Project - TimeLine

- 1838 - Book - An Essay on Probabilities, and Their Application to Life Contingencies and Insurance Offices, by Augustus De Morgan

- It is of great importance at the present moment that sound principles on the subject of insurance should be widely and rapidly disseminated.

- Whether they act by producing conviction, or opposition, a step is equally gained: nothing but indifference can prevent the public from becoming well acquainted with all that is essential for it to know on a subject, of which, though some of the details may be complicated, the first principles are singularly plain.

- 1871-1, NAIC Proc.

- Gustavus W. Smith, Kentucky Insurance Commissioner:

- (p128) - My attention was incidentally called to the subject of life insurance some year and a half ago, and when I found upon what a peculiar and very simple theory it is based, I was utterly amazed to think how little the thing was generally understood, and that the insuring public were utterly ignorant of what it was all about.

- The committee of which I am chair man has before it for consideration this peculiar element of life insurance which I refer to, and I think if the members of the committee will closely attend to and study over that matter, they will have different views when they come back of the theory of life insurance from those which they had when they came here.

- While on this subject, I may allude to what I consider the great trouble in life insurance.

- It is, in my opinion, an undoubted fact that educated, intelligent, influential business men of this country, as a class, are utterly ignorant of what this thing is.

- There is no such mystery in this that ordinary business men cannot learn it.

- If we can accomplish that with the people of this country—I do not mean all of them, only its leading, influential men to whom the people generally refer for advice, in reference to finance, law and other questions—I believe the institution is safe.

- You can then conduct your state supervision with some sort of safety.

- On the other hand, until these men do know all there is peculiar under this thing, all the state institutions that can be devised will not be able to hold this giant.

- The men interested in the life insurance business must know something what they are about; then they will be able to attend to their own business. (p128)

- It is, in my opinion, an undoubted fact that educated, intelligent, influential business men of this country, as a class, are utterly ignorant of what this thing is.

- Edwin W. Bryant, Actuary of the New York Insurance Department

- Why, there is not the least mystery in it.

- The only mystery is, how it has managed to live so long on the reputation of having a mystery, which it has not. [Laughter] (p128)

- (p128) - My attention was incidentally called to the subject of life insurance some year and a half ago, and when I found upon what a peculiar and very simple theory it is based, I was utterly amazed to think how little the thing was generally understood, and that the insuring public were utterly ignorant of what it was all about.

- Gustavus W. Smith, Kentucky Insurance Commissioner:

- 1914 - Academic - Conference on Life Insurance and Its Educational Relations, Published by the University of Illinois, Urbana - [PDF- 117p-GooglePlay]

-

No difference how well-intentioned and honest an insurance man's advice may be it may prove very expensive and harmful if not based on accurate knowledge. (p28)

-

-- Isaac Miller Hamilton, President of the Federal Life Insurance Company

-

-

- 1961 - Book - Modern Life Insurance, by Robert I. Mehr

- (p1) - ... in gaining a life insurance education, one problem does present itself... the basic question is where to begin.

- 1967 - SOA - Individual Life and Health Insurance, Society of Actuaries - 62p

- Ardian C. Gill: Computers may make it feasible to produce a highly flexible policy with benefits and premiums that vary with the policyholder's whim.

- Whether it is desirable to do so is another question.

- Ardian C. Gill: Computers may make it feasible to produce a highly flexible policy with benefits and premiums that vary with the policyholder's whim.

- 1971-2, NAIC Proceedings - 1971 0616 - First Report of the Industry Advisory Committee to the NAIC B·S Subcommittee to Review the Model Unfair Trade Practices Act

- 3. The regulator already has the practical power to accomplish on behalf of the consumer what consumer class actions are designed to accomplish.

- This is evident from the testimony of Commissioner Barger in connection with Senate Bill 3201 in August 1970 (1970 NAIC Proceedings pages 135-144) and from Commissioner Durkin's testimony on S. 984, S. 1222 and S. 1378 in April, 1971;

- 4. Insurers will never be able to rely on the decision of the regulator. If policyholders are able to challenge the decision of the Commissioner through the use of the class action, the whole regulatory mechanism will be subverted.

- 5. Consumer class actions will result in "judicial" regulation of the insurance business;

- 3. The regulator already has the practical power to accomplish on behalf of the consumer what consumer class actions are designed to accomplish.

- 1972 - SOA - Life Insurance and the Buyer, by Anna Rappaport, (2023 - The Actuarial Foundation, Emeritus Trustee), Society of Actuaries - 2p-Article

- Until the buyer understands how the product works, attempts to compare price are essentially meaningless.

- 1973 / 1974 - GOV (Senate) - The Life Insurance Industry, Senator Philip Hart (D-MI) - Part 2 of 4 - [PDF-733p-GooglePlay]

- (p1501) - John Durkin (New Hampshire Insurance Commissioner): As a starting point, there is little regulation of the life insurance industry by the States.

- The States do little with respect to life insurance regulations for many reasons, mainly because there are very few problems with complaints over claims.

- Most of the staffs are involved with complaints relating to automobile insurance and health insurance.

- Life insurance is sort of the stepchild of many, if not most, insurance departments.

- (p1501) - John Durkin (New Hampshire Insurance Commissioner): As a starting point, there is little regulation of the life insurance industry by the States.

- 1976 - SOA - Economic Role of Life Insurance, Society of Actuaries - 16p

- Anna Rappaport, (2023 - The Actuarial Foundation, Emeritus Trustee),

- Everybody has been talking a lot about a paper by James Anderson on the so-called universal life insurance policy which was an annuity-term combination.

- So you have to bring the annuity into this.

