NAIC WGs - Snippets

2013

24. Discussed Inconsistencies in Index-linked Universal Life Policy Illustrations John Bruins (ACLI) discussed the inconsistencies, across a number of companies, in the illustration of index-linked universal life policies.

- He said they would like the Task Force to consider an actuarial guideline or a change to a model regulation to address the matter.

2013-1A, NAIC Proceedings - LIAC, (6-32)

2014

2014-1

- John Bruins (American Council of Life Insurers – ACLI) said there are a wide range of practices in the area of policy illustrations, particularly for indexed universal life (UL) policies.

2014 0114 - NAIC Proceedings LATF CC - RE: IULISG – Indexed Universal Life Illustrations Subgroup

2014-2

We believe current illustrated rates are much higher than what is reasonably expected over the course of the policy and may lead to consumer disappointment, which could negatively impact the entire industry.

-- Metropolitan Life Insurance Company, New York Life Insurance Company and Northwestern Mutual Life Insurance Company

2014 0812 - NAIC - IULISG – Indexed Universal Life Illustrations Subgroup - Letter to LATF

2014-3

- 2014 0918 - NAIC - LATF, Life Actuarial Task Force, Conference Call

- (6-155) - Mr. Ostlund asked if the ACLI has received input from consumers. Mr. Bruins said the ACLI has not received input from consumers. He agreed to check with ACLI member companies to see if they have received any consumer input.

- (p6-155) - Doug Wheeler (New York Life), representing the ACLI member companies that are not in support of the ACLI actuarial guideline proposal, introduced an alternative actuarial guideline for IUL illustrations (Attachment Eight-B). - (p

- (p6-155) - Bobby Samuels (MetLife) said the companies that are not in support of the ACLI proposal are not opposed to the IUL product but are opposed to the current illustration practices.

- He clarified that the IUL product is strictly a general account product that uses general account returns to hedge the index risk within the product.

- He said one of dissenting companies’ concerns is that IUL illustrated rates tend to be double the rates used to illustrate traditional universal life products.

- He said the dissenting companies are also concerned about indexed loans, which can lead to significant leveraging within the policy. <LIRP>

- (p6-155) - Sheryl Moore (Moore Market Intelligence) said she is concerned that some companies are increasing their insurance charges to subsidize their option budget.

- She said she is also concerned that the practice of playing “bait-and-switch” with renewal rates is becoming more common among universal life products.

- It is my recollection and understanding that AG 49 was created in part due to a problem with ‘gamesmanship’ in IUL illustrations.

-- Mike Yanacheck (IA) - Letter

2014 1113 - NAIC - IULISG – Indexed Universal Life Illustrations Subgroup

- Greg Gurlick (Northwestern Mutual Life) said that if consumers are not satisfied with results of their IUL policies, it will not only impact the reputations of the companies selling the products but also the entire industry will be painted with a broad brush.

- He (John Bruins - ACLI) said overall guidance will produce better education for consumers, highlight the nonguaranteed nature and provide consistency for contracts….

- Mr. Ehren (Securian) said it is in the industry’s best interests to provide additional disclosures for IUL illustrations,

- He said that, in the midst of developing the compromise, the question of how to estimate and illustrate the risk premium emerged as a new issue.

- He said that issue should be handled separately from the issue of developing a guideline for IUL illustrations.

- Anthony Ferraro (New York Life) said that one of the goals of the Life Insurance Illustrations Model Regulation (#582) is to make sure that illustrations do not mislead consumers.

- He said a major aspect of consumer protection is the concept of supportability of illustrations.

- He said it is important that supportability is included in the proposed guideline.

- He emphasized that it is important that the accumulated cash flows that the customer sees in the illustration are supportable by the company.

- seven guidelines provided by Mr. Andersen (Attachment Twenty-Seven)

2014 11/14-15, NAIC Proceedings (6-63)

- 2014 11/14-15 - LATF

- 17. Discussed the ACLI and Coalition Group Proposals for an Actuarial Guideline for IUL Illustrations

Mr. Birdsall shared the results of the Kansas Insurance Department survey (Attachment Twenty-Five) on IUL policies - (6-62) - Mr. Schirripa asked if information is available that compares the illustrated rates with the rates actually credited.

- (6-63) - Mr. Birdsall asked if the agent compensation structure for IUL products provide greater incentives for agents than is provided by the compensation structure of traditional universal life (UL) products.

- Mr. Samuelson (MetLife) said that a compensation study he had previously conducted found that, on average, IUL policies have a target premium 80% higher than the average target premium for UL products.

- 17. Discussed the ACLI and Coalition Group Proposals for an Actuarial Guideline for IUL Illustrations

2015

2015-1

2015 0219 - NAIC LATF CC

2. Voted to Expose IUL Illustration AG Proposal

- He <Mr. Andersen> said his goals for developing the guideline were to:

3) have understandable illustrations that foster education of the consumer without misleading; and

4) avoid clamping down on IUL illustrations to a greater extent than has been applied to other product illustrations. - He <American Council of Life Insurers—ACLI> also asked if the guideline would be applicable to inforce illustrations.

- He <Fred Andersen> said the guideline was intended to be applicable to inforce illustrations, but he is willing to have further discussions on that point.

2015 0329 - NAIC Proceedings - LIAC, Life Insurance and Annuities (A) Committee

Appointed a New Working Group to Revise the Life Insurance Buyer’s Guide.

- Ms. Matthews said the Committee has a 2015 charge to review and consider revisions to the Life Insurance Buyer’s Guide (Buyer’s Guide) in conjunction with the Life Insurance Disclosure Model Regulation (#580). She noted that the Buyer’s Guide is woefully outdated.

- 2015 0416 - NAIC - LATF, Life Actuarial Task Force, Conference Call

- 1. Adopted the Proposed Actuarial Guideline for IUL Illustration

- Mr. Andersen (Chair - MN) reviewed a comment (Attachment Eleven-C) from Brian Lessing (AXA) related to a product for which additional charges led to a higher investment return.

- Mr. Andersen ... noted the issue was vetted earlier by regulators and the industry.

- He said it would be nearly impossible to create a standard that would treat different products equally without causing other problems.

2015-2

2015-3

3. (LIAC) Appointed a New Working Group to Address Life Insurance Policy Illustration Issues

- In response, she <Commissioner McPeak> said the Committee received comments from the American Academy of Actuaries (Academy), the American Council of Life Insurers (ACLI), the California Department of Insurance, the Massachusetts Mutual Life Insurance Company (MassMutual) and the NAIC consumer representatives.

- Mr. Schwartzer said that absent specific suggested revisions, he would urge caution in opening Model #582 for revision. He suggested tabling the discussion for now until the Committee receives specific suggested revisions. Ms. Froment expressed support for Mr. Schwartzer’s comments.

- Bruce Ferguson (ACLI) said more than 40 states have adopted Model #582. He noted that, in its comment letter, the ACLI suggests enhancing simplicity and transparency of the narrative summary in Model #582 to reflect the significant changes in the marketplace since Model #582 was adopted 20 years ago, including the demographics of consumers who buy life insurance, the product designs developed to meet the changing needs of consumers and the technology consumers use to obtain information about life insurance products.

- Commissioner Gerhart noted that some of the comments appear to merit some review of Model #582. Director Ramge agreed and made a motion, seconded by Commissioner Gerhart, that the Committee establish a new working group with a 2016 Proposed Charge to explore how the narrative summary required by Section 7B of Model #582 and the policy summary required by Section 5A(2) of the Life Insurance Disclosure Model Regulation (#580) can be enhanced to promote consumer readability and understandability of these life insurance policy summaries, including how they are designed, formatted and accessed by consumers.

- Mr. Regalbuto expressed support for opening Model #582 to look at issues related to AG 49. Mr. Robleto asked if appointing a new working group to look at the narrative summary provision in Model #582 and the policy summary provision in Model #580 addressed the Committee’s commitment to level the playing field among insurers. Commissioner McPeak said addressing that issue is still in progress.

2016

2016-1

2016 0403, LIIIWG CC, NAIC Proceedings (6-8)

- Mr. Schwartzer reminded the Working Group that the Life Insurance Illustration Issues (A) Working Group came out of concerns raised when the Indexed Universal Life (IUL) Illustrations (A) Subgroup under the Life Actuarial (A) Task Force was working on guidance for IUL policy Illustrations that would result in consumers being better able to understand the product performance and interest variability of IUL products.

- During the IUL Illustrations (A) Subgroup’s discussions, interested parties expressed a need to take a broader look at how all products are explained to consumers.

