Project - NAIC - Snippets - 2018

- 2018 0103 - NAIC - LIBGWG, Life Insurance Buyer's Guide Working Group - Letter - AAA / Academy of Actuaries - NGEWG Re: Comments on for the “CEJ Expanded Outline” Exposure Draft - Ian Trepanier, the Academy’s life policy analyst Gabe Schiminovich

- ... we would encourage you to go ahead and include specific mention of NGEs.

- The following are just a few of the concepts related to NGEs that consumers often do not understand:

- What are NGEs?

- What are the advantage and disadvantages of NGEs?

- What types of products usually have NGEs?

- Are there limits to when and how much the NGEs can change?

- How do I monitor changes to my policy’s NGEs?

- 2018 0205 - NAIC - LIBWG, Life Insurance Buyer’s Guide, Conference Call

- ⇒ Laura Hanson, Academy of Actuaries, suggested leaving out details if the information is something the consumer will undoubtedly find out and focus on information that could be missed.

- Ms. Kitt and Ms. Cude said they are concerned with eliminating information on the basis that the consumer will find out eventually.

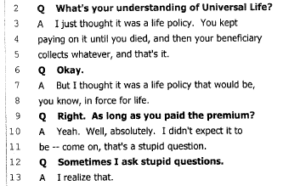

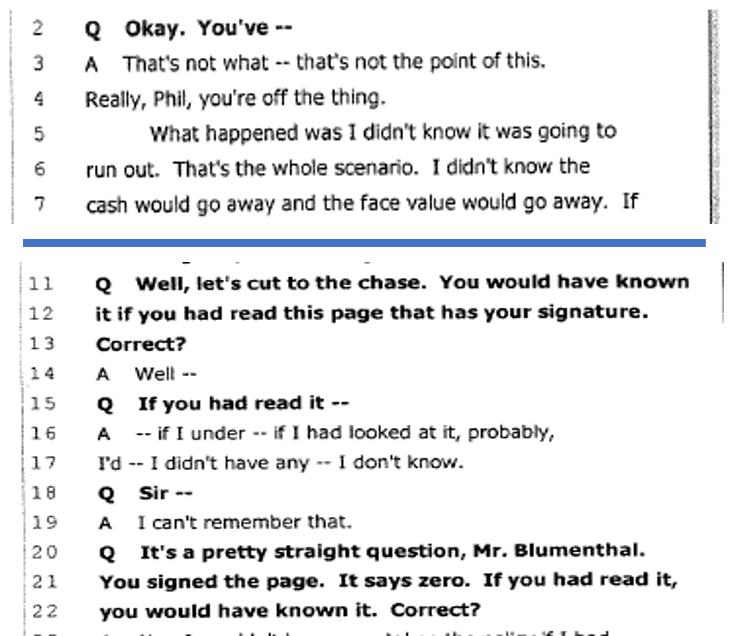

- [Bonk: 2010 - LC - Blumenthal v. New York Life

- Phillip E. Stano, Defense Attorney for New York Life:

- ⇒ Laura Hanson, Academy of Actuaries, suggested leaving out details if the information is something the consumer will undoubtedly find out and focus on information that could be missed.

⇒ Blumenthal v New York Life - Blumenthal Deposition

- 2018 0213 - NAIC - LIIIWG, Life Insurance Illustrations Working Group, Conference Call

- Richard Wicka (Chair - WI) said the focus of the next call will be to work through the outstanding issues list and add universal life data elements to the term and whole life data elements that have been added to Model #582 and Model #580.

- Once revisions to the models are drafted, the Working Group Will move back to working on the template.

- Richard Wicka (Chair - WI) said the focus of the next call will be to work through the outstanding issues list and add universal life data elements to the term and whole life data elements that have been added to Model #582 and Model #580.

- 2018 0222 - NAIC - LIBGWG, Life Insurance Buyer's Guide Working Group - Letter - Brenda Cude / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18,

-

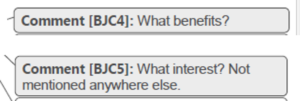

How much do the benefits build up in the policy?

