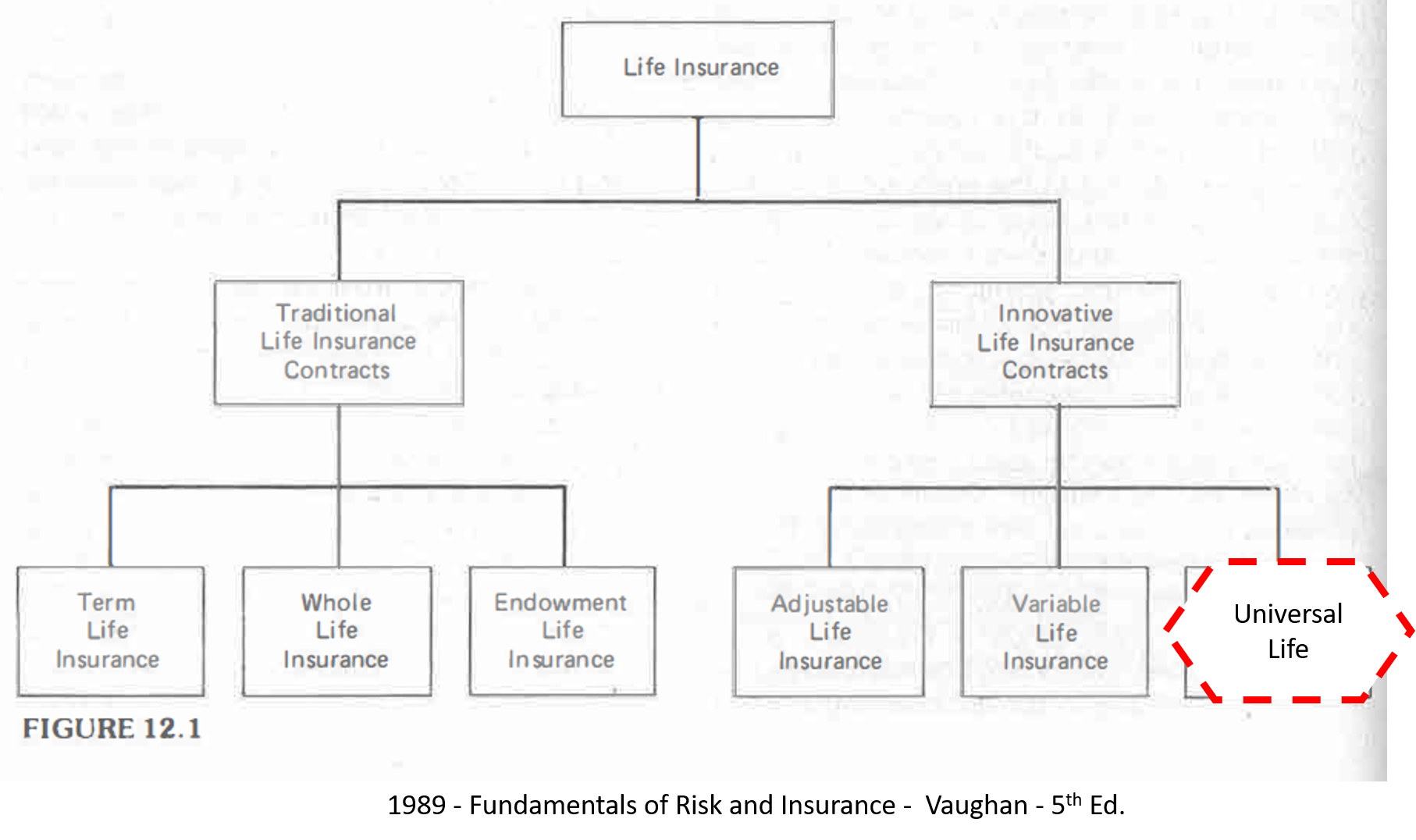

Q: How Can Universal Life be Classified? Permanent / Whole / Cash Value / Term / Other

Why is Universal Life called Permanent or Whole Life?

Maybe Universal Life Shouldn't be Called Permanent or Whole Life

How Else Could Universal Life Be Explained?

NAIC

- Drafting Note: Although highly flexible, Universal Life insurance is generally considered a permanent life insurance plan.

- Most companies encourage a premium level which will provide lifetime insurance protection.

- Every Universal Life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection.

