Start

Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products.

- During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers.

- Ancients

- NAIC - rehashing same problems, with no solutions

- Tony Higgins (N.C.) noted that considerable work and effort had been expended in the mid-1980s to revise the Model Life Insurance Disclosure Regulation to address concerns with policy illustrations, particularly with respect to universal life insurance.

- It was suggested that these revisions should be used as a starting point for evaluating additional steps to take in response to new and increasing concerns currently being expressed regarding policy illustrations.

- The NAIC staff was directed to provide copies of the revisions to the members for their review.

1993-1B, NAIC Proceedings

- Documents

- Consumer Testing

- 1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form Focus Group Summary, Consumer Issues Disclosure Working Group - NAIC --- [BonkNote] --- 10p

- Policies

- Adjustable Life Insurance

- 1977/10 - "Adjustable" Life Insurance. The idea is to have one policy you can change as your needs change. - Changing Times Magazine, (p17-19)

- Adjustable Life Insurance

- Illustrations

- Blumenthal vs. New York Life

- Vogt vs. State Farm

- Legal Cases

- 2010 - Maloof v John Hancock - Alabama Supreme Court Opinion - 39p

- Media

- 2018 - Universal Life Insurance, a 1980s Sensation, Has Backfired - New York Times - Leslie Scism

- Ohman naic woman

- Hartford Graph

- 2018 - Universal Life Insurance, a 1980s Sensation, Has Backfired - New York Times - Leslie Scism

- Consumer Testing

- Depositions

- Blumenthal

- Blumenthal -Expert Witness

- Vogt

- Judges

- Johnston x2 vs Conseco

- How does this system work?

- Norem? P1 vs P2

- Universal Life Description

- interested parties expressed a need to take a broader look at how all products are explained to consumers.

2016/4/3, LIIIWG CC, NAIC Proceedings (6-8) - Starters - Universal Life Descriptions

- Starters - Why is Universal Life Insurance sometimes called Whole or Permanent?

- Starters – Maybe Universal Life Insurance Shouldn’t be called Whole of Permanent

- interested parties expressed a need to take a broader look at how all products are explained to consumers.

- Language

- .....product differences between Universal Life and Ordinary Life cause current literature <language> to be inapplicable, as well as insufficient, for Universal Life. (p217)

1984 - American Academy of Actuaries - Journal

- .....product differences between Universal Life and Ordinary Life cause current literature <language> to be inapplicable, as well as insufficient, for Universal Life. (p217)

- Premium

- Performance

- SOA - Task Force Report

- Cost of Insurance

- Non-guaranteed

- Media

- Scism

- NAIC - 2018 - Ohman/woman

- Legal Cases

- Johnston - at some point, first principles- premium

- Norem?

- Worldview

- Policy Overview

1988-2, NAIC Proceedings

- Future Benefit Illustrations

People to get involved

- Judy Faucett

- Gary Hughes

- Shane Chalke

- William Hager

- Tom Foley

- J. Robert Hunter

- David Lange

- Gary Hughes

- Based upon various lawsuits that have been filed, adjudicated or settled, it is also clear that many purchasers of these instruments also had little understanding of the risks.

- It would not be unfair to conclude that regulators also had less than a clear understanding of the risks. (p28)

2013 03 - Comparative Failure Experience In The U.S. And Canadian Life Insurance And Banking Industries From 1980 To 2010, Society of Actuaries - 48p

Traditional plans are fairly simple in their structure.

- One can look at their premiums, their cash values and their dividends, if there happen to be any

Universal life presents something of a paradox. -- The complications begin with a very simple question:

- What's the premium for Universal Life?

- It could be almost anything.

- Then what's the cash value?

- That depends on the premium.

- It is the relationship between the premium and cash value that determines the product characteristics of Universal Life.

Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.

- A premium may be paid at any time and in any amount desired.

- Whenever a premium is paid, loads are deducted from that premium.

- The balance is added to a fund.

- On a monthly basis, cost of insurance charges are deducted from the fund.

- Expense charges may be deducted from the fund, especially in the early policy years, and interest is added to the fund on a monthly basis.

- The cash value changes each month based on the net impact of the income and deduction transactions.

- The policy does not lapse if a premium is not paid; rather, it lapses if the fund balance becomes too small to pay the next month's cost of insurance.

-- Ben H. Mitchell

1981 - Universal Life, Society of Actuaries - 16p

Traditional plans are fairly simple in their structure.

- One can look at their premiums, their cash values and their dividends, if there happen to be any

Universal life presents something of a paradox. -- The complications begin with a very simple question:

- What's the premium <P1> for Universal Life?

- It could be almost anything. <Minimum Premium, Target Premium, Guideline Single Premium, Guideline Level Premium, Guaranteed Maturity Premium, Dump-in / 1035 - Planned Premium>

- Then what's the cash value <SIV>?