- [paper = 1975 (originally) - SOA - The Universal Life Insurance Policy, James C.H. Anderson, Society of Actuaries - 10p]

- Anna Rappaport, (2023 - The Actuarial Foundation, Emeritus Trustee),

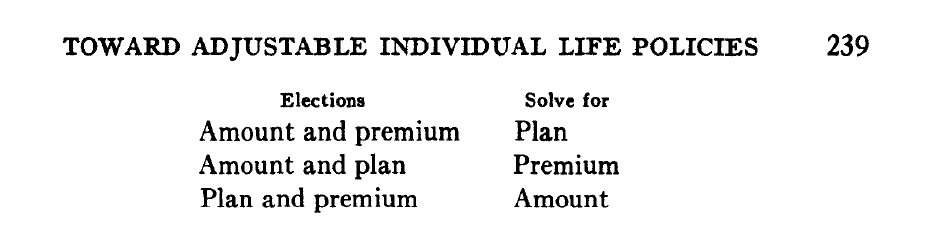

- 1976 - SOA - Toward Adjustable Individual Life Products, by Walter L. Chapin, Society of Actuaries - 50p

- -- Charles E. Rohm, (2023 - The Actuarial Foundation, Emeritus Trustee)

- This leads to the second attitude adjustment that is needed.

- The old distinction between term and permanent is usually not appropriate for an adjustable life policy.

- ⇒ In every sense an adjustable life policy should be a permanent policy regardless of what the current static plan may be.

- This leads to the second attitude adjustment that is needed.

- 1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- Because of the high level of flexibility provided in a "Universal Life" style Adjustable Life product..... -- David R. Carpenter

- 1980 0207 - GOV - Federal Register - re: Class Action Lawsuits, FTC, McCarran-Ferguson Act - p2382

- Class Actions, Fraud, NAIC, States, Unfair

- Statement of John Durkin, Commissioner, State of New Hampshire, Insurance Department, Concord, N.H.; Accompanied By Jon S. Hanson, Executive Secretary, National Association of Insurance Commissioners (NAIC) - Senator John Durkin - (D-NH), (Former New Hampshire Insurance Commissioner)

- I ask unanimous consent, Mr. President, that my testimony in April 1971 before the Consumer Subcommittee of the Commerce Committee be printed in the RECORD at this point.

- While the NAIC has taken no position for or against class action, intense regulation on behalf of the consumer lessens the need for class action.

- Furthermore, the state provides an effective local, readily accessible complaint mechanism available to the consumer which serves as an alternative to class action.

- 1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

- The complications begin with a very simple question: What's the premium for Universal Life? It could be almost anything.Then what's the cash value? That depends on the premium.It is the relationship between the premium and cash value that determines the product characteristics of Universal Life.

- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

- 1981 - SOA - Equity for Existing Policyowners, Society of Actuaries - 24p

- Walter Miller: Arnold suggested that Universal Life stemmed from the desire of many consumers to have a product that unbundles the insurance and investment elements. - [Arnold = Arnold Dicke]

- At New York Life, we get a lot of communications from policyowners but we cannot remember one single request for a product that unbundles the insurance and investment elements.

- I would like to ask how many people here have received requests for such unbundling from the public. (No hands were raised.)

- Walter Miller: Arnold suggested that Universal Life stemmed from the desire of many consumers to have a product that unbundles the insurance and investment elements. - [Arnold = Arnold Dicke]

- 1982 - Journal of Insurance Medicine - 1p

- Samuel H. Turner, President - The Life Insurance Company of Virginia

- Its fundamental "mechanics" are indistinguishable from those underlying traditional life insurance products.

- [Bonk: Its = Universal Life]

- Its fundamental "mechanics" are indistinguishable from those underlying traditional life insurance products.

- Samuel H. Turner, President - The Life Insurance Company of Virginia

- 1982-2, NAIC Proceedings - 1982 0406

- I. Objectives of the New (A) Committee - [Life Insurance (A) Committee]

- a. Simple disclosure form for universal type life products, as well as other simplified cost disclosure methods." (p356)

- I. Objectives of the New (A) Committee - [Life Insurance (A) Committee]

- 1982-1, NAIC Proceedings - ACLI - Paper on Cost Disclosure for Universal Life - p399 - 4p

- An additional item of information that is recommended to be required in the policy summary is the point at which the policy will expire based on the policy guarantees and the anticipated premiums shown in the summary.

- 1982 - SOA - Universal Life (rsa82v8n111), Society of Actuaries - 14p

- Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

- Gary P. Monnin, Senior Vice President, Chief Actuary of American Founders Life Insurance Company

- Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

- 1983 - SOA - Individual Life Insurance Retention and Replacement Strategies, Society of Actuaries - 24p

- Phillip B. Norton, not a member of the Society, is Vice President of The Lincoln National Life Insurance Company

- We designed commission rules that anticipated a relatively large number of rollovers of existing policies;.

- ..full commissions are paid provided the new Universal Life face amount is at least two times the face amount of the replaced policy.

- Phillip B. Norton, not a member of the Society, is Vice President of The Lincoln National Life Insurance Company

-

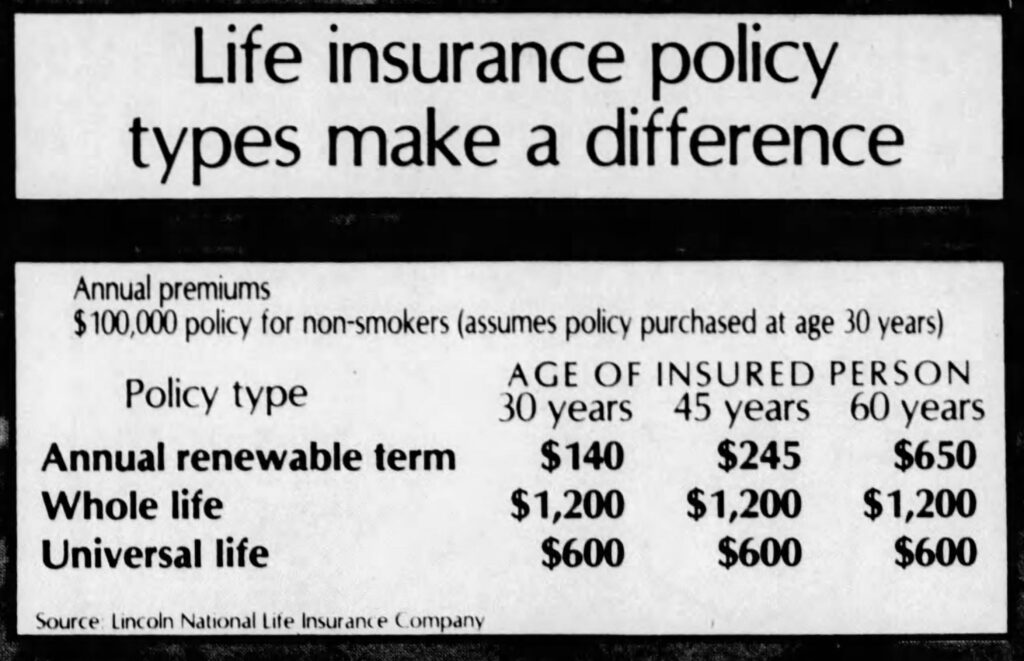

1983 0228 - Lincoln Life - Clarion Ledger

- 1983 - SOA - Universal Life, Society of Actuaries - 24p

- Broken down to its simplest basis, Universal Life has eliminated the concept of "plan of insurance" ... -- Christian J. DesRochers