- As a result, it is expected that most Universal Life insurance policies will be sold as permanent plans.

Consumer Representative / Academic

- Comment [BJC2]: Permanent insurance is a term used only by the industry – not by consumer educators.

- We would prefer – Life insurance comes in two basic types: Term and whole life (also referred to as permanent insurance).

-- Brenda Cude

No Date, Assuming approximately 11/15/2017 - NAIC - LIBG - Life Insurance Buyer’s Guide (A) Working Group Conference Call

ACTUARIAL

- Adjustable Policy

- The old distinction between term and permanent is usually not appropriate for an adjustable life policy.

- ⇒ In every sense an adjustable life policy should be a permanent policy regardless of what the current static plan may be.

- Its flexibility means that it can be the only policy a person ever owns even if the initial version corresponds to a ten-year term plan.

- It seems better to look at it in terms of what it can adjust to in the future rather than to concentrate on whatever plan today's premium/face amount relationship requires for defining values and dividends.

- The emphasis should be on the basic permanent result that flows from the adjustability.

- It is necessary that those with experience in individual life insurance adjust their thinking to adjustable life.

- Traditional attitudes and approaches are not always appropriate. (p282)

-- Charles E. Rohm

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, Walter L. Chapin - 50p

- The Model Regulation specifies that the expense allowance shall be that for level premium, level death benefit endowment insurance at the maturity date.

- The rationale for choosing a "whole life" expense allowance of this sort was thought out carefully.

- It was felt that most of these plans were sold as a substitute for traditional forms of permanent insurance.

- In addition, the expenses incurred in putting one of these policies on the books is comparable to plans where the whole life expense allowance is permitted.

- Any expense allowance smaller than that for whole life would leave universal life plans at an unfair disadvantage in comparison to traditional plans of insurance.

-- Shane Chalke

1984 - SOA - NAIC Update, Society of Actuaries - 24p

- Universal Life

- Unlike adjustable life, where a current plan is defined, but is subject to change, a universal life policy at any time has only a "minimum" and a "maximum' plan....

- The adoption in 1983 of the Model Regulation for Universal Life provided recognition that these policies could be configured as whole life policies. (p622)

- (p612-) - Attachment One-B, To: Members of The Society of Actuaries, Date: October 1988 - Re: (SOA) Task Force On Nonforfeiture Principles Interim Report-Tentative Conclusions

1989-1, NAIC Proceedings

INDUSTRY

- This approach treats flexible life as a continuous level premium, level death benefit whole life policy.

- This is the type of program that most people think about when life insurance is discussed.

- Second, this approach emphasizes that the payments made by the applicant are the premiums --not the expense loads or monthly mortality charges.

-- William T. Tozer

1981 - SOA - Individual Life Insurance Cost Disclosure Issues, Society of Actuaries - 22p

ACADEMIC

- Persons seeking life insurance for their entire lives have several choices: they may

- (1) buy a one-year renewable term contract and renew it annually, paying the full insurance cost for each year. (p37)

1987 - Textbook - Life Insurance: Theory and Practice, Mehr and Gustavson

GOVERNMENT

- There are two main types of life insurance policies:

- Whole (or universal) life insurance policies are considered permanent.

- As long as you pay the premium, the policy is in effect. (p32)

Consumer Action Handbook, published by USAGov, part of the U.S. General Services Administration’s (GSA) Office of Citizen Services and Innovative Technologies - 152p

- Life insurance is available in two basic types:

- term and

- permanent (which includes whole life, universal life, variable life, and variable universal life). 205

- Permanent (cash value) life insurance pays the beneficiary whenever the insured dies, as long as premiums have been paid. (p38)

2016 11 - FIO (Federal Insurance Office) - Report on Protection of Insurance Consumers and Access to Insurance - 58p

Life insurance is available in two basic types: term and permanent (which includes whole life, universal life, variable life, and variable universal life). 205 - ACLI

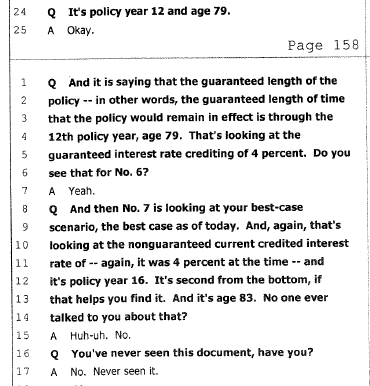

Legal Case

- Universal life is considered "permanent insurance" in the industry.

