed to pay the required premiums.

- (p5) - B. The Sales Process And Illustrations - Walker SANFRAN-#8165194-v1-2016_02_08_042_Appellees_Answering_Brief

Vogt v State Farm, Case 2:16-cv-04170-NKL Document 186-1 Filed 01/19/18

- NAIFA

- Van Mueller - State Farm Training - Video

- Gary Sanders - "Cash Value"

- 1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries - Robert Nelson

- How would you advise? Not Very Well

- Help us to Actuaries.

- They'll never forgive us

- Regulation

- LIIIWG

- Richard Wicka

- How do Agents use these?

- Jodi Lerner

- 2019 9 3 LIIIWG -If it was me, I already bought the Life Insurance policy. I already went through whatever Medical Exam I needed. I'm not going to look at this <Policy Overview when Policy was delivered>. I'm done.

- Universal Life Model Regulation - Page 5

-

Drafting Note: Although highly flexible, universal life insurance is generally considered a permanent life insurance plan. Most companies encourage a premium level which will provide lifetime insurance protection. Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection. As a result, it is expected that most universal life insurance policies will be sold as permanent plans.

-

- Richard Wicka

- LIIIWG

- IULISG - IUL Illustration Subgroup

- Illustrations

- Vincent? Primary Use of Illustrations is Comparison for new policy purchase

- Woman - I hope Illustrations aren't used for Comparison

- 1999-4 NAIC Proc. - Mr. Foley responded that, if consumers want to compare policies, they have the illustrations to do so. He opined that is better than an index.

