1990s - SOA - Society of Actuaries

- Illustrations, Assumptions, Non-guaranteed Elements

- Actuaries - Judy Faucett, Daphne Bartlett, Donna Claire,

- GOV - Metzenbaum

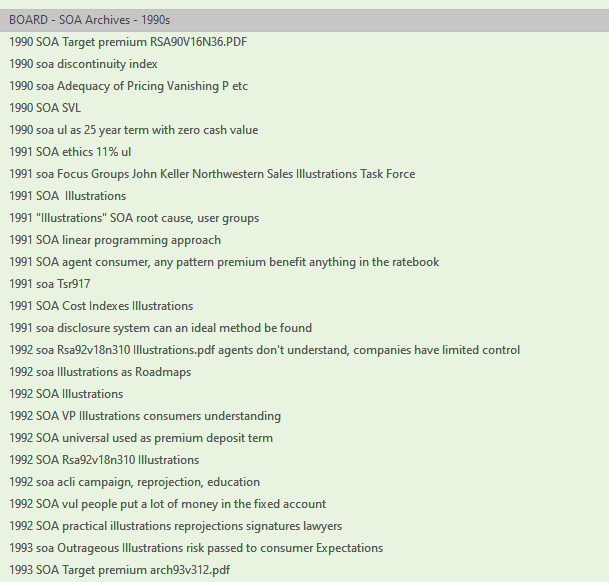

- 1990 - SOA - An Opportunity to Return to the Basics. -- Will We Take It?, Society of Actuaries - 14p

- 1990 - SOA - Life Product Development Update (rsa90v16n36), Society of Actuaries - 38p

- 1989 - Life Product Market Share - By Premium-Pie Chart, p2 - 1p

- 1989 - Life Product Market Share - By Face Amount-Pie Chart, p4 - 1p

- 1980-1989 - Universal Life Sales - Percent of Total Premium - Bar Chart, p18 - 1p

- 1990 - SOA - Life Product Development Update (rsa90v16n4b6), Society of Actuaries - 20p

- 1990 - SOA - Quality of Life Insurance Sales Illustrations, Society of Actuaries - 16p

- Tony Spano, ACLI: I'm going to discuss what Norm referred to as consumer disclosure forms

- 1991 - SOA - Disclosure Systems: Can an Ideal Method be Found?, Society of Actuaries - 22p

- 1991-1992 - SOA - Final Report* of the Task Force for Research on Life Insurance Sales Illustrations, Society of Actuaries --- [BonkNote] --- 142p

- Appendix II - Illustration Examples

- *Opinions expressed herein are those of the Task Force for Research on Life Insurance Sales illustrations and of the Committee for Research on Social Concerns. This report does not purport to represent the views of the Society of Actuaries or of its Board of Governors.

- 1991 - SOA - Illustrations, Society of Actuaries --- [BonkNote] --- 20p

- 1991 - SOA - Individual Life Product Development Update, Society of Actuaries - 34p

- Tillinghast Universal Life Analytic Study Data (TULAS)

- 1991 - SOA - Product Update - Individual Life, Society of Actuaries - 18p

- 1991 - SOA - The Image Crisis and the Actuary: Understanding Pubic Misunderstanding, Society of Actuaries - 32p

- 1992 - SOA - Companies on the Edge, Society of Actuaries - 20p

- 1992 - SOA - Life Insurance Sales Illustrations, Society of Actuaries - 16p

- 1992 - SOA - Principles of Actuarial Science, Committee on Actuarial Principles, Society of Actuaries - 64p

- Nathan F. Jones suggests that actuaries should speak out when the principles of their science appear to have been misapplied.

- The Committee agrees with Mr. Jones and hopes that the publication of "Principles of Actuarial Science" will help actuaries better articulate their concerns in such situations.

