2008 10 - CCIR - An Approach to Risk-Based Market Conduct Regulation - Final Report - 11p

- 2008 10 - CCIR - An Approach to Risk-Based Market Conduct Regulation - "The Approach" - Final Report --- [BonkNote] --- 11p

- History of Risk-based market conduct regulation (RbMCR) project

- In undertaking this work CCIR determined that applying risk-based methodologies to market conduct regulation provides some challenges not present in prudential regulation:

- First, whereas prudential regulators deal solely with insurers, risk based market conduct regulation may also have to encompass different product distribution channels and potentially thousands of intermediaries who are the face of the insurance industry to many consumers

- Second, there are a fairly small number of well-defined risks in solvency regulation. Market conduct risks tend to be much more difficult to define and quantify.

- Third, market conduct regulators may be charged with looking after a number of functions that do not fit well within a risk-based model. For instance, significant aspects of the regulatory structure around automobile insurance provisions and rate reviews do not lend themselves to a risk-based regulatory approach.

- Nevertheless, we are now proposing an approach which could form the basis for a framework for applying risk-based market conduct concepts to the ongoing work of regulators in Canada which is presented in this paper.

- Defining Market Conduct Regulation

- “Market conduct” encompasses any product or service relationship between the insurance industry, insurers, agents and individuals alike, and the public.

- It is influenced by many factors including: laws, established best practices, codes of conduct, and consumer expectations.

- To protect the public from unfair market practices, CCIR members oversee a wide range of company and intermediary practices (e.g. sales, underwriting, and claims processing) through a variety of regulatory activities such as licensing, consumer complaint reviews, and on-site examinations.

- Taken together, these regulatory practices are referred to as market conduct regulation.

- Defining Risk-based Market Conduct Regulation

- Risk-based Market Conduct Regulation means directing regulatory efforts to the most significant issues that either have the greatest potential for consumer harm or that could weaken public confidence if left unchecked.

- In a risk-based approach, regulators prioritize issues based on their potential impact (risk) to the achievement of desired regulatory outcomes.

- For example: Legislation may indicate that insurers must honour legitimate claims within a certain period of time after completed claims forms are filed. A risk-based approach could be used to focus regulatory attention on insurers where indicators suggest there is a high risk of non-compliance with the legislation rather than giving every insurer equal weight and examining them all.

- Marketplace Outcomes that Market Conduct Regulation seeks to achieve

- In its work to date CCIR has considered numerous mission statements and goal documents from around the world and we believe that the following marketplace outcomes (or public policy goals) describe the goals of market conduct regulation in Canada.

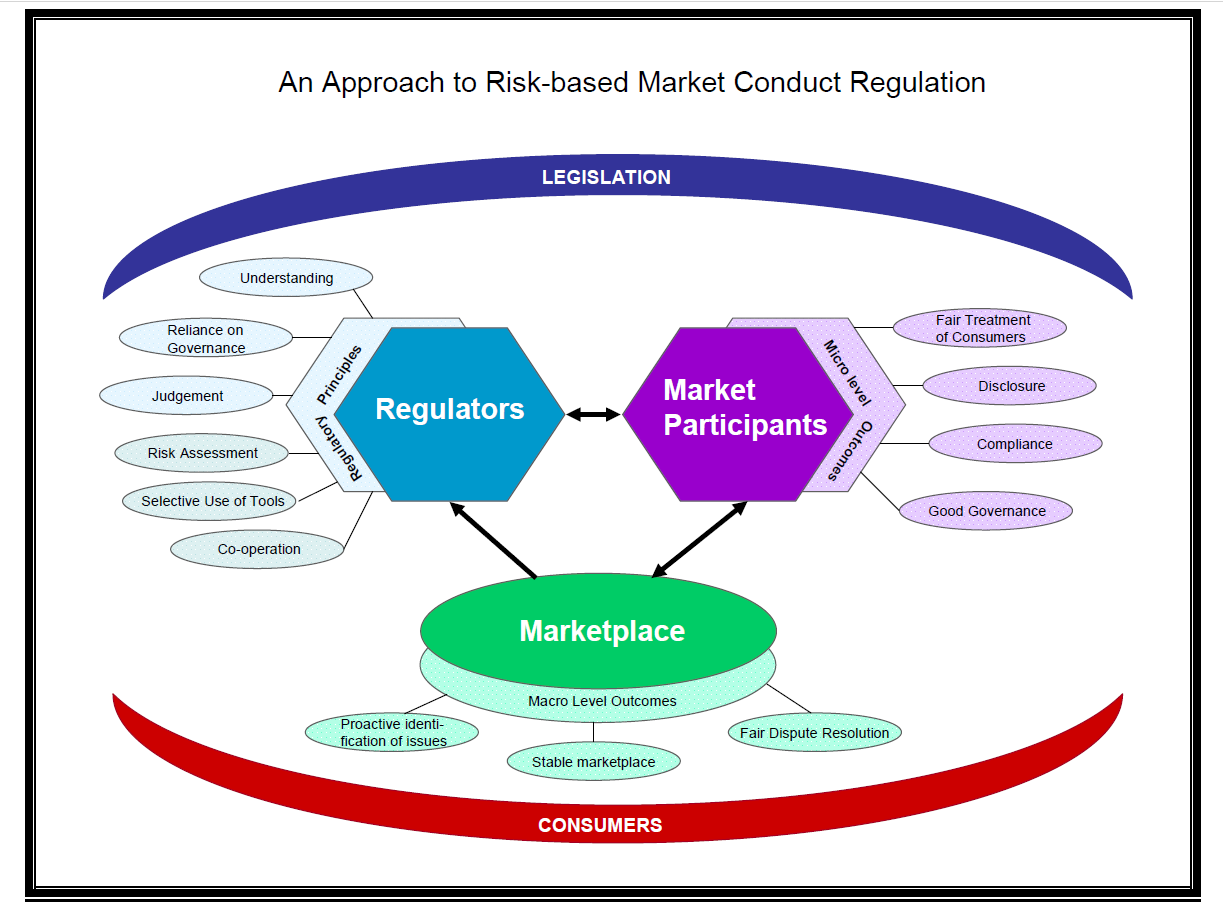

- These desired marketplace outcomes include both micro-level outcomes that are within the control of individual firms or intermediaries and broader systemic level outcomes that can only be achieved though the collective actions of the entire industry. It is expected that the micro-level outcomes must be achieved before the systemic outcomes can be fully realized.

- Micro-level outcomes:

- Fair treatment of consumers and claimants - Ethical and honest behaviour should be the accepted norm among market participants.

- Disclosure of information to enable consumers to make informed decisions - In keeping with fair treatment, consumers should have access to simple, easy to understand information.

- Compliance with laws - Market participants must comply with statutory, legal and corporate obligations.

- Good corporate governance - Companies should identify and manage risks through internal controls, risk management and business oversight mechanisms.

- Systemic level outcomes:

- Stable marketplace - In which the needs of consumers for understandable, available, accessible and affordable insurance are met;

- Proactive identification of issues - Collaboration between industry and regulators to prevent issues from arising rather than merely fixing problems after they happen; and

- Fair Dispute Resolution - A process by which disputes are dealt with by participants in a fair, timely and responsive manner.

- Below is a graphic representation of our vision of how these various aspects fit together into an ongoing system.