- Agents

- Wildcard

- Moore - 6% x Multiplier = 9% Illustrated - Agents don't know that

- Illustrations

- Premiums -

- Target Premium

- SOA -

- Planned

- Guideline Level Premium

- Target Premium

- Legal Cases

- Vogt

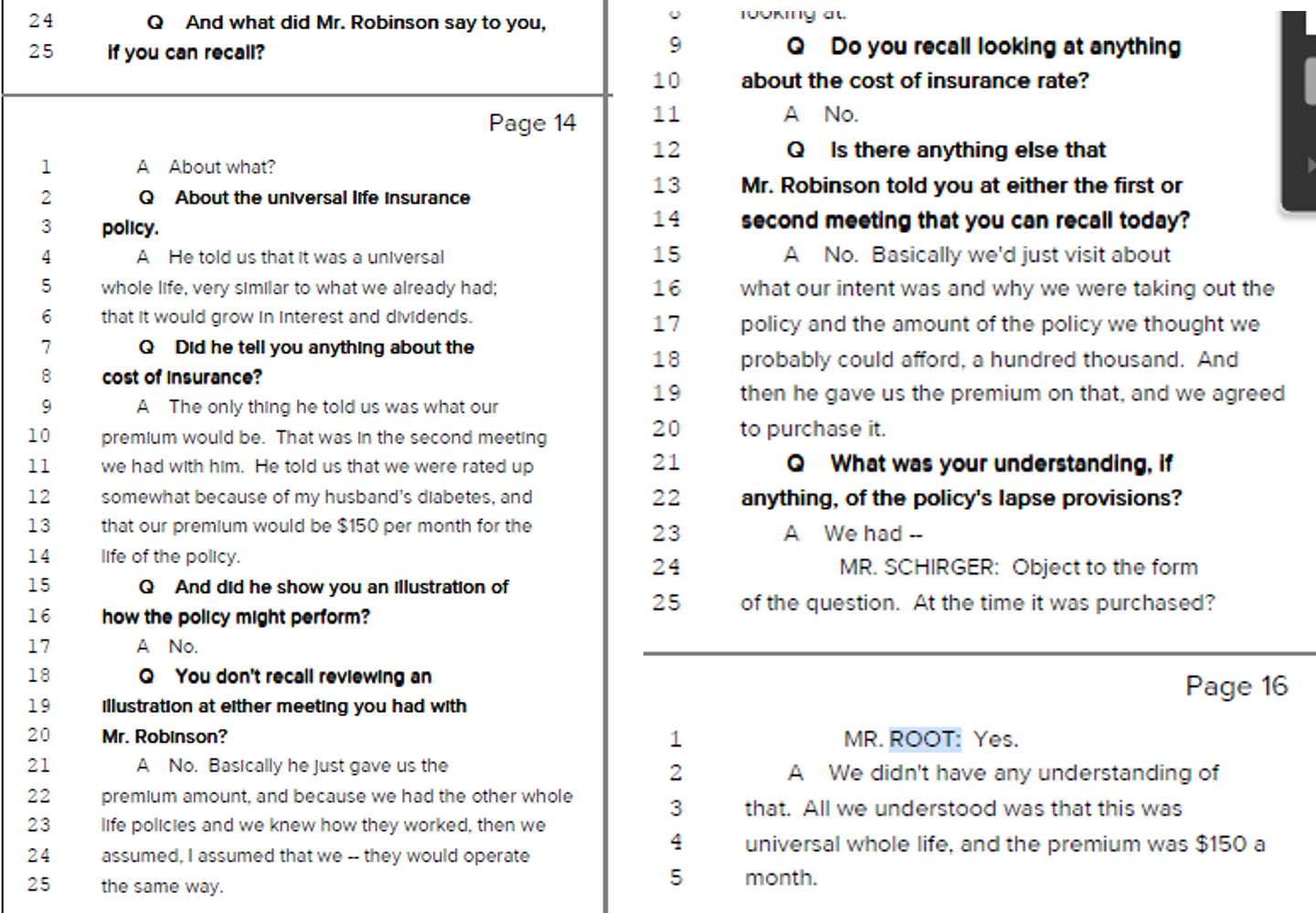

- Mrs. Depo - Same as other WL

- Video

- Johansen - not your normal policy

- Elhouty - Different from Traditional Permanent

- Vogt

- ACLI

- SOA - Tozer - what people expect...premium

- LIMRA

- Shopping Podcast

- Actuarial

- SOA - Agent - I didn't know Costs Came Out

- SOA - Miller -

- Agent Training

- 1999-4 NAIC Proc.

- Mr. DeAngelo said there had been a suggestion that Section 2A(1)(c) be revised. He said if materials for agents are misleading or incomplete, then agents may in turn mislead the public.

- Mr. DeAngelo said he did not recall seeing incorrect or misleading training materials, so this is somewhat a theoretical question.

- Mr. Hanson responded that he had seen misleading materials in market conduct examinations.

- Diana Marchesi (Transamerica) said this language would then be broad enough to include material designed to inspire agents to sell more for the company.

- 1999-4 NAIC Proc.

- LIMRA

- 2005 - SOA - Regarding Your Direct Response Office, by Pete Jacques & Ronald R. Neyer, As published in the Winter 2004 edition of LIMRA’s MarketFacts Quarterly - 8p

- NAIFA / NALU

- 2017 0207, NAIC Proceedings - LIBGWG, Life Insurance Buyer's Guide Working Group - Conference Call

- Gary Sanders (National Association of Insurance and Financial Advisors—NAIFA) agreed that use of the term “cash value” was confusing.

- 2017 0207, NAIC Proceedings - LIBGWG, Life Insurance Buyer's Guide Working Group - Conference Call

- I'd like to stress that agents don't pretend to know the answers.

- Sometimes it's like picking a style of an automobile: I know the model I like, I know the company I'd like to back-up the automobile I purchase, and I even enjoy using and driving it, but I don't pretend to know how the design engineers came up with all the features of the car I chose.

- I think the analogy comes through in the life insurance business on a very simplistic plane - we don't have the answers that I believe the actuaries do. It is our intent to ask for your help because we're currently living with problems that lack solutions. -- Robert Nelson

- I'm not saying that we are trying to circumvent the system, but consider for a minute that I don't sell a considerable amount of insurance by saying, "Let me tell you all that's wrong with this product.

- In addition, let me clearly explain the risk that you are about to assume."

- So where in the ideal sales process does this get communicated? -- Robert Nelson

- JAMES F. REISKYTL, Actuary: Bob, if I were coming to you to buy a policy, how would you tell me to compare whatever you're selling?

- You said you offered policies for three or four companies.

- How do you compare those policies and tell me which one I should buy?

- MR. NELSON, Agent / NALU: "Inadequately" would be the short answer.

- I sincerely believe we have a flawed instrument in today's sales illustrations.

- It is neither a reason to condemn our industry nor pretend our industry should have been immune to change, especially with the economic realities of the past few years.

- But we did not communicate the impact of change as well as we should have, especially the impact of change on the numbers we used in our sales illustrations.

- So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer.

- Our biggest mistake would be to delay. I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing. -- Robert Nelson (NALU / NAIFA)

1993 - SOA - Sales Illustrations - We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries --- [BonkNote] --- 20p

- Academic

- www2.imms.com/members/3rdparty/AmerCol/regbook/chap6d.htm

- Business-Getting Activity

- Insurance regulators exercise a substantial measure of control over the methods by which insurers and their agents obtain business. Such control seeks to enforce a higher standard of competition than that prevailing in other fields of endeavor and to protect the insurance consuming public against practices detrimental to their interest. State unfair trade practices acts and regulations promulgated thereunder constitute a major element in achieving these purposes.

- Misrepresentation in Getting Business

- Solicitation and Advertising in General

- Misrepresentation for the purpose of inducing the payment of an insurance premium was adjudged more than 100 years ago to be a crime in Massachusetts.