Target Premium

- If your training process for your agents is to sell at target premium, for example, and target premium carries the policy to maturity at a 7 percent rate, if you’re only crediting 6, it’s not making it there.

- So keep an eye on how you’re training your agents to sell your products and try to avoid problems up front in the product performance before they become a premium risk problem.

-- Joseph E. Paul, Clarica Life Insurance Company, Vice President and Pricing Actuary

2001 - SOA - Investment Strategies to Maximize Investment Yield, Society of Actuaries - 25p

- This can also allow for a low first-year target premium.

- On the other side, however, it may cause some difficulties in terms of the annual reporting to the policyholder if, indeed, the policyholder really pays attention to the statement sent to him.

-- Christian J. DesRochers

1983 - SOA - Universal Life (RSA83V9N212), Society of Actuaries - 24p

- "Target" premiums for universal life are those premiums upon which full first year commissions are paid.

2017 - Protective Life, 10k - [link]

- Target Premium - Michael Tivilini - LSW - product designer

- Q Are you familiar with the phrase "target premium"?

- A Yes.

- Q What's the target premium?

- A Well, it kind of has multiple -- multiple uses.

- It's -- primarily, it's the premium upon which the agent will earn top-level commission rate. (p108).

- A The other -- the other purpose of target premium is it's a premium that you'd like to get the policyholder to pay because it really would make the policy very safe.

- I mean, it was -- something I used to say to agents about these policies was, If you can get the policyholder to pay target premium, these will never lapse. (p109)

- All right, if this is at 4 percent, do these policies still carry the target premium? (p129)

2013 1211 – LC - DOC 735-2 : Deposition of Michael Tivilini- Walker v LSW – 215p

- In our Universal Life products, we need to find that critical point, or what is as important, what is the best level of premium relative to the target premium.

- You don't want all target premiums.

- In fact, the lower the premium is, the closer to the minimum premium, the happier we are.

- How do we communicate that to our agency people?

-- Richard Schwartz, product marketing function for the agency distribution systems for the Sun Life Group of America

1986 - SOA - Organizing the Product Development Fundtion, Society of Actuaries - 46p