- Mr. Lovendusky said the ACLI work group discussed whether the charge should include revising the Buyer’s Guide, which was a suggested addition to the charge from the American Academy of Actuaries (Academy).

- While the ACLI work group did not oppose including the Buyer’s Guide, some on the work group thought that revisions to the Buyer’s Guide might work instead of revisions to the models.

- However, Ms. Cude pointed out that the Buyer’s Guide has a different purpose from the policy summary and that revisions to one would not take care of the other because the Buyer’s Guide is designed to be educational, while the policy summary is informational and explains a particular policy.

- Michael Lovendusky - ACLI ... said consumers are mostly confused about options, guarantees and riders.

- The ACLI work group was considering asking the Life Insurance and Annuities (A) Committee to narrow the charge to look at only products with options, guarantees and riders, but Ms. Cude said she thinks that it is important to consider how the disclosures for all products could be improved.

- He (ACLI - John Bruins) said the ACLI is concerned about the reaction that may be received from consumers when their policy illustration changes, even though no changes have been made to the product being illustrated.

- He noted that several companies have indicated receiving negative reactions from policyowners when their policy illustration changed.

2016 04 - LATF

3. Discussed a Proposed Amendment to the Charge for the Life Insurance Illustration Issues (A) Working Group

Currently, the Life Insurance Illustration Issues (A) Working Group has a charge to:

- Explore how the narrative summary required by Section 7B of the Life Insurance Illustrations Model Regulation

(#582) and the policy summary under the Life Insurance Disclosure Model Regulation (#580) can be enhanced to

promote consumer readability and understandability of life insurance policy summaries, including how they are

designed, formatted and accessed by consumers.

Commissioner Gerhart explained that the American Academy of Actuaries (Academy) wrote a letter suggesting expansion of

the Working Group’s charge to include a review of the Life Insurance Buyer’s Guide (Buyer’s Guide).

He said the American Council of Life Insurers (ACLI) followed up with a letter stating that it did not oppose the addition, but pointed out that the Committee itself already has an existing charge to revise the Buyer’s Guide, and the addition of this task to the Working Group might slow down its ability to accomplish the current charge.

- Birny Birnbaum (Center for Economic Justice—CEJ) expressed support for updating the Buyer’s Guide generally, but said the charges contemplated for the Working Group serve a different purpose.

- He explained that the Buyer’s Guide is an educational document and the revisions contemplated in the charge to the Working Group focus on plan-specific information.

Mr. Regalbuto said New York is releasing Insurance Regulation 74 focusing on universal life illustration issues and updated

its buyer’s guide with respect to universal life.

- Brenda Cude said the Buyer’s Guide needs a total overhaul, not just a revision.

- She explained that the products in the marketplace have radically changed since the time the Buyer’s Guide was first written.

The Committee agreed that because there is an existing charge to revise the Buyer’s Guide and the focus of the Buyer’s

Guide is different from focus of the Working Group’s charge, the charge should remain as written.

8. Adopted its Working Group and Task Force Reports

a. Life Insurance Illustration Issues (A) Working Group

Mr. Schwartzer reported that the Life Insurance Illustration Issues (A) Working Group met for the first time April 3

(Attachment Two).

The Working Group asked the ACLI for examples of policy summaries and narratives currently in use and plans to begin to look into consumer testing to inform the Working Group as it moves forward.

2016-2

- Mr. Birnbaum suggested that questions for consumer testing could come from the Assurity white paper, such as whether a consumer can reasonably be expected to understand the consequences of varying payment patterns after reading the summary.

- Ms.Winer asked if it would be useful to ask states whether they have received consumer complaints about the summaries.

- Mr. Wicka said that it would be helpful to have that kind of information but that he is not sure it would be possible to track down complaints to that level of detail.

- Mr. Johnson said he agrees with Mr. Birnbaum that the NAIC should determine what the consumer is expected to get out of these summaries and what it wants to achieve from consumer testing.

2016-2, NAIC Proceedings - LIIIWG

2016/5/17 - Life Insurance Illustrations Issues Working Group Conference Call

- 2016 - Assurity Resources - Consumer Issues Associated with Guaranteed Universal Life Policies - NAIC, LIIIWG, Life Insurance Illustrations Working Group - BonkNote - 11p

- .....in particular, the impact consumer payment patterns have on the performance <Coverage Period> of the product.

- Bruce Ferguson (ACLI) said more than 40 states have adopted Model #582. He noted that, in its comment letter, the ACLI suggests enhancing simplicity and transparency of the narrative summary in Model #582 to reflect the significant changes in the marketplace since Model #582 was adopted 20 years ago, including the demographics of consumers who buy life insurance, the product designs developed to meet the changing needs of consumers and the technology consumers use to obtain information about life insurance products.

-

2015-3

- Mr. Wicka said the paper advocates for: 1) additional information to be provided to consumers regarding how the timing of their payments impacts the product; <Coverage Period> and 2) follow-up information to be provided to consumers at the time their payments go off-track so that consumers are aware of the impact to their policies.

- .....in particular, the impact consumer payment patterns have on the performance <Coverage Period> of the product.

- Ad Hoc Group

- If the summaries are able to be shared, Mr. Wicka suggested, and the Working Group agreed,

that a small ad hoc group of the Working Group should be formed to review the summaries

in order to better inform the Working Group’s recommendation to the Committee.

- If the summaries are able to be shared, Mr. Wicka suggested, and the Working Group agreed,

- Michael Lovendusky (ACLI) said the ACLI is supportive of developing the policy overview document, but does not believe that it should be a mandated document.

- He also said the ACLI does not believe that reopening either Model #580 or Model #582 is necessary to include the policy overview document.

- Mr. Lovendusky suggested other alternatives for including it, such as issuing a bulletin.

Mr. Wicka said the Working Group is not in a position at this point to decide whether it is appropriate to open the models, but will consider this issue at the appropriate time.

2016/08/17 - Life Insurance Illustration Issues (A) Working Group

2016/27/16 - Life Insurance and Annuities (A) Committee - Attachment Five

Brenda J. Cude (University of Georgia) commented that there are agents and brokers not doing a good service to consumers and that educating the agents and brokers is important.

Attachment Four-F

Senior Issues (B) Task Force

2016-2, 8/26/16 -ltc

2016-3

- Karrol Kitt (University of Texas at Austin) said that she and Brenda Cude (University of Georgia) suggest that the first thing that should be decided is the purpose of the buyer’s guide and whether it should be paper or electronic.

2016-3, NAIC Proceedings

She (Stegall) said the ad hoc group also discussed tasks to help it achieve its goal, including: 1) gathering background on how the summaries are used and by whom; and 2) reviewing

narrative and policy summary examples for key factors highlighted in the Working Group’s charge, such as readability, understandability, design and format.

Ms. Stegall said the ad hoc group learned that, in most cases, the summaries are not intended as direct-to-consumer pieces and are not meant to help a consumer shop around for coverage; they are delivered at the point of sale.

She also said that, except from some whole life insurance and term life insurance products, the summaries are explained to the consumer by an agent or broker and really serve as a tool for financial advisors in highlighting the features of a product.

Ms. Stegall said that during its July 7 conference call, the ad hoc group reviewed and discussed whole life insurance and term life insurance sample summaries provided by the American Council of Life Insurers (ACLI). She said the ad hoc group specifically discussed the amount of information the samples included and how different that information was from company to company. Ms. Stegall said the ad hoc group decided not to cross-compare the summaries, but focused instead on the idea of developing a one- to two-page policy overview document to accompany the summaries as a means to promote consumer readability and understandability of the policy information, due to the fact that the current summaries are not typically used in the marketplace to assist consumers with shopping for products.

2016/8/17, LIIIWG CC,

bonknote.com/liiiwg-ad-hoc-group/

c. “Cost Information” Category

Mr. Birnbaum disagreed and said including data that

does not apply is confusing.

d. “Policy Information” Category

The Working Group discussed the “policy information” category in the compilation document and the comments received.

The compilation document listed “policy/product type,” “policy name,” “policy form number,” “policy term,” “state of

issue,” “death benefit,” “living benefit,” “guaranteed or non-guaranteed benefit,” “assumed policy effective date” and “policy

may accumulate cash value (Y/N).”

Mr. Wicka suggested that work on the policy overview should start with term life policies before tackling the more complex

whole and universal life products.\

2016/10/20 - LIIIWG CC, 2016-3 NAIC Proceedings

a. Purpose of Policy Overview Document

Birny Birnbaum (Center for Economic

Justice—CEJ) suggested that the policy overview document should be a tool to aid consumers in comparing plans across

companies, but not to choose between types of plans.