- That depends on the premium <P1>.

- It is the relationship between the premium <P1> and cash value <SIV> that determines the product characteristics <Coverage Period / Plan of Insurance / Performance> of Universal Life.

Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment <P1>.

- A premium <P1> may be paid at any time and in any amount desired. <Minimum Premium, Target Premium, Guideline Single Premium, Guideline Level Premium, Guaranteed Maturity Premium, Dump-in / 1035 - Planned Premium>

- Whenever a premium <P1> is paid, loads <E1> are deducted from that premium. <P1>

- The balance is added to a fund. <SIV>

- On a monthly basis, cost of insurance charges <P2> are deducted from the fund. <SIV>

- Expense charges <E2> may be deducted from the fund, <SIV> especially in the early policy years, and interest <i> is added to the fund <SIV> on a monthly basis.

- The cash value <SIV> changes each month based on the net impact of the income <P1 / i> and deduction transactions. <E1/E2/P2>

- The policy does not lapse if a premium <P1> is not paid; rather, it lapses if the fund balance <SIV> becomes too small to pay the next month's cost of insurance. <P2>

-- BEN H. MITCHELL

1981 - Universal Life, Society of Actuaries - 16p

- ... insurance law and regulation can, in a variety of settings, potentially improve insurance markets by promoting coverage information. (p1480)

2017 - LR - Coverage Information in Insurance Law - Schwarcz - 72p

The working group did not come to a conclusion on whether to include the sensitivity analysis and decided that discussion at the next meeting would be helpful.

- Commissioner Wilcox said he was impressed** by the comments of those on the working group who were not actuaries that sensitivity adds more confusion than enlightenment.

- He said as an actuary, if he were buying a policy, he would want to see what 1% less interest produced.

- He said variations other than interest would be more difficult. (p674)

1994-4, NAIC Proceedings

**<Bonk: I was curious about use of the word "impressed." I looked it up on thesaurus.com and found that it is related to "affected" and "distressed" which would make more sense in that sentence. Thoughts?>

- Starters - Universal Life Insurance - Premium

- Starters - Non-guaranteed Elements

- Whole

- Permanent

- Dynamic

Premium -

- The <Universal Life> Model Regulation assumes that future premiums will be paid at the whole life level, and calls this premium the GMP (the guaranteed maturity premium).

- The GMP is analogous to the guideline level premium (GLP) from TEFRA, the only differences being in the area of assumptions.

- The GMP is calculated using plan guarantees, regardless of their level, and with no restrictions on plan form (20 year endowment, I0 pay life, etc.).

- For most plans, however, the GMP should be equal to the GLP from TEFRA.

-- Shane Chalke

1984 - NAIC Update, Society of Actuaries - 24p

Plans of insurance fall into five categories: term, limited pay whole life, continuous premium endowment, limited pay endowment, and income endowment where the ratio of amount of insurance to maturity value may be varied.

1976 - Toward Adjustable Life Products, Walter L. Chapin, Society of Actuaries - 50p

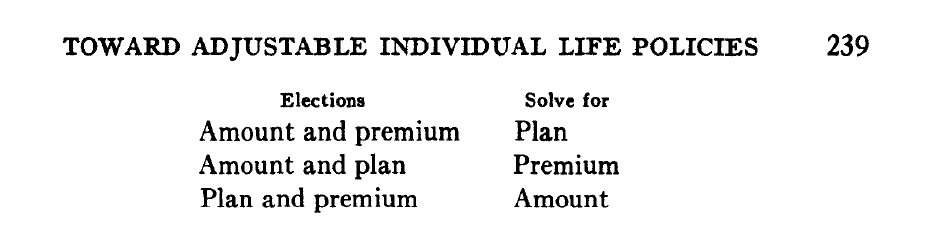

Defining the principal elements of a policy as amount of insurance, gross premium, and plan of insurance, an original issue involves election of any two of the elements and calculation of the third. Each change after issue involves a change elected for one element, either a change or continuation

for a second element, and calculation of the third element.

The complications begin with a very simple question:

- What's the premium for Universal Life?

- It could be almost anything.

- Then what's the cash value?

- That depends on the premium.

- It is the relationship between the premium and cash value that determines the product characteristics of Universal Life.

-- BEN H. MITCHELL

1981 - UNIVERSAL LIFE, Society of Actuaries - 16p

- Sheryl J. Moore (Moore Market Intelligence) concurred that in-force illustrations help manage the consumers expectations of their policy’s performance.

November 14, 2019 - <Should IUL Illustrations be Grandfathered?>

Attachment Twenty-Five - Life Actuarial (A) Task Force -12/5–6/19 (6-253)

- However, as we have stressed previously, at the time a life insurance policy is issued, the 'true cost' of a policy cannot be determined under any circumstances by any method.