How will the timing of money paid and received affect interest?

- 2018 0226 - NAIC, LIBGWG, Life Insurance Illustrations Working Group - Letter - Birney Birnbaum (CEJ)

- In paragraph 5, the advice is to be sure you can afford the premiums.

- This seems like a logical spot to indicate,...caution to consumers about complex insurance products that promise to pay the premium through investment earning or the recent problems with universal life policies.

- Given that majority of life insurance products are investment-type products of which the death benefit is one, sometimes small feature, this advice seems inadequate to prepare a consumer for the plethora of insurance products.

- 2018 0312 - NAIC Proceedings - LIBGWG, Life Insurance Buyer's Guide Working Group - Conference Call NAIC Proceedings

- The Working Group discussed language suggested by the ACLI defining the different kinds of life insurance policies for inclusion in the section titled, “Compare Different Kinds of Life Insurance.”

- Laura Hanson (Academy) expressed concern that, in the effort to provide a brief overview, the definitions are not wholly accurate.

- 2018 0319 - NAIC Proceedings - LIBGWG, Life Insurance Buyer's Guide Working Group - Conference Call NAIC Proceedings

- The Working Group discussed some language that was hard to understand referring to premiums and benefits.

- The Working Group agreed to include "premiums or values vary from year."

- 2018 0319 - NAIC Proceedings - LIBGWG, Life Insurance Buyer's Guide Working Group - Conference Call NAIC Proceedings

- 4. Compare the Different Kinds of Insurance Policies NS Note: Comment [NS(2]: Another key difference is UL is interest rate sensitive. Suggest adding that as it is an important distinction. - -- DRAFT 3-19-18 (based on 3-12-18 and 3-19-18 conference calls)

- [Bonk: Who is NS?]

- 2018 0319 - NAIC Proceedings - LIBGWG, Life Insurance Buyer's Guide Working Group - Conference Call NAIC Proceedings

- 2018 03 - Brenda Cude and Karrol Kitt edits DRAFT 3-19-18 (based on 3-12-18 and 3-19-18 conference calls)

- A key difference between the two is how you pay for the coverage. (Deleted BC)

- 2018 03 - Brenda Cude and Karrol Kitt edits DRAFT 3-19-18 (based on 3-12-18 and 3-19-18 conference calls)

- 2018 03 (No Date) - Teresa Winer (GA) - comments on Kitt’s and Cude’s document: “Suggested wording from 9 Additional…”

- There are other sources of information, such as Consumer Reports magazine, many articles and websites, such as Wikipedia’s page on life insurance, which can better adapt to future product changes.

- As products become more flexible, such as offering new LTC riders, and the lines between categories of insurance become more and more blurred, a longer buyer’s guide is more likely to become obsolete more quickly than a short one.

- Cost explanations are covered well by Consumer Reports, periodically (and others), thus it would be better to suggest that independent sources exist for buyers to review costs. (Note “Permanent life insurance” is the term used by Wikipedia on life insurance page for non-term insurance.)

- 2018 0314 - NAIC Proceedings - LIIIWG, Life Insurance Illustrations Working Group

- 1. Discussed Additional Data Elements for Universal Life Policies Risk Classes UL - Description of Premium, premium pattern,

- Ms. Micale said the ACLI is concerned with data element B(1)(b)(3) "A short statement describing if the premium varies after the first year, and, If so, how premium will be determined." Mr. Foster said the concern is this description could easily get wordy, and If this language is too a summary of the approved contract language, it could be confusing to the consumer and lead to litigation.

- If the consumer has the policy and the summary, which both contain this Information, is it necessary to repeat this information a third time?

- Mr. Birnbaum said this document is not intended to repeat information found in the policy or summary, it is intended to be resource that is short and a simple way to compare policies.