- 1979 - SOA - Future Trends and Current Developments in Individual Life Products, Society of Actuaries - 24p

- If that is the case, how does an agent program somebody?

- How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65? -- Allan W. Sibitroth

- 1984-2, NAIC Proc. - Report Of The (EX3) Market Conduct Surveillance Task Force Working Group On Consumer Complaint Analysis

- As a member of a regulatory body it is important that you become involved in self-education to increase your professional knowledge and keep current on developments within the ever-changing business of insurance.

- 1985 0719 Impact of Tax Reform on Insurance Industry, Pete Stark (D-CA) --- [BonkNote]

- Robert Beck, Prudential, Chairman and Chief Executive Officer

- RE: Vanishing Premium

- Under some permanent insurance, contracts being sold today, the chances are you could stop paying after 7, 8, or 9 years and the insurance would remain in force for the rest of your life without further premium payments. (p6069)

- [VIDEO-CSPAN] - Impact of Tax Reform on Insurance Industry - (at approx. 2:27:00-2:27:30)

- Robert Beck, Prudential, Chairman and Chief Executive Officer

- 1983 - SOA - Individual Life Insurance Retention and Replacement Strategies, Society of Actuaries - 24p

- Phillip B. Norton, not a member of the Society, is Vice President of The Lincoln National Life Insurance Company

- We designed commission rules that anticipated a relatively large number of rollovers of existing policies;.

- ..full commissions are paid provided the new Universal Life face amount is at least two times the face amount of the replaced policy.

- Phillip B. Norton, not a member of the Society, is Vice President of The Lincoln National Life Insurance Company

- 1986 - SOA - Variable Life/Fixed and Flexible Premium, Society of Actuaries - 38p

- We were very unenthusiastic latecomers to universal life.

- Gilbert W. Fitzhugh, Senior Vice President and Actuary at PRUCO Life, stock subsidiary of the Prudential Insurance Company

- We were very unenthusiastic latecomers to universal life.

- 1987 - Book Chapter - The Search for New Forms of Life, by G. R. Dinney, The Search for New Forms of Life. In: MacNeill, I.B., Umphrey, G.J., Chan, B.S.C., Provost, S.B. (eds) Actuarial Science. The University of Western Ontario Series in Philosophy of Science, vol 39

- George R. Dinney - Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication......

- .......Universal Life was developed in 1962 as a generic plan, which means that it subsumes all other life insurance products.

- George R. Dinney - Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication......

- 1989-1, NAIC Proceedings - Society of Actuaries - Task Force on Nonforfeiture Principles Interim Report-Tentative Conclusions (p612-?)

- Unlike adjustable life, where a current plan is defined, but is subject to change, a universal life policy at any time has only a "minimum" and a "maximum' plan.... (p662)

- 1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form Focus Group Summary, Consumer Issues Disclosure Working Group --- [BonkNote] --- 10p

- A great deal of the confusion seems to stem from a lack of understanding of how cash value insurance products work....

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

- One person was so confused that he said that the maturity age and endowment benefit were moot points, since the policy was going to end at year 31 anyway."

- 1993-3, NAIC Proceedings - 1992 0724 - Letter - NCOIL to State Governors - Re: Full Disclosure/No Misleading Advertising in the Sale of Life Insurance, Attachment Six-A2 - [link-pic]

- To encourage full disclosure and combat misleading advertising in the sale of life insurance, the Executive Committee of NCOIL urges that state insurance departments:

- (1) Require full disclosure of withdrawal charges and actual pure net interest when interest rates are used to advertise and sell life company products;

- (2) Stay alert and keep ongoing records to review insurance companies and agents who have complaints filed against them regarding life insurance replacement;

- (3) Review their existing statutes and regulations and to the extent possible, make companies and agents aware of those existing statutes and regulations with regard to false or misleading advertising in the sale of life insurance policies.

- To encourage full disclosure and combat misleading advertising in the sale of life insurance, the Executive Committee of NCOIL urges that state insurance departments:

- 1993-1, NAIC Proceedings - (EX Special Committee op Metropolitan Life, December 17 1993 - Conference Call - p43

- 1. Discussed the charge of the committee and described the problem as one where agents have been found to be marketing a life insurance product as an annuity/retirement product, particularly targeting consumers from business and professional associations, such as nurses and cosmetologists.

- 1993 0307 - NYT - States Set Fines for Met Life, by Michael Quint - [link]

- The Florida Report - <WishList>

- The improper activities involved sales of life insurance policies to customers who were told by sales agents that they were buying a retirement or savings plan, the report said.

- The Florida Report - <WishList>

- 1993 0525 - GOV (Senate) - When Will Policyholders Be Given The Truth About Life Insurance?, Senator Howard Metzenbaum (D-OH) --- [BonkNote]

- (p4) - Statement of Hon. Charles E. Grassley, A U.S. Senator From The State of Iowa

- I share Senator Metzenbaum's desire to ensure that insurance consumers have a thorough understanding of the obligations and performances that they can expect from a prospective life insurance policy, so that they can make fully informed purchase and investment decisions.

- (p13) - Statement of Gloria Darleen Newberry, Consumer

- The agent said that Universal Life policy premiums would stay the same, but I came to realize that this is not true of our policies.

- ...what bothers me is that I am afraid that this same misleading information may be the basis of my children's and grandchildren's ... planning...