- 1993 - SOA - Reinsurance and Rating Agencies. Society of Actuaries - 22p

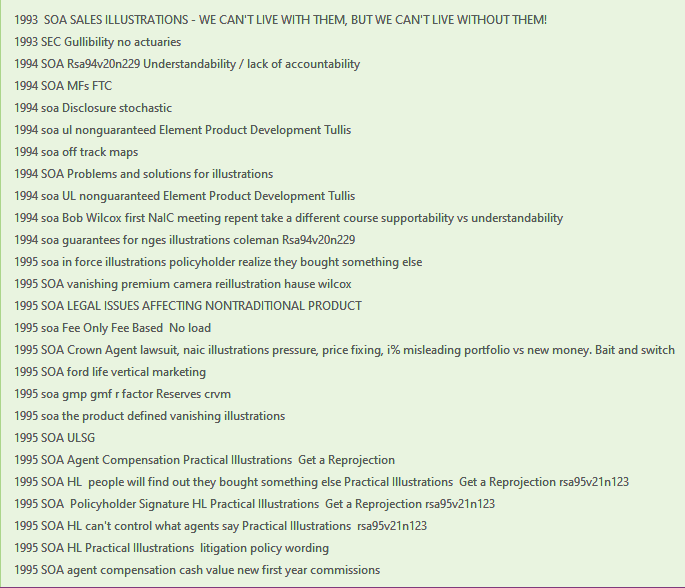

- 1993 - SOA - Sales Illustrations - We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries --- [BonkNote] --- 20p

- 1993 - SOA - Variable Products -- Product for the 1990s?, Society of Actuaries - 22p

- 1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- 1994 - SOA - The Driving Forces Behind Participating - Universal Life (UL) - Nonguaranteed Element Product Development, Society of Actuaries - 12p

- 1994 - SOA - What's New with Term Insurance?, (rsa94v20n21), Society of Actuaries - 20p

- 1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- 1995 - SOA - Liquidity: The Hidden Risk Factor, Society of Actuaries - 20p

- 1995 - SOA - NAIC Model Investment Law - Society of Actuaries - 20p

- 1995 - SOA - Nonforfeiture Laws Update (rsa95v21n4a20), Society of Actuaries - 18p

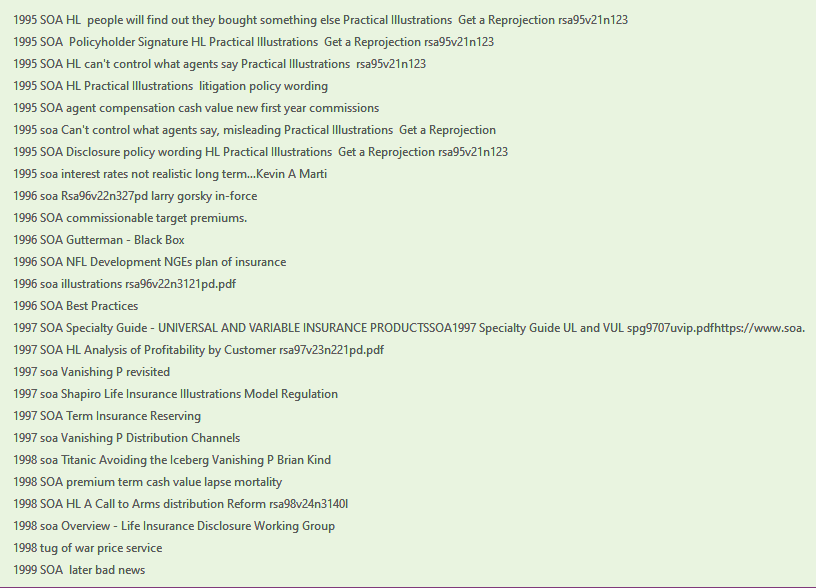

- 1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- 1995 - SOA - Sales Illustrations, Society of Actuaries - 14p

- 1996 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- 1996 - SOA - Implementing the Illustration Regulation: The Clock Is Ticking, Society of Actuaries - 25p

- 1996 - SOA - Legal Issues Affecting Nontraditional Products, Society of Actuaries - 14p

- 1996 - SOA - Life Insurance Sales Illustrations—What’s Next?, Society of Actuaries - 22p