1975-2, NAIC Proceeding

- Commissioner Robert Hunter (Texas) asked if the assumptions being discussed in Section V of the standards paper would be disclosed in the policy.

- Commissioner Wilcox responded that they did not need to be disclosed in the same manner that they would be disclosed to an actuary, but that some information would be required.

1994-3, NAIC Proceedings

- 1991- Judicial Rationales in Insurance Law: Dusting Off the Formal for the Function, PETER NASH SWISHER - 39p

- "Indeed, one writer has suggested that insurance contract cases frequently read like a chapter out of Alice in Wonderland,"1

- "Welcome to the wonderful world of Insurance. In it the rules of law of Contracts are reflected as in a fun house mirror."2

- Even Professor Keeton admits that the underlying justifications for many insurance law cases are "less than ordinarily enlightening."3

1 J. DOBBYN, INSURANCE LAW IN A NUTSHELL xix (1981).

2 K. YORK & J. WHELAN, INSURANCE LAW: CASES, MATERIALS AND PROBLEMS xv (1982).

3 R. KEETON, BASIC TEXT ON INSURANCE LAW 341 (1971). See also R. KEETON & A. WIDISS, INSURANCE LAW 614-16 (1988); infra note 52.

g. Clarifying “Coverage Period Description”

The Working Group discussed what information is intended to be included.

- Mr. Yanacheak said this is intended to capture how long a policy’s term is; i.e., a term of years or for life.

- Mr. Birnbaum said it is intended to answer the question: If I pay my premium, this policy will cover x amount of time.

Life Insurance Illustration Issues (A) Working Group

Conference Call

September 17, 2019

- Grove v Principal - Adjustable Life

- Sample Illustrations page - L100/T65

- Blumenthal

-

- Numeric Summary

- Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication......

- .......Universal Life was developed in 1962 as a generic plan, which means that it subsumes all other life insurance products.

1987 - The Search for New Forms of Life - G. R. Dinney

Universal Life Insurance Model Regulation (#585):

- Guaranteed Maturity Premium (GMP)

- "Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection."

- As a result, it is expected that most universal life insurance policies will be sold as permanent plans."

- Guaranteed Maturity Fund (GMF)

- r-ratio

- "The letter “r” is equal to one, unless the policy is a flexible premium policy and the policy value is less than the guaranteed maturity fund, in which case “r” is the ratio of the policy value to the guaranteed maturity fund."

The Life Insurance (A) Committee recommends to the Executive Committee that a task force with an industry advisory committee be appointed to be known as the "Universal Life Insurance Task Force."

The task force would be charged with:

- gathering appropriate information and recommendations,

- holding hearings and

- developing a Model Universal Life Insurance Regulation.

The regulation should address appropriate issues of regulatory concerns, including the following:

4. The manner in which prospective purchasers of such plans are fairly and accurately appraised of the nature of such plans and the manner in which existing policyholders under such plans are informed of the nature and status of their purchase.

1982-2, NAIC Proceedings

- Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products.

- During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers.

2016/4/3, Life Insurance Illustrations Working Group (LIIIWG), 2016-1, NAIC Proceedings (6-8)

Legal Actions

- Monitoring of litigation may alert regulators to issues that the regulatory system has not yet addressed.

2008-3, NAIC Proc.

2017/10/19 - LIBWG - Letter from the Non-Guaranteed Elements Work Group of the American Academy of Actuaries

We believe consumers would benefit from the inclusion of a discussion of NGEs in the buyer’s guide, and think the following points would be helpful:

- Products with NGEs have the risk that costs could increase or benefits could decrease, subject to guaranteed limits stated in the policy.

- Illustrations, if available during the purchasing process, can be useful tools to help consumers understand a range of possible product performance outcomes. <Coverage Periods - Benefits>

- Because NGEs are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits).

- This may include reviewing any annual statements or company correspondence and requesting updated illustrations.

MEDIA

LINDA M. LANKOWSKI: I think any way that we can make illustrations more understandable to the public is certainly going to help us.

- We've seen the problems that have occurred when Senator Howard Metzenbaum (D--OH) was given an illustration with a vanishing premium, and he had absolutely no idea that he had bought a policy that was not paid up in four years.

- It caused many problems for the industry; it caused many problems because the press got involved, and the press doesn't understand the products as well as it thinks it does.

1995 - Practical Illustrations and Nonforfeiture Values Society of Actuaries - 14p

Ms. Faucett noted that she had served as the chair of the SOA Task Force on Life Illustrations and that the task force had conducted an extensive survey of life insurance companies and insurance departments on the nature and extent of problems that exist with respect to policy illustrations.