- For example, a governmental website for seniors, maintained by the Social Security Administration, has the following definition

- "Permanent Insurance -- including whole, ordinary, universal, adjustable and variable life -- is protection that can be kept in force for as long as you live"8

2003 - LC - Rebuttal Report of Mr. Affleck by Donna R Claire re: William L. Fay, et. al. v. Aetna Life Insurance and Annuity Company et. al.

- 21. Aetna does not dispute this paragraph, but adds that Plaintiffs never asked what the term "permanent insurance" means.

2003 - LC - Fay v Aetna - Document 65 - Defendant Aetna Life Insurance And Annuity Company's Response To Plaintiffs' Separate Statement of Additional Undisputed Material Facts - Filed 06/02/03 Page 6 of 32 - Case 1:01-cv-10846-RGS

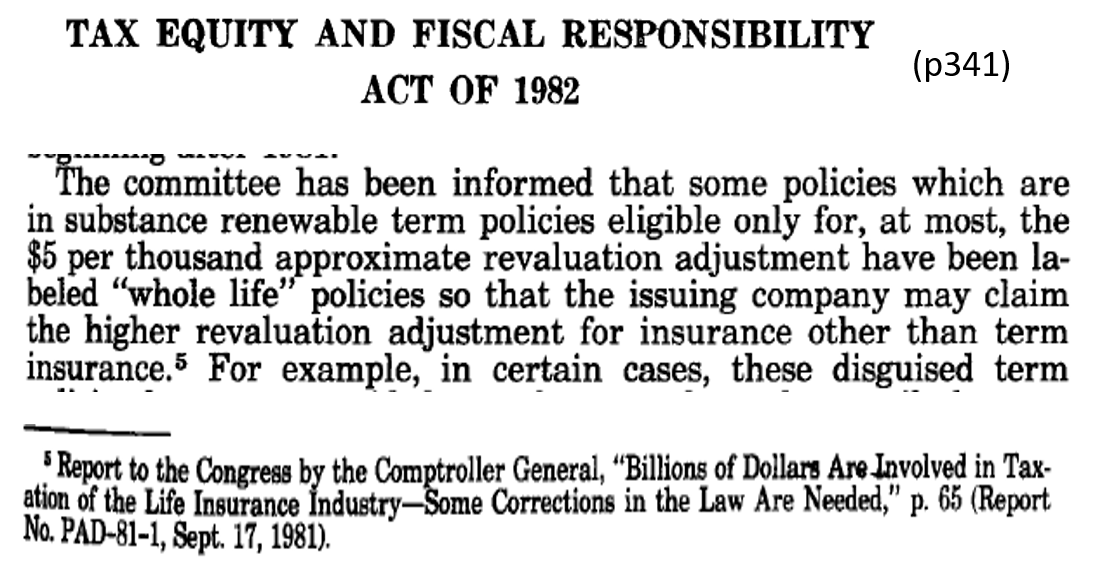

IRS (Internal Revenue Service)

- The 818(c) election is another issue that is being looked at by the Service. In the Hutton ruling, the Service specifically took a caveat indicating that they were saying nothing with respect to this issue.

- One question that was discussed briefly was what was the plan of insurance?

- How do you know whether you have a permanent policy that qualifies for $21 per thousand, or a term policy that qualifies for $5, or perhaps some that qualifies for nothing.

- That is an unanswered question."

-- William B. Harman, Jr.

1981 - SOA - Universal Life, (RSA81V7N412), Moderator: Samuel H. Turner, Ben H. Mitchell, Society of Actuaries - 16p

NAIC

- Universal Life Insurance Model Regulation (#585):

- The letter “r” is equal to one, unless the policy is a flexible premium policy (Universal Life) and the policy value is less than the guaranteed maturity fund, in which case “r” is the ratio of the policy value to the guaranteed maturity fund.

- John Montgomery (California) commented on the flexible premium Universal Life policy and the fact that it is not really a whole life policy, but a term policy until the premium is actually paid.

1988-2, NAIC Proc.

ACTUARIAL

- In essence, the model regulation assumes that at issue, all universal life policies are permanent plans.