-

Ms. Micale said the ACLI is concerned with the data elements in B(1)(d)(2) "conversion options, if any'; B(1)(d)(3) "option to extend the if any"; B(1)(d)(4) "any available optional riders, if any, and their cost"; and "option to lower benefits to reduce if any" She said the ACLI said it would be burdensome to list all this information Mr. Wicka said he is envisioning 'Yes or no" answers With a reference to the policy for details.

Ms. Micale asked what information was envisioned in data element "a description of cost of insurance fees needed to keep the policy in force and how it changes over time"

- Mr. Wicka said he wanted to flag the Issue of cost of insurance for consumers since it can be a more complicated element of a universal life policy. He said he was envisioning more of an explanation rather than the actual fees.

Ms. Micale said she is concerned that companies would be concerned with revealing trade secrets if they were required to disclose the cost of insurance schedule.

Mr. Wicka said the intention was to keep it simple. He said it was drafted with term policies in mind, but could be revisited in the universal life context, where premium structures can be more complex.

- Mr. Birnbaum said consumers should be able to see clearly the fees they will be charged, whether they are policy fees, investment fees or cost of insurance fees, with the starting amounts and whether that amount may change.

- 2018 0404 - Letter - AAA to NAIC LIBGWG, Life Insurance Buyer's Guide Working Group - Letter - Academy of Actuaries - NGE WG Re: Comments on the “3-19-18 Draft Buyer’s Guide” exposure draft for the Life Insurance Buyers Guide

- Section #4: We recommend clarifying, in the “Variable policies vs Non-Variable policies” paragraph, that “risk of loss” means risk of lower cash value or the need to pay additional premiums to keep the coverage inforce.

- Section #10: We believe adding a question that prompts a review of nonguaranteed elements would be beneficial for the consumer, such as “Have the premiums or benefits changed since my policy was issued?”

- 2018 0404 - Letter - ACLI to NAIC LIBGWG - Comments on the “3-19-18 Draft Buyer’s Guide” exposure draft for the Life Insurance Buyers Guide, Binder 4 p209

- Keep in mind that you may be able to make <ACLI Added> changes to <ACLI Added> your current policy to get the benefits or amount of coverage <ACLI Added> you want.

- and your cash value will reflect the premium pattern you choose to pay. <ACLI - Deleted>

- For non-variable universal life policies, the insurance company credits interest subject to a minimum guarantee.

- These policies may earn fixed interest (which is based on a declared interest rate) and/or indexed interest (which is based, at least in part, on changes in one or more market indices).

- For non-variable whole life policies, the insurance company guarantees a minimum cash value and may pay dividends that could increase your actual cash value.

- Premium Payments changed to Premium - Deleted: the premium payments required Deleted: will you still be able to afford it? Deleted: Does your policy have a cash

- The insurance company can provide policy statements and illustrations to assist with this review. <ACLI Deleted>

- Keep in mind that you may be able to make <ACLI Added> changes to <ACLI Added> your current policy to get the benefits or amount of coverage <ACLI Added> you want.

- 2018 0408 - NAIC - LIBG, Life Insurance Buyer's Guide Working Group Conference Call - Rhode Island

- First, the Rhode Island Department of Insurance (DOI) suggested a statement on universal life policies’ investment performance affecting the premiums paid.

- This suggestion mirrored a comment from the American Academy of Actuaries (Academy).

- The other Academy edits were previously discussed. Subject to any readability edits, the Working Group agreed to add the following sentence: “Premiums you pay are impacted by the performance of your investment fund.”

- First, the Rhode Island Department of Insurance (DOI) suggested a statement on universal life policies’ investment performance affecting the premiums paid.

- 2018-2, NAIC Proceedings - LIIIWG, Life Insurance Illustrations Working Group, Conference Call

- Ms. Micale, ACLI ... said that she envisions the policy overview acting as a kind of 'front porch" document to help consumers better understand the summaries provided under the models, and should follow the order of the summary.

- She said the charge does not Include the development of a comparison tool.

- She said the summaries and the policy overview are delivered at the point of sale and are not shopping tools.