Mr. Wicka explained

that he envisions the policy overview as being a high-level document including the basic elements of the plan. He said the

policy overview should enhance consumer understanding, but not replace the buyer’s guide or the details in the illustrations

Ms. Mealer said she agrees with Mr. Wicka’s description of the intended purpose of the policy overview document.

He said that even if this is not included in term policies, the Working Group may want to consider listing elements if they may be in whole life policies or universal life policies, and include “not applicable to this policy.” He suggested the information may be helpful to consumers who are comparing different types of policies from the same company.

Mr. Birnbaum said he understood what Mr. Struck was saying, but that he still preferred tailoring the policy overview document to the policy being described.

Ms. Micale said the ACLI agrees with Mr. Birnbaum on this point.

2016/11/15 - <Birny Birnbaum> said each model currently includes a list of the elements to include in the summaries, which is what has resulted in the Working Group’s current charge to make those documents more understandable.

2017

2017-1

2017/2/7 - LIBGWG Conference Call

- Emily Micale (American Council of Life Insurers—ACLI) said the ACLI has a life insurance buyer’s guide available on the its website titled, “What You Should Know About Buying Life Insurance.” Ms. Micale said the document was developed in 2014 and is being offered by the ACLI as an alternative to revising the NAIC Buyer’s Guide.

- Ms. Mealer agreed that there are aspects of the document that the NAIC can draw from, but that it takes a different approach than what the NAIC typically takes.

- Ms. Neil expressed concern about some of the terminology in the ACLI guide, in particular the use of “cash value” to describe “permanent insurance,” but agreed there is likely some information that could inform the NAIC’s work.

- <What is permanent insurance?

Permanent (cash value) insurance provides lifelong protection as long as premiums are paid.- Excerpt from ACLI “What You Should Know About Buying Life Insurance.”>

- <What is permanent insurance?

- "Gary Sanders (National Association of Insurance and Financial Advisors—NAIFA) agreed that use of the term “cash value” was confusing."

- Brian Fechtel (Breadwinners’ Insurance) ... said consumers do not understand the different types of insurance policies, noting that the guide should explain the different types and their advantages.

- He <Birney Birnbaum> said it is critical to include questions about product features and situations

where consumers may need to pay more.

(LIAC) 4. Received an Update from the Life Insurance Buyer’s Guide (A) Working Group.

Ms. Mealer said the Life Insurance Buyer’s Guide (A) Working Group met via conference call Feb. 7. She said the Working

Group, interested insurance regulators and interested parties were asked to submit feedback on the audience, structure,

content and format of revisions to the buyer’s guide.

2017/3/27, LIBGWG

He <Mr. Lovendusky - ACLI> suggested that the Working Group consider two things: 1) relieving insurers of the obligation of providing a Buyer’s Guide by creating an NAIC website to which all consumers could be directed....

2017-2

2017/5/19, LIAC

Michael Lovendusky (American Council of Life Insurers—ACLI) agreed with exploring having the NAIC as the destination for information on more sophisticated products.

2017/7/19, LIBGWG - Letter from Brenda Cude and Karroll Kitt

With that in mind, we started by making a list of basic information about life insurance that first-time buyers probably don’t know.

- We based this not only on Brenda and Karrol’s years of experience teaching college students (who probably know as little as anyone about life insurance) but also on a search of the Internet.

- We didn’t find any scholarly research on the topic but did find references to a number of industry sponsored surveys.

- Brenda made the list that follows.

Director Ommen said the Buyer’s Guide should be short and tailored to address more typical issues and could include a reference to other resources to get additional information.

2017-2, Attachment One-A, Life Insurance and Annuities (A) Committee, 8/7/17

2017-3

2017/9/14, LIIIWG CC

He <Richard Wicka> explained that state insurance departments do not give advice and should not be a place where consumers call with questions about how a specific policy works.

2017/10/15 or 19 - LIBWG - Letter from the Non-Guaranteed Elements Work Group of the American Academy of Actuaries

We believe consumers would benefit from the inclusion of a discussion of NGEs in the buyer’s guide, and think the following points would be helpful:

- Products with NGEs have the risk that costs could increase or benefits could decrease, subject to guaranteed limits stated in the policy.

- Illustrations, if available during the purchasing process, can be useful tools to help consumers understand a range of possible product performance outcomes. <Coverage Periods - Benefits>

American Academy of Actuaries - "Because NGEs <Non-Guaranteed Elements> are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

Brenda Cude - Consumer Rep. / Professor -

|

No Date LIBG

|

Comment [BJC2]: Permanent insurance is a term used only by the industry – not by consumer educators. We would prefer – Life insurance comes |

2017/11/15 Letter, LIBGWG, ACLI Redlined Draft

Unlike a term policy, which can end after a specified number of years, permanent life insurance will continue to the policy’s maturity age so long as premiums are paid.

- (Note that this isn’t exactly accurate for UL, where policies can continue as long as the cash value is sufficient to pay the policy charges. We may want to make that distinction.) <<< ----ACLI Wording <Bonk>>>>

5. When do I pay for life insurance?

- Most people pay their life insurance in scheduled premiums (annually, quarterly, or monthly).

- You can explore other premium payment

methods with the insurance company or your financial professional.

2017 1115 - Letter - LIBGWG, Life Insurance Buyer's Working Group - AAA / American Academy of Actuaries to NAIC- xp

Universal Life: This type of permanent policy offers some flexibility with premium payments.”

- While it is true these policies offer some flexibility, there are circumstances out of the policyholder’s control, such as decreasing interest credits or increasing policy charges, where additional premium payments may be required to keep the policy in force.

- Universal life also allows for flexibility in policy benefits, not just premium payments.

Mr. Reyna (NY) said the policy overview should help consumers understand how cash value accumulates and can work to their advantage over time.

Mr. Wicka (Chair) acknowledged that the issue is complicated because a lot depends on how the policy is funded; however, just the knowledge that the policy has cash value could be helpful information for a consumer comparing a term policy to a whole life policy.

2017/11/16, LIIIWG CC. , 2017-3

9. Read Your Policy Carefully

Do premiums or benefits vary from year to year? How much do the benefits build up in the policy? What part of the premiums or benefits is not guaranteed? What is the effect of interest on money paid and received at different times on the policy? How will the timing of money paid and received affect interest earned in the policy? These are all questions that you should be able to answer by reading your policy thoroughly. Your agent can help you understand things that are unclear.

2017/12/14 - Academy Letter NGE WG - Gabe Schiminovich

Re: Comments on the “10 Things You Should Know Before Purchasing Life Insurance” Exposure Draft"

Second, ACLI members question the associated costs and practical responsibilities related to development of such an online tool. One such practical consideration is who will be responsible to host, ensure accuracy and maintenance of the online tool. Would the NAIC assume this responsibility and cost?

2017/12/27 - LIBGWG, ACLI Letter, Emily Micale

2018

2018-1

we would encourage you to go ahead and include specific mention of NGEs.

- The following are just a few of the concepts related to NGEs that consumers often do not understand:

- What are NGEs?

- What are the advantage and disadvantages of NGEs?

- What types of products usually have NGEs?

- Are there limits to when and how much the NGEs can change?

- How do I monitor changes to my policy’s NGEs?

2018/1/3 LIBG WG, Academy Letter - NGEWG Re: Comments on for the “CEJ Expanded Outline” Exposure Draft Ian Trepanier, the Academy’s life policy analyst Gabe Schiminovich

Talk to an insurance agent. He or she can help you evaluate your insurance needs and give you information about available policies.[KKA2]

Revised 1-31-18 for discussion on conference call Monday, Feb 5, 2018

Life Insurance Buyer’s Guide (A) Working Group Conference Call

2018/2/5

- <Laura> Hanson <Academy>suggested leaving out details if the information is something the consumer will undoubtedly find out and focus on information that could be missed.

- Ms. Kitt and Ms. Cude said they are concerned with eliminating information on the basis that the consumer will find out eventually.

Mr. Wicka said the focus of the next call will be to work through the outstanding issues list and add universal life data elements to the term and whole life data elements that have been added to Model #582 and Model #580. Once revisions to the models are drafted, the Working Group Will move back to working on the template.

2018/2/13- LIIIWG CC

Section #1: Since there are many sources knowledgeable about insurance, such as insurance agents, company representatives, financial planners, registered investment advisors (RIAs), Certified Public Accountants (CPAs), and attorneys, we recommend referring to individuals knowledgeable about life insurance and providing some examples.