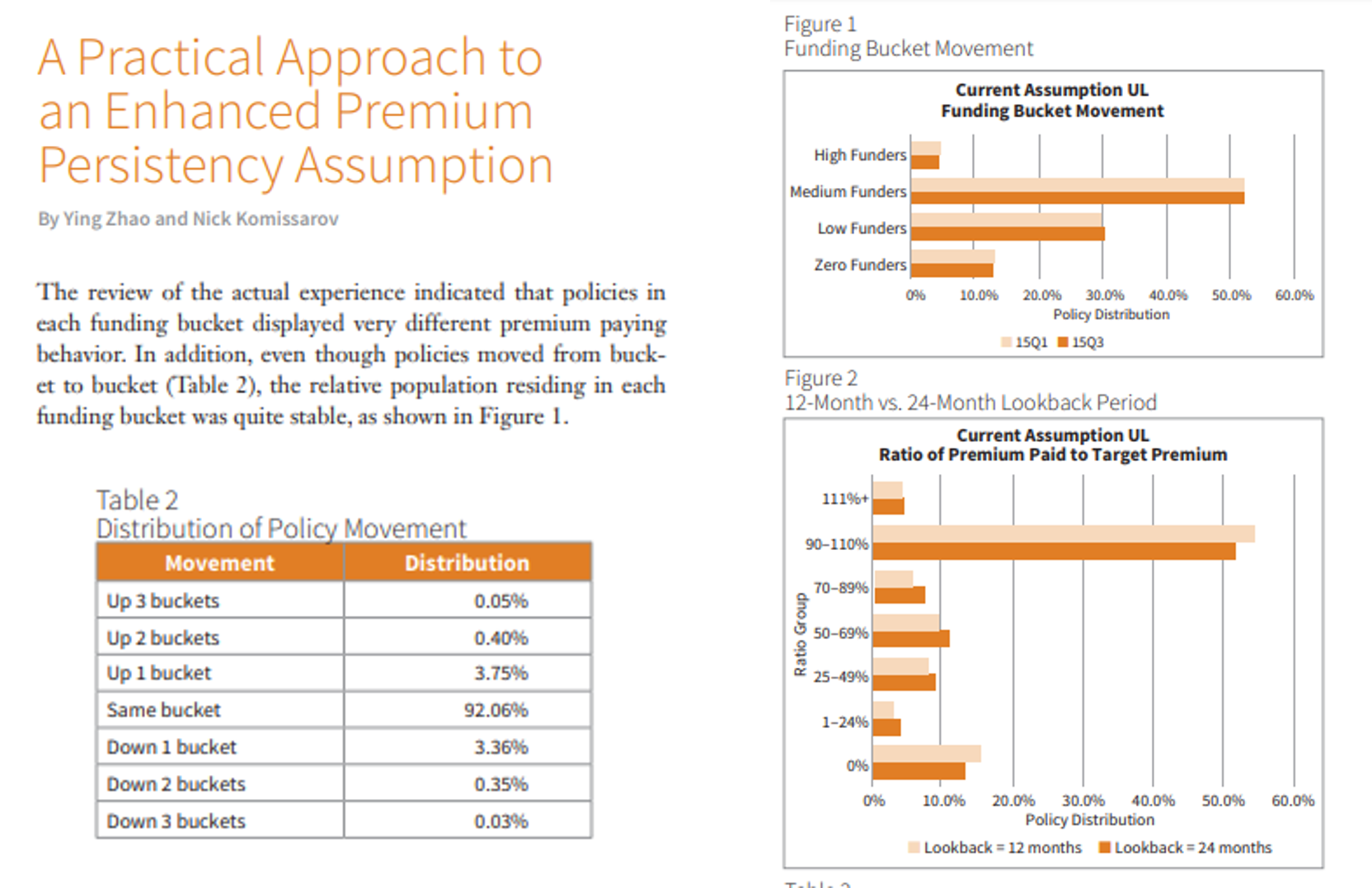

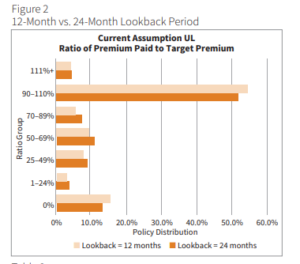

2016 - SOA - A Practical Approach to an Enhanced Premium Persistency Assumption, by Ying Zhao and Nick Komissarov - 4p

- Mr. Birdsall asked if the agent compensation structure for IUL products provide greater incentives for agents than is provided by the compensation structure of traditional universal life (UL) products.

- Bobby Samuelson (MetLife) said that a compensation study he had previously conducted found that, on average, IUL policies have a target premium 80% higher than the average target premium for UL products.

2014 - NAIC - LATF - 11/14-15/2014 - 6-63

- ... most products have a target premium of some sort for each policy that could be and often is used as a future premium assumption.

2016 - SOA - A Practical Approach to an Enhanced Premium Persistency Assumption, Ying Zhao and Nick Komissarov, Society of Actuaries - 4p

- Thus, we have universal life policies with a so-called low target premium where excess interest earnings can carry the policy for the whole of life with the payment of that low premium.

- We have the other extreme where the premium is higher but through the use of dividends or excess interest earnings, premiums are paid for only a few years. [Bonk: Vanishing Premium]

-- John L. Marcus, Prudential

1984 - SOA - Deregulation of Financial Industries (rsa84v10n221), Society of Actuaries - 30p

- It will be mathematically possible to calculate a schedule of "target" periodic premiums to be paid under the policy, which will be intended to provide the insurance benefits desired by the policyholder at any given time.

- Many policies may stipulate a target premium schedule, and many companies and agents will encourage (but not require) purchasers to make payments in accordance with such a schedule.

- The failure to pay a target premium will not of itself cause the policy to lapse, however.

