Signature

- The working group next discussed the appropriateness of including a requirement for a consumer signature on the document.

- The group decided it was important not to imply consumer understanding of what was in the illustration but just an acknowledgment of receipt of the illustration.

1994-2, NAIC Proceedings

- I think the only thing the illustration signature will do is to cover us when their lawyers come at us.

-- Linda M. Lankowski

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- 2003 - LC - Fay v. Aetna --- [BonkNote]

- Donna Claire - Fay v Aetna - You said you understood it

- I think that requiring the policyholder's signature does serve a purpose, which is not legal coverage for the company, of allowing the home office to know that the policyholder has received the last page of the illustration that contains the required disclosures.

-- H. Lee Michelson

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- Noel Morgan (Ohio) said he was uncomfortable with the disclosure statement required to be signed by the consumer. He said it took away too much from the consumer.

- Bob Wright (Va.) agreed that this went much further than the working group had intended.

- George Coleman, responded that insurers need to get something out of this compromise also.

- He suggested this would allow companies a little protection.

- -- George Coleman, Prudential, ACLI, TRG-Technical Resource Group for the NAIC (Industry Advisory Group - Illustrations)

- Mr. Phillips suggested that the second sentence of the disclosure statement had too much legalese.

1994-4, NAIC Proceedings

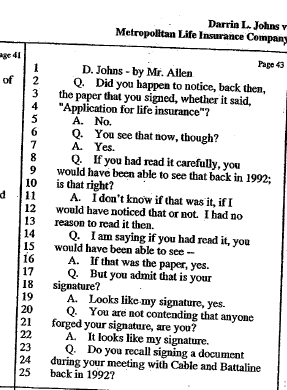

2006 - Case 8:93-cv-01849-SDM Document 382-13 Filed 08/31/2006 Page 12 of 41

2006 DP Darren L Johns v MetLife 43p.pdf

- 240 CHAPTER 28 • Dictionaries, Vocabulary, and Spelling FOR TEACHING: Finding Information in Dictionaries (28a)

- Consider demonstrating the keen usefulness of the information in dictionaries by bringing in a couple of legal contracts — say, from life insurance companies.

- Reading these contracts calls for a sharp eye and a very clear knowledge of what each word means.

- Materials describing one such life insurance plan, for example, contain the following terms: semiannual, net cost, underwrite, waiver, conversion, incontestability, and incapacitated.

- Ask students to define each of these words, without — and then with — the help of a dictionary.

- Which words would they want to make sure they really understood before signing a contract?

- Consider demonstrating the keen usefulness of the information in dictionaries by bringing in a couple of legal contracts — say, from life insurance companies.

2011 - Book - The St. Martin’s Handbook, Instructor's Handbook - 7th Edition - 492p