- [Bonk: model regulation = Universal Life Model Regulation]

- The r-ratio is meant to measure the extent to which the policy is "on track" as a permanent plan.

2018 - Book - Statutory Valuation of Individual Life and Annuity Contracts | 5th Edition, by Donna Claire, Lombardi and Summers

- Chalke and Davlin point out that a policy (Universal Life) that provides whole life benefits assuming 10 percent interest is not a whole life plan if the guaranteed cash value is only 4 percent.

- Such a plan is term insurance only for a period of years.

-- Thomas G. Kabele

1983 - SOA - Universal Life Valuation and Nonforfeiture: Generalized Model, Shane A. Chalke and Michael F. Davlin, Society of Actuaries - 72p

- Unlike adjustable life, where a current plan is defined, but is subject to change, a universal life policy at any time has only a "minimum" and a "maximum' plan....

- The adoption in 1983 of the Model Regulation for Universal Life provided recognition that these policies could be configured as whole life policies.

-- (p612-) - Attachment One-B, SOA - Task Force On Nonforfeiture Principles Interim Report-Tentative Conclusions

1989-1 (p662), NAIC Proceedings

- (p299) - Whole life policies provide a guaranteed set of future cash values and death benefits for a specified premium. In other words, the terms are fixed and guaranteed….."

- (p300) - Universal life insurance contracts have "terms that are not fixed and guaranteed," (page 300)

2018 - Book -Statutory Valuation of Individual Life and Annuity Contracts | 5th Edition -- Donna Claire, Lombardi and Summers

- In the last two years a new product has surfaced - combining the buy term and invest the rest into one product which is tax sheltered from the buyers point of view.

- This product is the so-called "Universal Life."

-- Stanley B. Tulin

1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

- Jesse M. SCHWARTZ: Why are people so reluctant to call Total Life permanent insurance?

- [Bonk: Total Life = Universal Life Insurance]

- Myron H. MARGOLIN: Universal Life type products are, I suppose, permanent.

- It is a semantic question whether they are permanent life or not, but clearly they are not the traditional cash value products as we have known....

1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

- Daniel J. McCarthy:

- A regulator had told them that in that case they should not treat their Universal Life as though it was a Whole Life policy matured by paying the GMP (Guaranteed Maturity Premium).

- Rather, you should assume that people will pay the guideline level premium, and that will give you a policy that provides guaranteed coverage for something less than the whole of life. What were the implications of that?

- Craig R. Raymond:

- I guess I don’t disagree with anything you said.

- The model regulation (Universal Life Model Regulation) has a structure that says you must go back to this level premium format.

- You’re caught into this box where you’ve got a product that, when you go back to that format, it’s an iteration of the product that can’t exist.

1999 - SOA - 1999 Valuation Actuary Symposium, (va99-44of), Edward L. Robbins, Society of Actuaries - 28p

- He said many consumers cannot distinguish between universal life and whole life.

- He said a narrative explanation was needed because many did not understand the numbers or the fact that a universal life policy might drain the cash value until there was no coverage left.

-- Mr. Barkacs, Western Southern

1994-3, NAIC Proceedings

ACADEMIC

- A few companies have introduced a product known as Universal or Total Life.

- The concept involves...the company withdraws an amount sufficient to pay the premiums for an annual renewable term coverage for the amount selected for the for the current policy year.

- [Bonk: This passage was in Chapter 5 titled "Term Insurance," p70]

1982 - Book - Life Insurance - Huebner and Black

GOVERNMENT

- A Universal Life policy with a large insurance component can become a close substitute for renewable term insurance...

1984 - DOTT - The Taxation of Income Flowing through Life Insurance Companies, U.S. Treasury Department - 80p

- (p196) - Overwhelming numbers of Life Insurance buyers do not even understand which, if any, elements of their sales illustrations are guaranteed.

- For instance, as we demonstrated in our hearing, an Alexander Hamilton illustration did not make it clear that there was no guaranteed death benefit after 12 years.

-- Senator Howard Metzenbaum (D-OH), letter to the NAIC

1993 0525 - GOV (Senate) - When Will Policyholders Be Given The Truth About Life Insurance?, Howard Metzenbaum (D-OH) --- [BonkNote]

Legal Case

- Universal Life Is Permanent lnsurance

- Mr. Affleck states that using the term "permanent" is "deceptive" with regard to universal life insurance.