1983 - Federal Register / Vol. 48, No. 231 / Wednesday, November 30 - Securities and Exchange Commission. PROPOSED RULES

Investment companies: 54043 Flexible premium variable life insurance

- An approach which seems to be gaining in popularity expresses commissions as a percent of a target or a minimum premium.

-- Christian J. DesRochers

1983 - SOA - Universal Life (RSA83V9N212), Society of Actuaries - 24p

- Mr. Herget: Our next speaker is Paul Hekman, an FSA and a member of the AAA. Paul is a vice president at PolySystems...

- He also was one of the first to develop the target premium concept of agent compensation for flexible premium universal life insurance contracts.

1997 - SOA - Anatomy of an Earned-Interest Rate, Society of Actuaries - 22p

- As a result of the declining interest rates during the first ten years, the amount accumulated in the deposit fund after ten years is less than anticipated when the contract was issued, and less than necessary to keep the contract in force for the long term if the original "target premium" assumptions were continued.

- Industry experience indicates that policyholders will increase their renewal premium payments in order to maintain their valuable insurance and minimum deposit interest rights.

- For purposes of these Illustrations, we assume that the policyowner wishes to keep the UL contract in force and increases the renewal premium payments from duration ten.

- Therefore, after the tenth year, an increase in the rate of premium payments into the deposit fund is illustrated sufficient to provide funds to maintain the contract in force under the changed financial conditions.|

- In practice, policyholders are continually modifying their behavior to reflect changing circumstances.

2004 - ACLI/ IAA - Renewal Premiums and Discretionary Participation Features of a Life Insurance, A Joint Research Project - 52p

- Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

- Products which are sold with target premiums may not have had the fact considered that in any proposal based on high interest rates over long periods, more coverage will be needed.

- We would be happy to illustrate the other way for the policyholder if he wants it that way, but I don't think he knows that he wants it that way.

-- Gary P. Monnin, Senior Vice President, Chief Actuary of American Founders Life Insurance Company

1982 - SOA - Universal Life, Society of Actuaries - 14p

- The complaint set forth a litany of alleged facts misrepresented or concealed from policyholders, including,..... (d) Farmers encouraged setting the premium for FFUL policies no higher than a "target" rate, by its commission structure; however, policies would lapse when only the target premium was paid;

- Plaintiffs also noted that Farmers's computerized rate-setting program would inform agents of the minimum and target premiums, thus suggesting that the premium be set between these two numbers, and no higher.

- Plaintiffs' argument regarding the underfunding of the FUL policies was more direct.

- As Farmers set the premiums on these policies, it was solely within Farmers's control to establish initial premiums high enough to accrue sufficient interest so that the policies would be on track to last until maturity.

- Farmers set the premiums based on a presumed 11.5 percent interest rate, which plaintiffs argued was unrealistically high, and would result in the policies lapsing.

- Fairbanks v. Farmers New World Life Insurance - Scholar.google.com

2011 - LC - Fairbanks v. Farmers New World Life Insurance --- [BonkNote]