Academy Letter NGE WG Re: Comments on the “Revised Draft 2-9-18” exposure draft for the Life Insurance Buyers Guide Gabe Schiminovich Ian Trepanier

2018-2-22 - LIBGWG

11. Review Your Life Insurance Program Every Few Have your premiums or benefits changed since your policy was issued?

2018/26/18 - ACLI Comments on Draft 2/9/2018- conference call 2-26-18

- In paragraph 5, the advice is to be sure you can afford the premiums. This seems like a logical spot to indicate,...caution to consumers about complex insurance products that promise to pay the premium through investment earning or the recent problems with universal life policies.

- Given that majority of life insurance products are investment-type products of which the death benefit is one, sometimes small feature, this advice seems inadequate to prepare a consumer for the plethora of insurance products.

-- Birny Birnbaum Letter

2018/2/26 - LIBGWG

- The Working Group discussed language suggested by the ACLI defining the different kinds of life insurance policies for inclusion in the section titled, “Compare Different Kinds of Life Insurance.”

- Laura Hanson (Academy) expressed concern that, in the effort to provide a brief overview, the definitions are not wholly accurate.

2018/3/12 - LIBGWG

|

How much do the benefits build up in the policy? How will the timing of money paid and received affect interest? |

|

2018 - LIBGWG - Cude Letter / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18

2018/3/12 <Bonk: descriptions for different types of policies>

4. Compare the Different Kinds of Insurance Policies NS Note: Comment [NS(2]: Another key difference is UL is interest rate sensitive. Suggest adding that as it is an important distinction.

<Bonk: Who is NS?>

-- DRAFT 3-19-18 (based on 3-12-18 and 3-19-18 conference calls)

A key difference between the two is how you pay for the coverage. (Deleted BC)

2018/3 - Brenda Cude and Karrol Kitt edits DRAFT 3-19-18 (based on 3-12-18 and 3-19-18 conference calls)

- 1. Discussed Additional Data Elements for Universal Life Policies Risk Classes UL - Description of Premium, premium pattern,

- Ms. Micale said the ACLI is concerned with data element B(1)(b)(3) "A short statement describing if the premium varies after the first year, and, If so, how premium will be determined." Mr. Foster said the concern is this description could easily get wordy, and If this language is too a summary of the approved contract language, it could be confusing to the consumer and lead to litigation.

- If the consumer has the policy and the summary, which both contain this Information, is it necessary to repeat this information a third time?

- Mr. Wicka said the intention was to keep it simple. He said it was drafted with term policies in mind, but could be revisited in the universal life context, where premium structures can be more complex.

- Mr. Birnbaum said this document is not intended to repeat information found in the policy or summary, it is intended to be resource that is short and a simple way to compare policies.

- Ms. Micale said the ACLI is concerned with the data elements in B(1)(d)(2) "conversion options, if any'; B(1)(d)(3) "option to extend the if any"; B(1)(d)(4) "any available optional riders, if any, and their cost"; and "option to lower benefits to reduce if any" She said the ACLI said it would be burdensome to list all this information Mr. Wicka said he is envisioning 'Yes or no" answers With a reference to the policy for details.

- Ms. Micale asked what information was envisioned in data element "a description of cost of insurance fees needed to keep the policy in force and how it changes over time"

- Mr. Wicka said he wanted to flag the Issue of cost of insurance for consumers since it can be a more complicated element of a universal life policy. He said he was envisioning more of an explanation rather than the actual fees.

- Ms. Micale said she is concerned that companies would be concerned with revealing trade secrets if they were required to disclose the cost of insurance schedule.

- Mr. Birnbaum said consumers should be able to see clearly the fees they will be charged, whether they are policy fees, investment fees or cost of insurance fees, with the starting amounts and whether that amount may change.

2018/3/14 - LIIIWG CC

2018 0319 - (LIBGWG) Life Insurance Buyer's Guide Working Group -Conference Call NAIC Proceedings

- The Working Group discussed some language that was hard to understand referring to premiums and benefits.

- The Working Group agreed to include "premiums or values vary from year."

- The Working Group agreed that language comparing different types of policies should be included in the next draft.

-- Teresa Winer - comments on Kitt’s and Cude’s document: “Suggested wording from 9 Additional…” No Date - appoximately 2018 03 |

- Section #4: We recommend clarifying, in the “Variable policies vs Non-Variable policies” paragraph, that “risk of loss” means risk of lower cash value or the need to pay additional premiums to keep the coverage inforce.

- Section #10: We believe adding a question that prompts a review of nonguaranteed elements would be beneficial for the consumer, such as “Have the premiums or benefits changed since my policy was issued?”

Academy Letter NGE WG Re: Comments on the “3-19-18 Draft Buyer’s Guide” exposure draft for the Life Insurance Buyers Guide

2018/4/4 - LIBGWG

- Keep in mind that you may be able to make <ACLI Added> changes to <ACLI Added> your current policy to get the benefits or amount of coverage <ACLI Added> you want.

- and your cash value will reflect the premium pattern you choose to pay. <ACLI - Deleted>

- For non-variable universal life policies, the insurance company credits interest subject to a minimum guarantee. These policies may earn fixed interest (which is based on a declared interest rate) and/or indexed interest (which is based, at least in part, on changes in one or more market indices). For non-variable whole life policies, the insurance company guarantees a minimum cash value and may pay dividends that could increase your actual cash value.

- Premium Payments changed to Premium - Deleted: the premium payments required Deleted: will you still be able to afford it? Deleted: Does your policy have a cash

- The insurance company can provide policy statements and illustrations to assist with this review. <ACLI Deleted>

ACLI Letter: Comments on the “3-19-18 Draft Buyer’s Guide” exposure draft for the Life Insurance Buyers Guide

- First, the Rhode Island Department of Insurance (DOI) suggested a statement on universal life policies’ investment performance affecting the premiums paid.

- This suggestion mirrored a comment from the American Academy of Actuaries (Academy).

- The other Academy edits were previously discussed. Subject to any readability edits, the Working Group agreed to add the following sentence: “Premiums you pay are impacted by the performance of your investment fund.”

2018

/4/8 - LIBGWG CC

2018-2

- He <Richard Wicka?> explained that the policy overview document Will make the summaries in Model # 580 and Model #582 easier to understand.

- Birny Birnbaum (Center for Economic Justice—CEJ) said the charge clearly talks about enhancing the summaries in Model #580 and Model #582. He said while he does not object to the one- to two-page policy summary, he does not think it fulfills the charge. He said in order to fulfill the charge, the summaries in Model #580 and Model #582 have to be addressed.

- Mr. Wicka suggested that consistent headings are important, but he said he is not convinced that they need to be in the same order.

- Mr. Struk and Ms. Winer said that the information should be in an order that makes sense with the summary it is accompanying.

- Ms. Lerner said that she would like to see a required order of information so that it is easy to compare policies.

- Ms. Cude said having items in a consistent order facilitates comparisons.

- Ms. Micale <ACLI> said that she envisions the policy overview acting as a kind of 'front porch" document to help consumers better understand the summaries provided under the models, and should follow the order of the summary.

- She said the charge does not Include the development of a comparison tool.

- She explained that the charge is to improve the readability and comprehensibility of the summaries, and in order to do that, the policy overview needs to reflect what actually exists.

- She said that imposing a uniform order would not facilitate an apples to apples comparison between products because the products are not all going to be apples.

- She said the summaries and the policy overview are delivered at the point of sale and are not shopping tools.

- Ms. Megregian said that the Academy's comment letter expresses the concern that consumers will mistakenly think that the policy overview provides enough information about a policy to make a purchasing decision when it should really only be referred to hand in hand with the primary policy documents to enhance understanding of those documents.

- Mr. Birnbaum said the purpose section of Model #580 states: "The purpose of this regulation is to require insurers to deliver to purchasers of life insurance information that will improve the buyer's ability to select the most appropriate plan of life insurance for the buyer's needs and improve the buyer's understanding of the basic features of the policy that has been purchased or is under consideration."

- He said this clearly contemplates comparison shopping.

- Risk Class

- Wicka explained that the issue is whether the policy overview should include a description of a consumer's "risk class" and if so, how to describe it. The Working Group discussed whether the risk class should be included in the policy overview, if it is included, should it be listed with a reference to a page or section of the policy or narrative summary for a description, or should an explanation be included in the policy summary.

- `Mr. Struk said he thinks it should be listed With a reference to a more detailed explanation in the policy or summary.

- Ms. Winer said she is concerned that there might be too much Importance placed on the name of the risk class when it is the rate that is important.

- Ms. Megregian asked whether the risk class applied for, or whether it is after underwriting.

- Ms. Micale said the information about risk class would not contain any detail, and she is concerned that consumers might be misled into thinking they are getting a better deal just because one company says it is in the 'best rate class" when a better deal might be available in the "second best rate class" with another company.