- (p196) - Senator Howard Metzenbaum (D-OH), Letter to the NAIC

- Overwhelming numbers of Life Insurance buyers do not even understand which, if any, elements of their sales illustrations are guaranteed.

- For instance, as we demonstrated in our hearing, an Alexander Hamilton illustration did not make it clear that there was no guaranteed death benefit after 12 years.

- (p4) - Statement of Hon. Charles E. Grassley, A U.S. Senator From The State of Iowa

- 1993-4, NAIC Proceedings - Mr. Higgins agreed that there was a problem with lack of education of the agents.

- 1993-4, NAIC Proceedings - Life Disclosure Working Group – NAIC

- The working group's concern was how to bring about a change without damage to the market place.

- 1993 1030 - NYT - Insurance; Confusion Over Policies Leads to Talk of Change, Leonard Sloane - [link]

- Buyers of life insurance are entitled to descriptions of their policies and how they work.

- After a long period of consumer complaints, Congressional hearings and industry reports on the insurance tables, widely known as illustrations, state regulators are preparing to take action.

- The National Association of Insurance Commissioners intends to adopt by March disclosure guidelines for illustrations that the states can use as a model to create their own laws.

- While acknowledging some abuses in illustrations, insurers and actuaries say buyers often misunderstand what is being presented to them.

- 1993 - SOA - Sales Illustrations - We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries - 28p

- Bruce E. Booker, (a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustrations

- Actuaries can do lots of things.

- We can provide the field with a clear description of the policy and how it works.

- Robert Nelson, Chairperson of the National Association of Life Underwriters (NALU) Task Force on Illustrations - [Currently NAIFA]

- I sincerely believe we have a flawed instrument in today's sales illustrations.

- ...we did not communicate the impact of change as well as ...we should have.

- Our biggest mistake would be to delay.

- I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing.

- Bradley E. Barks

- It is probably true that most of the information needed is already in illustrations but doesn't get to the consumer because of their limited attention span or because of how the information is presented.

- Though it is usually not stated so simply, in the area of llustrations, format not content is the key to improving disclosure.

- Bruce E. Booker, (a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustrations

- 1994 0308 - NYT - Regulators Seek Limits On Insurer Sales Pitches, by Michael Quint - [link]

- cka NAIFA / fka NALU - William N. Albus, senior general counsel for the National Association of Life Underwriters, which represents life insurance sales agents, said illustrations of future benefits "are essential to explaining how a policy works."

- 1994-1, NAIC Proceedings

- Consumers Union

- As the cases of Metropolitan Life and Prudential suggest, no amount of oversight or self-policing will protect consumers from unethical or illegal company and agent practices.

- The structure of the market needs to change.

- Consumers Union

- 1994 0613 - APNews - Life Insurance Buyers Allege Misleading Sales Tactics Were Used With PM-Vanishing, by Mark Dennis - [link]

- 1994 0629 - NYT - Met Life Is Said to Be Facing U.S. Investigation for Fraud, by Michael Quint - [link]

- The inquiry by the United States Attorney's office comes as Met Life has been besieged with lawsuits by former customers contending they were misled, and by former agents who say the company wrongfully terminated their employment.

- In one recent suit, a former agent, Robert M. Slade of Happauge, L.I., said the company's unwillingness to distinguish between the misleading sales practices in the Tampa office and tactics of other agents who sold life insurance as a retirement product had opened the door to groundless complaints.

- 1994-3, NAIC Proceedings - Life Disclosure Working Group – NAIC

- Richard Weber, Merrill Lynch Life ... suggested that the illustration show ... how the policy values are paying the premium.

- Mr. Morgan said that this issue needs specific attention because many complaints were received in the state insurance departments on this issue. (p521)

- 1995-1, NAIC Proceedings

- Fred Nepple (Wis.) asked: if a charge was not rational, did that mean it could not be charged or it could not be illustrated?

- The working group agreed that the result was that it could not be illustrated.

- Fred Nepple (Wis.) asked: if a charge was not rational, did that mean it could not be charged or it could not be illustrated?

- 1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- Linda M. Lankowski:

- I think any way that we can make illustrations more understandable to the public is certainly going to help us.

- We've seen the problems that have occurred when Senator Howard Metzenbaum (D-OH) was given an illustration with a vanishing premium, and he had absolutely no idea that he had bought a policy that was not paid up in four years.

- It caused many problems for the industry; it caused many problems because the press got involved, and the press doesn't understand the products as well as it thinks it does.

- Mark J. Greene, FSA. MAAA, Supervising Actuary, New York State Insurance Department:

- What I noticed was there is a requirement for in-force illustrations, and people may have thought they bought one thing and whenever you have to give them an in-force illustration with a current disciplined scale, they're going to realize they bought something else.

- I think many companies will have serious problems with policyholder retention.

- Linda M. Lankowski:

- 1996 05 - Report of The Multi-state Life Insurance Task Force and Multi-state Market Conduct Examination of The Prudential Insurance Company of America - By the Examiners of The Multi-state Life Insurance Task Force From Several State Departments of Insurance and other State Regulatory Agencies - 270p

- 33 percent of the sales complaints concerned misrepresentation by agents in the course of a sale. (p8)

- Such complaints were not new, but due to recent media attention and other factors, have been received and handled in large numbers. (p12)

- There is ample evidence to suggest that many of the practices at Prudential are, or were, present at other life insurers.

- 1996 - SOA - Nonforfeiture Law Developments, Society of Actuaries - 23p

- Larry Gorski, Illinois Insurance Department - Actuary

- They are complaints about things that we can’t do anything about because the contract might be a universal life type product with nonguaranteed elements, and there is no regulatory framework to deal with those issues.

- Those complaints just fall by the wayside because there is nothing that can be done.

- Larry Gorski, Illinois Insurance Department - Actuary

- 1996 - SOA - The Actuary, The Actuarial Black Box, by Sam Gutterman, Society of Actuaries - 2p

- Sam Gutterman, 1995-96 President of the Society of Actuaries, (2023 - The Actuarial Foundation, Emeritus Trustee)

- All of you have heard of the actuarial black box.

- This is a situation I will define as one in which actuarial analysis has not been adequately explained to its users.

- We can eliminate black boxes by more complete disclosure, more time spent with the user explaining what was done, and with better communication.