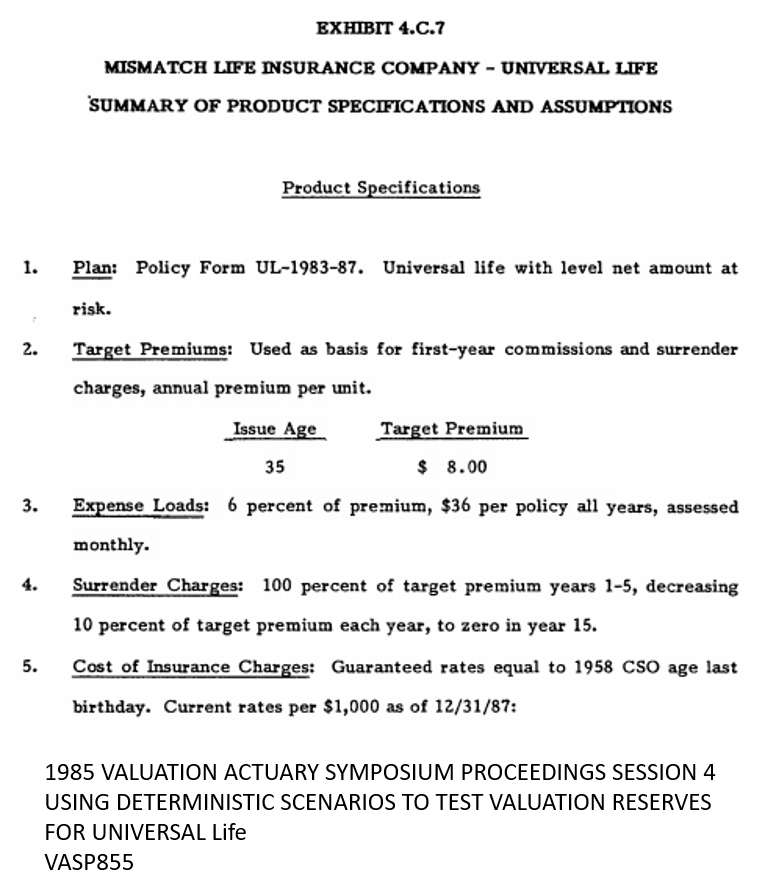

1985 - SOA - Using Deterministic Scenarios To Test Valuation Reserves For Universal Life, Valuation Actuary Symposium Proceedings, (VASP855), Society of Actuaries - 86p

- Actually, a target premium can be calculated in this manner for any number of years: so it can be used in a UL proposal system to calculate the premium required to reach a certain fund at a certain point.

- Calculate Target Premium Directly

- TARGET PREMIUM:

- " Start thru calculation from last year forward.

- " If calculating to maturity, target age is (maturity age - I).

- This is because you are going to the END of the previous ago

- TARGET PREMIUM:

1993 - SOA - Speeding Up Universal Life Calculations in BASIC, by Dennis Radliff, Society of Actuaries - 12p

- Commissions are usually a large (35-85%) percentage of the '"target"

or "Minimum Allowable Premium (MAP), but are much smaller on premium dollars generated in excess of the target premium. (p198)

1985 11 - FTC - Report - Life Insurance Products And Consumer Information, by Michael P. Lynch and Robert J. Mackay, Staff Report Bureau of Economics, Federal Trade Commission --- [BonkNote] --- [PDF-317p]

2016 - SOA - A Practical Approach to an Enhanced Premium Persistency Assumption, by Ying Zhao and Nick Komissarov - 4p

- The "target premium" Universal Life differs from the classic product in several respects.

- First of all, commissions are expressed as a percentage of the target premium and typically are comparable to non-par whole llfe.

- So it might be something like 90% of $10 per thousand.

- Commission percentages are the same for all ages and all face amounts.

- And commission percentages generally are quite high, as I mentioned, perhaps in the range of 90%.

- The "target premium" plan is currently the most popular Universal Life type policy being developed and it is expected that the trend toward developing this type of plan will continue.

- First of all, commissions are expressed as a percentage of the target premium and typically are comparable to non-par whole llfe.

- Why is this?

- First of all, the plan has a simple commission structure, just like the whole life policy with which the agents are accustomed.

- Secondly, it pays the higher commission rate that the traditional agent is familiar with.

- And as more traditional companies enter the Universal Life marketplace, this is sort of a middle-of-the-road approach.

- The companies can say that they have Universal Life but it has the high commissions with which the agent is familiar on traditional whole life plans.

- Now in the long term (whether that's six months or six years), one might expect the trend back to the classic Universal Life with the three factor approach, having somewhat lower commissions, especially on savings, and commission rates that reduce by policy size.

- Basically, it is very difficult to analyze exactly what's happening with loads and commissions.

- But if one looks at the target premium whole life, it is clear that the load and the commission on the savings element involved is quite high, relative to alternative products being offered by other industries.

- In the long term, it is impossible to compete for savings dollars with very high front-end loads and high commissions on the pure savings element of the product.

- In addition, we are about the only industry that still doesn't recognize "cheaper by the dozen" and offer substantially discounted prices and compensation for larger type policies, which is a basic feature of classic Universal Life.