- Mr. Bimbaum said the information that consumers are.. the third of seven risk classifications gives them Increased understanding of their risk profile and could prompt them to ask questions about what they may do to Improve their risk profile.

- Working Group agreed that the policy overview should identify the risk class and include cross reference to the place in the policy or narrative summary where risk classifications are explained in more detail.

- Wicka explained that the issue is whether the policy overview should include a description of a consumer's "risk class" and if so, how to describe it. The Working Group discussed whether the risk class should be included in the policy overview, if it is included, should it be listed with a reference to a page or section of the policy or narrative summary for a description, or should an explanation be included in the policy summary.

2018 0501 - Life Insurance Illustrations Working Group (LIIIWG) Conference Call

- Ask what might be the highest premium you'd have to pay to keep your coverage.

- Evaluate the Future of Your Policy

- Does your policy have a cash value?

- In some cash value policies, the values are low in the early years but build later on. In other policies the values build up gradually over the years. <Bonk: Assumes the Cash Value always increases.>

- Most term policies have no cash value.

- Ask your insurance agent, financial advisor, or an insurance company representative for an illustration showing future values and benefits.

Edited for Readability 5-17-18 Draft 4-9-18 Finalized by Life Insurance Buyer’s Guide (A) Working Group,

2018/5/17 - LIBGWG

2018 0621 - NAIC - Project History Life Insurance Disclosure Model Regulation (#580) Revised Life Insurance Buyer’s Guide

- 2018 0719 - NAIC - Adopted by Life Insurance and Annuities (A) Committee - Life Insurance Disclosure Model Regulation - Appendix A. Life Insurance Buyer’s Guide

2018-3

- 2018-3, NAIC Proc. - Director Cameron asked whether CIPR developed resources for producers to use that could help explain complex products Mr. Karapiperis said that was not a current focus of CIPR.

- Goal of Policy Overview

- Birny Birnbaum (CEJ) - Shopping

- ACLI - Not Shopping

- What is a Supplemental Illustration? (Birny Birnbaum, Donna Megregian, Richard Wicka - More Complicated products would need more pages.)

- Birny Birnbaum- Don't want to put Agent in the position of choosing what to disclose and not to disclose.

- Birney Birnbaum - Payments/ Benefits - Mini-Illustration - Guarantees only Illustrations have Tables. (Samples of ACLI)

- Birney Birnbaum - Policy Overview would be tailored for each person.

- Accumulation of Cash Value

- ACLI - YES/NO

- People Agreed with YES/NO

- AAA - Based on G or NGE?

- ACLI - YES/NO

- Birny Birnbaum - Policy Overview only applies when the consumer is shopping for the policy.

- Michael Lovendusky (ACLI) - Whistling into the winds of change. These are Dynamic Contracts.

- Richard Wicka - Policy Overview Currently Connected to Narrative

- Wicka - No Response, so I guess you all agree.

2018 1009 - LIIIWG - <Bonk>

BB: The Policy Overview wouldn't apply except for when the consumer is shopping for the product.

RW: This document is tied to the Narrative Summary

RW: Just applies to the Basic Illustration

2018 1018 - LIIIWG - <Bonk>

6. Agreed to Discuss Universal Life Policies

Kim O'Brien (Americans for Asset Protection-AAP) said:

- there is a growing problem with universal life insurance policies that is hitting the elderly particularly hard.

- Due to the low interest rate environment, policies purchased 10 and 20 years ago require additional premiums to stay in force, and the premium hikes are particularly difficult for the elderly to pay.

Commissioner Ommen said:

- he would put the issue on the agenda for a future meeting.

- the issue might be one for the Market Regulation and Consumer Affairs (D) Committee, as well.

2018-3, NAIC Proc. (LIAC)

- Neither model was intended to generate Buying Guides or to relieve consumers of their own individual responsibilities to understand the product that they are spending their hard-earned money to buy after all.

- …there are examples of companies attempting to develop completely Dynamic services and policies opportunities for their customers to purchase and to elect a variety of options.

- And that the options themselves might be changed over time, dynamically, at the will of the purchaser with perhaps his or her financial advisor.

- And so, one must I think wonder we're actually whistling into the winds of change here by attempting to make these summaries and overviews more static and less dynamic.

-- Michael Lovendusky, ACLI

2018/11/9 - NAIC Conference Call <Bonk>

- 2018 12 - NAIC - LIIIWG, Life Insurance Illustrations Issues Working Group

- Richard Wicka (Chair - WI): How do Agents use these? It would be good to hear from agents.

2019

2019-1

The Working Group agreed that an online format lends itself to being as comprehensive as possible.

3/18/2019 OLIBG CC

2019-2

Mr. Gendron said the Center for Insurance Policy and Research (CIPR) is looking to facilitate communication with academics on consumer issues, from both a risk management perspective and a consumer understanding perspective; it could also inform the disclosures contemplated in Model #245. <p1>6

2019/8/24 - Life Insurance and Annuities, National Meeting - Summer

- 2019 0830 - Life Insurance Illustrations Issues Working Group - CEJ Letter - 12p

- The personalized information in the Policy Overview is the premium for the policy – based on information known to the producer or insurer at the time and subject to change based on additional or revised information – and that information can be provided prior to purchase.

- If an insurer can produce an illustration for a complex, investment type life insurance product prior to the consumer purchase, it is clearly possible for an insurer to provide the premium for a policy prior to purchase.

For anyone following the working group 's efforts, the observer might be surprised at the blatant contradiction and abject hypocrisy shown by Mr. Lovendusky<ACLI> in asking the working group to ignore its charge after routinely taking up the working group's time with diatribes and false accusations against others for recommendations allegedly exceeding the working group's charge.

Yet, now, as the working group is finalizing its work, Mr. Lovendusky shows neither embarrassment nor shame for engaging in precisely the same offensive act of which he has accused others. I

Despite no participation to date in the working group’s efforts over the past four years, NAIFA decides it needs to now weigh in on the important role of agents in the life insurance sales process and that without an agent to interpret these documents for consumers, the consumers will be lost at sea.

Mr. Sanders’s drive-by comments to the working group are based on false assertions and misunderstanding of the working group’s efforts. His comments have no relevance for the current efforts of the working group.

2019-3

- 2019 0903, NAIC - LIIIWG, Life Insurance Illustrations Working Group [Bonk: Not in NAIC Proceedings]

- Michael Lovendusky, ACLI: We stood back and thought, how can we somehow deliver a respectable work product to the A Committee that will in fact meet the charge of this Working Group, which is to Improve the Readability and Understandability of the policies that are discussed in the 2 models of the charge for this working group.

- By aligning to the work of the Online Buyer's Guide Work Group and then the ACLI is willing to participate by advertising the Online Buyer's Guide at an earlier date.

- We might rename the Online Buyer's Guide to the Online Consumer's Guide and get it out to consumers who have not yet bought a policy to help with the basic understanding of the different types of policies and how different features of policies might operate to the consumers interest.

- Richard Wicka (Chair - WI)

- My hope and my goal is this completed by the fall national meeting.

- Should we do something else or continue with the Policy Overview.

- Birny Birnbaum (CEJ)

- 2016, April …. ACLI suggestion re: stop policy overview and put info into Online Buyer's Guide.

- Should be a policy overview for different types…..

- Thinks the product overview templates will be easy once the template for term is completed as well as the model itself.

- Michael Lovendusky, ACLI: We stood back and thought, how can we somehow deliver a respectable work product to the A Committee that will in fact meet the charge of this Working Group, which is to Improve the Readability and Understandability of the policies that are discussed in the 2 models of the charge for this working group.

-

- Mary Mealer (MO): I feel like this is like the Groundhogs Day Movie all over again almost every call. We keep rehashing these issues.

- Teresa Winer (GA)

- ... this came out of the fact that Illustrations were not as clear. And the purpose of this entire committee was to provide some kind of summary to make it a little bit more clear.

- So, I think ... if you can refer to the eventual illustration and just show the cash value.

- 2019 0917, NAIC Proceedings - LIIIWG, Life Insurance Illustrations Issues Working Group, (Fall, 6-77)

- Richard Wicka (Chair - WI): This is probably more for the Universal Life Products, but how do we want to capture the concepts like Cost of Insurance and other fees in this document?

- Teresa Winer (GA) ...said that disclosure is helpful, but only if it is meaningful.

- g. Clarifying “Coverage Period Description"

- Mr. Yanacheak (IA) ... said this is intended to capture how long a policy’s term is—a term of years or for life.

- Mr. Birnbaum said it is intended to answer the question: If I pay my premium, this policy will cover x amount of time.