- Birny Birnbaum (CEJ) ....said the purpose section of Model #580 states: "The purpose of this regulation is to require insurers to deliver to purchasers of life insurance information that will improve the buyer's ability to select the most appropriate plan of life insurance for the buyer's needs and improve the buyer's understanding of the basic features of the policy that has been purchased or is under consideration."

- He said this clearly contemplates comparison shopping.

- Ms. Micale, ACLI ... said that she envisions the policy overview acting as a kind of 'front porch" document to help consumers better understand the summaries provided under the models, and should follow the order of the summary.

- 2018 0517 - NAIC (LIBGWG) - Life Insurance Buyer's Guide Working Group - Edited for Readability 5-17-18 Draft 4-9-18 Finalized by Life Insurance Buyer’s Guide (A) Working Group

- Ask what might be the highest premium you'd have to pay to keep your coverage.

- Evaluate the Future of Your Policy

- Does your policy have a cash value?

- In some cash value policies, the values are low in the early years but build later on. In other policies the values build up gradually over the years.

- [Bonk: Assumes the Cash Value always increases.]

- Most term policies have no cash value.

- Ask your insurance agent, financial advisor, or an insurance company representative for an illustration showing future values and benefits.

- 2018 0621 - NAIC - Project History Life Insurance Disclosure Model Regulation (#580) Revised Life Insurance Buyer’s Guide

- 2018 0719 - NAIC - Adopted by Life Insurance and Annuities (A) Committee - Life Insurance Disclosure Model Regulation - Appendix A. Life Insurance Buyer’s Guide

- 2018 1009 - NAIC (LIIIWG), Life Insurance Illustrations Working Group - [Bonk: Not in NAIC Proceedings]

- Goal of Policy Overview

- Birny Birnbaum (CEJ) - Shopping

- ACLI - Not Shopping

- What is a Supplemental Illustration? (Birny Birnbaum, Donna Megregian, Richard Wicka - More Complicated products would need more pages.)

- Birny Birnbaum - Don't want to put Agent in the position of choosing what to disclose and not to disclose.

- Birney Birnbaum - Payments/ Benefits - Mini-Illustration - Guarantees only Illustrations have Tables. (Samples of ACLI)

- Birney Birnbaum - Policy Overview would be tailored for each person.

- Accumulation of Cash Value

- ACLI - YES/NO

- People Agreed with YES/NO

- AAA - Based on G or NGE?

- ACLI - YES/NO

- Policy Overview

- Birny Birnbaum (CEJ) - Policy Overview only applies when the consumer is shopping for the policy.

- Michael Lovendusky, ACLI - Neither model was intended to generate Buying Guides or to relieve consumers of their own individual responsibilities to understand the product that they are spending their hard-earned money to buy after all.

- And what has happened most recently is that.. And indeed in the most recent development …there are examples of companies attempting to develop completely Dynamic services and policies opportunities for their customers to purchase and to elect a variety of options.

- And that the options themselves might be changed over time, dynamically, at the will of the purchaser with perhaps his or her financial advisor.

- And so, one must I think wonder we're actually whistling into the winds of change here by attempting to make these summaries and overviews more static and less dynamic.

- And what has happened most recently is that.. And indeed in the most recent development …there are examples of companies attempting to develop completely Dynamic services and policies opportunities for their customers to purchase and to elect a variety of options.

- Richard Wicka - Policy Overview Currently Connected to Narrative

- Wicka - No Response, so I guess you all agree.

- Goal of Policy Overview

- 2018 1009 - NAIC Conference Call - LIIIWG, Life Insurance Illustrations Working Group - [Bonk: Not in NAIC Proceedings]

- Michael Lovendusky, ACLI - Neither model was intended to generate Buying Guides or to relieve consumers of their own individual responsibilities to understand the product that they are spending their hard-earned money to buy after all.

- …there are examples of companies attempting to develop completely Dynamic services and policies opportunities for their customers to purchase and to elect a variety of options.