As a result of the survey the task force determined that consumers do not understand illustrations or how they should be used. (p788)

1993-1B, NAIC Proceedings

- Why can’t I compare cash value products and have some sense of what is going on in the marketplace?

- Because the notion—I mean, it really is a problem, and it is a problem that is under addressed because everyone is so focused on solvency that they forget all these other important regulatory issues.

2011/09/14 - GOV - EMERGING ISSUES IN INSURANCE REGULATION - 51p

Commissioner Hager of the Universal & Other Plans (A) Task Force stated that there appeared to be disclosure problems with universal life plans and that the identification of these items should be placed on the Actuarial Task Force agenda.

- The members present agreed that the disclosure issues extended to variable life as well as universal life.

- The main concern was that an unsophisticated buyer purchased a policy and did not know what the coverages, benefits and limitations were.

- It was suggested that Sections 8 and 9(f) of the Universal Life Insurance Model Regulation needed considerable expansion.

It was suggested that disclosure requirements be placed in the illustrations section of the models as well as in the contract itself.

Some of the items identified which should be disclosed:

- (1) what is guaranteed versus what is not;

- (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

- (3) disclosure of the guaranteed surrender values on a flexible premium policy.

1988 Proc. II 566.

3. Universal Life and Related Plans of Life Insurance and Annuities

There is considerable interest in these types of life insurance and annuities, and a number of new varieties of plans have

recently been developed.

- The wording of the 1980 version of the model Standard Valuation Law and the model Standard Nonforfeiture Law for Life Insurance contemplates that the commissioners of insurance for the states will issue regulations

on these types of life insurance plans. - It is hoped that there can be considerable uniformity in such regulations.

- A model regulation is needed urgently, and it should be drafted some time in 1982 and then possibly adopted by the NAIC later in that year. (p349)

1982-1, NAIC Proceedings

LINDA M. LANKOWSKI: I think any way that we can make illustrations more understandable to the public is certainly going to help us.

- We've seen the problems that have occurred when Senator Howard Metzenbaum (D--OH) was given an illustration with a vanishing premium, and he had absolutely no idea that he had bought a policy <Executive Life> that was not paid up in four years.

- It caused many problems for the industry; it caused many problems because the press got involved, and the press doesn't understand the products as well as it thinks it does.

1995 - PRACTICAL ILLUSTRATIONS AND NONFORFEITURE VALUES, Society of Actuaries - 14p

<Bonk: Connect with:

- Legal Case - Video - 15-16740 Kamies Elhouty v. Lincoln Benefit Life Company - Judge: there used to be cases...>

- I'd like to stress that agents don't pretend to know the answers.

- It is our intent to ask for your <actuaries> help because we're currently living with problems that lack solutions.

-- Robert Nelson, chairperson of the National Association of Life Underwriters (NALU) Task Force on Illustrations

1993 - Sales Illustrations - We Can't Live With Them, But We Can't Live Without Them!, Society of Actuaries - 20p

Actuaries can do lots of things.

- We can provide the field with a clear description of the policy and how it works.

-- Bruce E. Booker (a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustrations

1993 - Sales Illustrations - We Can't Live With Them, But We Can't Live Without Them!, Society of Actuaries - 20p

B. Lack of accountability of any of the parties to the sale-applicant agent and company.

- In the current marketplace involving life insurance sales, there is virtually no accountability for any participants in the sale.

- Some insurance companies indicate that they are aware that the illustrations they provide are manipulated by agents, but that they have no way to control these practices.

- Many agents do not appear to understand the illustrations or the assumptions underlying the illustrations provided by the insurance company.

- In some cases, it has been reported that portions of illustrations have not been explained, or even presented, to the applicant.

- Many applicants do not understand the nature of the information in the illustration or how to make use of this information.

- When actual performance under the policy is less than that illustrated, they believe they have been misled.

1993-1, NAIC Position Paper - White Paper on Illustrations - Life Insurance Disclosure Model Regulation - 443 (4)

- Guideline G6 - ILLUSTRATIONS - Canada

- “Primary scenario” means a scenario for values or features of a policy that is based on assumptions about factors affecting the values or features that the insurer judges as reasonable. This includes but is not limited to interest rates. (p1)

- The interest rate(s) in the primary scenario should generally reflect reasonable assumptions as to the long-term performance of the market to which the interest rate is linked. (p4)

- One of these scenarios, the primary scenario, should be drawn from an identified range of scenarios that the insurer judges as reasonable. (p5)

- The general basis and the key assumptions for each scenario should be outlined in the illustration. (p5)

- The process of identifying a range of scenarios should be done at least annually. If the new identified range differs from the previous one, the new basis should be implemented within a reasonable period of time, i.e., 90 days