- [Bonk: Mr. Affleck = Plaintiff Expert Witness

- Mr. Affleck states that using the term "permanent" is "deceptive" with regard to universal life insurance.

- Universal life is considered "permanent insurance" in the industry.

- For example, a governmental website for seniors, maintained by the Social Security Administration, has the following definition...

- ..."Permanent Insurance -- including whole, ordinary, universal, adjustable and variable life -- is protection that can be kept in force for as long as you live."8

- For example, a governmental website for seniors, maintained by the Social Security Administration, has the following definition...

2003 - LC - Fay v Aetna - Rebuttal of Mr. Affleck's Report, by Donna R. Claire

NAIC

- "Completely Flexible" - "The completely flexible life insurance plans are sometimes called "Universal Life insurance plans."

1980-2, NAIC Proceedings

ACTUARIAL

- "Dynamic Products" are products with premiums and benefits that can fluctuate from month to month.....

- "Some common names for dynamic products include Universal Life.... " (p288)

2000 - Book - Life Insurance Products and Finance, D.B. Atkinson and J.W. Dallas

- The product was sold as permanent coverage.

- Policyholders could, of course, develop many different benefit patterns depending on their level of contributions. (p323)

2018 - Book - Statutory Valuation of Individual Life and Annuity Contracts | 5th Edition -- Donna Claire, Lombardi and Summers

- Because of the high level of flexibility provided in a "Universal Life" style Adjustable Life product....

-- David R. Carpenter

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- Broken down to its simplest basis, Universal Life has eliminated the concept of "plan of insurance".....

-- Christian J. DesRochers

1983 - SOA - Universal Life (RSA83V9N212), Society of Actuaries - 24p

- Universal Life is a ratebook and more, all by itself.

- If you say you have Universal Life, you in fact have more of a product than you probably have in your current portfolio at the present time.

-- Thomas F. Eason

1983 - SOA - Individual Life Insurance, Society of Actuaries - 22p

- ...product that I devised in 1962 called Universal Life.

- Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication....

- .....Universal Life was developed in 1962 as a generic plan, which means that it subsumes all other life insurance products.

1987 - The Search for New Forms of Life, by George R. (G.R.) Dinney, Actuarial Science - Actuarial Science: Advances in the Statistical Sciences

INDUSTRY

- ...completely Dynamic services and policy opportunities for their customers to purchase and to elect a variety of options.

- [Bonk: Not in NAIC Proceedings]

-- Michael Lovendusky, ACLI

2019 1109 - NAIC - LIIIWG, Life Insurance Illustration Conference Call

- ...life insurance contracts such as universal life..... same risk-shifting attributes as their more traditional predecessors.

- They merely afford purchasers greater flexibility in designing their contracts so as to meet their individual needs."

ACLI - Statement of the American Council of Life Insurance Before the NASAA NAIC Joint Regulatory Insurance - 10p

1982-1, NAIC Proceedings

- In fact, it is accurate to describe Universal Life as a generalized version of the actuarial formulas underlying traditional life insurance products.

- In other words, it is possible to produce any traditional plan of insurance from the generalized formulas underlying universal life. (p448)

-- Alan Richards, president and chief executive officer of E. F. Hutton Life Insurance Co.

1983 0510, 0511 and 0728 - GOV (House) - Tax Treatment of Life Insurance, Pete Stark (D-CA) --- [BonkNote]

ACADEMIC

- In fact, a UL policy will turn out to provide term life insurance, whole life insurance, or endowment insurance, depending on the premiums paid and other policy factors.

- [Bonk: UL = Universal Life Insurance]

2015 - Book - Life Insurance, Black Jr., Skipper, Black III, (Huebner Series)

- .... UL has always been a simple question of Duration.

201x - AP - Universal Life Insurance Duration Measures, Lange - 14p

- VIDEO: Exam MLC Problem 297 "Learning Objective "Universal Life."

- UW- Madison / SOA

- Question: Calculate the Level Annual Premium that results in an account value of 0 at the end of the 20th year."

- <Bonk: Goal: use a Universal Life policy to design a 20-year term policy.>

INNOVATIVE LIFE INSURANCE CONTRACTS

GOVERNMENT

DICTIONARY

- Universal

- `3b: comprehensively broad and versatile

- 4b: denoting every member of a class

- https://www.merriam-webster.com/dictionary/universal