- And that the options themselves might be changed over time, dynamically, at the will of the purchaser with perhaps his or her financial advisor.

- And so, one must I think wonder we're actually whistling into the winds of change here by attempting to make these summaries and overviews more static and less dynamic.

- 2018-3, NAIC Proceedings - LIAC, Life Insurance (A) Committee

- 6. Agreed to Discuss Universal Life Policies

- Kim O'Brien (Americans for Asset Protection-AAP) said:

- there is a growing problem with universal life insurance policies that is hitting the elderly particularly hard.

- Due to the low interest rate environment, policies purchased 10 and 20 years ago require additional premiums to stay in force, and the premium hikes are particularly difficult for the elderly to pay.

- Commissioner Ommen (Chair - IA) said:

- he would put the issue on the agenda for a future meeting.

- the issue might be one for the Market Regulation and Consumer Affairs (D) Committee, as well.

- 2018-3, NAIC Proc. - Director Cameron asked whether CIPR developed resources for producers to use that could help explain complex products Mr. Karapiperis said that was not a current focus of CIPR.

- ⇒ bonknote.com/2018-3, NAIC Proceedings/

- 2018 1218, 2019-1, NAIC Proceedings - LIIIWG, Life Insurance Illustrations Issues Working Group (A) - Conference Call and [Bonk: Not in Proceedings]

- [Richard Wicka (Chair-WI) said the Oct. 9, 2018, draft takes a different approach than previous drafts in which a policy overview was a cover page to the policy summary in Model #580 and the narrative summary in the Life Insurance Illustrations Model Regulation (#582).

- Instead, the Oct. 9, 2018, draft revises Model #580 to include a policy overview document that accompanies all life insurance policies, which is to be delivered at the same time as the Life Insurance Buyer’s Guide.

- Mr. Wicka said Model #582 would not be revised.

- The Working Group reviewed comments submitted by Mr. Birnbaum on the Oct. 9, 2018, draft

- [Bonk: These were the only Comments on the Draft]

-

Richard Wicka (Chair - WI) - "In Wisconsin, especially in our financial department, we like to non-disapprove things, so, I'm not wholly against the double-negative." - [Not in NAIC Proceedings]

- Mr. Birnbaum suggested the following definition of “policy overview” instead of the revisions in the Oct. 9, 2018, draft: “Policy overview” means a document describing the basic features of the policy presented in a manner to facilitate the purposes of this model, containing the elements required in Section 5.A. and substantially similar to the model forms in Appendix X.

- Michael Lovendusky [ACLI] suggested using broader language, such as a “document reasonably designed to inform consumers of the basic features of the policy.”

- Mr. Birnbaum explained that he deleted the language, allowing for the delivery of the Buyer’s Guide with the delivery of the policy if there is a free look period because there is no reason in the modern age to allow for the delivery of the Buyer’s Guide after the policy has been purchased. He said it encourages buying and cancelling a policy as a way to learn about the policy.

- Teresa Winer (GA) - asked whether this change would be hard on agents.

- [Bonk: Not in Proceedings] - Teresa Winer (GA) - Without agents on the committee I don’t know.

- [Bonk: Not in Proceedings] - Richard Wicka (Chair - WI): We need to hear from all relevant parties, including agents.

- I would want to have a better understanding of how things work in the marketplace.

- Birny Birnbaum: He said that how the insurer designates the policy is irrelevant.

- Richard Wicka (Chair-WI) - He said that changing the current Buyer’s Guide delivery requirements is beyond the scope of the Working Group’s charge.

- Mr. Birnbaum pointed out that Model #580 includes the defined term “generic name” that is not used in the model.

- Mr. Wicka agreed to remove the term in the next draft.

- [] - Add from OneNote

- [Richard Wicka (Chair-WI) said the Oct. 9, 2018, draft takes a different approach than previous drafts in which a policy overview was a cover page to the policy summary in Model #580 and the narrative summary in the Life Insurance Illustrations Model Regulation (#582).