Premium Calculation

- PVFB=PVFP

- Ratebook

- Plan of Insurance

- When it offers a plan of insurance for a specified premium it does so on the basis of an expected level of mortality, interest, withdrawal, expense and taxation in the future.

- It also recognizes that the future experience levels will vary from those expected at issue through statistical variability or through long term or cyclical trends and sets its premiums to make allowances for this variability.

- As the experience under the plan unfolds the company can release into earnings the differences between the provisions in the premiums for variability and actual variations experienced to date.

- The instrument for accomplishing this is the reserve and, specifically, the release from risk reserve system is based on this concept.

1974 - SOA - Report of the Historian - Special Report, Society of Actuaries - 116p

- One thing to keep in mind is that you can take a traditional whole life policy and determine an underlying benefit generating function, because the cash values are simply there.

- You can fix one item and say, "We are charging 1980 CSO mortality and 6% interest," and then solve for the effective nonforfeiture net premium.

-- Douglas DOLL

1989 - SOA - Status Report on Standard Nonforfeiture Law Revisions, Society of Actuaries - 14p

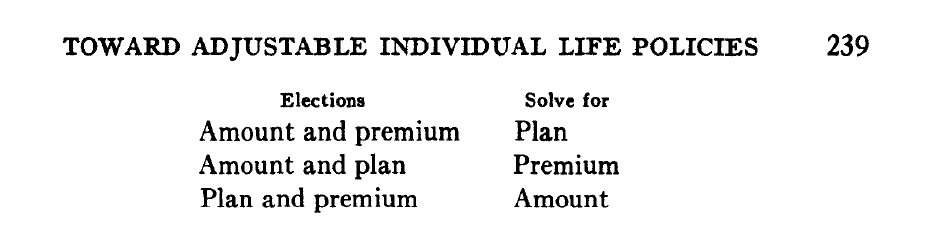

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, by Walter L. Chapin - 50p

- [Bonk - Grading, Interest Rate, PVFB=PVFP, Mortality - Term higher than Perm]

- Samuel P. Adams: All these methods are based one way or another on the ancient truth that the present value of benefits, expenses, and margins must equal the present value of premiums.

- When one considers the interest assumption, it must be remembered that rates are presently very high but may be showing signs of leveling off.

- It seems inconceivable in view of the past that interest rates will stay at their present levels for a long period of time.

- If the interest assumption in the early policy years is taken as the rate on new investments, the actuary should allow for the possibility of a reduction after the first few policy years and provide for a more conservative rate at the later policy durations.

- When one considers the interest assumption, it must be remembered that rates are presently very high but may be showing signs of leveling off.

- CHAIRMAN Robert W. WALKER: We also recognize the difference between term and permanent mortality with a higher mortality charge on term contracts.

- RUSSELL E. MUNRO: We also develop our rate structure so as to reimburse our agency force on a basis which does not place the agent in an awkward position in his recommendations for his client cost per $1,000 at risk.

1968 - SOA - Premiums and Dividends for Individual Ordinary Insurance, Society of Actuaries - 30p

- 1987 - SOA - Life Insurance Transformations, Society of Actuaries, by Douglas A. Eckley - 22p