-- Randall P. Mire

1983 - SOA - Universal Life, Society of Actuaries, (rsa83v9n32) - 22p

- Donald L. ADDINK: Since this meeting has been on inflation, and universal life addresses many aspects of inflation, and because competition frequently does not address itself to the interest rate, but to the target premium at point of sale itself, have either of the panelists addressed the question of consumer protection in terms of inflation particularly, with regard to the interest rate used in the target premium calculation? The extremely high interest rates used in target premium calculations may be building an obsolecene in the premium itself, since it relies on inflation (whereas the benefit does not). Instead of using something like a real rate of interest in the premium calculations, so that the benefit has to be increased due to inflation, the premium itself would be increased because of the excess interest that is built up inside the contract.

- Gary MONNIN, Senior Vice President, Chief Actuary of American Founders Life Insurance Company: We are not attempting to sell the minimum premium on universal life and we do not have a target premium calculator, although we will. We illustrate universal life under a number of interest rates. Our illustration system uses the guaranteed rate plus another interest rate. Our policy summary shows three interest rates. We are not providing the policyholder with a target premium. Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

- Jim PARRISH, Fidelity Mutual, Vice President and Actuary: We are in the same position as Gary is in. The product that we have on the shelf will not be sold with a target premium indicated. Products which are sold with target premiums may not have had the fact considered that in any proposal based on high interest rates over long periods, more coverage will be needed. We would be happy to illustrate the other way for the policyholder if he wants it that way, but I don't think he knows that he wants it that way.

1982 - SOA - Universal Life (rsa82v8n111), Society of Actuaries - 14p

- 2012 - NAIC - Emerging Actuarial Issues (E) Working Group: Draft Exposure 11/20/2012

- Issue / Question:

- Erie Family Life has a shadow account product design feature where the premium load is expressed as a fixed percentage of premium up to the target premium, where the target premium is reasonably consistent with level premium funding of the lifetime guarantee.

- In effect, there is a fixed dollar cap on the annual premium charge.

- Please clarify that a fixed dollar cap for the premium load, regardless of how the cap is expressed, does not make such a product incompatible with Policy Design # 1.

- Issue / Question:

- Issue / Question

- 1. A shadow account product has a design feature where the premium load is expressed as a fixed percentage of premium up to the target premium, where the target premium is reasonably consistent with level premium funding of the lifetime guarantee.

- In effect, there is a fixed dollar cap on the annual premium charge.

- The literal form of the charge is simply a specified percentage of premiums up the target premium and 0% thereafter.

- This will always mathematically produce the same result as the capped charge described above.

- Please clarify that a fixed dollar cap for the premium load, regardless of how the cap is expressed, does not make such a product incompatible with Policy Design # 1.

Interpretation of the Emerging Actuarial Issues (E) Working Group - Actuarial INT 12-24

Date Adopted by Emerging Actuarial Issues (E) Working Group - December 19, 2012

Date Adopted by Financial Condition (E) Committee - December 20, 2012

Reference - Actuarial Guideline 38- The Application of the Valuation of Life Insurance Policies Model Regulation

- \1\ A Target Premium is a measure of premium specified in a policy that varies from insured to insured and never exceeds a Guideline Annual Premium (``GAP''), as defined in Rule 6e-3(T)(c)(8) under the 1940 Act.

SECURITIES AND EXCHANGE COMMISSION - [Rel. No. IC-21931; File No. 812-10100] The Manufacturers Life Insurance Company of America, et al. April 30, 1996. AGENCY: Securities and Exchange Commission (``SEC''). ACTION: Notice of application for exemptions under the Investment Company Act of 1940 (``1940 Act''). - https://www.govinfo.gov/content/pkg/FR-1996-05-06/html/96-11231.htm

No Results - Actuarial Toolkit (SOA), ACLI,

There were no results for your search - https://actuarialtoolkit.soa.org/tool/glossary/search?search=%22target+premium%22&field_topics_target_id=All

No results for "target premium"

https://www.acli.com/search?archive=0#q=%22target%20premium%22