- Most actuaries I know can communicate well.

- However, they don't always give communications enough attention as an important part of any project.

- The more a user understands what we do, the more the end product will be valued and trusted, and the more times the actuary will become involved in significant issues.

- I hope that you join me in feeling confident in the value of the actuarial approach to problem-solving.

- If we can boost our users' confidence and trust in us, the better off we will all become.

- All of you have heard of the actuarial black box.

- Sam Gutterman, 1995-96 President of the Society of Actuaries, (2023 - The Actuarial Foundation, Emeritus Trustee)

- 1996-3V2, NAIC Proceedings - 1996 0815 - Report of the Cost Indices Subgroup of the Life Disclosure (A) Working Group

- (p931) - The group first considered a suggestion from Chris Kite (FIPSCO) for a new type of index that would allow consumers to compare the assumptions in the illustration.

- Mr. Kite said his index has the advantage of prompting the prospect to question assumptions used.

- Delmer Borah (MassMutual) suggested that consumers are more concerned about total cost than assumptions.

- Brenda Cude (Cooperative Extension Service) opined that the target audience does not care about assumptions. (p931)

- (p931) - The group first considered a suggestion from Chris Kite (FIPSCO) for a new type of index that would allow consumers to compare the assumptions in the illustration.

- MDL-1061 – Prudential Insurance Company of America Sales Practices Litigation

- 1997 1030 - GOV (Senate) - Class Action Lawsuits: Examining Victim Compensation and Attorneys' Fees, Charles Grassley (R-IA) - [PDF-97p-GooglePlay]

- (p59) - Brian Wolfman, attorney, Public Citizen

- John Hancock Mutual Life Insurance Company

- This is a case brought on behalf of hundreds of thousands of current and former policy holders who were subject to false or deceptive sales practices by John Hancock.

- On behalf of former Senator Howard Metzenbaum, who is a Hancock policyholder and member of the class...

- John Hancock Mutual Life Insurance Company

- (p59) - Brian Wolfman, attorney, Public Citizen

- 1999 - SOA - The Next Generation Universal Life, Society of Actuaries - 30p

- The actual versus expected performance for some Universal Life policies led to class-action lawsuits that have caused a substantial amount of negative attention to be focused on cash-value life insurance in the illustration of projected values. --- Deanne Osgood, Milliman & Robertson

- 1999 - SOA - 1999 Valuation Actuary Symposium, (va99-44of), Society of Actuaries - 28ps

- Daniel J. McCarthy: The other question was much more specific and got at the same point and said that particular company for that particular product was not allowing its customers, in the early years, to pay more than the guideline level premium. A regulator had told them that in that case they should not treat their universal life as though it was a whole life policy matured by paying the GMP. Rather, you should assume that people will pay the guideline level premium, and that will give you a policy that provides guaranteed coverage for something less than the whole of life. What were the implications of that?

- Edward L. Robbins: I’ll talk about the complications. The typical policy that runs into this issue is a policy with a 3% interest guarantee where the guideline level premium requires a 4% interest guarantee. Therefore, under the policy guarantees, and by paying the guideline level premium year by year, the policy will expire at age 68 without value. It’ll be term to 68. Your guideline level premium is less than the premium that would be theoretically required to mature the policy at age 100 or 95. Therein lies the problem.

- Craig R. Raymond: I guess I don’t disagree with anything you said. I guess I see the issue a little differently. I like to separate the 7702 issue from the contractual words. There are very few contracts today sold that do not state contractually that they will maintain compliance with 7702. If the contract didn’t state that, I don’t see any reason why this would be an issue. The fact that the contracts do state that puts this into the same category as some of these secondary guarantee issues where the real problem is the UL model regulation doesn’t fit here. It doesn’t work. The model regulation has a structure that says you must go back to this level premium format. You’re caught into this box where you’ve got a product that, when you go back to that format, it’s an iteration of the product that can’t exist. I’d have to go back and read the regulation to see what the technical answer to the question is. In a lot of ways, it just seems like you must try to get under the intent of this. The intent is, if you’re selling this thing as a level premium permanent product, there should be a way of dealing with that. I really think it’s just again hitting another flaw and another hole in how the UL model regulation applies to the real world today.

- FROM THE FLOOR: That put a whole lot of us in this position where guideline level is going to be less than guaranteed maturity on any recently issued product.

- 2000-1, NAIC Proceedings - March 14, 2000

- (p81) - Thomas Foley said the working group had been charged to make amendments to the Life Insurance Disclosure Model Regulation - (Attachment Three-A) to be consistent with the Life Insurance Illustrations Model Regulation adopted in 1995.

- (p83) - Thomas Foley said that for a variable product, if the 12% illustration is used, it can show a very low premium for coverage.

- If the policy does not attain the 12% return it will not be a permanent policy.

- He opined that consumers are misled if the 12% is not a reasonable amount over time and consumers are in the same position as they were in the 1980s when "vanishing premiums" were touted.

- 2001-1, Suitability Working Group - NAIC

- Ron Panneton (National Association of Insurance and Financial Advisors -- NAIFA) said most of the comments from his association focused on whether the regulation should apply to recommendations and sales or just to recommendations that result in sales.

- He said the company has an obligation to draft guidelines for producers and to make sure they are used.

- The company should have the ultimate responsibility for unsuitable sales because it should look at the applications that come in.

- He urged the working group to consider both sales and recommendations.

- Ron Panneton (National Association of Insurance and Financial Advisors -- NAIFA) said most of the comments from his association focused on whether the regulation should apply to recommendations and sales or just to recommendations that result in sales.

- 2002-2v1, NAIC Proceedings - Mike Velotta (Allstate Life) ... said that the industry is regulated more by class action litigation than state law.

- 2002-2v2, NAIC Proceedings - 2002 0608 - Industry Representatives White Paper on Class Action Lawsuits Preserving The Regulatory Authority of State Insurance Commissioners, Preliminary Draft - p1609-1612

- 2002 0731 - GOV (Senate - Committee on the Judiciary) - Class Action LItigation - [PDF-178p]

- (p55) - ACLI - Patrick Baird

- The life insurance industry has experienced over a decade of abusive class actions.