- Mr. Wicka suggested, and the Working Group agreed, to the following revised language to Section 5A(2)(e)(iii): (iii) Indicate whether it is a term or permanent policy. If it is a term policy, indicate the length of the initial term.

-

- Mr. Birnbaum said there is no need to get too caught up in the details; he said just include enough information that a consumer could compare one policy to another and say, for example: The cost of insurance is between 1% of cash value up to 3% of cash value.

- Mr. Wicka suggested including three elements: 1) cost of insurance charge; 2) net amount at risk; and 3) maximum allowable charge.

- The Working Group agreed to the following revision to Section 5A(2)(d)(vi): (vi) If applicable, A narrative description explanation of the cost of insurance fee, a narrative explanation of the net amount of risk to which the fee will apply, and other fees needed to keep the policy in force and how those fees may change over time the maximum allowable cost of insurance fee allowed under the policy.

- 2019 0917 - NAIC - LIIIWG, Life Insurance Illustrations Working Group, Conference Call - [Bonk: Not in NAIC Proceedings]

- Cost of Insurance / Costs / Premium

- Birney Birnbaum

- <can be done in a fairly transparent way …even easier than what you can do with a Surrender Charge.

- - So, for example, if there's a Cost of Insurance charge, what's the initial "Cost of Insurance Charge" and can it change and are there any limits to what the changes can be.

- That's useful information for a consumer. If I look and see that … here's what the "Cost of Insurance" is, but this fee can go up without limit … that's useful information compared to a product where the "Cost of Insurance" can go up, but it's capped at 2 times the initial charge for example."

- Michael Lovendusky, ACLI

- So, the ACLI recommends that you steer away from Cost of Insurance elements in the Cost Information, other than to acknowledge that there is a Cost of Information

- Cap, basic information might be agreeable.

- Teresa Winer (GA)

- The Cost of Insurance Charge is a rate and that's applied to the Insurance Coverage, which is like a Net Amount At Risk, which varies depending on your Cash Value Amount and how much you've deposited.

- So, you've got a rate, but then it depends on your Cash Value as well.

- It's kind of a circular thing and it gets so complicated because it's being deducted from a Cash Value account, but as your Cash Value grows it gets smaller, even though….. I know Birny was talking about rates going up … and that's important to see.....but....

- The way that it's actually used to get the Cost of Insurance Amount is that they just have to take the rate and then multiply is by something else …and they are not going to know what that is.

- So, that's what I'm saying… it gets so …. It's interesting, but the value of what you are going to be charged is not going to come out of that …. It gets really complicated."

Birney Birnbaum:

- So, if the information that you provide here is the initial cost of insurance, what percent of the cash value and it can increase up to 3% of the cash Value.

- Then that is information that can be used to compare across companies….

- So, the comments that Mr. Lovendusky made were basically contradictory.

- On the one hand, he talked about how complicated this stuff is, but at the end he then said, well, we could give the initial and then what the cap is.

- And that is exactly what CEJ had suggested for this particular provision --- Which is: What am I starting with and what can this thing go up to.

- That is in fact useful information to the consumer.

- And this will not only, not create litigation, because this is what's in the policy form, but it will prevent litigation, because it will be much more transparent to the consumer… what the possibility is that the consumer is facing.

So, I can admit that I am completely baffled why Industry, which has been sued over this issue would not try to make this much more transparent up front to avoid the problems it is now encountering.

2019/9/17, NAIC LIIIWG, <Bonk>

Teresa Winer:

- I feel like a lot of these policies had good intentions and came out of Buy Term and Invest the Difference to compete with that so people wanted more disclosure of all the components.

- What I've found is people just can't, for some reason, put all the components together and get so frustrated.

- In my experience very smart people don't really know what all the components mean. I mean I feel like it does lead to confusion.

- So, I think if you can refer to the eventual illustration and just show the cash value.

Initial Premium - Does the premium change after the first year? If so, how?

BB: How to lower your premiums, join a gym

TW: point them to the illustration / policy

BB: Referring to the policy defeats the purpose of the Policy Overview

- 2019 1115 - NAIC - LIIIWG, Life Insurance Illustrations Working Group - Letter - ACLI to Richard Wicka (Chair) - RE: Revisions Considered for Life Insurance Policy & Narrative Summaries

- The working group charge arose from concerns relating to the illustrations of one product, Indexed Universal Life Insurance;

- 2019 1115, NAIC - IULISG – Indexed Universal Life Illustrations Subgroup, Conference Call - [Bonk: Not in NAIC Proceedings]

- Rachel (Texas): We can see why it would be confusing and difficult to explain… without eroding some confidence on the consumer's part.

- Scott Harrison (Harrison Law) - Representing-?

- First thing that I want to say is that there have been some references to Misleading Illustrations.

- I'm certainly not aware of the Regulators have not found that Illustrations are misleading.

- That seems to be just an allegation that is left hanging in the air, which is inaccurate.

- The Illustration is not misleading.

- The policy is performing according to policy mechanics.

- Gary Sanders, NAIFA

- And that leads to my second concern which is that consumer confusion I think, and we fear, in large part is going to be translated into a lack of confidence or a lack of trust in their advisor.

- And in some way or another, the consumer is going to end up with the feeling that the advisor did some form of misrepresentation initially to the consumer and now the truth is coming out.

- And I think that is a very big concern and not only would it harm the consumer's confidence in the producer, but it could have a lot of reputational damage to producer's as well.

2020

2020-1

- We want you to know that Financial Education is important, but that many other groups are better situated to design deliver and evaluate education than NAIC is.

- We think NAIC's most important role in Retirement Security is to make sure that consumers can safely buy well-designed insurance products in stable insurance markets.

-- Brenda Cude / Karroll Kitt

- Our attitudes, our beliefs... they really come from our life experiences and they point us to different actions...

2020 01-? - NAIC - Retirement Security, Conference Call

John Robinson (Minnesota): I think that there are 2 wildcards that need to be considered....And the other Wild Card is…we're working with the perceptions of someone and what we intend may not be what is exactly going on in their mind. ....I guess, involved the Agent. And the value of the Illustration … is shaped a lot of times by how it's presented by the Agent. And if you provide an Illustration that doesn't provide what the Agent thinks the prospect is looking for … then maybe that Illustration doesn't get put in front of the prospect. ….those are two Big Wild Cards that affect everything we're trying to do here.

2020 0312 - NAIC - IULISG – Indexed Universal Life Illustrations Subgroup, Conference Call – [Bonk: Not in NAIC Proceedings]

- Thanks to Donna Megregian for doing the research.

- American Academy of Actuaries

- A lot of people don't understand why the illustration model regulation is the way it is.

-- Fred Andersen (MN) - (Chair - IULISG – Indexed Universal Life Illustrations Subgroup)

2020 0303 - NAIC Proc. - IULISG – Indexed Universal Life Illustrations Subgroup, Conference Call

2020-2

- 2020 0724 - NAIC - LIIIWG, Life Insurance Illustrations Working Group, Conference Call - [Bonk: Not in NAIC Proceedings]\

- Pat Reeder, ACLI

- Idea of the Informed Consumer

- 3 Broad Recommendations:

- 1) Consumer Testing - Fundamental Question: Will this form enhance the customer experience?

- 2) Enhance the NAIC Electronic Consumer's Guide - NAIC Life Insurance Information - Example: SEC Summary Prospectus

- 3) Have a larger discussion about the disclosure and buying process... backed with data driven studies to understand when consumers need what information in the buying process. Consider the information available at each point in time.

- Deputy Commissioner To said New York would vote “No” on this guideline.

- We acknowledge this is a small step in the right direction but feel it falls short of the standard we should impose to ensure consumers are protected.

- We believe this proposal continues to allow the use of unrealistic and unreasonable crediting rates.

- Illustrations are supposed to show consumers how an insurance product works and is expected to perform in the future.

- We know insurers have used these illustrations to compete with each other and to sell equity indexed life insurance products by using unrealistic growth cash values.

- This misleads consumers.

- This causes consumers harm.

- We feel it is critically important for the NAIC to advocate for more realistic and reasonable credit rates and we don’t believe this proposal achieves that.” (3-6)

2020 Summer- NAIC Proceedings - IULISG – Indexed Universal Life Illustrations Subgroup

2020-3

- 2020 1110 - NAIC - LIAC, Life Insurance and Annuities (A) Committee -Virtual Meeting

- Commissioner Ommen (IA) asked whether Mr. Birnbaum is aware of any consumer testing of illustrations or research that has

already been done that looks at consumer understanding in this area. - Mr. Birnbaum said ..... he is not aware of any consumer testing in this area.

