Sandbox - UL - Dynamic Products - Raindrop or Umbrella - 414

In essence, the model regulation <Universal Life Model Regulation> assumes that at issue, all universal life policies are permanent plans.

The r-ratio is meant to measure the extent to which the policy is on track" as a permanent plan.

Statutory Valuation of Individual Life and Annuity Contracts | 5th Edition Claire, Lombardi and Summers

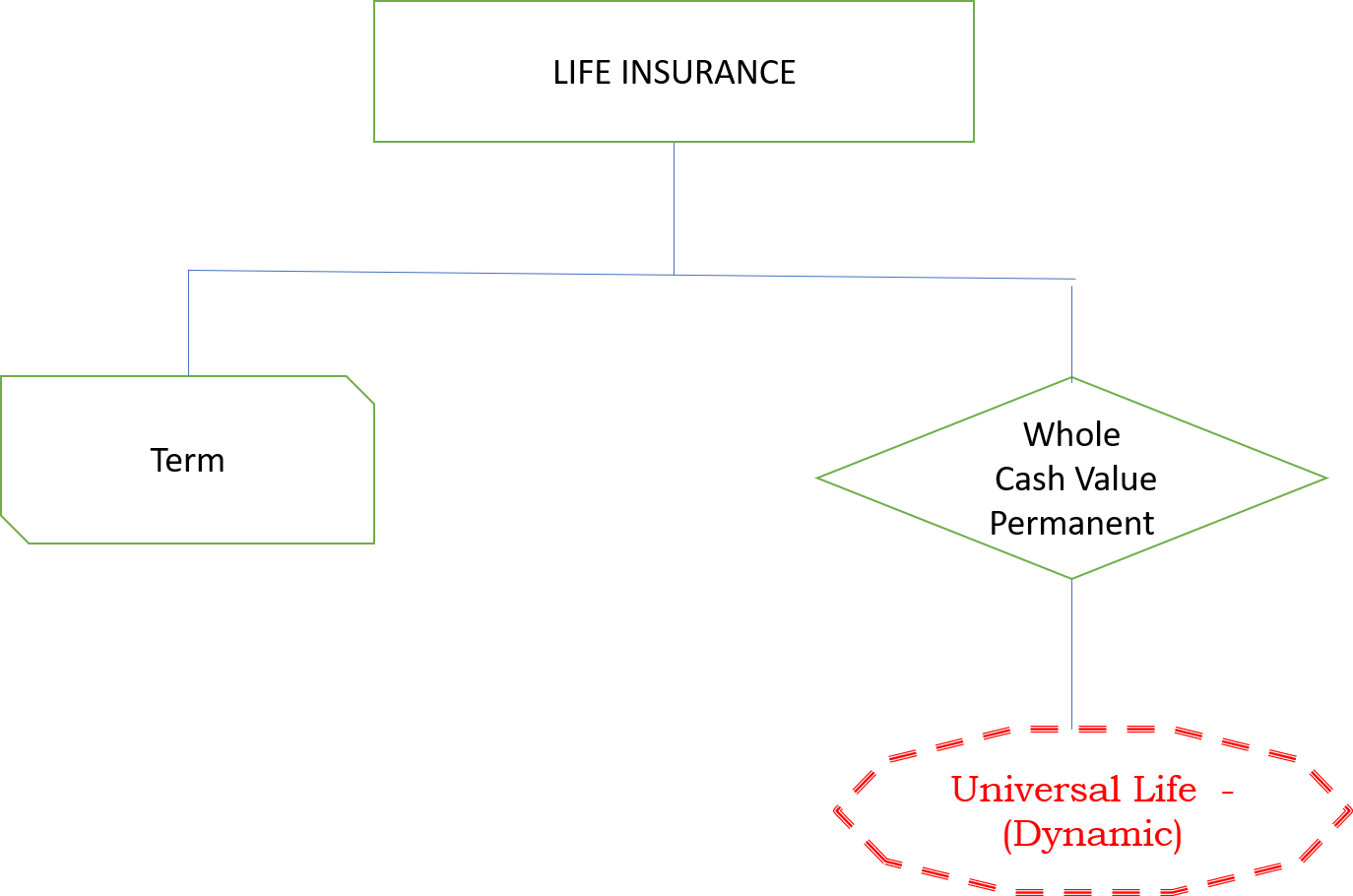

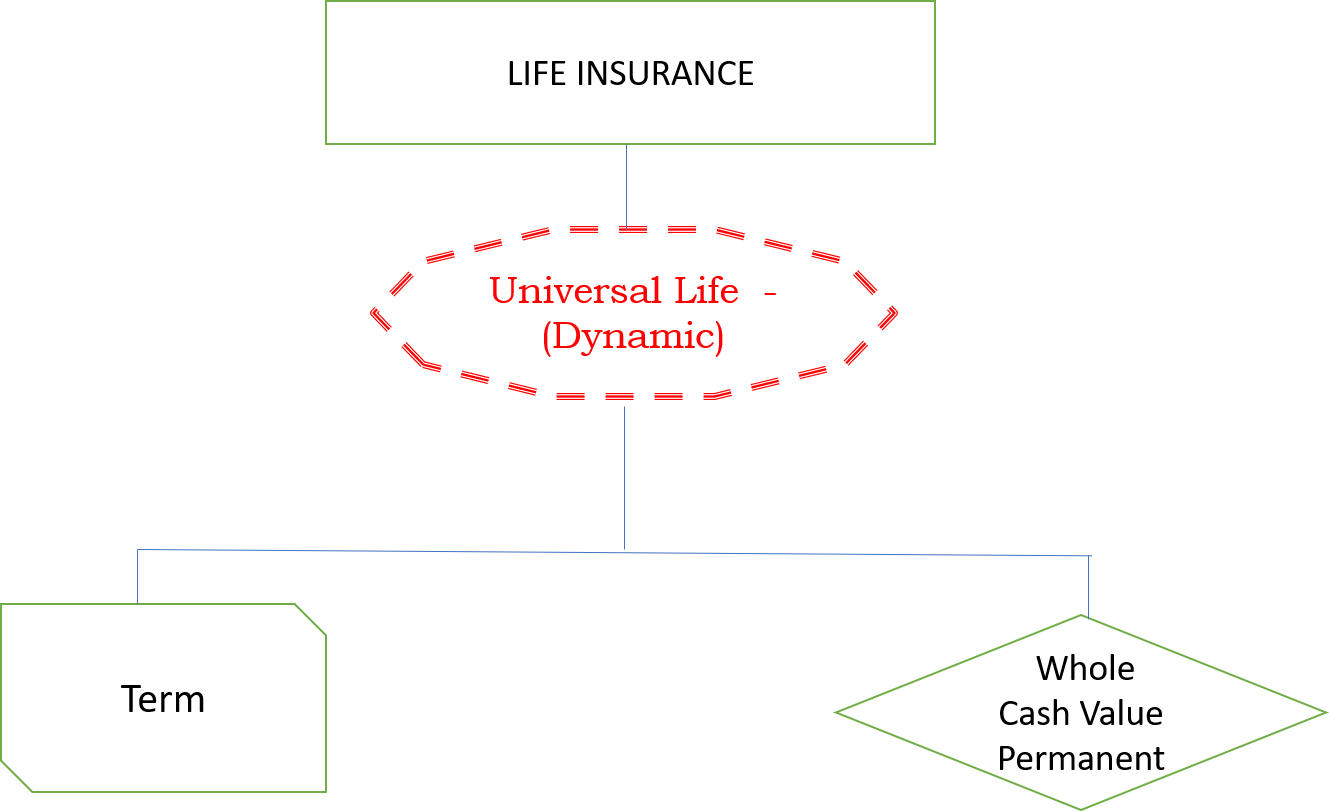

The complications begin with a very simple question: What's the premium for Universal Life? It could be almost anything.

Then what's the cash value? That depends on the premium.

It is the relationship between the premium and cash value that determines the product characteristics of Universal Life.

MR. BEN H. MITCHELL

1981, Universal Life, Society of Actuaries

2016/5/17 - LIIIWG NAIC, Assurity White Paper

2017/11/15, LIBGWG NAIC, American Academy of Actuaries, Letter

Universal life also allows for flexibility in policy benefits, not just premium payments.

TW - Maybe we just point out the cash value

You Generally pay a planned premium designed to keep the policy in force for life, and accumulate cash value, based upon the interest and expense and mortality charges you assume. It is important that these assumptions be realistic because if they are not, you may have to pay more to keep the policy from decreasing or lapsing. On the other hand, if your experience is better then the assumptions, than you may be able in the future to skip a premium, to pay less, or to have the plan paid up at an early date.