- In one of the more recent examples of such class action abuses.

- State courts in New Mexico are certifying nationwide classes of plaintiffs for the manner in which their premiums are disclosed in their policies.

- These cases are being certified even though State Commissioners of Insurance reviewed and approved these policy disclosures.

- These class action cases have steadily weakened the very fabric of State regulation of insurance as the State judges' decisions have had national implications for insurers in other states.

- The result of nationwide regulation through targeted class action litigation has indirectly usurped the role and authority of the State Commissioners of Insurance.

- (p55) - ACLI - Patrick Baird

- 2003 - SOA - Do You Know How Much You're Spending? The Hidden Costs of Product Complexity, Society of Actuaries - 19p

- UL is a horror. Who understands UL?

- The home office doesn't.

- The IT department doesn't.

- The owner doesn't.

- Jeff Robinson

- UL is a horror. Who understands UL?

- 2003-2, NAIC Proceedings - ATTACHMENT THREE-A - Outline of White Paper on Class Action Lawsuits

- 2003 - LC - Fay v Aetna - Doc 65 - Defendant Aetna Life Insurance And Annuity Company's Response To Plaintiffs' Separate Statement of Additional Undisputed Material Facts - 01-cv-10846 - 32p

- 20. Aetna does not dispute that Mr. Pflugfelder described the Policies as "permanent insurance."

- He did so correctly, as Plaintiffs concede.

- 21. Aetna does not dispute this paragraph, but adds that Plaintiffs never asked what the term "permanent insurance" means. - Page 6 of 32

- 20. Aetna does not dispute that Mr. Pflugfelder described the Policies as "permanent insurance."

- 2004 0319 - ksl.com - Former Senator Sues Conseco for Alleged Insurance Fraud, Jake Garn (R-UT) - [link]

- A former Utah senator is suing Conseco, claiming insurance fraud.

- Former U-S Senator Jake Garn has filed a class-action lawsuit against Conseco's life insurance division.

- The lawsuit alleges that Conseco Life forced clients to pay dramatically higher premiums on certain universal life policies or surrender them for cash value to bolster its parent company's troubled finances.

- 2005 1117 - GOV (Senate) - A Review of the GAO Report on the Sale of Financial Products to Military Personnel, Hrg. 109-892 --- [BonkNote]

- 2006 0626 - GOV (House) - The McCarran-Ferguson Act: Implications Of Repealing The Insurers' Antitrust Exemption, S. Hrg. 109-557 - [PDF-160p, VIDEO-?]

- , Washington, D.C

- (p23) -J. Robert Hunter, Insurance Director, Consumer Federation of America - I would like to comment on one thing.

- There were huge life insurance market conduct violations with billions of dollars paid by MET Life, Prudential and others a few years ago.

- I do not think there were any criminal charges brought in any of that.

- I really do think that that Chairman Specter’s idea of calling for what has happened in terms of actual numbers of criminal charges is very important information, and I hope the NAIC would help with that as well.

- 2007 - Book - Actuarial Aspects of Individual Life Insurance And Annuity Contracts, Easton and Harris

- (p15) - While many of the original intentions of issuers of universal life was to make clear the exact costs of life insurance by showing and charging exactly the interest, mortality and expenses incurred, most insurers do not observe this at the present time.

- 2007 - IAA (International Actuarial Association) - Measurement of Liabilities for Insurance Contracts: Current Estimates and Risk Margins, IAA ad hoc Risk Margin Working Group - 170p

- (p156) - E6.2.3 - The following are some considerations that can affect expected discontinuance assumptions.

- The way the contracts were sold and marketed (e.g., a universal life contract sold as low premium term insurance or primarily for investment purposes).

- (p156) - E6.2.3 - The following are some considerations that can affect expected discontinuance assumptions.

- 2007 1030 - GOV (House) - Additional Perspectives on the Need for Insurance Regulatory Reform, Paul Kanjorski, (D-PA) - [PDF-180p, VIDEO-Archive.org]

- (p10-11) - Statement of J. Robert Hunter, Director of Insurance, Consumer Federation of America

- There are problems waiting to emerge that will be uncovered by lawsuits, not the regulators, or by the media.

- Consider life insurance market conduct abuses of a decade ago.

- The largest life insurers told people their premiums would disappear, and confused them into believing their life insurance was an investment.

- It took lawsuits to uncover these problems.

- [Bonk: Vanishing Premium, LIRP - Life Insurance as a Retirement Plan]

- (p10-11) - Statement of J. Robert Hunter, Director of Insurance, Consumer Federation of America

- 2010 0410 - NAIC to GOV (Senators - All) - re: NAIC letter to Senators on the Restoring American Financial Stability Act of 2010 (RAFSA) - 4p

- If a study is necessary, we urge the Senate to request the study from an objective body, such as the Government Accountability Office (GAO).

- 2011 0914 - GOV (Senate-Banking/SII) - Emerging Issues in Insurance Regulation, Senator Jack Reed (D-RI) --- [BonkNote]

- Daniel Schwarcz, (Associate Professor, University of Minnesota Law School )

- (p10) - In sum, State insurance regulation has generally failed at a core task of consumer protection regulation—making complex markets comprehensible to consumers and broadly transparent to those who may act on their behalf.

- Why can’t I compare cash value products and have some sense of what is going on in the marketplace?

- (p26) - Because the notion—I mean, it really is a problem, and it is a problem that is under addressed because everyone is so focused on solvency that they forget all these other important regulatory issues.

- (p10) - In sum, State insurance regulation has generally failed at a core task of consumer protection regulation—making complex markets comprehensible to consumers and broadly transparent to those who may act on their behalf.

- Terri Vaughan, (NAIC-CEO / IA)

- (p13) - The first thing I want to say, I agree with Professor Schwarcz that the level of our collaboration in market regulation is behind the level of collaboration in solvency regulation and that is something we have been working on for a number of years, to try to increase the collaboration.

- Mary A. Weiss, Deaver Professor of Risk, Insurance, and Healthcare Management, Temple University

- (p25) - One other comment I might make is that it seems that when Dr. Vaughan and Mr. Schwarcz were talking about consumer affairs, it occurred to me that the conversation that was going on was at two different levels.