- Commissioner Ommen (IA) asked whether Mr. Birnbaum is aware of any consumer testing of illustrations or research that has

Universal Life

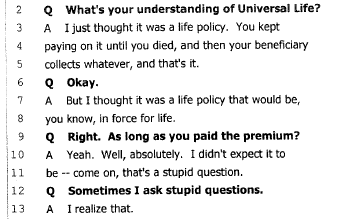

Universal life insurance is more flexible than whole life. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower than the cost of insurance, the difference is taken from the cash value. If the cash value reaches zero, your policy could lapse.

The company will send you a report each year showing your cash value and how long the policy might last. The estimate is based on the cash value amount, the cost of insurance, and other factors. Review it carefully. You might need to pay more in premiums to keep the policy in effect until the maturity date.

New York reports that they have determined that Section 216 and 208, (a) and (b), and perhaps other sections of their law, prohibit the issuance of universal life type products. Their law is currently being amended to permit such policies.

1982-2, NAIC Proceedings

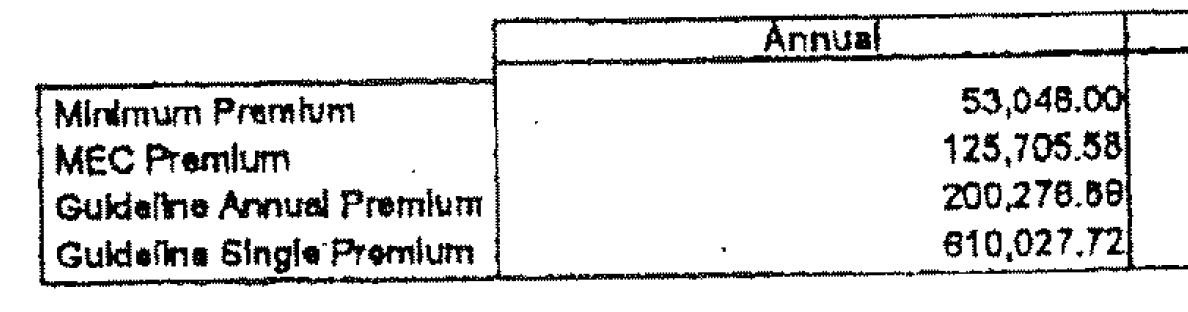

The complications begin with a very simple question:

- What's the premium for Universal Life?

- It could be almost anything.

- Then what's the cash value?

- That depends on the premium.

- It is the relationship between the premium and cash value that determines the product characteristics <Performance / Coverage Period> of Universal Life."

-- BEN H. MITCHELL

1981 - UNIVERSAL LIFE, Society of Actuaries

- Universal Life type products are, I suppose, permanent. It is a semantic question whether they are permanent life or not, but clearly they are not the traditional cash value products as we have known them...

-- Myron H. Margolin

1981 - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

Dale R. Gustafson ...nominees for the hard questions are:

- Are short-term new money investments appropriate for a product designed to meet life-long insurance needs?

- Is it appropriate for buyers, or potential replacers to compare “new money” with “portfolio” sales illustrations without explaining the profound differences between them?

- How will the great continuing planning and service needs of Universal Life policyowners be provided for?

- Who will satisfy these needs and how will they be compensated?

- Does anyone believe that a policyowner can figure it out all by himself, or that an 800 number in the home office will suffice?

1981 - MORE ON UNIVERSAL LIFE, The Actuary, Society of Actuaries

Other policies may have special features which allow flexibility as to premiums and coverage. Some let you choose the death benefit you want and the premium amount you can pay. The kind of insurance and coverage period are determined by these choices.

One kind of flexible premium policy, often called Universal Life, lets you vary your premium payments every year, and even skip a payment if you wish. The premiums you pay less expense charges) go into a policy account that earns interest, and charges for the insurance are deducted from the account. Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

1983-I. NAIC Proc - STATEMENT ON BEHALF OF THE AMERICAN COUNCIL OF LIFE INSURANCE TO THE NAIC (A) COMMITTEE'S

LIFE COST DISCLOSURE TASK FORCE. November 29, 1982

<Bonk: Also Found in NAIC Life Insurance Buyer's Guide editions until the 1996 Proc. 3rd Quarter 9, 40, 907, 918, 931-936 (amended Buyer’s Guide).

"The "unbundling" of services and other product differences between Universal Life and Ordinary Life cause current literature to be inapplicable, as well as insufficient, for Universal Life."

1984, STATEMENT 1984-32, Academy Journal, American Academy of Actuaries (page 217)

"The most obvious is if we fail policyholder expectations, we may have policyholder suits <lawsuits>."

-- LARRY R. ROBINSON (Chairman of the ACLI Subcommittee on Cost Comparisons)

1988 - ACTUARIAL OPINION ON NON-GUARANTEED ELEMENTS, Society of Actuaries

We are seeing a real crisis in confidence:

- That, in my mind, is probably the worst thing that could happen.

- There is not a company in the country that can stand runs that Commissioner Weaver was talking about, where people ask for $1 billion in policy loans and surrenders in a 2-week period. <page 13>

--- William McCartney, William, Director of Insurance, State of Nebraska and Vice President, National Association of Insurance Commissioners

1991 - GOV - REGULATION OF INSURANCE COMPANIES AND THE ROLE OF THE NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS - 286p

Tony Higgins (N.C.) referred the group to a resolution of the National Conference of Insurance Legislators (NCOIL) urging state insurance departments to become aware of disclosure and abuse issues in life insurance solicitation (Attachment Six-A2).

1993-2, NAIC Proceedings

Mr. Wright <Chairman> said the Society of Actuaries report referred to the fact that companies said they had no control over what agents did.

1994-4, NAIC Proceedings

1996-1

-

The working group next reviewed Appendix D to the Life Insurance Disclosure Model Regulation, which contained policy information for a universal life policy or indeterminate premium policy.

-

The working group agreed that, since most of this information was directly based on non-guaranteed elements, it would be appropriate to delete the entire appendix.

They are complaints about things that we can’t do anything about because the contract might be a Universal Life type product with Nonguaranteed Elements, and there is no regulatory framework to deal with those issues.

Those complaints just fall by the wayside because there is nothing that can be done.

-- Mr. Gorski <Regulator>

1996 - Nonforfeiture Law Development, Society of Actuaries - 23p

1997 - What Does it Mean to be a Consumer Representative? - Brenda Cude - 3p

"In 1994 I was selected as a funded held. In these meetings, groups work consumer representative to the on specific charges they have identified National Association of Insurance or that have been assigned to them by Commissioners (NAIC)."

"In reality, much of what NAIC consumer representatives do to

represent consumers is to educate regulators."

"If regulators learn about issues only by listening to the industry, their knowledge is unquestionably biased."

A third problem is of great concern to me...

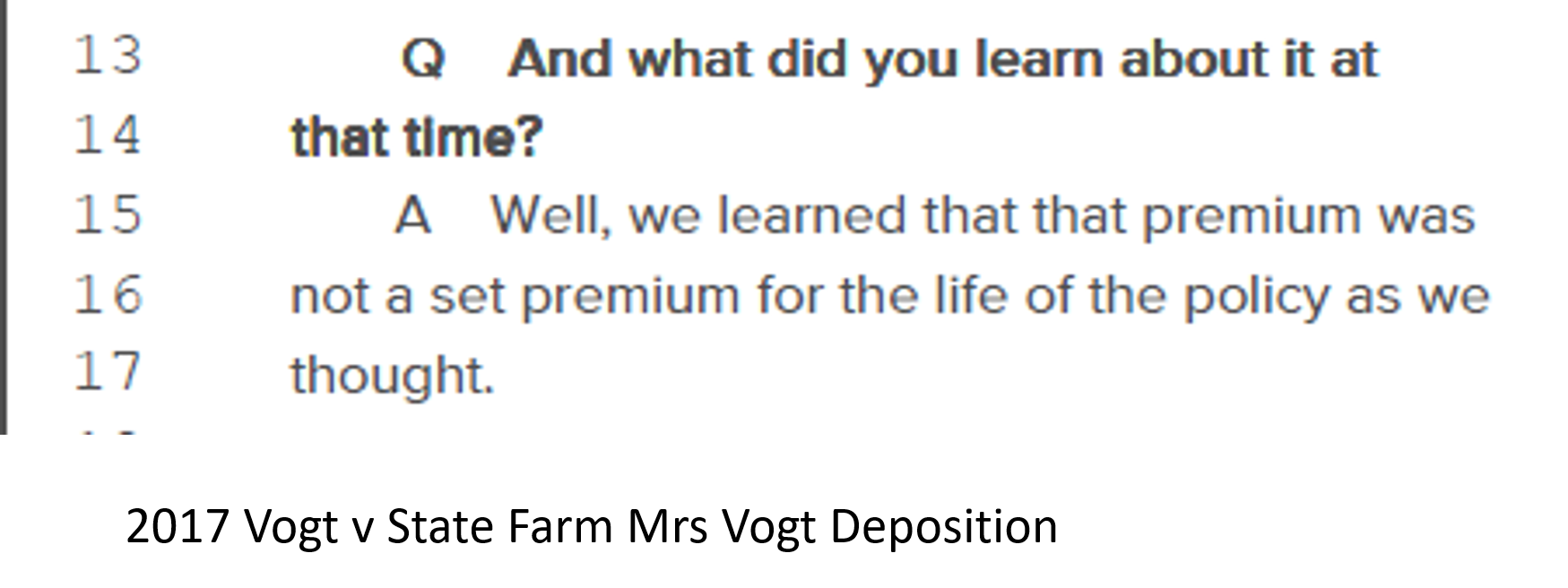

A few years ago, an awful lot of universal life policies were sold using, in effect, level premium illustrations - your policy will go for all of life or whatever - with companies using 10% or 11% interest rates, which is what the interest rate environment was then.