You do not have to pay the planned premium, but if you pay less, the benefit may be more like term insurance, which is only in force for a limited time and builds no cash value. On the other hand, if you pay more, and your assumptions are realistic, it is possible to pay up the policy at an early date. Basic Types of Policies

You do not have to pay the planned premium, but if you pay less, the benefit may be more like term insurance, which is only in force for a limited time and builds no cash value. On the other hand, if you pay more, and your assumptions are realistic, it is possible to pay up the policy at an early date. Universal Life Basic Types of Policies - New York Department of Financial Services

Brenda Cude

2018/2/9

Revised 2-9-18 for discussion on

conference call 2-22-18

Cude/Kitt Comments

LIFE INSURANCE BUYER’S GUIDE

| Do premiums or [benefits] vary from year to year?

Cude Note: Comment [BJC3]: To what does this <refer?> |

|

| How much do the benefits build up in the policy?

Cude Note: Comment [BJC4]: What benefits? |

|

| How will the timing of money paid and received affect interest?

Cude Note: Comment [BJC5]: What interest? Not mentioned anywhere else. |

Birney Birnbaum

Regulators - Mary Mealer, Richard Wicka, Lois Lerner

Lois Lerner - I'm done

Richard Wicka - the PO for UL will be easy.

Mary Mealer - NGE's/ Cude

The main concern was that an unsophisticated buyer purchased a policy and did not know what the coverages, benefits and limitations were.

Some of the items identified which should be disclosed: ...

(2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988 Proc. II 566., UNIVERSAL LIFE INSURANCE MODEL REGULATION Proceeding Citations