- Daniel Schwarcz, (Associate Professor, University of Minnesota Law School )

- 2014-1, NAIC Proc. - Letter - Moore Market Intelligence - Sheryl J. Moore - RE: Actuarial Guideline on Illustrations for Indexed Life Insurance Policies

- It is during this time that I became intimately familiar with the class action lawsuits that plagued nearly all sellers of interest-sensitive life insurance products that were marketed in the 1980's.

- Although equally exposed to "vanishing premium" cases on the whole life side, it is the Universal Life (UL) purchasers that I spoke to most-frequently.

- These were often elderly people, on fixed incomes, and recently uninsurable; individuals who had been shown UL illustrations at then-current rates of 12.00% at the UL policy's point-of-sale, but later had their inforce renewal rates dropped to the minimum guaranteed rates of 4.00%.

- I am certain that all interested parties in this matter can understand the grand disparity between projected and realized outcomes on these policies.

- 2014 0812 - NAIC - IULISG – Indexed Universal Life Illustrations Subgroup

- Letter to LATF - Metropolitan Life Insurance Company, New York Life Insurance Company and Northwestern Mutual Life Insurance Company

- We believe current illustrated rates are much higher than what is reasonably expected over the course of the policy and may lead to consumer disappointment, which could negatively impact the entire industry.

- Letter to LATF - Metropolitan Life Insurance Company, New York Life Insurance Company and Northwestern Mutual Life Insurance Company

- 2016-2, NAIC Proceedings - 2016 0516 - LIIIWG - Life Insurance Illustrations Working Group, Conference Call

- Teresa Winer (GA) asked if it would be useful to ask states whether they have received consumer complaints about the summaries.

- Richard Wicka (Chair - WI) said that it would be helpful to have that kind of information but that he is not sure it would be possible to track down complaints to that level of detail. (6-161)

- 2016 0813 - NYT - Why Some Life Insurance Premiums Are Skyrocketing, by Julie Creswell and Mary Williams Walsh - [link]

- 2017 1106 - NAIC Proceedings - LIBWG - Life Insurance Buyer's Guide Working Group - Conference Call

- AAA - American Academy of Actuaries - "Because NGEs are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

- Brenda Cude (Consumer Representative / University of Georgia) said the issue of NGEs is interesting, but not something the average consumer would understand.

- She did not think it was information that was appropriate for a short guide for first-time purchasers.

- ..... Mary Mealer (Missouri Insurance Department) - also agreed that this was an important topic probably best addressed in the online tool.

- 2018 0319 - NAIC Proceedings - LIBGWG - Life Insurance Buyer's Guide Working Group - Conference Call

- The Working Group discussed some language that was hard to understand referring to premiums and benefits.

- The Working Group agreed to include "premiums or values vary from year."

- 2018-3, NAIC Proc. - LIAC - Life Insurance (A) Committee

- 6. Agreed to Discuss Universal Life Policies

- Kim O'Brien (Americans for Asset Protection-AAP) said:

- there is a growing problem with universal life insurance policies that is hitting the elderly particularly hard.

- Due to the low interest rate environment, policies purchased 10 and 20 years ago require additional premiums to stay in force, and the premium hikes are particularly difficult for the elderly to pay.

- Commissioner Ommen (IA) said:

- he would put the issue on the agenda for a future meeting.

- the issue might be one for the Market Regulation and Consumer Affairs (D) Committee, as well.

- Kim O'Brien (Americans for Asset Protection-AAP) said:

- 2018 0919 - WSJ - Universal Life Insurance, a 1980s Sensation, Has Backfired: A long decline in interest rates caused premiums to soar when they were supposed to stay level, by Leslie Scism - [link]

- 6. Agreed to Discuss Universal Life Policies

- 2019 0903 - NAIC - LIIIWG - Life Insurance Illustrations Working Group, Conference Call - [Bonk: Not in NAIC Proceedings]

- Teresa Winer (GA): I'm guessing that, perhaps, this came out of the fact that Illustrations were not as clear.

- Maybe there's been complaints.

- And the purpose of this entire committee was to provide some kind of summary to make it a little bit more clear.

- Teresa Winer (GA): I'm guessing that, perhaps, this came out of the fact that Illustrations were not as clear.

- 2019 0917 – LIIIWG – NAIC – Life Insurance Illustrations Issues Working Group – Proceedings (Fall, 6-77) – Cost of Insurance

- Birny Birnbaum (CEJ): So, I can admit that I am completely baffled why Industry, which has been sued over this issue would not try to make this much more transparent up front to avoid the problems it is now encountering.

- 2020 12 - NCOIL - 30 Day Materials and Tentative General Schedule, NCOIL Annual Meeting, December 9 - 12, 2020 - 220p

- (p165) - Senator Bob Hackett (R-OH) - stated that one of the problems that the life insurance industry has been experiencing for several years is that when universal life was sold years ago interest rates were so much higher and these policies are really going to blow up much earlier.

- 2020 - IMF - United States - FSAP - Technical Note - Insurance Supervision and Regulation - 1USAEA2020004 - [link-Download-94p]

- In more modern times, insurance products became considerably more complex (e.g., universal life type products with various forms of guarantees, various forms of renewable term, etc.).

- These products arose from a significant rise in interest rates in the early 1980’s and a wave of consumer demand for products better meeting their needs.

- 2022 1224- WSJ - Stock Selloff Hits Life Insurers’ Fastest-Growing Product Indexed universal-life policies grew with low rates and soaring markets, by Leslie Scism - [link]

- The insider joke about indexed universal-life policies is that it takes an actuary, an attorney and maybe even an engineer to understand how the product works.

- Some regulators worry that hypothetical projections of savings growth using these indexes are overly rosy and can lead to unrealistic consumer expectations.

- If a projection proves faulty, a buyer could be stuck with an unaffordable insurance bill.