The concern that I have, which may soon give much of the industry a very black eye....created an illusion that will crash down on many people that they had whole life coverage, and now they find themselves with what is truly annual renewable term to insolvency. -- BRUCE E. NICKERSON

1991 - Illustrations, Society of Actuaries

"So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer. Our biggest mistake would be to delay.

I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing." Robert M. Nelson (Chairman- National Association of Life Underwriters (NALU) Task Force on Illustrations)

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

When I attended the first meeting, I very much wanted to repent and take a different course.

In that first meeting, I was hearing some things that I knew were very much fraught with problems, it was important to observe that these nonactuary regulators, experienced, competent people, were seeing a different set of problems than we, as actuaries, were used to focusing on.

-- Robert E. Wilcox - Chairman of the Life Disclosure Working Group (NAIC)

1994 - PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS, Society of Actuaries

MS. DAPHNE D. BARTLETT: I'm a member of the NAIC working group that developed this regulation and I am terribly disappointed.

1995 - SALES ILLUSTRATIONS, Society of Actuaries - 14p

"Commissioner Wilcox said that he admitted that the working group <Life Disclosure Working Group> had gotten a little sloppy on its terminology, but it had been clear all along that the working group was focusing on sales."

1996-4V2, NAIC Proc. re: Illustrations Model Regulation

1994-2 NAIC Proc.

Mr. Coleman said that he thought this section needed some fleshing out to provide more

information. He said that the cover page prepared by the technical resource advisors was a good

way to provide a greater amount of information. Mr. Wright said he would agree, but the

illustration cover sheet, which is Appendix A, was already pretty full.

The whole process started in the NAIC, as it had to. If radical changes in the way

we illustrate policies were going to be made, they had to start at the NAIC.

-- Frank S. Irish, Actuarial Standards Board

1997 - Professional Standards Affecting Life Actuaries, Society of Actuaries - 18p

You’re caught into this box where you’ve got a product that, when you go back to that format, it’s an iteration of the product that can’t exist.

The intent is, if you’re selling this thing as a level premium permanent product, there should be a way of dealing with that.

I really think it’s just again hitting another flaw and another hole in how the UL model regulation applies to the real world today.

--Craig R. Raymond

1999 - 1999 Valuation Actuary Symposium - Session 44, Society of Actuaries - 28p

"More complex products sold to individual consumers (e.g., Universal Life policies) tend to generate more market conduct problems than simple products (e.g., term life insurance)."

2003 - "The Path to Reform –The Evolution of Market Conduct Surveillance Regulation," Prepared for the Insurance Legislators Foundation by PricewaterhouseCoopers LLP and Georgia State University

Complaints and inquiries related to life insurance and annuity products were less frequent, and generally concerned consumer dissatisfaction with, or confusion regarding Universal Life insurance policies.

2018 - Wisconsin Insurance Report, page 90

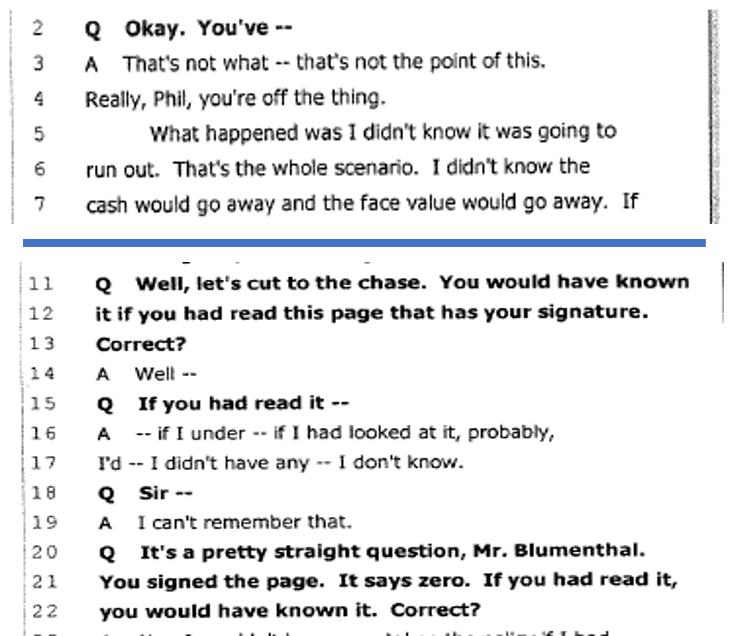

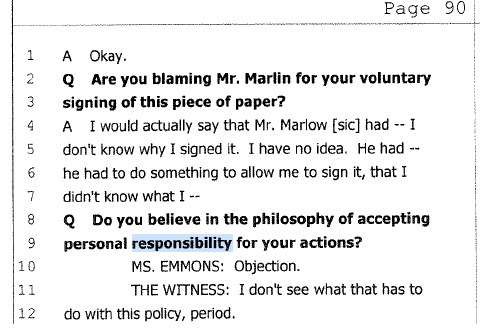

- After receiving these notices, John <Policyholder> contacted Glasgow <Agent>, who had retired in 2000, to inquire why his policies would be terminating, even though he had timely paid the premiums on the policies for approximately 18 years.

-

(page 21) The Maloofs allege that Glasgow agreed to procure life-insurance policies for them that would provide benefits available to pay estate taxes due upon John's death; however, they argue, they now have no such life-insurance policies.

The undisputed facts indicate that Glasgow <Agent> did in fact procure two universal life-insurance policies for the Maloofs and that, had the Maloofs continued to pay sufficient premiums on those policies, they would have remained in effect and the benefits of those policies would have been available for any purpose after John died.

- (page 7) - Glasgow <Agent> subsequently joined in that motion.

2010 - Maloof v John Hancock Life Insurance Company and Parker A. Glasgow - SUPREME COURT OF ALABAMA

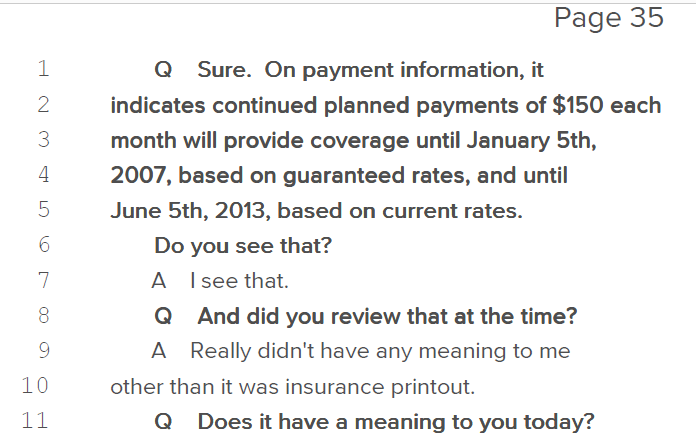

2000/10/5 - Annual Report - Continued planned payments of $150.00 each month will provide coverage until:

- November 5, 2005, based on guaranteed rates

- July 5, 2013, based on current rates

2004/10/5 - Annual Report - Continued planned payments of $150.00 each month will provide coverage until:

- June 5, 2009, based on guaranteed rates

- October 5, 2014, based on current rates.

2012/10/8 - Annual Report - If continued planned payments of $150 .00 each month Bil! made, your policy will provide coverage until:

- October 5, 2013, when the Insured's age Is 67, based on guaranteed rates

- July 5, 2014, when the lnsured's age Is 68, based on current rates