- 1996 - SOA - National Association of Insurance Commissioners (NAIC) Recent Developments, Society of Actuaries - 14p

- 1996 - SOA - Nonforfeiture Law Developments (rsa96v22n38pd), Society of Actuaries - 23p

- 1996 - SOA - Professional Standards Affecting Life Actuaries, Society of Actuaries - 18p

- 1996 - SOA - Update on Life Insurance Illustrations, Society of Actuaries - 24p

- 1997 - SOA - "Actuarial Counseling" - A New Role for the Actuarial Profession, Society of Actuaries - 21p

- 1997 - SOA - Keeping Current on Fixed Annuities, Society of Actuaries - 21p

- 1997 - SOA - Professional Standards Affecting Life Actuaries, Society of Actuaries - 18p

- 1997 - SOA - Vanishing Premium Illustrations Revisited, Arnold F. Shapiro, Society of Actuaries - 10p

- 1998 - SOA - Current Issues in Sales Illustrations, Society of Actuaries - 26p

- 1998 - SOA - Market Conduct: A New Actuarial Frontier, Society of Actuaries - 20p

- 1998 - SOA - Market Conduct Issues for Product Development Actuaries, Society of Actuaries - 27p

- Summary: Market conduct issues are perhaps one of the most serious facing the life insurance industry today. How did we get to this point? And more importantly, what actions are companies taking to address these issues?

- 1999 - SOA - 1999 Valuation Actuary Symposium, (va99-44of), Edward L. Robbins, Society of Actuaries - 28p

- 1999 - SOA - A Brief History of Universal Life, by Douglas C. Doll, , Society of Actuaries - 4p

- 1999 - SOA - Insurance Company Failures of the Early 1990s - Have We Learned Anything?, Society of Actuaries - 25p

- 1999 - SOA - The Next Generation Universal Life, Society of Actuaries - 30p

- 1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- James D. ATKINS: I'd like to start out by posing a question and that is, what is the impetus behind introducing this illustration regulation? Why are we doing this?

- Robert WILCOX (NAIC - Chairman of the Life Disclosure Working Group - Utah Insurance Commissioner): Whatever we did to illustrate those contracts when they were sold, the policyholders did not understand the contingent nature of that vanish. That's the underlying reason we got into this.

- MR. ATKINS: You mean just because they didn't understand the vanishing premium illustration we have all this regulation being imposed?

- MR. WILCOX: If you try to get down to the catalyst that made it turn the comer, that's probably true.

-

- Walter MILLER: Perhaps that was the catalyst, but I have a somewhat different point of view as to what triggered all this.

- In addition to the widely publicized sets of problems that had to do with the vanishing premium illustrations, much of that had to do not so much with the illustration, but how the illustration was explained, if at all. I mean that's a somewhat different animal.

- There are many industry people, however, who feel that for better or worse, there is a perception among many regulators that too many companies are being too aggressive in the bases underlying their illustrations and we need to do something about that.

- I think there are several new model regulations that your group is developing and there's obviously some proposed actuarial standard of practice that addressed this point.

- MR. WILCOX: I think you're right, Walter, in a significant respect.

- The fact is that a minority would be inclined to make those overly aggressive assumptions and produce unsupportable illustrations, but every time one company would take that stand and use assumptions for the illustration that don't make sense, there's another company that competes with them and feels compelled to play in the same ball park and then another company that competes with them.

- In the absence of regulation on those who would be most aggressive, the problem grows, but your point is well taken.

- MR. ATKINS: Does anybody think the market could take care of these excesses on its own?

- MR. MILLER: It demonstratively hasn't.

- I published an article in a CLU journal several years ago where I wrote about what I call "The Illustration Is The Product," a syndrome that unfortunately pervades our industry. To agents, potential customers, their advisors, and some regulators, the illustration is the product. If this illustration looks better than that illustration, then this policy is a better policy than that policy and that means this company is better than that company.

- 1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- KEVIN A. MARTI: What I'm thinking about in particular is, Universal Life companies, back in the early 1980s, were illustrating interest rates that we all knew were not realistic long term.