Legal Cases

- bonknote.com/legal-cases-index/

- 1990s -

- 2000-2009

-

- 2009 - Legal Case - Blumenthal v New York Life --- [BonkNote]

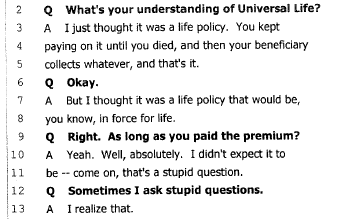

Blumenthal v New York Life - Deposition - Pay Premium

-

- 2010-2020

- 2010 - Legal Case - Maloof v. John Hancock Life Ins. Co. - 60 So. 3d 263 - Alabama Supreme Court Opinion --- 39p --- [BonkNote]

- Walker v Life Insurance Company of the Southwest

- 2014 0425 - DOC 813 - Trial Transcript - Walker v LSW - 224p - [BonkNote]

- Closing Argument by Mr. Martens, Defendant Attorney, Life Insurance Company of the Southwest - LSW

- (p171) - (p170) - Mr. Brosnahan said: Well, the fees can cause policies to lapse. Is that a secret?

- I mean, fees cost something. That's the point of fees. If someone puts money into their policy, there will be fees, as they know, coming out of those policies.

- If you don't put enough premiums into your policy, over time the fees will keep decreasing the value of the policy. That's what fees do.

- That's not a defect in the policy. That's how policies work.

- (p171) - The fact that we charge people fees that we have disclosed and that fees reduce the value of your policy, and if your policy keeps reducing in value, it will lapse, is not a fraud.

- That's common sense.

- That's how life insurance works.

- 2014 0425 - DOC 813 - Trial Transcript - Walker v LSW - 224p - [BonkNote]

- Walker v Life Insurance Company of the Southwest (LSW) - DOC 810 - Trial Transcript - Day 7 - Joyce Walker - 260p

- (p27-30) - Q And did you end up sending the letter to the California Department of Insurance?

A Yes.

Q And did you at any point after the complaint was filed with the Department of Insurance have contact with anyone at the department with respect to your complaint?

A Yes. Christine Wilton.

Q And did you exchange e-mails with Ms. Wilton during the process of her investigation? - (p28) - A Yes.

Q Would you take a look at Exhibit 733. Is that one of the e-mail exchanges you had with Ms. Wilton at the Department of Insurance?

A Yes, it is.

Q And had you had a number of communications with Ms. Wilton prior to the January 21, 2010, e-mail, Exhibit 733?

A Yes.

Q And to your knowledge had Mr. Burgess also spoken with her a number of times?

A Yes.

Q And Ms. Wilton, was she a lawyer with the Department of Insurance?

A Yes, sir.

Q Reading from your e-mail, 733: Thanks again for staying with me on this LSW policy. Sounds like you might have found an omission that just might work in my favor in terms of getting all my money back. The lack of stated reason for an amount percentage of fees taken out every month could be the loophole I need. What did you understand about the omission she may have found with respect to the fees?

A I understood that it had to do with something with the fee structure. - (p29) - Q And what did you mean when you said the omission about fees could be the loophole that you needed?

A Well, like you said, Christine is a lawyer. Her area of expertise is insurance law. She indicated that there was an omission --

MR. SHAPIRO: Objection, Your Honor. Nonresponsive.

THE COURT: Sustained. This part of the answer will be stricken.

BY MR. FREIBERG:

Q What did you understand from what she said?

A I understood that there was a possibility and that I was encouraged that she had found something that I might be able to use against the defense that LSW was saying I signed my contract and I had no other recourse.

Q Did the Department of Insurance ultimately take any action with respect to your complaint?

A No, they did not.

Q Did you receive a letter to that effect?

A Yes, I did.

Q And is Exhibit 668 that letter?

A Yes, it is.

Q And that letter is from Christine Wilton, the lawyer with whom you had been communicating at the Department of Insurance? - (p30) - A Correct.

Q In this letter does Ms. Wilton tell you the following: As a regulatory agency, the Department of Insurance does not have the authority to resolve complaints where the allegations are based upon undocumented conversations. This department may not be your final resource. You may wish to seek the advice of an attorney or pursue the matter in Small Claims Court. I regret the department was unable to assist you. Thank you for contacting us with your concerns. Is that what you received?

A Yes.

Q Did you speak with Ms. Wilton after you received this letter?

A I did.

Q What did she say?

MR. SHAPIRO: Objection, Your Honor. Calls for hearsay.

MR. FREIBERG: Same, Your Honor.

THE COURT: Not for the truth.

THE WITNESS: We had some discussion and ultimately she recommended that I have a forensic analysis done on this policy.

BY MR. FREIBERG:

Q What did you understand a forensic analysis meant?

A That there might be something more to it that she had yet to discover as well.

- (p27-30) - Q And did you end up sending the letter to the California Department of Insurance?

- Vogt v. State Farm

- 2017 - LC - Deposition of Mrs. Vogt v State Farm - 20p

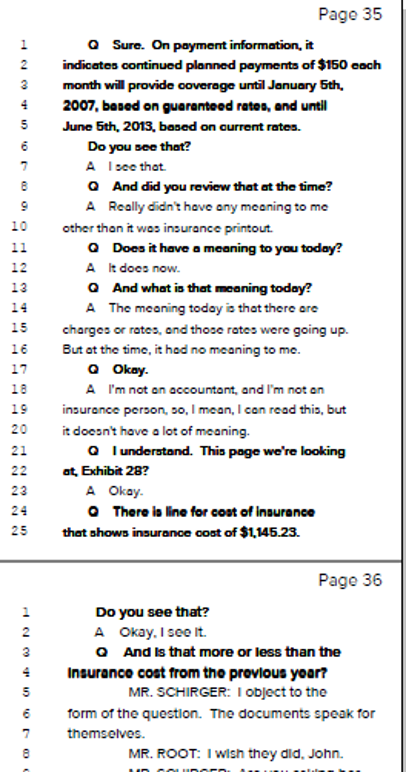

- Vogt v State Farm - Annual Notices 33p

2017Vogt v State Farm Mrs Vogt Deposition - Costs

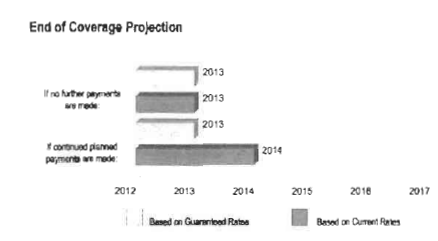

Vogt-End-of-Coverage-Graph